Jon Tetzlaff/iStock Editorial through Getty Photographs

Saia, Inc. (NASDAQ:SAIA), the LTL transportation holding firm, reported comparatively weak quarterly outcomes on July 26, sending its inventory worth plummeting 19% in someday. Earnings per share have been $3.83 as an alternative of the anticipated $4.08, and income for 2Q2024, though it reached a file worth of $823 million, was additionally under analysts’ forecasts of $843 million.

Immediately I wish to take a look at how dramatically the enterprise is doing following this market response to the report and discover out by cautious quantitative evaluation of the monetary information whether or not SAIA shares are viable investments in the present day.

LTL Business Overview

Saia supplies less-than-truckload (LTL) providers by a single built-in group. The corporate additionally provides prospects varied value-added providers throughout North America, together with non-asset truckload, expedited, and logistics providers. Much less-than-truckload or less-than-load is a delivery service for comparatively small hundreds or portions of freight. LTL providers have gained nice significance within the trendy financial system with the rise of e-commerce, delivering merchandise shortly to prospects is a should for on-line companies.

US LTL Market (Mordor Intelligence)

Regardless of this, the LTL section remains to be considerably smaller than full truckload (FTL) with an approximate share of 11.3% of trucking. Nonetheless, this is a reasonably large market with a quantity of roughly $109 billion and a progress price of three.24% CAGR (4.19% is anticipated for 2024-2023).

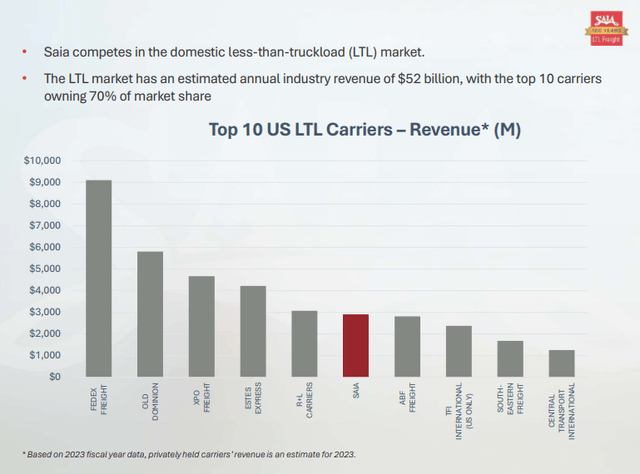

Saia is among the many prime 7 firms within the trade, with an annual income of $3.1%. What’s extraordinarily necessary is that it’s growing a lot sooner than the market, demonstrating a progress price of 12.3% CAGR.

In accordance with this indicator, the corporate is considerably forward of market leaders FedEx (FDX) with 5.5% and Outdated Dominion Freight Line (ODFL) with 8.7% progress charges.

This dynamics permits me to imagine that the corporate will have the ability to win the a part of the market shortly and considerably improve its present share of two.8% (primarily based on 2023 outcomes). True, the corporate operates with a market quantity of $52 billion, contemplating solely privately held carriers’ income.

High 10 US LTL Firms (Saia Inc.)

Monetary Efficiency

Saia would not impress with its margins. Judging by the reporting for the second quarter, 45% of income is spent on paying workers, virtually 20% – on gasoline and supplies, and seven% goes to cowl the acquisition of recent autos. Add depreciation right here and we get a web margin of 12%. Though the corporate doesn’t disclose the price of items offered and gross margin in its experiences, in accordance with Searching for Alpha, gross margin is 27%.

Nonetheless, the standard of earnings of $354.8 million for 2023 and $102.5 million for Q2 2024 could be very excessive. That is evidenced by the evaluation of money circulation statements. Dividing web money offered by working actions money circulation by web revenue for the final 12 months, I get a worth of 1.38 or 138% – whichever is extra handy so that you can analyze the numerical worth. Saia can affirm the accrued revenue within the monetary statements with the precise funds obtained into the corporate’s account, and that is undoubtedly a optimistic level for me.

