FinkAvenue

This is an interesting ongoing activist campaign. I have never seen so many star activists involved in a company. One of the activists has already managed to take a board seat. Meanwhile, the company’s share price is down materially since its peak. Such a combination implies that good things are bound to happen, making this an interesting opportunity for event-driven investors.

Salesforce (NYSE:CRM) is a $164m market cap enterprise-focused CRM software giant. After peaking in late 2021 ($300+/share), the company’s share price has continued to stumble, recording a 46% decline since then. Downward pressure for CRM’s share price has come amid a broader market sell-off as well as operational and corporate governance difficulties:

- The company’s top line growth and gross margins have declined in the deteriorating macroeconomic environment leading to lower customer demand for CRM software. As an illustration, in Aug ’22, CRM cut sales growth guidance down from 20% to 17%. Moreover, the company slashed estimates of FY2023 operating cash flow growth from 21-22% to 16-17%.

- On the governance side, the company has recently seen a number of high-profile management team members leaving. Among the departing personnel were four high-level executives, including co-CEO and Chief Strategy Officer as well as two CEOs of the company’s Tableau and Slack divisions.

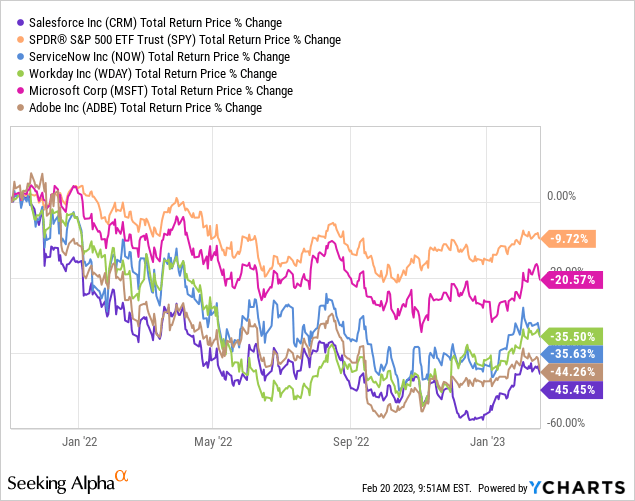

YCharts

Perhaps not surprisingly, CRM has come under increasing pressure from a number of activists. In Oct ’22, Starboard Value accumulated an undisclosed stake in the company. Other activists, such as Paul Singer’s Elliott Investment Management, ValueAct, as well as Jeff Ubben’s Inclusive Capital followed suit, accumulating stakes in CRM. This month, reports appeared that Dan Loeb’s Third Point has joined the already reputable list of investors. One of the activists, Starboard Value, noted CRM has quite significantly underperformed versus the peers and the general market (see chart above). Starboard suggested the company should implement considerable cost cuts while other investors have criticized the company’s expensive acquisitions and high employee pay. While few details on the activists’ specific intentions have surfaced, the suggestions have reportedly revolved around improving the company’s profitability through higher margins as well as performing selected asset divestitures. Elliott has noted intentions to nominate its entire slate of directors during the upcoming shareholder meeting.

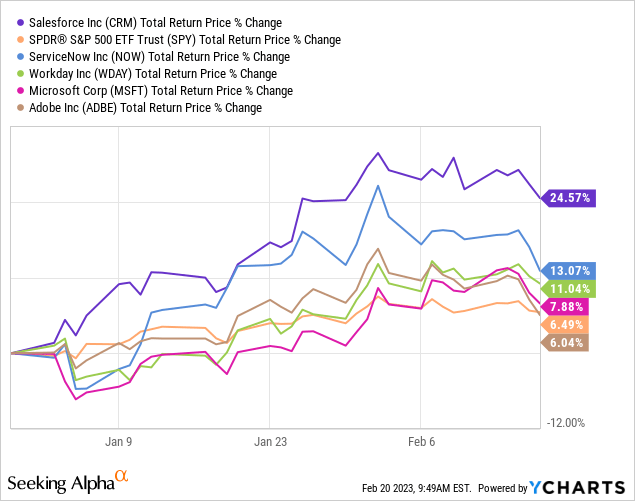

Activist pressure has already yielded some tangible results. In late January, ValueAct’s nominee was appointed to CRM’s board. Moreover, CRM has recently initiated an operational turnaround, aimed at addressing the turmoil at the company. In Jan ’23, CRM announced plans to lay off 10% of its workforce as well as plans to reduce leased real estate footprint. The management expects the recent measures to result in cost savings from $3bn to $5bn, with recent layoffs accounting for $1.7bn-$2.4bn. This compares to $5bn in run-rate FCF ($5.3bn in FY2022 and $4.1bn in FY2021). While it is questionable if the management can achieve these hefty goals, cost savings in the ballpark of the mentioned range would clearly be highly accretive to the bottom line and FCF. Moreover, CRM recently authorized its first share buyback ($10bn) in the company’s history. CRM’s investors have seemingly taken the recent developments positively, with the share price jumping 25% this year. While the entire tech sector has been trending upwards in 2023 so far, CRM has outperformed its peers as well as the broader market (see below). Worth noting that last week rumors appeared that CRM might come to a settlement with Elliott as soon as this week.

