The countries’ moves could increase inflation and the cost for drivers at the pump.

DUBAI, United Arab Emirates — Saudi Arabia and Russia agreed Tuesday to extend their voluntary oil production cuts through the end of this year, trimming 1.3 million barrels of crude out of the global market and boosting energy prices.

The dual announcements from Riyadh and Moscow pushed benchmark Brent crude above $90 a barrel in trading Tuesday afternoon, a price unseen in the market since November.

The countries’ moves could increase inflation and the cost for motorists at gasoline pumps. It also puts new pressure on Saudi Arabia’s relationship with the United States, as President Joe Biden last year warned the kingdom there would be unspecified “consequences” for partnering with Russia on cuts as Moscow wages war on Ukraine.

Saudi Arabia’s announcement, carried by the state-run Saudi Press Agency, said the country still would monitor the market and could take further action if necessary.

“This additional voluntary cut comes to reinforce the precautionary efforts made by OPEC+ countries with the aim of supporting the stability and balance of oil markets,” the Saudi Press Agency report said, citing an unnamed Energy Ministry official.

State-run Russian news agency Tass quoted Alexander Novak, Russia’s deputy prime minister and former energy minister, as saying Moscow would continue its 300,000 barrel a day cut.

The decision “is aimed at strengthening the precautionary measures taken by OPEC+ countries in order to maintain stability and balance of oil markets,” Novak said.

Benchmark Brent crude traded Tuesday above $90 a barrel after the announcement. Brent had largely hovered between $75 and $85 a barrel since last October. A barrel of West Texas Intermediate, a benchmark for America, traded around $87 a barrel.

White House national security adviser Jake Sullivan declined to comment on the market impact of the decision, though he said U.S. officials had regular contact with the kingdom. He added that Biden would look to utilize “everything within his toolkit” to assist American consumers.

“The thing that we ultimately stand for is a stable, effective supply of energy to global markets, so that we can in fact deliver relief to consumers at the pump, and we do this in a way that is consistent with the energy transition over time,” Sullivan said.

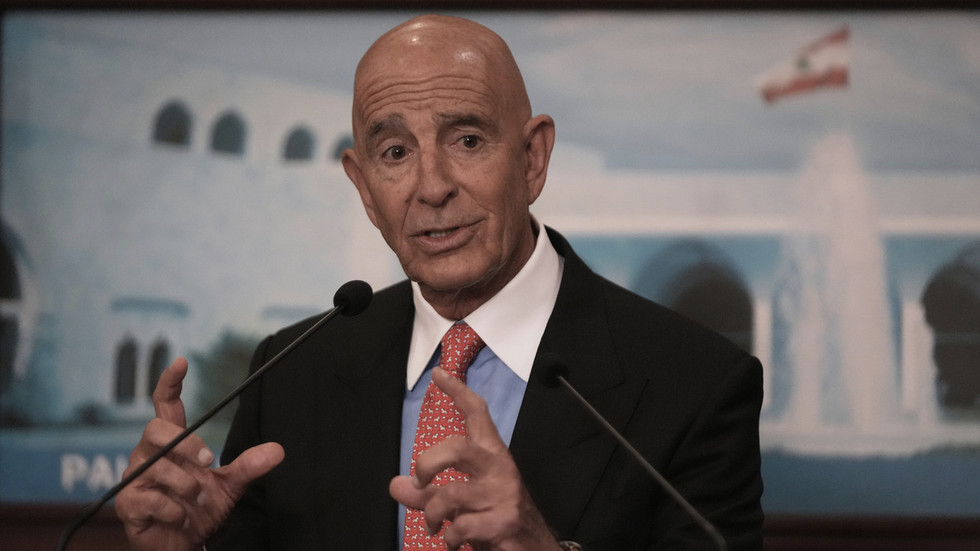

Bob McNally, the founder and president of the Washington-based Rapidan Energy Group and a former White House energy adviser, said Saudi Arabia and Russia had “demonstrated their unity and resolve to proactively manage” the risk of oil prices potentially dropping in tougher economic conditions with their announcement Tuesday.

“Barring a sharp economic downturn, these supply cuts will drive deep deficits into global oil balances and should propel crude oil prices well above $90 per barrel,” McNally said.

The average gallon of regular unleaded gasoline in the U.S. stands at $3.81, according to AAA, just under the all-time high for Labor Day of $3.83 in 2012. However, gasoline demand typically drops for U.S. motorists after the holiday so it remains unclear what immediate effect this could have on the American market, AAA spokesman Andrew Gross said.

“I’m more concerned about what the rest of hurricane season may hold,” Gross told The Associated Press. “A big storm along the Gulf coast could move prices dramatically here.”

Hurricane Idalia just plowed through Florida and U.S. forecasters said Tuesday that a new tropical depression in the Atlantic Ocean could become a “major hurricane.”

Meanwhile, higher gasoline prices can increase transportation costs and ultimately push the prices of goods even higher at a time when the U.S. and much of the world is already raising interest rates to combat inflation.

“The impact these cuts will have on inflation and economic policy in the West is hard to predict, but higher oil prices will only increase the likelihood of more fiscal tightening, especially in the U.S., to curtail inflation,” said Jorge Leon, a senior vice president at Rystad Energy.

The Saudi reduction, which began in July, comes as the other OPEC+ producers have agreed to extend earlier production cuts through next year.

A series of production cuts over the past year has failed to substantially boost prices amid weakened demand from China and tighter monetary policy aimed at combating inflation. But with international travel back up to nearly pre-pandemic levels, the demand for oil likely will continue to rise.

The Saudis are particularly keen to boost oil prices in order to fund Vision 2030, an ambitious plan to overhaul the kingdom’s economy, reduce its dependence on oil and to create jobs for a young population.

The plan includes several massive infrastructure projects, including the construction of a futuristic $500 billion city called Neom.

But Saudi Arabia also has to manage its relationship with Washington. Biden campaigned on a promise of making the kingdom’s powerful Crown Prince Mohammed bin Salman a “pariah” over the 2018 killing of Washington Post columnist Jamal Khashoggi.

In recent months, tensions eased slightly as Biden’s administration sought a deal with Riyadh for it to diplomatically recognize Israel.

But those talks include Saudi Arabia pushing for a nuclear cooperation deal that includes America allowing it to enrich uranium in the kingdom — something that worries nonproliferation experts, as spinning centrifuges open the door to a possible weapons program.

Prince Mohammed already has said the kingdom would pursue an atomic bomb if Iran had one, potentially creating a nuclear arms race in the region as Tehran’s program continues to advance closer to weapons-grade levels. Saudi Arabia and Iran reached a détente in recent months, though the region remains tense amid the wider tensions between Iran and the U.S.

Higher oil prices would also help Russian President Vladimir Putin fund his war on Ukraine. Western countries have used a price cap to try to cut into Moscow’s revenues. But those sanctions have seen Moscow be forced to sell its oil at a discount to countries like China and India.