buradaki

Satellogic (NASDAQ:SATL) is a company that flown somewhat under the radar since its 2021 arrival on the Nasdaq. Satellogic has its executive offices in Montevideo, Uruguay which may explain why the firm hasn’t become a more well-known satellite play as of yet. Despite the relative lack of attention, however, Satellogic weighs in with a $260 million market cap which is bigger than a fair number of its satellite and space peers nowadays.

Satellite stocks are also on the move recently. Since all the excitement around spy balloons and purported unidentified flying objects started last month, traders have turned their attention to space stocks. We saw a huge move in Redwire (RDW) shares earlier in February. And then, last Wednesday, shares of Terran Orbital (LLAP) jumped 70% on news of a big new contract.

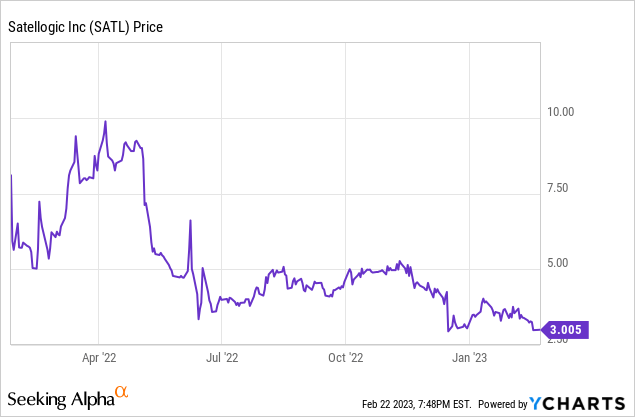

Despite the excitement in the sector, Satellogic shares are trading near their lifetime lows:

This naturally leads to the question of whether this is a good time to go bottom-fishing in Satellogic stock.

On Paper, A Great Opportunity

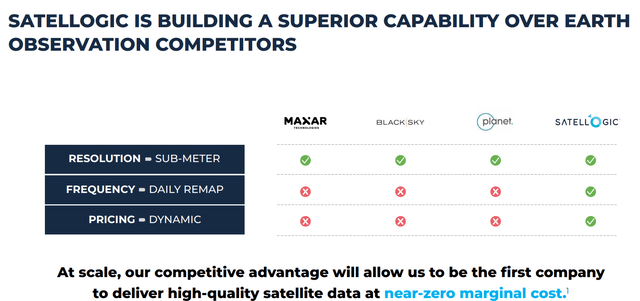

According to Satellogic’s investor presentation slides, the company has vastly superior satellite technology to its direct peers:

Satellogic’s capabilities (Corporate Presentation)

Producing high-quality images at higher frequency with a fraction of the cost of peers should be a winner. And the idea of delivering additional data at a near-zero marginal cost sounds incredible. Let’s add a little more to the bullish pitch.

Here’s Satellogic CFO Rick Dunn explaining the case for the company shortly after completing its SPAC offering:

We’ve got 17 high-resolution satellites in orbit today. That represents more capture capacity than our next four competitors combined, all of whom are public companies […]

What we’re looking to achieve is to create a searchable database of everything that’s happening on Earth. To provide data and information to help solve some of the world’s biggest problems that we’re facing. Whether that’s climate change, energy production, migration, food supply, etc. Lower-orbit satellites are well-positioned to do that.

That gets to what Satellogic is offering.

But how does the company stack up on a commercial basis against its rivals? According to Dunn, from that same interview, Satellogic is orders of magnitude more efficient than its competition:

The challenge has been getting the unit economics to the point where you can roll it out commercially in a broad way. This team has spent the last ten years achieving that. We looked to reduce the cost of these satellites 1,000x and we did that and so today we’re able to offer sub-meter high-resolution imagery at high frequency with unit economics that are between 60 times and 100 times better than the competition. That allows us to really expand the current market into commercial applications that weren’t able to utilize this imagery in the past.

These are some pretty bold words. You’d expect Satellogic’s business to be booming based on this purported capability. With unit costs so much cheaper than the competition, Satellogic should be winning a dominant share of the existing market while signing up new customers every quarter.

The company also has some well-known backers. Among them is Steven Mnuchin, the former Treasury Secretary, who is now on Satellogic’s board. So, this company seemingly checks a lot of boxes.

