BalkansCat/iStock Editorial via Getty Images

Investment Thesis

In last week’s article, I explained the reasons behind having included Philip Morris into The Dividend Income Accelerator Portfolio. So far, The Dividend Income Accelerator Portfolio consisted of 1 ETF (SCHD (SCHD)) and two individual positions (Realty Income (O) and Philip Morris (PM)).

The goal of today’s article is to explain the reasons behind having included Royal Bank of Canada (NYSE:RY) into The Dividend Income Accelerator Portfolio. In this analysis, I will compare Royal Bank of Canada to some of its competitors such as The Toronto-Dominion Bank (TD), Bank of Montreal (BMO), and The Bank of Nova Scotia (BNS).

Royal Bank of Canada has a 60M Beta Factor of 0.79, which indicates that we can reduce the risk level of The Dividend Income Accelerator Portfolio with its inclusion. It is also worth mentioning that Royal Bank of Canada combines dividend income with dividend growth, aligning with the portfolio’s investment approach.

With the acquisition of Royal Bank of Canada, The Dividend Income Accelerator Portfolio now provides a Weighted Average Dividend Yield [TTM] of 3.89% and a Weighted Average Dividend Growth Rate [CAGR] of 11.76%, indicating that it helps investors to generate extra income while increasing this extra income to a significant amount from year to year. At the same time, the portfolio provides its investors with a reduced risk level (several positions have a 60M Beta Factor below 1).

The Dividend Income Accelerator Portfolio

The Dividend Income Accelerator Portfolio’s objective is the generation of income via dividend payments, and to annually raise this sum. In addition to that, its goal is to attain an appealing Total Return when investing with a reduced risk level over the long-term.

The Dividend Income Accelerator Portfolio’s reduced risk level will be reached due to the portfolio’s broad diversification over sectors and industries and the inclusion of companies with a low Beta Factor.

Below you can find the characteristics of The Dividend Income Accelerator Portfolio:

- Attractive Weighted Average Dividend Yield [TTM]

- Attractive Weighted Average Dividend Growth Rate [CAGR] 5 Year

- Relatively low Volatility

- Relatively low Risk-Level

- Attractive expected reward in the form of the expected compound annual rate of return

- Diversification over asset classes

- Diversification over sectors

- Diversification over industries

- Diversification over countries

- Buy-and-Hold suitability

Royal Bank of Canada’s Competitive Advantages

Strong Brand Image and Reputation

Royal Bank of Canada is the largest bank in Canada in terms of Market Capitalization (with a current Market Capitalization of $123.69B) and it is among the most valuable brands in the world. According to the latest brand ranking from Brand Finance, the Canadian bank is ranked 135th among the most valuable brands in the world.

Strong Financial Health

Different metrics underline Royal Bank of Canada’s financial strength: the Canadian bank has an Aa1 credit rating from Moody’s and a Net Income Margin [TTM] of 27.28%. At the same time, it shows a Return on Equity of 14.26%. All these metrics underline the bank’s financial health, representing an additional competitive advantage.

Experience in Managing Risks

The Canadian bank was founded back in 1864 and it has a long track record of a robust risk management that has helped it to navigate through all kinds of market conditions, providing the bank with an additional competitive edge over competitors.

Broad and Diversified Product Portfolio

Royal Bank of Canada has a broad and diversified product portfolio, which helps it to mitigate risks. The bank distinguishes between the following segments:

- Personal & Commercial Banking

- Wealth Management

- Insurance

- Investor & Treasury Services

- Capital Markets

- Corporate Support

Each of the above competitive advantages of Royal Bank of Canada contributes to the economic moat the bank has over its competitors. Due to these strong competitive advantages, I believe the bank is an ideal fit for The Dividend Income Accelerator Portfolio.

