John M. Chase

Salesforce, Inc. (NYSE:CRM) investors who braved the pessimism and picked its lows late last year have been well-rewarded, as CRM took off in 2023, significantly outperforming the S&P 500 (SP500, SPX, SPY).

I last updated investors with a Buy rating in early December 2022, which was slightly early as CRM didn’t bottom out until mid-December. However, it was still a solid buy point for investors who ignored the market’s pessimistic calls, as CRM surged nearly 80% from its December lows toward its recent highs.

Therefore, given the remarkable recovery, I believe it’s an opportune time to help CRM holders assess whether the current levels are still constructive to buy more shares.

I’m pleased to highlight that I gleaned the opportunity in recovery play in CRM remains valid, as its valuation is still at pessimistic levels, despite the recovery over the past six months. Its price action has also not demonstrated significant momentum spikes, suggesting investors had rushed into CRM, which could lead to bull traps or false upside breakouts preceding potentially steep pullbacks.

Interestingly, the market remains lukewarm over CEO Marc Benioff and his team’s generative AI strategy, as they announced a suite of upgrades to the Salesforce ecosystem.

But why? Does the market think CRM deserves to trade at a steep discount against its historical averages as it moves toward a better balance between profitability and growth?

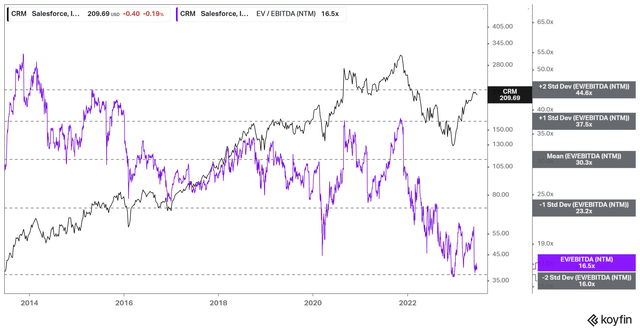

CRM forward EBITDA multiple trend (koyfin)

As seen above, CRM last traded at a forward EBITDA multiple of 16.6x, close to the two standard deviation zone under its 10Y average of 30.3x. In other words, CRM is cheap, relatively speaking.

It’s also trading well below Microsoft’s (MSFT) forward EBITDA multiple of 21.7x and below its SaaS peers’ median of 21.9x (according to S&P Cap IQ data). Therefore, while CRM has recovered remarkably from last year’s battering, as it closed in on its 2020 COVID lows, I assessed that its valuation is still appealing.

Salesforce launches a series of generative AI offerings expected to drive better integration with its ecosystem. However, I assessed that the market could remain tentative over the company’s ability to drive near-term topline growth after its first-quarter earnings release in early June.

Keen investors should recall that the company didn’t raise its full-year revenue forecast despite the solid FQ1’24 performance, although it improved its outlook for adjusted operating profitability.

As such, the market is likely assessing the company’s ability to drive higher revenue accretion through its new AI cloud and data integration before re-rating it further upward.

Does it make sense? I think it’s justified. The revised consensus estimates indicate that Salesforce is expected to deliver revenue growth of 10.5% for FY24, in line with management’s guidance. However, that’s down significantly from FY23’s 18.3% and even more from FY22’s 24.7%.

Therefore, I believe the market is adjusting its expectations over the company’s new revenue growth cadence, given its heightened focus on improved bottom-line metrics. Moreover, analyst estimates don’t expect a much-improved top line growth in FY25, with a projected increase of just 10.8%. Therefore, I gleaned that the market is likely awaiting more constructive progress from the company’s generative AI offerings before readjusting their expectations on CRM’s growth cadence.

Despite the market’s pessimism, Salesforce’s wide economic moat is underpinned by its ability to cross-sell multiple solutions across its ecosystem. As such, the attraction of its multi-cloud strategy, coupled with its ability to integrate third-party AI models, should help attract customers to its AI offerings. Moreover, Salesforce’s focus on compliance and “trusted AI” should help bolster more robust enterprise adoption.

Despite that, I believe the market’s demand for a wider margin of safety, given its much slower topline growth cadence, is understood. The changes are markedly different from Salesforce’s previous acquisitive-heavy approach to growing its business. As such, a significant discount is justified and expected until the market fully understands how Salesforce’s new AI offerings could help bolster its ability to move back into the “performant” phase.

With that in mind, investors need to have a high conviction over Benioff’s ability to continue Salesforce’s recovery through its AI strategy, which remains a work in progress. However, I assessed that there aren’t many wide-moat SaaS players with Salesforce’s capabilities still trading at such depressed levels that should warrant the market’s attention subsequently.

Moreover, CRM’s price action suggests that it’s at the cusp of recovering its long-term uptrend, indicating that the recovery is still in its earlier stages.

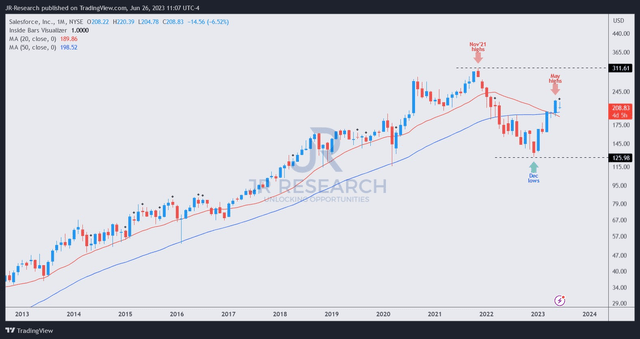

CRM price chart (monthly) (TradingView)

CRM lost its long-term bullish bias even as it bottomed out in December 2022. However, the resurgence in dip buying sentiments has helped it recover its uptrend momentum, despite the pullback in June.

After such a remarkable recovery, a welcomed pullback should not be unexpected. Hence, if Salesforce, Inc. stock could stay above the 50-month moving average or MA (blue line), it should provide more confidence for momentum investors to return. As such, it should help lift CRM from its depressed valuation levels, suggesting that buyers are confident that the market’s perception of CRM’s valuation is too pessimistic at the current levels.

Rating: Maintain Buy.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!