© Reuters. FILE PHOTO: A cease highway signal is seen subsequent to skyscrapers at Moscow Worldwide enterprise centre, also referred to as “Moskva-Metropolis”, in Moscow, Russia April 14, 2022. REUTERS/Maxim Shemetov

By Man Faulconbridge

LONDON (Reuters) – Moody’s (NYSE:) mentioned Russia could also be in default as a result of it tried to service its greenback bonds in roubles, which might be one of many starkest penalties so far of Moscow’s exclusion from the Western monetary system since President Vladimir Putin’s invasion of Ukraine.

If Moscow is asserted in default, it might mark Russia’s first main default on overseas bonds because the years following the 1917 Bolshevik revolution, although the Kremlin says the West is forcing a default by imposing crippling sanctions.

Russia made a fee due on April 4 on two sovereign bonds – maturing in 2022 and 2042 – in roubles somewhat than the {dollars} it was mandated to pay below the phrases of the securities.

Russia “subsequently could also be thought-about a default below Moody’s definition if not cured by 4 Could, which is the tip of the grace interval,” Moody’s mentioned in a press release on Thursday.

“The bond contracts haven’t any provision for compensation in another forex apart from {dollars}.”

Moody’s mentioned that whereas some Russian eurobonds issued after 2018 permit funds in roubles below some situations, these issued earlier than 2018 – akin to these maturing in 2022 and 2042 – don’t.

“Moody’s view is that traders didn’t get hold of the foreign-currency contractual promise on the fee due date,” Moody’s mentioned.

The Russian finance ministry didn’t reply to a request for touch upon Friday. Finance Minister Anton Siluanov informed the Izvestia newspaper earlier this month that if Russia is compelled right into a default, it should take authorized motion.

Earlier than Putin’s Feb. 24 order for what he casts as a particular navy operation in Ukraine, Russia was rated as funding grade. However its sovereign bonds have change into a goal in what the Kremlin says is an financial warfare waged by the USA.

Russia in 1998 defaulted on $40 billion in home debt and devalued the rouble below President Boris Yeltsin as a result of it was successfully bankrupt after the Asian debt disaster and falling oil costs shook confidence in its short-term rouble debt.

In 1918 Bolshevik revolutionaries below Vladimir Lenin repudiated Tsarist debt, stunning world debt markets as a result of Russia then had one of many world’s greatest overseas debt piles.

This time, Russia has the cash however cannot pay as a result of the reserves – the world’s fourth largest – that Putin ordered be constructed up for simply such a disaster are frozen by the USA, European Union, Britain and Canada.

DEFAULT

As Russia couldn’t and wouldn’t borrow proper now, a default could be largely symbolic, marking the tumultuous finale to its post-Chilly Struggle try and combine into the West’s monetary structure.

Whereas Russia has solely $40 billion in worldwide bonds excellent throughout 15 greenback or euro-denominated points, its corporates have constructed up vastly extra overseas debt.

The U.S. Treasury this month halted Russia’s skill to make use of overseas forex reserves held by the Russian central financial institution at U.S. monetary establishments to pay its debt.

The Kremlin says the West has already defaulted on its obligations to Russia by freezing its reserves, and that it desires a brand new system to interchange the Bretton Woods monetary structure established by the Western powers in 1944.

S&P earlier this month lowered Russia’s overseas forex rankings to “selective default” on elevated dangers that Moscow will be unable and keen to honor its commitments to overseas debtholders.

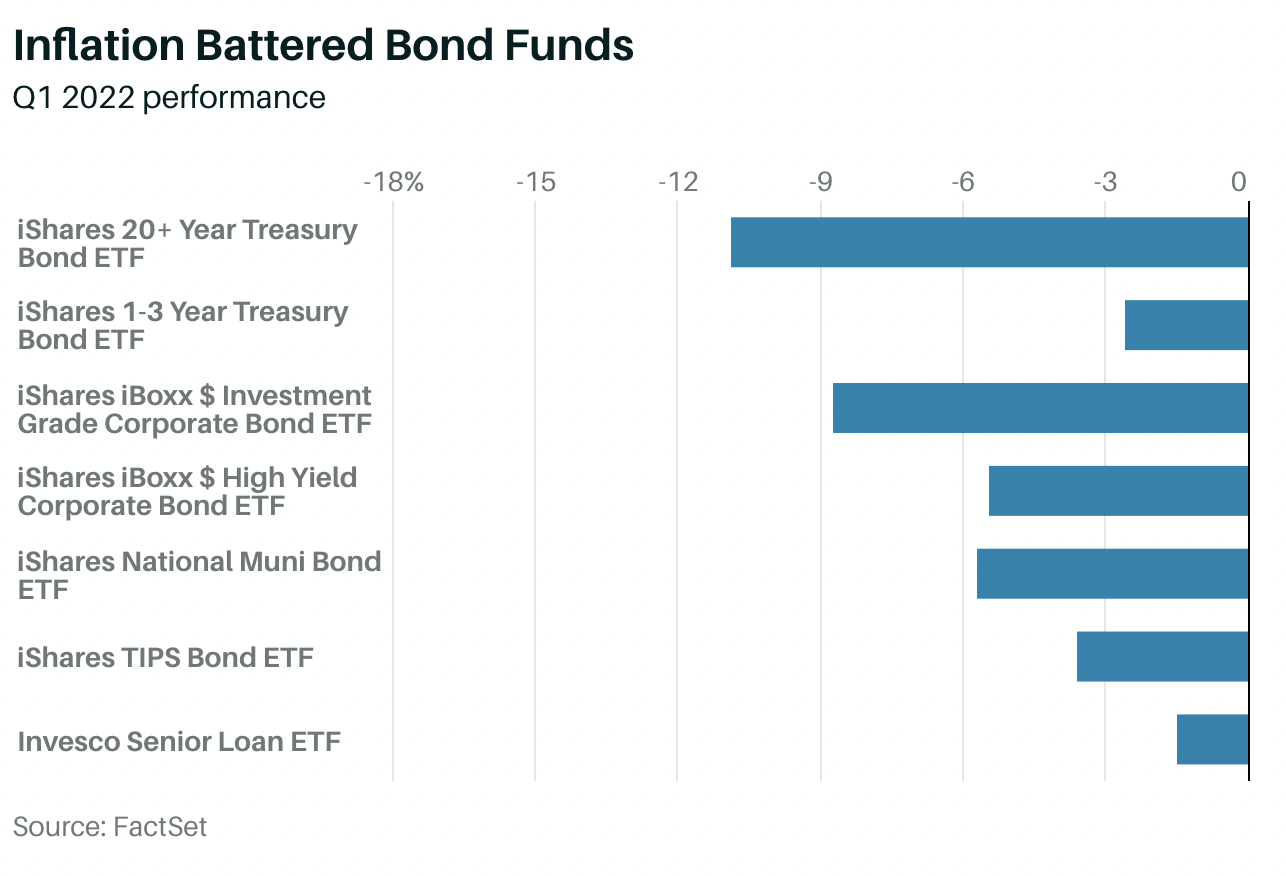

Russia’s economic system is heading for the worst contraction because the years following the 1991 fall of the Soviet Union, with hovering inflation and capital flight.