Zero-emission Nikola Heavy Truck (Nikola Motor)

Frankly, the evaluation of profitability indicators that I do in quest of some undoubted benefits of the corporate isn’t spectacular. There are not any important flaws within the experiences, nor are there any super-positive alerts. Comparatively low margins are an illustration of excessive competitors within the trade; due to this fact, buyers mustn’t anticipate a fast and a number of improve in share worth from Saia – there are merely no conditions for this.

Monetary Place

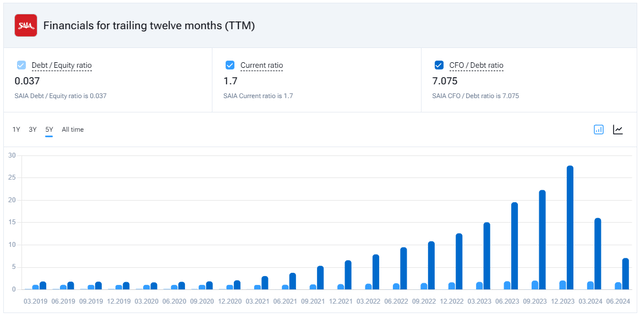

Instantly, within the second quarter, the corporate elevated its long-term borrowings by 28 occasions: from $6 to $169 million! Saia is a celebration to an unsecured credit score settlement with Revolving Credit score Facility, which supplies as much as a $300 million revolving line of credit score by February 2028, in accordance with the Credit score Preparations notes (web page 9) to Condensed Consolidated Monetary Statements.

I’ll quote the phrases of Saia President and CEO, Fritz Holzgrefe, who commented on the quarter, stating in a press launch on the corporate web site:

Through the quarter, we efficiently opened six new terminals and relocated two others in new and established markets, whereas sustaining our excessive service requirements. Efficiently opening and relocating terminals required investments in worker hiring, coaching and different prices that come upfront of opening and income era… We’re excited concerning the opening of our new Stockton, California and Davenport, Iowa terminals earlier this week, and as we transfer by the remainder of 2024, we plan to proceed executing on our opening timeline, with the potential to open an extra 10 to 13 new terminals this 12 months.”

Saia’s solvency metrics (eyestock.io)

In accordance with the steadiness sheet as of June 30, 2024, money and equivalents have been solely $11 million. Evidently the entire above figures and firm statements are linked in a single chain. To take care of the enterprise progress that I spoke about on the very starting, the corporate is making applicable efforts, which is necessary, with out severely compromising its solvency.

Regardless of this truth of borrowings rising, complete debt stays very modest: roughly $180 million towards a stockholders’ fairness of over $2.1 billion. Should you take a look at the Debt-to-equity ratio of 0.037, then every thing is so as. Liquidity can be good, the present ratio is 1.7.

Administration Effectivity and Development Sustainability

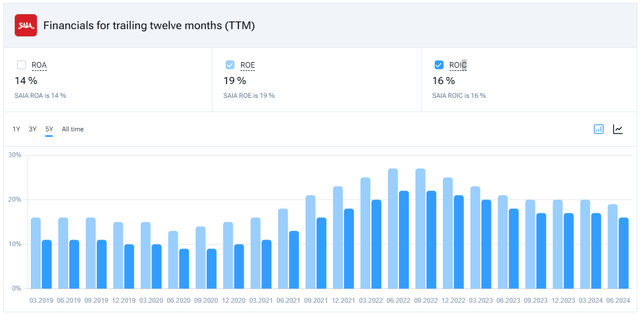

As with margins, the effectivity of administration within the type of return on capital is enough for me, however not dizzying. Return on fairness is nineteen% in accordance with my calculation and ROIC, which I want a bit of extra for evaluating effectivity – is 16%. What’s necessary is that each indicators have a medium-term downward development.

