Funtap

Written by Nick Ackerman, co-produced by Stanford Chemist

Fee cuts are right here, or virtually practically right here, as September is very anticipated to see no less than a 25 foundation level reduce. That has been fueling curiosity rate-sensitive sectors resembling actual property. The Cohen & Steers High quality Earnings Realty Fund (NYSE:RQI) and the Cohen & Steers Actual Property Alternatives and Earnings Fund (NYSE:RLTY) are two funds which have been benefiting from the anticipated price cuts.

These are leveraged closed-end funds centered on investing in largely fairness actual property funding trusts (“REITs”) but in addition carry sleeves of most well-liked and different fixed-income holdings. Most well-liked and fixed-income investments ought to profit as effectively from a decrease price surroundings if risk-free charges proceed to pattern decrease as effectively. Whereas they have been on a strong run already forward of the particular price reduce occasion, I consider that every of those funds has extra upside to them.

Cohen & Steers High quality Earnings Realty Fund

- 1-12 months Z-score: 0.88

- Low cost/Premium: -4.66%

- Distribution Yield: 7.21%

- Expense Ratio: 1.40%

- Leverage: 29.74%

- Managed Property: $2.5 billion

- Construction: Perpetual

RQI’s funding goal is to offer a “excessive present revenue.” In addition they have a secondary funding goal of “capital appreciation.” They’ll spend money on “actual property securities together with frequent shares, most well-liked shares and different fairness securities of any market capitalization issued by actual property firms, together with actual property funding trusts (REITs) and comparable REIT-like entities.”

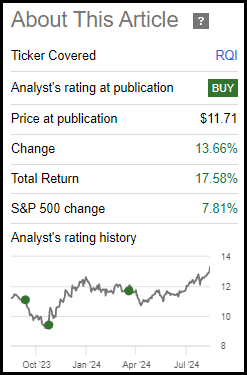

The sturdy run in REITs has seen RQI clawing again losses they skilled when the Fed raised charges. Since our final replace earlier this 12 months, RQI has delivered a complete return of over 17%—simply outpacing the S&P 500 Index throughout this time. Although the S&P 500 Index is not an acceptable benchmark, it could nonetheless assist present some context of the general monster transfer.

RQI Efficiency Since Prior Replace (In search of Alpha)

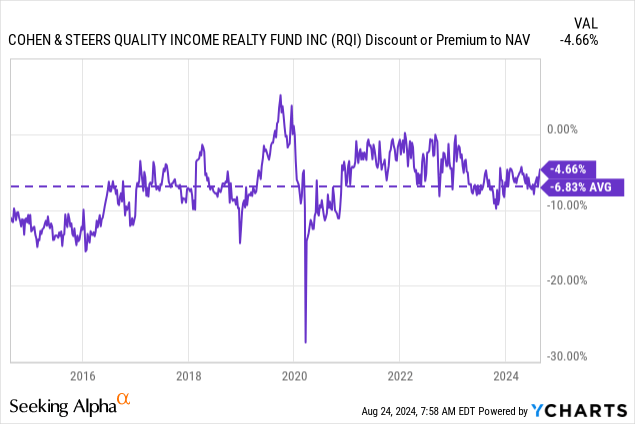

I consider there may be nonetheless extra to go and the low cost nonetheless has some enchantment right here as effectively. Actually, the low cost hadn’t narrowed an excessive amount of since our final replace, which means the returns delivered that we see above had been primarily fueled by the precise underlying efficiency of the portfolio.

Over the long run, the -4.66% low cost introduced in opposition to its common nearer to -7% means that it is not a discount. Our precise “Purchase Below Low cost” goal is -5%, so we’re fairly shut.

Ycharts

Additional, given the expectation that I consider the REIT area will do effectively, this is among the eventualities the place I am prepared to view it as a beautiful alternative nonetheless. If the fund moved to a premium, I might be a bit extra cautious, however we aren’t essentially wildly overvalued or something on RQI.

