Samantha Gossman/iStock via Getty Images

Last year’s Santa Claus Rally was comforting for those who were forecasting a prosperous 2023. This year that lot, including me, isn’t so lucky. Santa didn’t show up during the last five trading days of 2023 and the first two of the new year, which is the period otherwise known as a Santa Claus Rally when posting a positive rate of return. The concern for some is that he usually shows. In fact, according to the Stock Trader’s Almanac, we have had a positive rate of return over this seven-day stretch in 24 of the past 30 years for an average gain of approximately 1.3%. In the six years that produced a negative rate of return, the S&P 500 was down for the year that followed four times. The other two years produced buying opportunities that led to a positive return by year end. Therefore, this is more like a chink in the armor to start the year rather than a bad omen of what’s to come.

Finviz

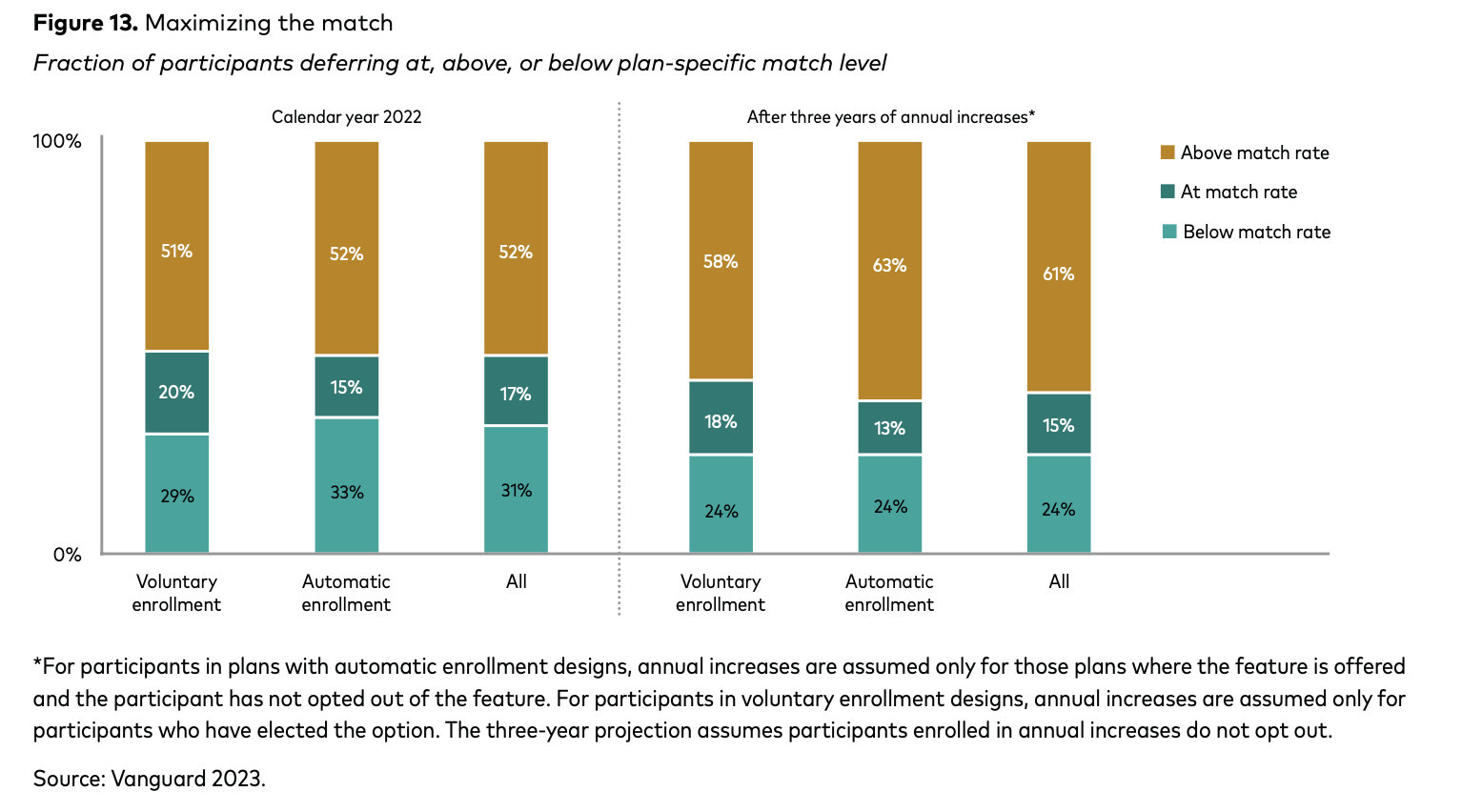

I would be more concerned if the recent decline wasn’t attributed to the extent of the rally that preceded it, which was parabolic. When stock prices start to fall and sentiment begins to sour, news is interpreted negatively, regardless of whether it is news or not. That appears to be how investors read the Fed’s meeting minutes from December, which were released yesterday afternoon. There was nothing new here. Fed officials acknowledged the progress made in lowering the inflation rate with “diminished upside risks,” and expressed concerns about the impact an “overly restrictive” monetary policy might have on the economy. That is good news for bulls.