YCharts

Having said that, there seems to be further upside remaining here from a valuation perspective. CRM is currently trading at 5.4x TTM revenues. While there are no similar-sized comparable peers, other enterprise software companies NOW and WDAY trade at 11.9x and 7.6x multiples. Worth noting that CRM is a significantly larger company than both comps with a $164bn market cap compared to $48bn for WDAY and $89bn for NOW. All three companies have boasted similar adjusted operating margins in CY2023E – 20% for CRM, 19% for WDAY and 25% for NOW. Moreover, the companies have grown at a comparable pace in recent years – CRM’s revenue CAGR in FY2018-FY2022 has stood at 26% compared to 21% for WDAY and 29% for NOW (though CRM’s growth has been partially fueled by acquisitions). These points suggest CRM should be valued more in line with these peers.

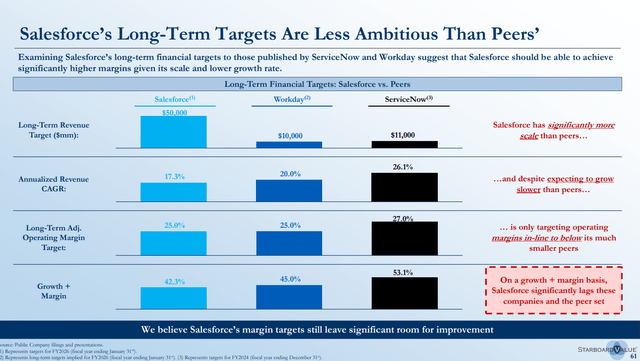

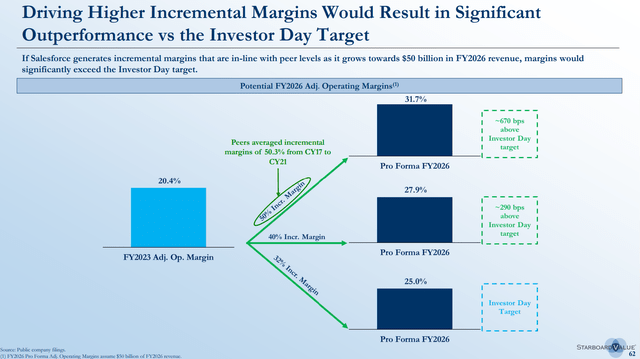

As noted by Starboard Value, the discrepancy in valuation between CRM and the two comps might be explained by WDAY and NOW’s more optimistic long-term financial targets, including annualized revenue CAGR and adjusted operating margins (see below). However, as suggested by the activist, CRM management’s targets might be overly conservative. As a reference point, in the latest quarter (Q3 FY23), CRM already reported record-high 23% operating margins (compared to the FY2026 target of 25%). Starboard has noted that CRM would record much higher long-term operating margins of 32% if the company is able to achieve incremental margins of 50% going forward – in line with peers’ average from CY2017 through CY2021. Given a number of activists involved and the fact that the management has already initiated a number of changes, such a target does not seem out of reach. With these points in mind, I am inclined to conservatively value CRM at 7x TTM revenues or $212/share – 28% upside from current levels.

Starboard Value Investor Presentation, October 2022

Starboard Value Investor Presentation, October 2022

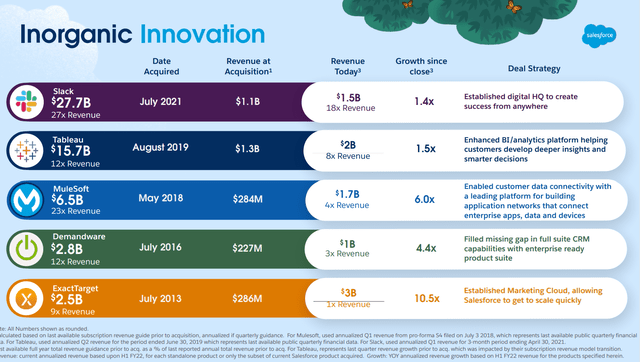

Another possible course of action pursued by the activists/CRM’s management might be asset divestitures. Potential segment sales have been highlighted by Starboard and reportedly by other activists. I view this as a less likely option given that 1) CRM’s strategy revolves owning a portfolio of best-in-breed businesses, allowing it to provide a bundled software offering and 2) a potential sale would need to come at a material discount to where the businesses were acquired. Nonetheless, it is possible that the activist might initiate sales of particular segments, such as Tableau and Slack. Recent departures of Slack’s CEO/founder as well as Tableau’s CEO might seem interesting in this context.

Salesforce Investor Presentation, September 2022

Activists

Track-record of the activists involved gives confidence in a favorable outcome here. Elliott – which is one of the most reputable among the bunch – has led a number of high-profile successful activist campaigns in technology companies, including at Pinterest, Twitter and eBay. Another activist Starboard has successfully pressured the management at Humana, Magellan Health, Acacia Research and Symantec. Worth noting that Elliott and Starboard previously worked in their activist campaign at eBay where the company eventually sold its classified advertising business. Third Point has managed to drive changes at Campbell Soup, Walt Disney and Intel. Meanwhile, ValueAct has extensive experience in pursuing transformations in software companies. The activist’s nominees have previously served on the boards of Microsoft and Adobe. At Microsoft, ValueAct’s CEO helped drove the company’s transformation into an enterprise software cloud-based business. At Adobe, ValueAct took a board seat at a time when the company pursued a transformation into a subscription cloud service. Both company market capitalizations have soared since the involvement of the activist.

Conclusion

Salesforce currently presents an interesting ongoing activist campaign. A number of reputable activist investors are involved, moreover, the management has already cooperated with one of the activists. Coupled with the company’s low relative valuation and ample room for margin expansion, these points suggest the setup might potentially offer substantial upside.