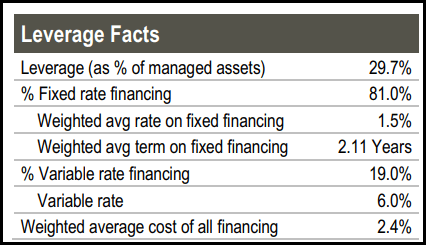

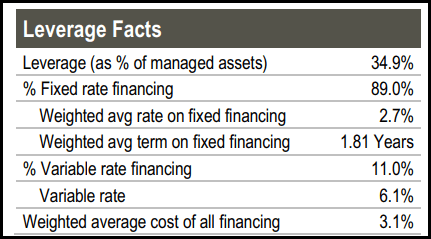

With decrease charges anticipated, that not solely helps the underlying portfolio as a result of REITs turn into a extra enticing revenue different but in addition will assist ease among the borrowing prices for RQI. Whereas RQI had hedged a good portion of its borrowing prices, these would not final endlessly. Charges are coming down in time for RQI to refinance under the height of the present price cycle.

Alternatively, charges nonetheless aren’t anticipated to return to zero, which suggests they’ll nonetheless see greater charges, simply not as excessive as in the event that they hadn’t hedged themselves. The times of mounted financing at 1.5%, as RQI has had on a majority of its borrowings, most likely aren’t coming again until we see a black swan occasion — which might have its personal destructive penalties for the REIT area.

RQI Leverage Stats (Cohen & Steers)

As we are able to see, the variable price got here in at 6%. That is been fairly frequent from what we have seen in different funds that make the most of floating-rate borrowings. For each 25 foundation level discount from the Fed, that ought to immediately see a 25 bp drop for borrowings. It is because they’re borrowing based mostly on SOFR plus a diffusion for his or her credit score facility.

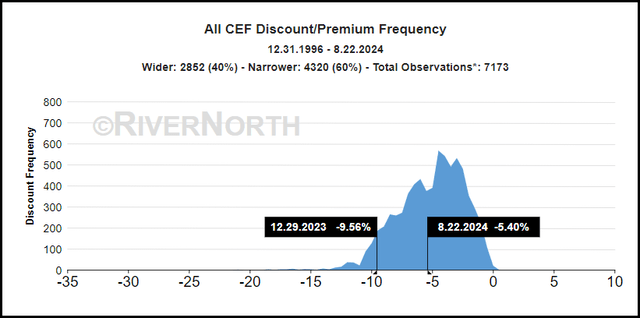

Basically, most closed-end funds are leveraged and beneath a decrease price surroundings — not anticipated to be zero, to reiterate — that may make CEFs look comparatively extra enticing.

Total, that could possibly be one of many the explanation why we have been seeing reductions slender throughout the board. Then once more, since 1996, CEF reductions have been narrower 60% of the time.

CEF Low cost/Premium Historical past Vs. Present Common (RiverNorth)

REITs make use of their very own leverage as effectively, and it’s typically based mostly on mounted charges for a good portion of the borrowings; in the next price surroundings, they nonetheless should pay greater mounted charges in terms of refinancing or trying to develop extra by way of debt issuance. In order that’s why decrease charges profit REITS as effectively, and subsequently, profit RQI’s underlying portfolio.

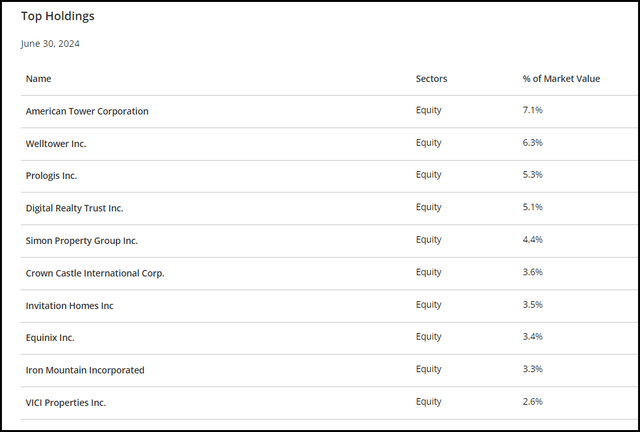

Talking of the underlying portfolio, the fund invests with a tilt towards extra growth-oriented REITs, versus what could possibly be thought-about the high-yield REIT basket. The place they lack sizeable yields, they typically ship some dividend progress.

RQI High Ten Holdings (Cohen & Steers)

In fact, there are at all times exceptions; American Tower Corp (AMT) and Crown Fort (CCI) have frozen their dividends the place they’re in the interim, although hopefully, that is solely a short lived freeze. AMT is on an excellent trajectory to return to dividend progress in 2025, and so they’ve indicated they count on to as effectively.

