Maudib/iStock via Getty Images

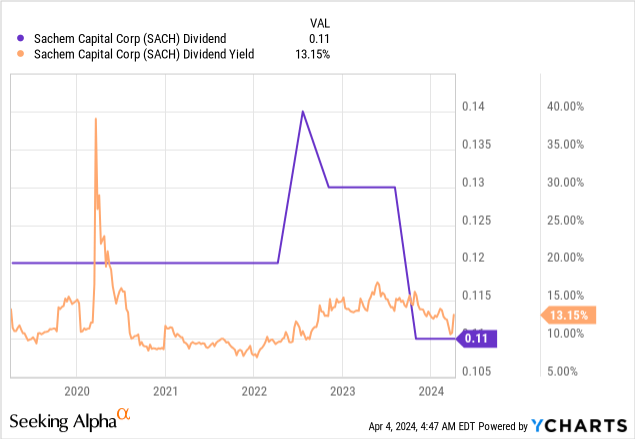

Sachem Capital’s (NYSE:SACH) double-digit slump after its fiscal 2023 earnings brought the mortgage REIT back in line with the dip we’ve seen across the space after a rally to a 52-week high before the earnings report. At risk for bulls is the dividend with SACH last declaring a quarterly cash distribution of $0.11 per share, kept unchanged sequentially and $0.44 per share annualized for a 12% dividend yield. The dip was led by a higher than expected provision for credit losses as SACH’s revenue for the full year 2023 grew to $65.6 million, a 25.5% growth over its year-ago comp and ahead of consensus by $1.28 million.

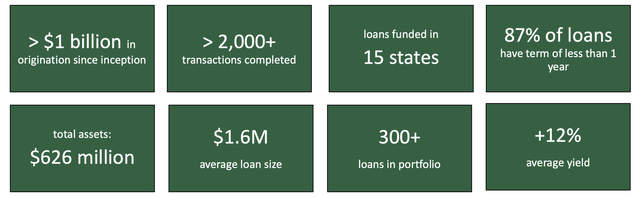

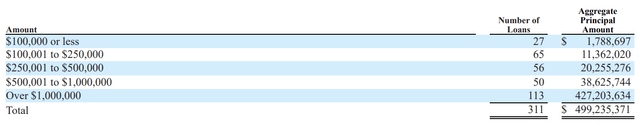

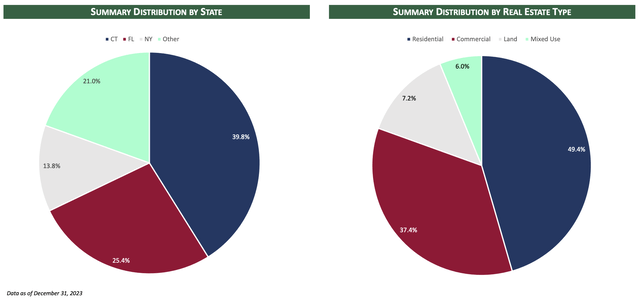

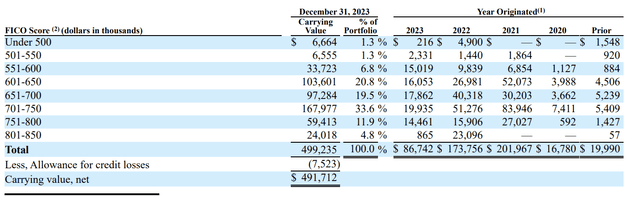

The mREIT originates, services, and manages a portfolio of short-term loans secured by first mortgage liens on a mix of real estate mainly concentrated in Connecticut, Massachusetts, and New York. This portfolio was valued at $499.2 million at the end of the recent fourth quarter, up sequentially from $495.9 million in the third quarter with total assets at $625.5 million and total liabilities at $395.5 million exiting the fourth quarter. It meant SACH’s book value before adjustment for its preferreds at $230 million dipped by $5.4 million sequentially, the first dip since 2020 as higher base interest rates discombobulated both residential and commercial real estate. SACH was forced to push through a $7.5 million allowance for credit loss.