The 5-year dynamic of Saia’s ROE and ROIC (eyestock.io)

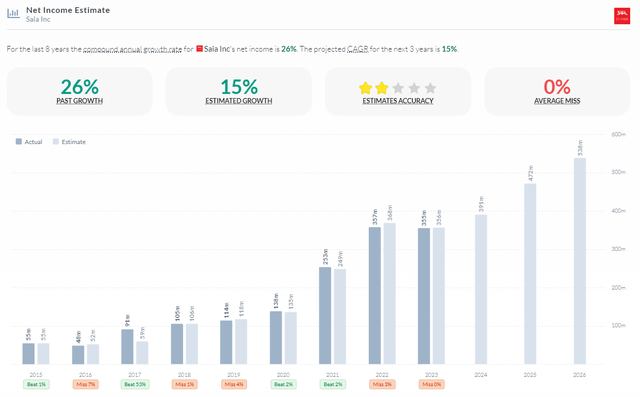

In addition to the expansion price of web revenue, for those who take a look at quarterly dynamics. Nonetheless, as I stated, the corporate has traditionally grown at a sooner price than the market. For the final 8 years, the compound annual progress price for Saia’s web revenue is 26%. The common progress price of web revenue over 5 years (42%) is considerably larger than the 2 years (14%) if we take the quarter-to-quarter ratio as a foundation. This confirms that the corporate is in a correction part. Nonetheless, what I pay shut consideration to is the mathematical deviation of the expansion price. For five and 2-year intervals, the deviation worth is 45% and 11%, which virtually corresponds to the common progress price. Is that this good? I imagine that that is a suitable indicator at this level, which means that future earnings will be predicted primarily based on this monitor with a excessive confidence interval.

Saia’s progress price of web revenue (alphaspread.com)

After the evaluation and the listed monetary traits relating to the trade and the corporate itself, I had a transparent concept that I used to be not coping with a star, however with a really powerful nut to crack that would turn out to be a part of my funding portfolio. Nonetheless, for such investments, it’s doubly necessary to fastidiously choose the entry level, since a mistake with it may damage the entire thought.

Valuation and Future Prospects

I’m not a powerful forecaster. And it isn’t a part of my decision-making system. Due to this fact, I’ll decide the worth of Saia solely from the standpoint of numbers, evaluating the present valuation with the historic one and with opponents. As of August 14, Saia’s worth share is $375 and which means that the price-to-earnings ratio is about 26. This estimate is larger than the trade median and, particularly, the trade chief in market share, however not when it comes to efficiency, FedEx (P/E TTM 16). For causes which might be clear to me: FedEx is performing a lot worse financially, and its revenue progress price is far weaker.

However this rating is decrease than ODFL (P/E TTM 33). And likewise for causes which might be clear to me. The second-largest market participant has considerably higher margins and returns on capital, and due to this fact has a premium in valuation. It appears like Saia is being priced pretty as of in the present day.

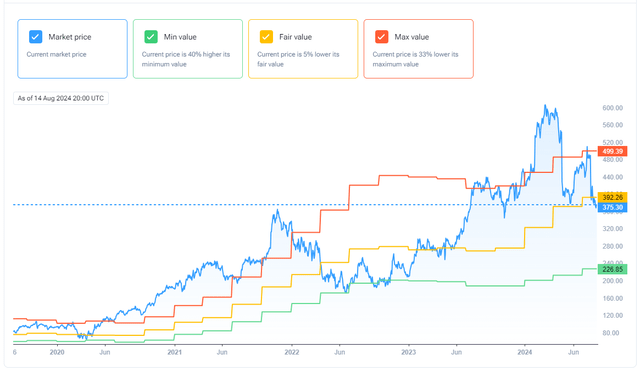

Saia’s quantitative valuation (eyestock.io)

Furthermore, the historic median which means of Saia’s P/E for the final 20 quarters is 27.6 which is so near the present valuation. The present worth is 5% under the median P/E multiplied by 12-month trailing earnings per share, which I take advantage of as a good valuation. That’s, the expansion potential is sort of restricted.

Conclusion

With pretty stable financials on evaluation and a powerful trade presence, the corporate caught my eye and is a top quality candidate for a average portfolio share given the latest share worth decline. Whereas not a star inventory with prospects for a number of progress, Saia can turn out to be an excellent consultant of the Industrial sector with a transparent growth monitor. Nonetheless, after I cope with such shares with restricted prospects, I wish to get a worth low cost, however there’s none. The corporate is now pretty valued by all strategies. I don’t exclude that I’ll start to gather a place at present costs quickly, however, after all, I wish to see costs at $220-240 per share to obtain a powerful purchase sign.