The owners of the Westfield San Francisco Centre mall are giving up the property to lenders, adding to deepening real estate pain in a city struggling to bring back workers and tourists after the pandemic.

The mall, co-owned by Unibail-Rodamco-Westfield and Brookfield, has $558 million in outstanding mortgage debt. Management will be turned over to a receiver.

The move comes a month after Seattle-based Nordstrom said it was closing its store at the site, citing a drop in customer traffic and the changing dynamics of the city. The mall is in the heart of San Francisco’s Union Square district, one of the downtown’s main shopping and tourist areas.

“Given the challenging operating conditions in downtown San Francisco, which have led to declines in sales, occupancy and foot traffic, we have made the difficult decision to begin the process to transfer management of the shopping center to our lender to allow them to appoint a receiver to operate the property going forward,” Molly Morse, a spokeswoman for Unibail-Rodamco-Westfield, said in the statement.

San Francisco has been among the hardest-hit cities since the pandemic as office vacancies soar, retail vacancies rise and concerns about safety deter visitors. Last week, Park Hotels & Resorts said it was stopping payments on loans tied to two downtown hotels with $725 million in outstanding debt.

Sales at the Westfield San Francisco Centre fell to $298 million last year from $455 million in 2019, while foot traffic dropped 43%, Morse said. Traffic and sales at other Westfield properties increased during the same period.

Westfield’s decision to stop paying its debt was first reported by the San Francisco Chronicle.

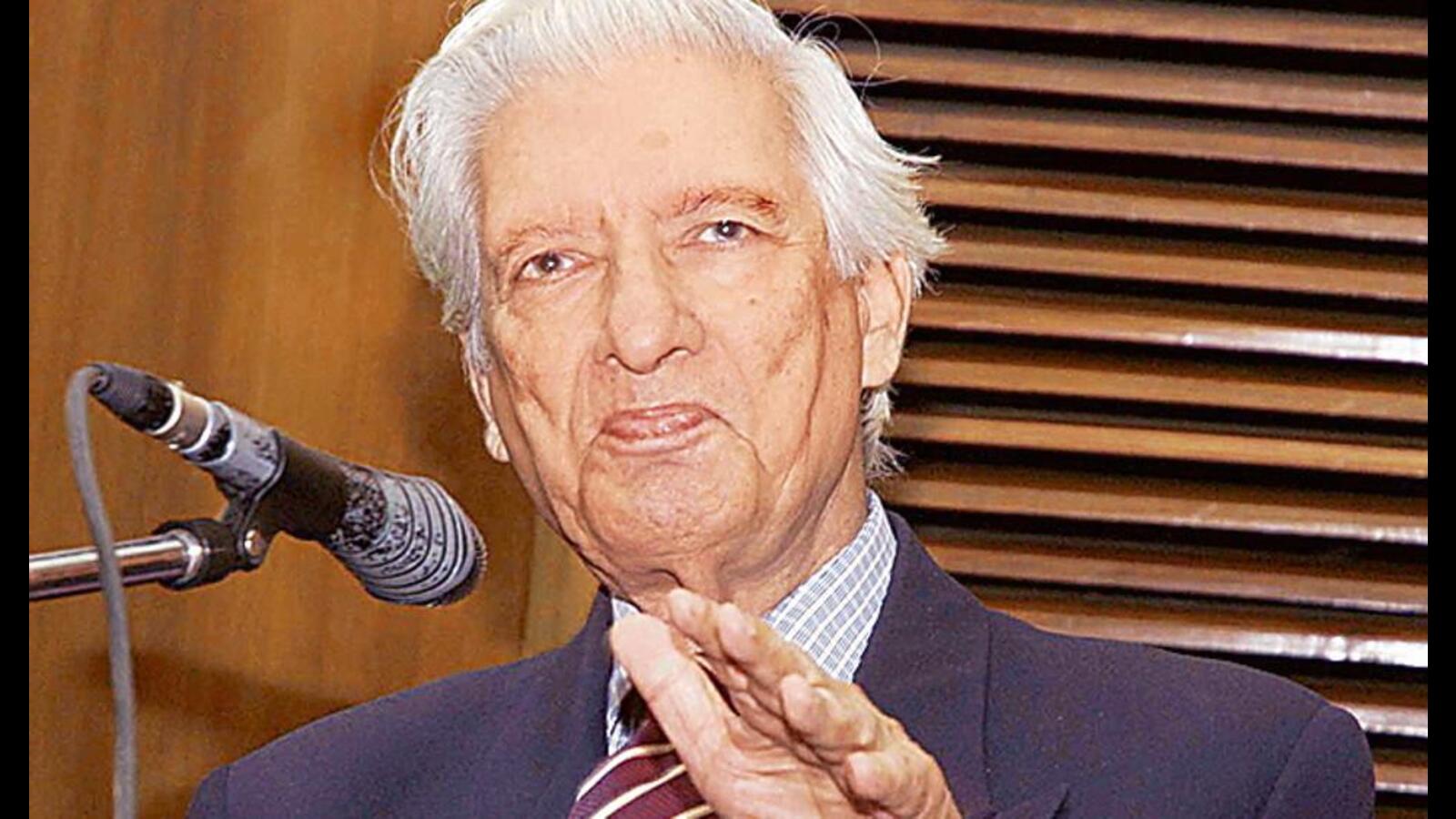

In a statement, San Francisco Mayor London Breed said the move was “coming for some time” and pointed to plans by Unibail-Rodamco-Westfield to leave the US market entirely. The Paris-based company planned a “radical reduction of our financial exposure to the US over the course of 2022 and 2023,” Chief Executive Officer Jean-Marie Tritant has said.

“With new management, we will have an opportunity to pursue a new vision for this space that focuses on what the future of downtown San Francisco can be,” Breed said. “Whether that’s attracting new types of business or educational institutions, or creating a totally different experience, we need to be open to what’s possible.”