Sachem Capital Fiscal 2023 Form 10-K

EPS, Dividend Coverage, And Loan Performance

Sachem Capital Fiscal 2023 Form 10-K

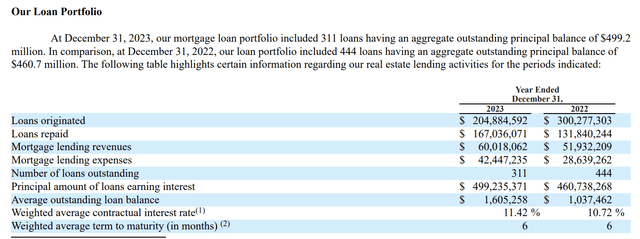

The mREIT originated $204.9 million in loans in 2023, a dip from $300.3 million in loan originations in 2022. Management highlighted a more refined approach to underwriting and a focus on higher-quality loans versus volume. SACH has 87% of its loans on terms of less than 1 year and with 56.6% of loans repaid in full in 2023 before maturity. The mREIT’s weighted average contractual interest rate at 11.42% at the end of 2023 was up 70 basis points from a year ago. SACH had 311 loans outstanding at the end of 2023.

Sachem Capital Fiscal 2023 Form 10-K

Overall, SACH’s focus on high-quality shorter-term loans is somewhat attractive as it means less time exposure against a highly discombobulated market for real estate loans. SACH’s CRE exposure sits at 37.4% with the mREIT focused on residential loans at 49.4% of its loan portfolio.

Sachem Capital April 2024 Investor Presentation

Net income attributable to common shareholders at $12.1 million in 2023 dipped from $17.2 million in 2022 with EPS of $0.27, down by 19 cents from 2022. It means the common shares are currently trading for 13.4x times 2023 EPS and that SACH is currently unable to cover its dividend through EPS with a payout ratio currently at an unsustainable 163%, roughly 61.4% coverage. This will lead to an erosion of book value with SACH seeing this happen during the fourth quarter.

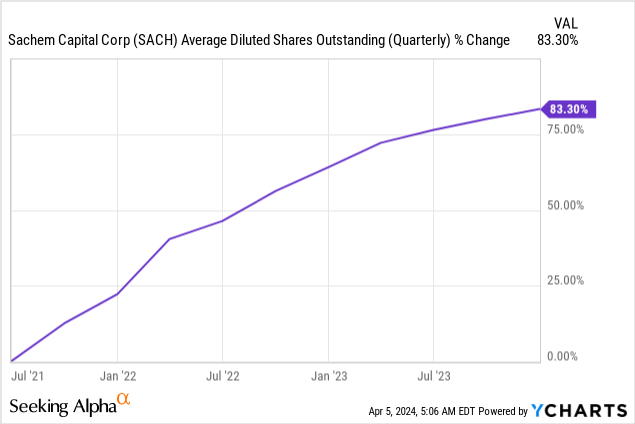

The company’s book value after subtracting the liquidation value of 2,029,923 shares of Series A preferred stock (NYSE:SACH.PR.A) is $3.78 per share. This comes with a level of dilution on the commons that is significant with SACH’s weighted average number of common shares outstanding up roughly 83% over the last three years. The bonds and preferred make the better choice against this zeitgeist of dilution and lack of dividend coverage.

| Bond / preferred Series | Premium/discount to liquidation value ($25) | Annual coupon | Yield on cost % | Maturity date |

| 7.125% notes due 2024 (NYSE:SCCB) | +0.2% ($25.03) | $1.78 | 7.12% | 6/30/2024 |

| 6.875% notes due 2024 (NYSE:SACC) | -1.4% ($24.65) | $1.72 | 6.97% | 12/30/2024 |

| 7.75% notes due 2025 (NYSE:SCCC) | -0.5% ($24.87) | $1.9375 | 7.79% | 9/30/2025 |

| 6.00% notes due 2026 (NYSE:SCCD) | -10.56% ($22.36) | $1.5 | 6.71% | 12/30/2026 |

| 6.00% notes due 2027 (NYSE:SCCE) | -10.36% ($22.41) | $1.5 |

6.69% |

3/30/2027 |

| 7.125% notes due 2027 (NYSE:SCCF) | -9.12% ($22.72) | $1.78125 | 7.84% | 6/30/2027 |

| 8.00% notes due 2027 (NYSE:SCCG) | -5.8% ($23.55) | $2 | 8.49% | 9/30/2027 |

| 7.75% Series A Cumulative Preferreds (SACH.PR.A) | -6% ($23.50) | $1.9375 | 8.25% | N/A |

Two of SACH’s notes, (SCCB) and (SACC), are maturing this year with the longer-dated and hence more risky bonds and the Series A preferred offering higher yields on cost. I don’t have a position in the bonds but I’d lean towards the 2027 maturities.

Sachem Capital Fiscal 2023 Form 10-K

SACH’s loan quality remains titled towards higher FICO scores, however, the percentage of the loan portfolio with a FICO score of 751 and above sat at 16.7% at the end of the fourth quarter, down materially from 32.5% at the end of the third quarter and when I last covered the ticker. I’d be more comfortable with the bonds here with the common shares to avoid.