South Korea’s financial watchdog, The Financial Service Commission (FSC), would monitor crypto whales with assets of over 100 million won ($70,000) to prevent money laundering efforts using digital assets.

The FSC noted that the greater the proportion of virtual assets and stablecoins, the higher the money laundering risk. Thus, special focus should be placed on monitoring crypto whales with significant digital asset and stablecoin holdings under the new anti-money laundering guidelines, reported local media.

The report also drew attention to the use of stablecoins in money laundering and noted that stablecoins, especially those that are commonly used by the public, are more likely to be used as a means of crime. The report reads:

“In the case of an independently listed virtual asset, it is possible that it did not meet the listing criteria of other virtual asset operators, and it can be evaluated that the risk of money laundering of virtual asset operators with a high proportion of the virtual asset is high.”

Apart from monitoring crypto whales and their activities, the report also advocated for keeping a check on retail customers making high-value deposits. Those customers making high crypto transactions should be monitored for any significant change in holdings every quarter.

“Customers with large virtual asset holdings are at higher risk of money laundering,”

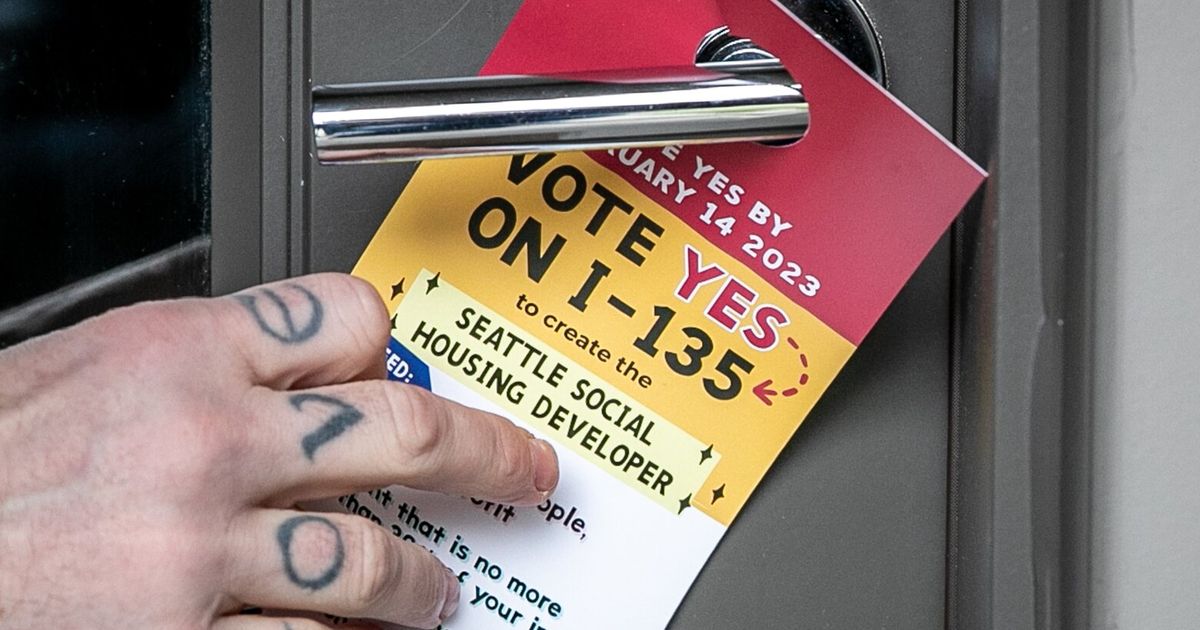

South Korea is known for its strict implementation of crypto-related policies, especially in the wake of the Terra-LUNA collapse. The financial regulators have doubled down on their efforts to ensure investor protection and bring crypto legislation by early 2024.

Related: Koreans to have access to blockchain-powered digital IDs by 2024

In August this year, the chair of FSC said the regulator plans to expedite its review of 13 bills pending in the country’s National Assembly related to digital assets. The aim of the review was to make institutional supplements that will take a balanced approach to blockchain development, investor protection and market stability.