Editors’ be aware: This column is a part of the Vox debate on the financial penalties of warfare.

The havoc introduced upon international locations by violent warfare causes, subsequent to immeasurable private ache, heavy financial disruptions. Destruction of manufacturing websites, disrupted provide chains, and the displacement of individuals usually provoke a sudden and sturdy rupture of financial exercise. Whereas we do not need a lot generalisable empirical proof on the financial prices of worldwide wars, which was a uncommon phenomenon in latest a long time, the literature on civil wars coined the time period ‘growth in reverse’ to explain the usually persistent, adverse financial results of sustained episodes of warfare (Collier et al. 2003).

Presently, we see such a growth in reverse unfolding in Ukraine. Solely weeks after Russian forces commenced their invasion of Ukraine, hundreds of thousands of individuals have left the nation, and previously affluent cities lie in ruins (Skok and de Groot 2022). On the similar time, the worldwide group punishes Russia with sanctions of an unprecedented scale, which have the potential to harm the Russian financial system considerably and finish a long time of financial collaboration (Berner et al. 2022, Felbermayr et al. 2019). Nonetheless, an embargo on oil and gasoline imports from Russia has not but been carried out regardless of intensive public dialogue, as a number of massive European international locations concern the financial penalties of forfeiting these hard-to-substitute imports (Bachmann et al. 2022) . Taking a look at how the worldwide financial system coped with prior disruptions to financial change attributable to violent warfare helps us kind expectations concerning the financial way forward for Ukraine, Russia, and the sanctioning international locations.

(How) do provide chains undertake to financial disruptions?

In a latest research, we examine how worldwide commerce flows reply to unilateral financial shocks (Korn and Stemmler 2022). For this, we give attention to nationwide civil wars, which have been discovered to trigger vital disruptions to international locations’ manufacturing and export capabilities (Blattmann and Miguel 2010). Particularly, we ask whether or not and the way importers modify their commerce flows if a civil warfare breaks out in one in every of their primary commerce companions (see Arezki 2022 on the worldwide spillovers of the warfare in Ukraine). To reply this query empirically, we use bilateral commerce knowledge that embody over 150 international locations for the interval 1995 to 2014.