And yet, when we turn to actual financial results, the story starts to lose its luster.

Badly Missing Prior Financial Projections

At the time Satellogic initially filed its SPAC presentation to market the deal, it was projecting 2022 revenues of $47 million and 2023 revenues of $132 million. How have those projections played out?

For the first half of 2022, Satellogic brought in a grand total of $2.4 million in revenues, and it guided to a midpoint $7 million of full-year 2022 revenues. Given that revenue has actually declined sequentially over the past few quarters, I’d be surprised if 2023 really marks a major change, either. In other words, the company is going to come up more than 80% short of its initial 2022 revenues projections, and could miss the initial 2023 revenue guidance by as much as 90%.

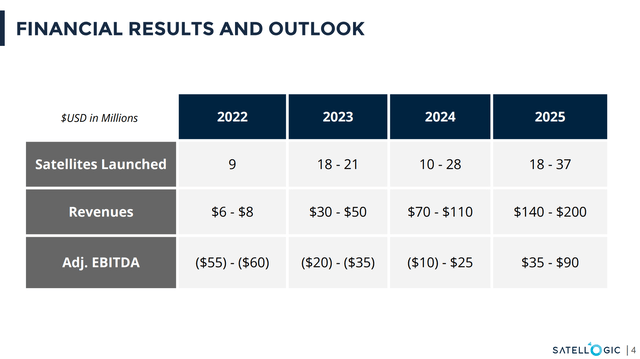

Back in 2021, Satellogic was aiming for nearly $800 million of annual revenues in 2025, with an EBITDA margin of 60% on those sales. Nowadays, Satellogic is guiding to just $70 million midpoint revenues in 2025 with a far lower EBITDA margin:

Satellogic Dec. 2022 Business Update (Corporate Presentation)

If the company can hit those 2025 numbers, it would probably be quite a good investment from the current share price. But after seeing the company’s results against its past projections, I need to see more evidence of actual commercial demand before getting too excited. It’s one thing to launch satellites, it’s another thing to get real customers to pay market prices to access their data and imagery.

SATL Stock Verdict

I’ve previous written about one of Satellogic’s direct competitors BlackSky Technology (BKSY). In that article, I warned that BlackSky stock was still relatively expensive, even at $2/share, given its weak profitability metrics and fairly slow growth trajectory.

However, perhaps I was too harsh on BlackSky. At least BlackSky has gotten to $65 million in projected revenues for full-year 2022, which is a number you can probably build a viable business off of. And, analysts expect BlackSky to hit the $100 million market in 2023.

Despite Satellogic’s purportedly superior technology, it is struggling to generate a tenth of the revenues of BlackSky. And it’s not like Satellogic started up yesterday. The firm began operations in 2010 and had satellites in orbit by 2017. The CFO states that the company has much more imaging capacity today than its direct listed peers. I find the company’s current revenue picture to be especially puzzling considering these facts.

Simply put, it’s 2023 and Satellogic still can’t show all that much meaningful commercial adoption of the product. The Government of Albania is a paying customer, I’ll give Satellogic that. But when that’s one of Satellogic’s highest-profile clients to date, it speaks to the relatively slow adoption of the product.

In theory, Satellogic’s satellite platform has significant advantages over key rivals such as BlackSky and Planet Labs (PL). In practice, however, it’s hard to know how much credence to put toward these claims. Based on Satellogic’s stated satellite capabilities, it should be winning over clients left and right. Great image quality at far cheaper prices. In theory, the product should virtually sell itself.

And yet, revenues are minimal and not increasing at a particularly inspiring pace. I’m not sure if the problems are in Satellogic’s core product capabilities, its marketing approach, or some other matter. I’d also note that when I researched the space industry via expert calls, there was meaningful commentary about Planet, BlackSky and other rivals, but Satellogic was not discussed much. This suggests that industry leaders may not have Satellogic at the top of their minds when considering the overall state of the market.

Putting these factors together, I would need to see sharply higher revenue growth to give Satellogic a second look. On paper, the company seems to have promising technology. But, there simply isn’t a commercial track record that inspires confidence. And, with the company running sizable operating losses, the clock is ticking to get some business traction before the balance sheet becomes a major concern.