JOSE LUIS CALVO MARTIN & JOSE ENRIQUE GARCIA-MAURIÑO MUZQUIZ

Sarepta Therapeutics, Inc. (NASDAQ:SRPT) is synonymous with Duchenne Muscular Dystrophy (“DMD”). Exondys, the corporate’s exon-skipping molecule, was the primary FDA-approved remedy to deal with particular mutations in DMD. It is a debilitating dysfunction characterised by progressive muscle degeneration as a consequence of mutations within the dystrophin gene in boys with an estimated prevalence of 1 in each 3500 to 5000 births.

A landmark FDA resolution extending SRP-9001 to all age teams in DMD

The corporate not too long ago acquired FDA approval for its DMD gene remedy program, SRP-9001 with a broad label. Earlier than this approval, we realized an 84% revenue from our place, which we acquired throughout a dip following the issuance of the entire response letter, CRL final 12 months. Following the approval, the inventory surged by 40%; nonetheless, it has since retreated by 20% over the month, presenting a chance to reinvest within the inventory with a longer-term perspective.

Though the pivotal EMBARK research for SRP-9001 didn’t obtain its main endpoint, the North Star Ambulatory Evaluation (NSAA), it did meet secondary endpoints, such because the time taken to face up and the 10-meter stroll check after one 12 months. Within the SRP 9001-12 research, a big enchancment in NSAA rating was noticed in comparison with a management after two years. Equally, a notable enhancement in NSAA rating was seen in comparison with management at 4 years within the SRP 9001-101 research. The remedy was in a position to stabilize the decline in muscle operate seen on this probably deadly illness, saving the lives of hundreds of younger boys affected by the illness.

In a landmark resolution, the FDA granted accelerated approval for SRP-9001 final month to deal with DMD throughout all age teams. This reveals the remedy’s potential to avoid wasting the lives of youngsters impacted by this debilitating illness with out different therapies.

A 63% annual income development is predicted to speed up additional with current FDA approval for SRP-9001’s expanded label

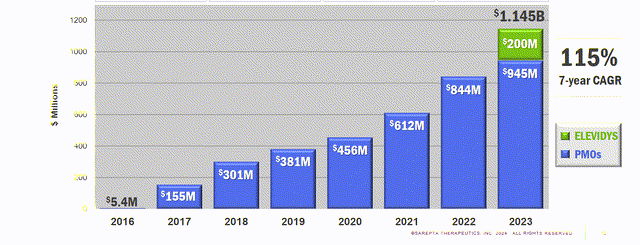

In Q1 2024, the corporate reported revenues of $413 million, marking a 63% year-over-year improve. Within the absence of different FDA-approved therapies for DMD, there’s robust market demand for the corporate’s merchandise. Income development is predicted to speed up after the broad label granted for SRP-9001 final month.

In Q1 2024, the corporate additionally beat income and earnings per share, EPS estimates. The corporate is nicely funded, with $1.4 billion in money reserves.

SRPT Income Progress Chart (Investor presentation)

Funding Alternative

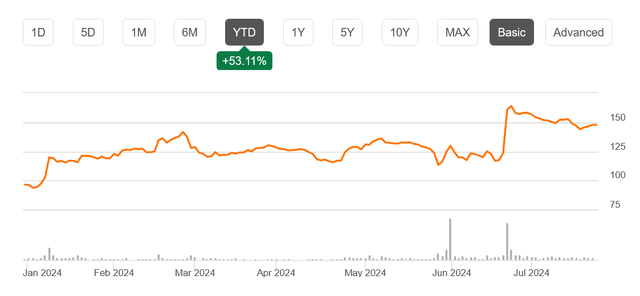

Regardless of the numerous FDA approval, the inventory skilled a 20% pullback from current highs in a single month, presenting a gorgeous shopping for alternative for long-term traders.

The corporate is addressing a big U.S. market of fifty,000 present DMD instances. SRP-9001 (now branded as Elevidys). The remedy’s wholesale worth is $3.5 million/per affected person. Utilizing an enter common gross sales worth of $2.6 million/affected person (74% of the wholesale worth, common for biotech/pharma per the Pharmagellan information), it’s a cumulative $130 billion income alternative for the corporate. The corporate’s present enterprise worth is $13.75 billion, thus making it undervalued (biotech shares normally commerce at an enterprise worth of peak gross sales occasions seven per NYU-Stern information from Damodaran).

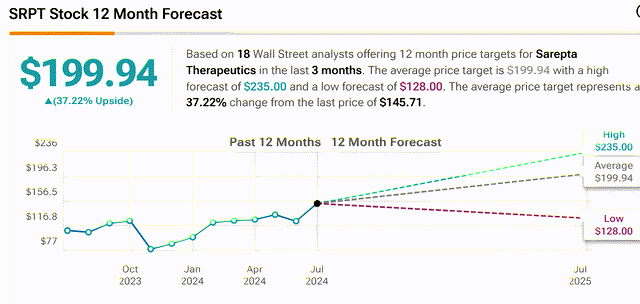

The common sell-side analyst worth goal on the inventory (from revised rankings post-approval) is $200 (37% upside potential, starting from $128 to $230).

SRPT sell-side analyst worth targets (Tipranks)

This current decline might current a chance for traders to purchase into the inventory. The market response could also be extra as a consequence of profit-taking after the information reasonably than considerations concerning the firm’s long-term prospects.

SRPT Inventory Value Chart (Searching for Alpha)

Conclusion

In abstract, Sarepta’s SRP-9001 gene remedy for DMD has promising potential to revolutionize this discipline. The corporate has a big time lead over its competitors on this illness, permitting it to achieve a big market share on this market.

.png)