So, that is type of the way in which we give it some thought. We might count on that the dividend progress would resume in 2025 based mostly on what we’re seeing within the numbers going past 2024.

CCI, alternatively, does not sound as assured, but it surely does include a considerably greater dividend yield at 5.57%. (Bolding added to emphasis the primary level.)

Ari Klein, BMO Capital Markets

Thanks. After which perhaps you talked slightly bit about elevated flexibility which incorporates the steadiness sheet and perhaps bringing leverage decrease. Might that in some unspecified time in the future, embrace shifting the dividend technique and the way you consider that?

Daniel Schlanger, Crown Fort CFO

Sure. I believe given the truth that we’re in the course of the strategic evaluation which would come with the thought round capital allocation, dividend coverage, every thing else in the end. We’re actually not in an important place to speak about what is going on ahead till we’ve got extra of a conclusion on what companies we’ve got and the place we’re going to be sooner or later.

The primary takeaway from taking a fast take a look at the highest ten, although, is that progress is necessary since RQI will gas most of its distribution to traders by way of capital positive factors. They’ve maintained the identical $0.08 month-to-month payout for a few years now, which incorporates by way of Covid and the newest price climbing cycle.

RQI Distribution Historical past (CEFConnect)

The present distribution price works out to 7.21%; on an NAV foundation, it is available in at 6.88%, a bit decrease due to the low cost. I consider this can be a wholesome payout degree, and we should not count on to see a distribution reduce. In fact, that comes with the standard caveat of barring any type of important market downturn for an prolonged time period.

Cohen & Steers Actual Property Alternatives and Earnings Fund

- 1-12 months Z-score: 0.52

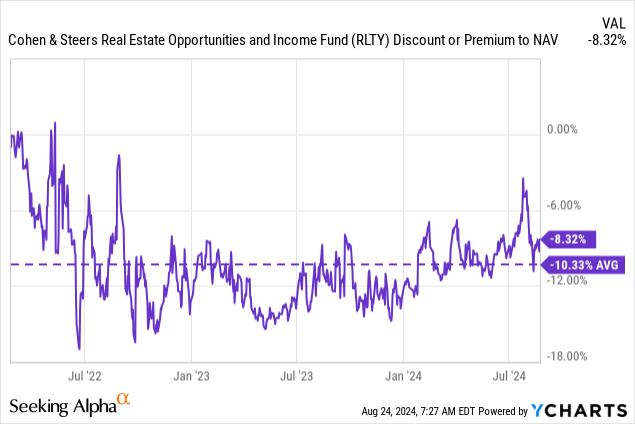

- Low cost/Premium: -8.32%

- Distribution Yield: 8.38%

- Expense Ratio: 1.74%

- Leverage: 34.93%

- Managed Property: $417 million

- Construction: Time period (anticipated liquidation date February 23, 2034)

RLTY’s funding goal is “excessive present revenue.” The secondary goal is for “capital appreciation.” To attain this, the fund will make investments “no less than 80% of its managed property in (i) actual estate-related investments, and (ii) most well-liked and different revenue securities.” That is fairly simple and fairly just like Cohen & Steers’ different actual estate-focused funds.

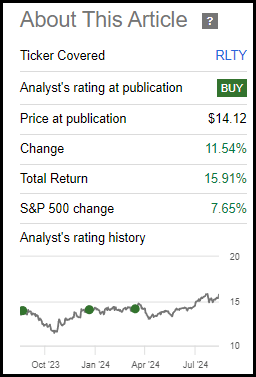

RLTY is one other fund from the identical fund household that’s benefiting equally to RQI. This could be largely anticipated as a result of the fund invests equally to its older and bigger sister fund. Since our final replace, RLTY has additionally been performing effectively. Extra particularly, this era is measuring from March 22, 2024. Once we appeared on the RQI efficiency since our final replace above, it was from March 27, 2024.

RLTY Efficiency Since Prior Replace (In search of Alpha)

RLTY is buying and selling at a reduction that’s wider than RQI, which might make it a extra attention-grabbing wager. That’s the reason I needed to the touch on RLTY for traders prepared to take a little bit of an opportunity on a comparatively newer fund in comparison with the extra established RQI.

RLTY had its ordinary drop to a big low cost after a CEF launch, exacerbated by the unfavorable market situations for leveraged REIT CEFs. It additionally not too long ago noticed its low cost slender considerably, solely to widen again out. Being a comparatively smaller fund, it might see some extra volatility in its low cost/premium in comparison with RQI, because it typically will not take as a lot to maneuver it.