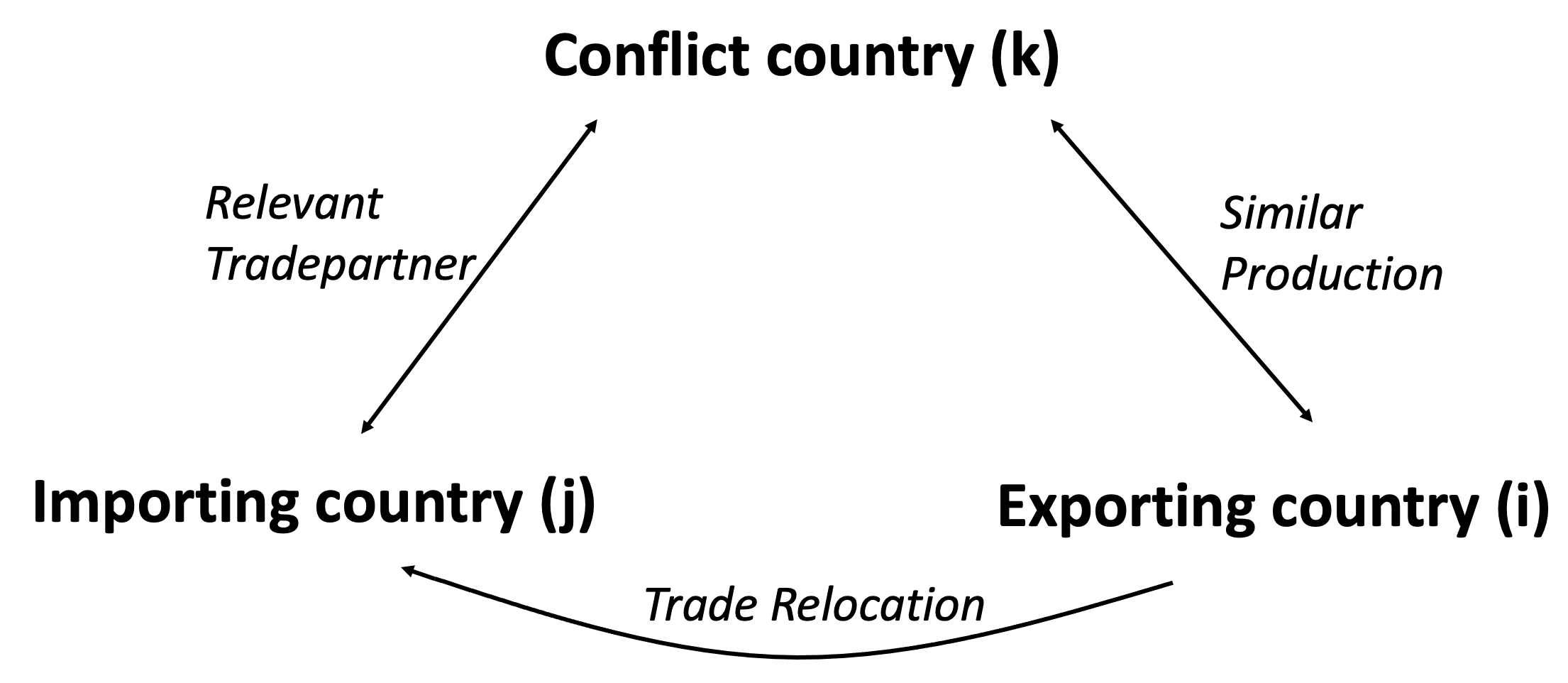

On this dataset, we first establish exporters that have a civil warfare in a given yr in line with the civil warfare classification from the Uppsala Battle Knowledge Program (Sundberg and Melander 2013). Then, we code which buying and selling dyads are most certainly to be affected by commerce relocation away from the battle nation. We base this coding on two traits, which we illustrate in Determine 1. First, we establish all international locations for which the battle nation was a primary buying and selling accomplice (i.e. among the many prime seven exporters to this nation).1 Second, we establish all international locations that provide quite a lot of items much like the battle nation. Utilizing numerous classification algorithms, we kind international locations into clusters with related manufacturing portfolios primarily based on manufacturing volumes throughout 61 SITC product traces. We mix these relevance and similarity situations to code which importer-exporter dyads are prone to expertise commerce relocation results, because the importing nation substitutes its demand away from the battle nation in the direction of one other exporter who affords an identical number of items. Lastly, we examine empirically whether or not commerce values improve between these ‘relocation dyads’ in response to a civil warfare.

Determine 1 Illustration of commerce relocation coding

Notes: This determine illustrates our coding of relocation propensity. For every battle nation okay in a given yr, we establish its primary buying and selling companions in addition to all international locations that present an identical manufacturing portfolio. For every dyad ij the place each situations overlap, i.e. the place the importer j is a related buying and selling accomplice of battle nation okay, and the exporter i produces related merchandise to battle nation okay, we anticipate a commerce relocation impact to materialise.

We discover sturdy proof that international provide chains adapt comparatively rapidly to financial disruptions from civil conflicts, however that this commerce relocation impact reveals a good quantity of heterogeneity. First, the reactions of provide chains in agricultural items and the mining sector are exceptionally robust. On common, commerce volumes between such ‘relocation dyads’ improve by 12% and 13%, respectively, already one yr after the beginning of a civil warfare. Within the manufacturing sector, commerce values improve by 7% on common, and provided that conflicts final for a number of years. Therefore, manufacturing provide chains appear to be extra hesitant to relocate in comparison with imports of major items. Apparently, we discover no proof of provide chain changes within the fuels sector. If something, importers reduce on gasoline imports from various buying and selling companions to take care of their present gasoline imports of their primary exporting accomplice who’s now at battle. It is a response we see once more in the present day, the place international locations extremely depending on Russian oil and gasoline battle to cut back on these imports, despite the fact that they assist numerous different sanctions. Our findings additional add to the latest dialogue in Kwon et al. (2022), who discover proof that sanctioning international locations substitute for exports from third, non-sanctioned international locations. If our outcomes apply equally to the financial results of sanctions, and in gentle of the present debate on oil and gasoline embargos in opposition to Russia, we’d not anticipate finding such a substitution impact for commerce in fuels.