Bloomberg

Yet investors seemed to focus on the statement that there remained “an unusually elevated degree of uncertainty,” which could lead to further rate increases, and that policy may remain restrictive for some time. Investors should know by now that every statement is threaded with hawkish rhetoric to manage inflation expectations and keep financial conditions tight. This meeting was held in mid-December, during the surge in risk asset prices, which probably concerned some officials at that time. Financial conditions did loosen dramatically by year end, due largely to the drop in interest rates and increase in stock prices. Yet policy will be based on the incoming data, and there is nothing in the numbers that suggests the disinflationary trend is not on track. As a result, we saw no change yesterday in the high probability that the first rate cut from the Fed will come in March.

I hate falling in line with the consensus, but in terms of rate cuts, it’s the consensus that has fallen in line with me in expecting six rate cuts by the end of this year, which would lower the Fed funds rate from a range of 5.25-5.5% to 3.75-4%. I think more progress on lowering the rate of inflation combined with a further softening of the labor market will further increase this probability by the time March is here.

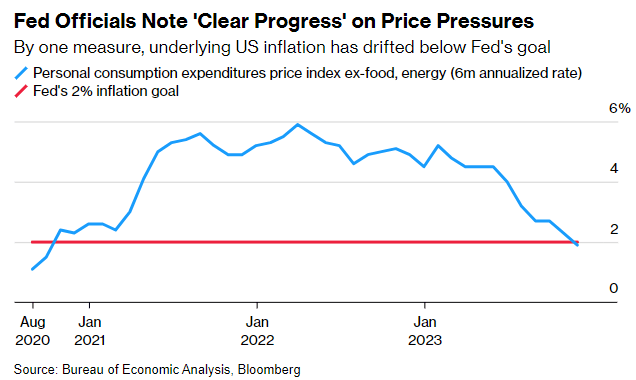

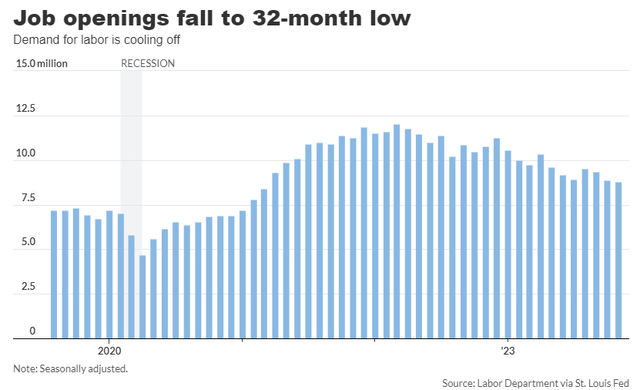

Yesterday’s job openings (JOLTS) report supports those odds with the number falling to 8.79 million and closing in on pre-pandemic levels. There are still 1.4 job openings per unemployed worker, but the steady progress in reducing vacancies should further ease wage inflation.

MarketWatch

The rate at which workers are quitting their jobs fell to its lowest level since September 2020, which also reduces the upside pressure on wage gains. When workers are less inclined to leave their current job and look for another one it suggests that they are less likely to find a higher wage. It should be clear that the demand for labor and its supply is gradually falling back into balance, which is exactly what we need to see to produce the soft landing that markets are now expecting.

This is what makes navigating the current marketplace more difficult than last year. When the economic numbers were on track for such an outcome, but investors and market prices were not expecting it, there was a margin of safety in risk asset prices. Now that the consensus is on board with the soft landing narrative, and risk asset prices are fully reflecting that outcome, downside risks exist that didn’t last year, and we need new catalysts to drive prices higher. I think that will come in the form of corporate profits for the fourth quarter of last year, which start next week.

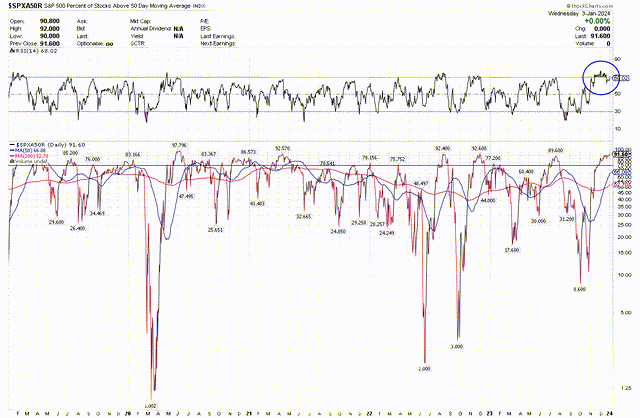

As for the pullback I have been expecting in risk assets across the board, it is obviously happening. Despite how sharp the decline has been over the past three trading days I do not get the sense that this is close to being over. We stretched the rubber band exceedingly far in one direction and it has simply been snapping back. The dollar is rallying, bond yields are climbing, volatility is picking up, and stocks are falling. To show how far extended we were going into the final trading day of the year, the carnage of the past three days still leaves the percentage of stocks in the S&P 500 trading above their 50-day moving average at 91.6%. In fact, it has risen to a new high since bottoming at 8.6% at the end of October. If you look at the history of this indicator over the past five years, it can stay elevated at this level for a couple of months, but it inevitably reverts to a mean. That has not started yet.

Stockcharts

I suspect we continue to see lots of rotation between sectors and stocks with last year’s winners dragging the overall market indexes lower into the fourth-quarter earnings season. Better-than-expected earnings will need to be the catalyst to end the pullback and resume the uptrend. That is my expectation. Until then, I am leaning defensively, but in the context of a bullish outlook for 2024.