Ycharts

One distinction between RQI and RLTY is that RLTY is a time period fund with an anticipated termination date. As we’re fairly a bit away from that anticipated liquidation, that is not an excessive amount of of a key issue at this level.

As an alternative, for now, the place the funds primarily differ is of their fairness/mounted revenue weightings. RQI is at a weighting of 80/20% between fairness and glued revenue. RLTY is nearer to 69% invested in equities and 31% in most well-liked/fixed-income. There’s additionally the group’s different leveraged sister fund, Cohen & Steers REIT and Most well-liked and Earnings Fund (RNP), which carries a portfolio cut up between 51% equities and 49% most well-liked and fixed-income.

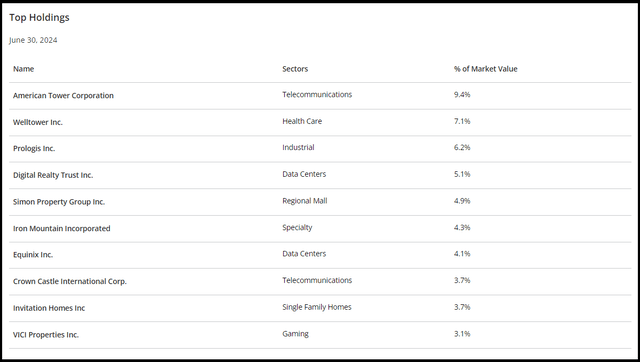

The entire high ten holdings are the identical as RQI however with some completely different share weighting that adjustments up the order a bit.

RLTY High Ten Holdings (Cohen & Steers)

Different variations that impression efficiency are RLTY’s greater expense ratio and utilizing a bit extra leverage. The fund’s inception date was additionally early 2020, which impacted the leverage prices of the fund. Whereas they largely hedged themselves with mounted charges, it got here in at a median mounted financing of two.7% in comparison with RQI’s 1.5%.

RLTY Leverage Stats (Cohen & Steers)

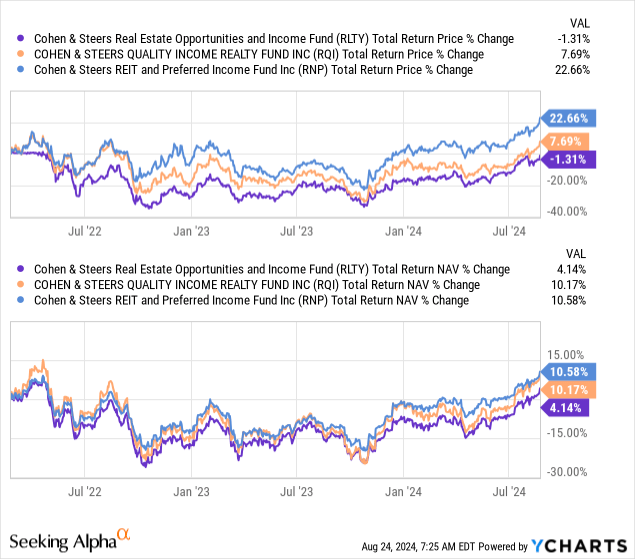

Given the upper leverage and bills, and even slight variations within the portfolios, it has resulted in RLTY being a comparatively weaker performer since its inception.

Ycharts

On a complete share worth return, we see that the fund delivered destructive outcomes because it slipped to a reduction. That is fairly regular, however the primary takeaway right here can be the full NAV return slippage as effectively. The fund’s heavier utilization of leverage probably noticed larger strain to the draw back in the course of the troublesome occasions. The upper expense ratio additionally immediately takes away from complete returns as effectively.

I do know most traders will take a look at that chart above after which write off RLTY and simply need to follow tried and true RQI. I get it; RQI is my largest single funding throughout all my accounts, and I’ve a number of confidence over the long run within the fund.