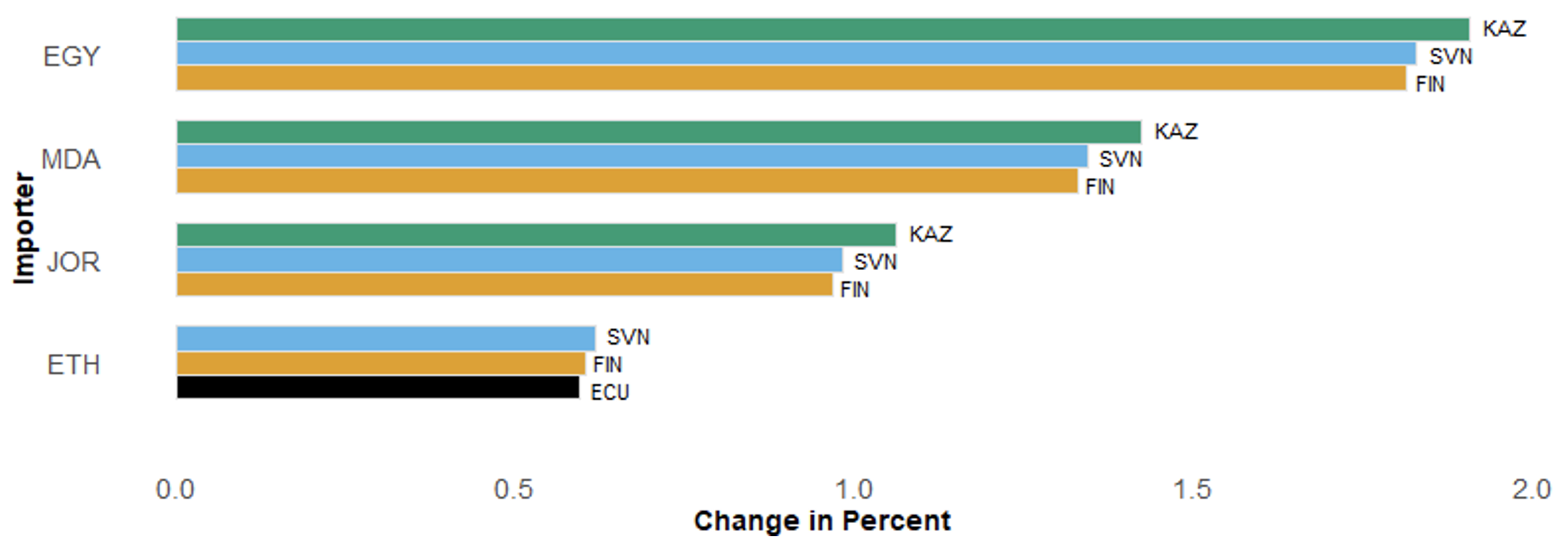

Determine 2 Commerce relocation after Ukraine’s civil warfare

Notes: This determine experiences the adjustments in bilateral commerce values in 2015 in comparison with a hypothetical counterfactual world the place the 2014 civil warfare in Ukraine by no means occurred. On the y-axis, we report the 4 importers that reported the most important commerce relocation results in response to Ukraine’s civil warfare (Egypt, Moldova, Jordan, and Ethiopia). For every of those importers, we offer three bars, which point out the scale of the relative commerce improve for the three primary substitution companions (Kazakhstan, Slovenia, Finland, and Ecuador).

What do our findings indicate for Ukraine’s international provide chains? Right here, we will draw on case research proof from Russia’s annexation of Crimea and the following civil warfare that erupted in Ukraine’s Donbas area. Making use of an identical structural gravity-general equilibrium estimation approach as in Kwon et al. (2022), we estimate the discount in Ukraine’s exports following the outbreak of the civil warfare in 2014. We then use this estimate to compute hypothetical commerce patterns and welfare ranges of nations worldwide if this battle would by no means have occurred. Evaluating precise to hypothetical commerce flows and welfare ranges, we get an concept of how this battle affected the worldwide financial system. Whereas we will hardly evaluate the dimensions of violence throughout the civil warfare to in the present day’s state of affairs, the qualitative tendencies are prone to be related. We discover that a number of dyads improve their bilateral shipments in response to the civil warfare. The international locations most affected by the disruption of imports have been Egypt, Moldova, Jordan, and Ethiopia. For many of them, Kazakhstan, Slovenia, and Finland resembled the principle substitution companions, as they elevated their imports from these international locations by as much as 2% in response to the civil warfare. Taking a look at welfare adjustments, nevertheless, we discover that each one international locations are left worse off in comparison with the counterfactual the place the civil warfare didn’t happen. Whereas it isn’t stunning that Ukraine itself suffered probably the most, even these international locations that profit from commerce relocation (e.g. Kazakhstan and Slovenia) turn into worse off total from the civil warfare, because the will increase in export demand don’t compensate the loss referring to commerce alternatives with Ukraine.

