D-Keine

I last updated The Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) in July 2023, informing holders why the opportunity to add exposure is appropriate. However, I cautioned the opportunity could be premature, buying into the ETF “before the tide turns up.” In other words, while I assessed the opportunity as attractive, SCHD’s “price action would likely take a couple of months to demonstrate its consolidation.” As a result, I also highlighted that “more risk-averse investors can consider giving SCHD more time to prove itself.”

The market has spoken, as SCHD underperformed the S&P 500 (SPX) (SPY) after an attempt to bottom out between July and August 2023. However, SCHD holders suffered another outward rotation before bottoming out again in late October 2023. Therefore, I gleaned investors who missed its late October bottom have another fantastic opportunity to assess whether the current levels are timely as market participants rotated back into SCHD following the bottom. The critical questions facing holders are whether SCHD’s buying sentiments, valuations, and dividend yields (TTM: 3.66%) support the inward rotation. Investors who want to gain more insights into the fund’s construction can refer to previous updates here and here.

Observant investors should know that the top three sectors accounted for nearly 50% of the fund’s exposure. Accordingly, the industrial, financial, and healthcare sectors comprised its top three sectors based on its most recent update. Notably, the tech sector accounted for 12% of the ETF’s holdings, fifth place behind the consumer defensive sector.

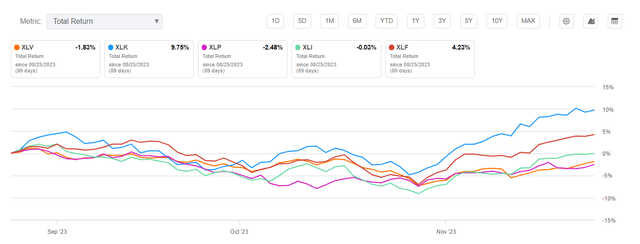

Selected sectors 3M total return % (Seeking Alpha)

Therefore, I believe that it should provide clues into why SCHD fell further toward its late October lows before bottoming out. As seen above, the tech sector (XLK) has significantly outperformed the top four sectors in SCHD’s exposure, suggesting broad sector headwinds worked against its upward momentum. However, investors should regard that as past performance and shouldn’t be used as the only basis to evaluate whether SCHD’s top holdings could outperform from here.

| No. | Company | Weight | Sector | Industry |

|---|---|---|---|---|

| 1 | Broadcom (AVGO) | 4.67% | Technology | Semiconductors & Semiconductor Equipment |

| 2 | Verizon Communications (VZ) | 4.40% | Communication Services | Telecommunication Services |

| 3 | Amgen (AMGN) | 4.36% | Healthcare | Biotechnology |

| 4 | Coca-Cola (KO) | 4.00% | Consumer Staples | Beverages |

| 5 | Merck (MRK) | 3.95% | Healthcare | Pharmaceuticals |

| 6 | PepsiCo (PEP) | 3.90% | Consumer Staples | Food Products |

| 7 | AbbVie (ABBV) | 3.89% | Healthcare | Pharmaceuticals |

| 8 | The Home Depot (HD) | 3.87% | Consumer Discretionary | Specialty Retail |

| 9 | Texas Instruments (TXN) | 3.79% | Technology | Semiconductors & Semiconductor Equipment |

| 10 | United Parcel Service (UPS) | 3.60% | Industrials | Air Freight & Logistics |

SCHD ETF top ten holdings. Data source: Seeking Alpha

As seen above, Broadcom (AVGO) and Texas Instruments (TXN) are the only tech stocks in SCHD’s most recent top ten holdings. Moreover, TXN has significantly underperformed the market and its sector peers over the past six months, although AVGO outperformed significantly. Accordingly, AVGO delivered a 6M total return of 45.6% compared to TXN’s disappointing -6.6%. The difference is stark, given Broadcom’s well-diversified portfolio underpinned by robust AI tailwinds, but much less for TXN.

In addition, the downward de-rating in the stocks of Coca-Cola and PepsiCo was brutal, as investors rotated out of these expensive consumer defensive plays, worried about the headwinds from the GLP-1 drugs.

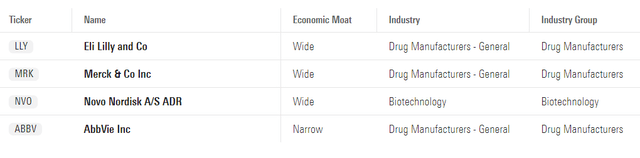

In addition, Merck (MRK) and AbbVie (ABBV) also suffered a torrid time, as the leading pharma companies generally endured a highly challenging year, as investors took profit. Where could these investors have gone to? You probably guessed it: Eli Lilly (LLY) and Novo Nordisk (NVO).

Pharma comps (Morningstar)

Is it reasonable for the outward rotation? Based on the market’s enthusiasm for the sustainability of GLP-1 drugs on weight loss, rotation to wide-moat players like NVO and LLY could be considered appropriate.

As a result, the outperformance in LLY and NVO has likely contributed to the underperformance against its peers, including defensive stocks like PEP and KO. Investors likely also reassessed the structural headwinds that could emerge from people cutting down their consumption of less healthy food and beverages. Novo Nordisk CEO Lars Fruergaard Jørgensen stressed that Wegovy consumers have “reported changes in their behavior, including reduced snacking and adoption of healthier eating habits.” However, Jørgensen also highlighted that the market reaction is likely overstated, suggesting that “the impact of these drugs on various sectors has been overblown.”

With that in mind, I believe it’s a good reminder for SCHD holders to maintain their conviction that the ETF tracks the Dow Jones U.S. Dividend 100™ Index. The index is “focused on the quality and sustainability of dividends.” In addition, these stocks are “selected for fundamental strength relative to their peers.” As a result, I believe these companies are expected to demonstrate resilience, corroborating their fundamental strength, and recover eventually after the implied “market overreaction.”

Furthermore, according to Morningstar, almost 89% of the ETF’s constituents are companies assigned a narrow (31.54%) or wide economic moat (57.09%). Therefore, I believe these companies have proved their sustainable competitive advantage, giving investors more confidence about buying significant dips when the opportunities present themselves.

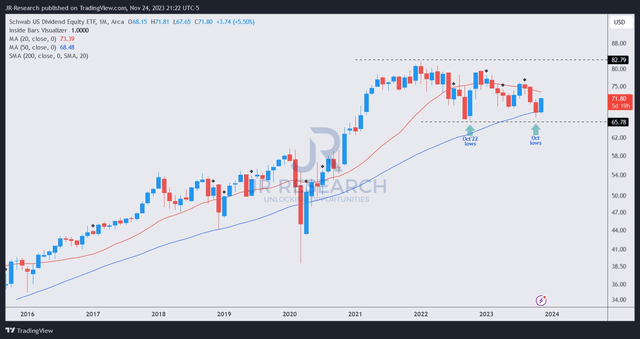

SCHD price chart (monthly) (TradingView)

Based on SCHD’s long-term price action, dip buyers returned with conviction, helping to defend against a further slide from its October 2023 lows. Notably, SCHD has recovered all its October losses and more. With SCHD’s P/E falling to 12.4x, I assessed that significant pessimism had been reflected.

In addition, much-improved buying sentiments in SCHD have bolstered my confidence that the worst in SCHD is likely over in October 2023, as it looks ready to resume its upward bias. As a result, near-term volatility in SCHD should be capitalized to add more exposure.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!