Scary Nationwide Debt Numbers

October 29, 2024 | Tags: BEACON

Prepared for a pre-Halloween scare?

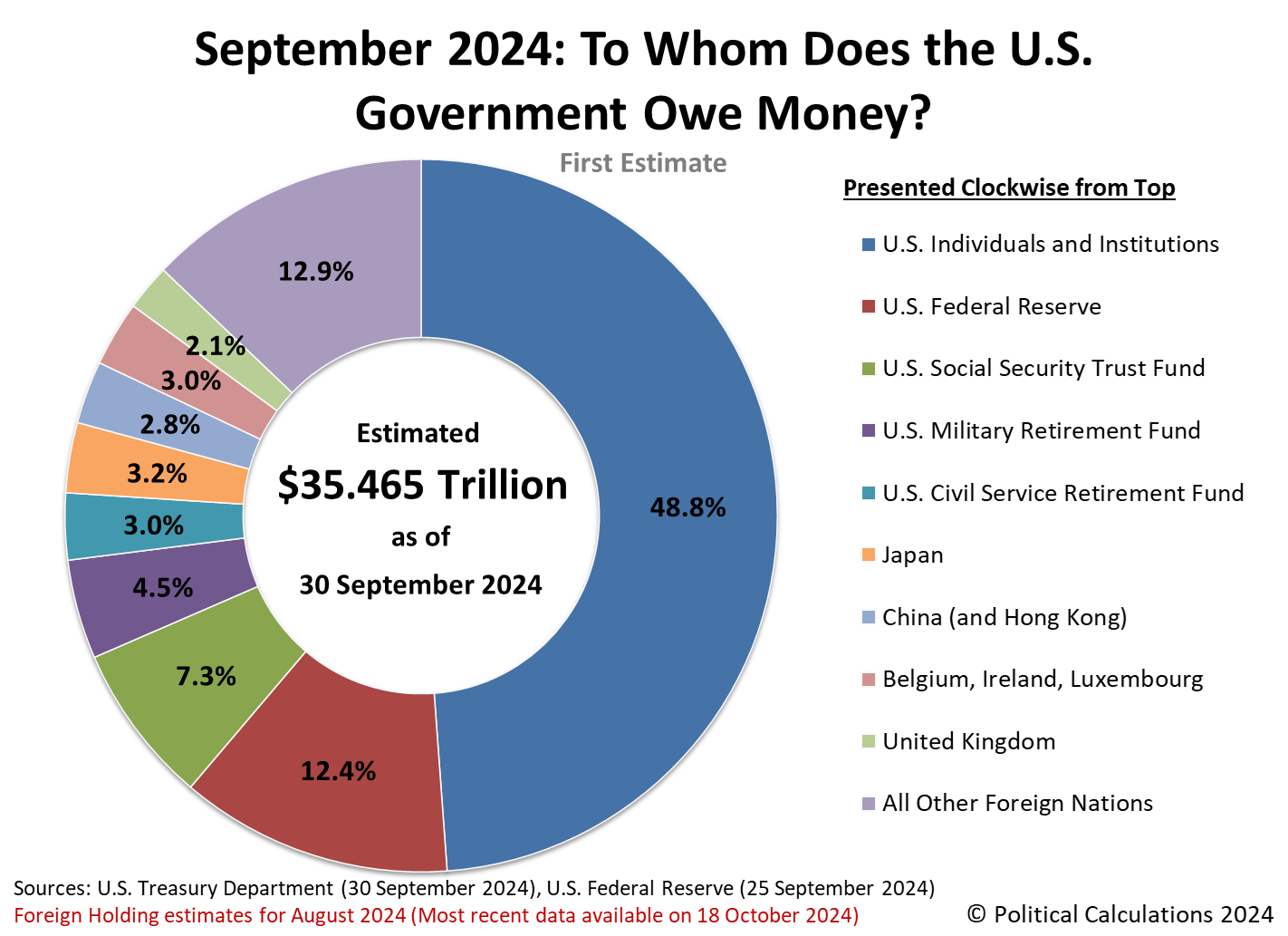

The U.S. authorities’s whole public debt excellent surpassed $35.465 trillion on the finish of its 2024 fiscal yr on September 30, 2024.

That large quantity is the equal of $268,265 of nationwide debt for every family in the US. This determine is above and past the quantity of debt every family has accrued by way of their mortgages, automotive loans, and bank cards.

It’s additionally an underestimate as a result of the nationwide debt has stored rising. As of October 24, the nationwide debt elevated by one other $334 billion, or by about $2,647 per family. Altogether, the nationwide debt has grown by $54,862 per family through the Biden-Harris administration’s tenure. There’s a good probability the Biden-Harris administration will beat the $57,989 per family determine run up throughout Donald Trump’s time period in workplace earlier than President Biden leaves the White Home on January 20, 2025.

Who has the U.S. authorities borrowed a lot from?

That’s a reasonably cheap query to ask. Political Calculations took a snapshot of the U.S. authorities’s main collectors as of September 30, 2024. The chart under reveals the main collectors to whom the U.S. authorities owes cash and the way a lot of that debt every is owed.

Right here’s their general image of who owns the U.S. nationwide debt:

The U.S. Federal Reserve is as soon as once more the U.S. authorities’s single largest creditor holding U.S. government-issued debt securities price 12.4% of the U.S. authorities’s total whole public debt excellent. Nevertheless, its share of the nationwide debt is down from the 18.3% it held in 2022 and the 15% recorded final yr because the Federal Reserve has continued lowering its holdings. In doing so, the Fed continues to be following the financial coverage of shrinking its steadiness sheet that it initiated in March 2022 when it started climbing rates of interest to fight inflation unleashed by President Biden’s insurance policies.

Talking of rates of interest, on 19 September 2024, the Federal Reserve initiated a brand new collection of rate of interest reductions after holding them regular at an elevated stage for over a yr. These increased charges have attracted U.S. people and establishments resembling banks, insurance coverage corporations, funding funds, firms, and people to collectively enhance their share of the nationwide debt from 47.1% in 2023 to 48.8% in 2024.

Social Safety’s share of the nationwide debt plunged from 8.1% in 2023 to 7.3% in 2024. This decline coincides with the continuing depletion of its Outdated Age and Survivors Insurance coverage belief fund, which has run within the purple in yearly since 2009.

The mixed share of the U.S. nationwide debt held by the federal government’s navy (4.5%) and civilian (3.0%) worker retirement belief funds swelled from 7.2% to 7.5% from FY 2023 to FY 2024.

Altogether, the portion of the U.S. nationwide debt held by U.S. entities in 2024 is 76.0%, a small dip from the 77.4% in 2023, however up barely from 75.7% share in 2022….

The portion of the U.S. whole public debt excellent held by overseas people and establishments is 24.0%.

Throughout the previous couple of years, curiosity on the nationwide debt has develop into the fastest-growing class of presidency spending. That cash comes straight out of the U.S. authorities’s tax collections with out ever doing something U.S. taxpayers anticipate to be accomplished with their tax {dollars}.

Prepared for the true scare? Until one thing dramatic modifications issues, these numbers will likely be larger and scarier subsequent yr.

The publish Scary Nationwide Debt Numbers appeared first on The Beacon.

Learn Extra…