The way forward for the worldwide financial system

We conclude this column by wanting forward. How can the Ukrainian and Russian economies get well from the warfare as soon as the violence ends and the sanctions are lifted? So far as worldwide commerce is worried, it extremely is dependent upon how lengthy the warfare and sanctions will go on, and on how the remainder of the world reacts. In our research, we estimate how commerce relationships behave after a civil warfare ends. Right here, we discover that the commerce relocation results we estimate throughout a civil warfare stay of virtually the identical magnitude as much as 9 years after a civil warfare ended. Our 20-year pattern sadly doesn’t enable us to search for for much longer intervals. Particularly within the manufacturing sector, the relocation results robustly stay unchanged after peace is established. That’s, whereas manufacturing provide chains have a tendency to stay intact throughout shorter intervals of violence, additionally they keep relocated as soon as a substitution occurred. As a attainable clarification of this persistence, we offer proof that (sustained) intervals of violence and the ensuing commerce relocation results improve the chance that the substituting importers persistently lower the bilateral commerce prices with their substitution companions by signing Preferential Commerce Agreements with them. Therefore, relocation persists as a result of the world financial system reaches a brand new equilibrium, wherein the (former) battle international locations’ relative commerce prices have elevated in comparison with the pre-war state of affairs.

This has implications ought to the warfare in Ukraine proceed for therefore lengthy that the relocation of provide chains and the following conclusion of latest worldwide cooperation agreements cement a brand new construction of the world financial system. In that state of affairs, our evaluation means that each Ukraine and Russia would discover it exhausting to get well their worldwide financial standing from earlier than the battle (Chepeliev et al. 2022). The latest go to of Germany’s Secretary of Financial Affairs to Qatar and negotiations on higher commerce relationships could also be one of many first steps on this route. However, present issues to foster financial and political relations with Ukraine, and even to provoke the method of Ukraine becoming a member of the EU, generally is a legitimate measure to counteract the loss in commerce entry introduced upon them by Russia’s declaration of warfare.

References

Arezki, R (2022), “Conflict in Ukraine, affect in Africa. The impact of hovering power and meals costs”, Video Vox, 17 March. s

Bachmann, R, D Baqaee, C Bayer, M Kuhn, A Löschel, B Moll, A Peichl, Ok Pittel and M Schularick (2022), “What if Germany is lower off from Russian power?”, VoxEU.org, 25 March.

Berner, R, S Cecchetti and Ok Schoenholtz (2022), “Russian sanctions: Some questions and solutions”, VoxEU.org, 21 March.

Blattman, C and E Miguel (2010), “Civil Conflict”, Journal of Financial Literature 48: 3-57.

Chepeliev, M, T Hertel and D van der Mensbrugghe (2022), “Slicing Russia’s fossil gasoline exports: Brief-term ache for long-term achieve”, VoxEU.org, 9 March.

Collier, P, H Hegre, A Hoeffler, M Reynal-Querol and N Sambanis (2003), “Breaking the Battle Entice: Civil Conflict and Growth Coverage”, World Financial institution Publications.

Felbermayr, G, C Syropoulos, E Yalcin and Y Yotov (2019), “On the Results of Sanctions on Commerce and Welfare: New Proof Based mostly on Structural Gravity and a New Database”, LeBow School of Enterprise Working Paper Collection, Drexel College.

Korn, T and H Stemmler (2022), “Your Ache, My Achieve? Estimating the Commerce Relocation Results from Civil Battle”, Hannover Financial Papers.

Kwon, O, C Syropoulos and Y Yotov (2022), “Extraterritorial sanctions. A stick and a carrot”, VoxEU.org, 4 March.

Skok, Y and O de Groot (2022), “Conflict in Ukraine: The monetary defence”, VoxEU.org, 17 March.

Sundberg, R and E Melander (2013), “Introducing the UCDP Georeferenced Occasion Dataset”, Journal of Peace Analysis 50: 523-532.

Endnotes

1 On common, the highest seven exporters are chargeable for the primary quartile of a rustic’s total imports.