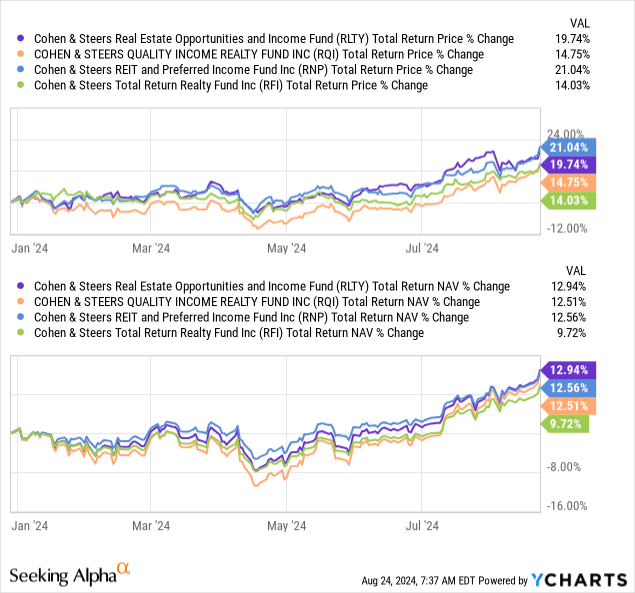

Nevertheless, I additionally maintain RLTY. It was off to a tough begin, but it surely appears to be discovering its stride extra not too long ago. On a YTD foundation, the fund has been way more aggressive in opposition to its sister funds. RNP was the strongest performing fund by way of a lot of the 12 months, with RQI being the laggard of the trio. It was RLTY within the center earlier than with the ability to edge out its sisters on a complete NAV return foundation extra not too long ago.

Ycharts

I’ve even included the Cohen & Steers Whole Return Realty Fund (RFI) as a result of if I did not, individuals would ask why. RFI is a non-leveraged clone of RQI, mainly. So naturally, we see that RFI has been the laggard as the opposite funds profit from the stronger returns boosted by their leverage utilization.

Going ahead, the upper expense ratio for RLTY in comparison with its sister funds will at all times be a slight drag. Nevertheless, with a extra enticing low cost, that minor distinction could possibly be overcome doubtlessly by way of some additional low cost narrowing. The fund’s greater utilization of leverage might additionally assist the fund proceed to carry out higher in a rate-cutting surroundings.

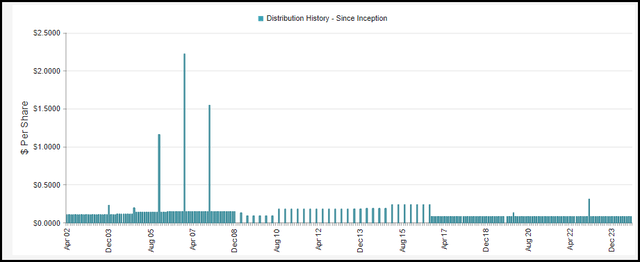

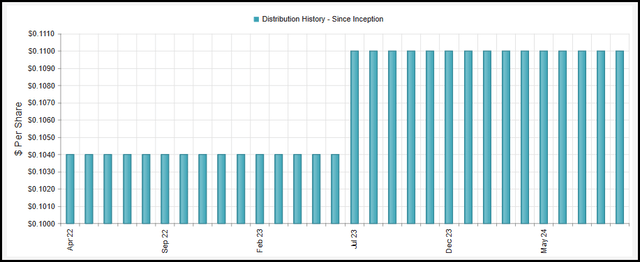

For RLTY’s month-to-month distribution, the fund had paid $0.1040, which they lifted to $0.11 per 30 days. That places the present distribution price at 8.38%, with a NAV price of seven.68%.

RLTY Distribution Historical past (CEFConnect)

Conclusion

With price cuts anticipated within the close to time period, REITs have been blasting greater, and that is translated into closed-end funds resembling RQI and RLTY to carry out rather well. They’ve each carried out strongly since our earlier articles earlier this 12 months, however I consider they nonetheless have some extra to go too.

Being leveraged funds, they will profit extra considerably in a good surroundings for REITs. In fact, that additionally comes with larger dangers and including leverage to REITs, that are already leveraged themselves, means they would not be for risk-averse traders.

Those that can deal with the volatility and elevated dangers might additionally doubtlessly see larger reward as effectively. The funds are nonetheless buying and selling at low cost ranges to their NAV per share, which may be one other approach that these CEFs might outperform. RLTY seems to be like the most effective deal on this entrance, however it’s the newer fund. With RQI buying and selling above its longer-term common low cost, it does not appear to be a discount, however I am prepared to nonetheless view it favorably based mostly on the anticipated advantages of a lower-rate surroundings.