Royal Bank of Canada’s Dividend and Dividend Growth and the Projection of its Yield on Cost

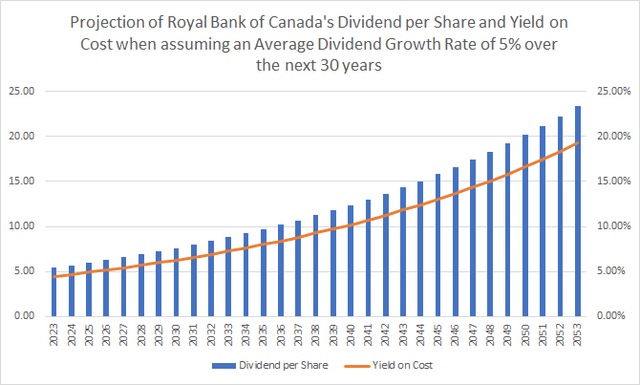

At this moment in time, Royal Bank of Canada pays its shareholders a Dividend Yield [FWD] of 4.49%. The Canadian bank has shown a 10 Year Dividend Growth Rate [CAGR] of 7.92%. Both metrics indicate that the bank is an excellent pick for investors who would like to combine dividend income and dividend growth.

The graphic below illustrates the assumption that the Canadian bank would be able to raise its Dividend by 5% per year during the following 30 years. This assumption means that you could be able to reach a Yield on Cost of 7.26% by 2033, 11.82% by 2043, and 19.25% by 2053.

Source: The Author

Royal Bank of Canada Compared to its Peer Group

When compared to competitors such as The Toronto-Dominion Bank, Bank of Montreal, or The Bank of Nova Scotia, it can be highlighted that Royal Bank of Canada has the slightly lower Dividend Yield [FWD]: while Royal Bank of Canada’s Dividend Yield [FWD] stands at 4.49%, The Toronto-Dominion Bank’s lies at 4.69%, Bank of Montreal’s at 5.08%, and The Bank of Nova Scotia’s is at 6.64%.

In terms of Dividend Growth, however, it can be highlighted that Royal Bank of Canada is ahead of most of its competitors: the bank’s 3 Year Dividend Growth Rate [CAGR] of 7.36% stands above the one of The Toronto-Dominion Bank (7.20%) and The Bank of Nova Scotia (4.78%). Only the one of Bank of Montreal is higher (10.70%).

In terms of Valuation, I also believe that Royal Bank of Canada is attractive. Its P/E [FWD] Ratio stands at 11.76, which is significantly lower than the P/E [FWD] Ratio of The Toronto-Dominion Bank (13.73) or Bank of Montreal (18.08). Only the Valuation of The Bank of Nova Scotia is lower (9.72).

It is further worth mentioning that Royal Bank of Canada’s Payout Ratio of 47.90% lies below the one of Bank of Montreal (49.14%) and The Bank of Nova Scotia (58.31%), indicating that Royal Bank of Canada has more room for future dividend enhancements when compared to these competitors.

It is also worth mentioning that Royal Bank of Canada’s is an excellent choice when it comes to Profitability. Proof of this is the bank’s Net Income Margin (which is at 27.28%) and its high Return on Equity of 13.51%. Royal Bank of Canada’s Return on Equity stands significantly above the one of Bank of Montreal (10.26%) and The Bank of Nova Scotia (10.89%).

RY | TD | BMO | BNS | |

Company Name | Royal Bank of Canada | The Toronto-Dominion Bank | Bank of Montreal | The Bank of Nova Scotia |

Sector | Financials | Financials | Financials | Financials |

Industry | Diversified Banks | Diversified Banks | Diversified Banks | Diversified Banks |

Market Cap | 123.69B | 109.61B | 61.01B | 56.73B |

Dividend Yield [FWD] | 4.49% | 4.69% | 5.08% | 6.64% |

Payout Ratio | 47.90% | 46.48% | 49.14% | 58.31% |

Dividend Growth 3 Yr [CAGR] | 7.36% | 7.20% | 10.70% | 4.78% |

Dividend Growth 5 Yr [CAGR] | 6.24% | 6.91% | 7.84% | 4.07% |

P/E GAAP [FWD] | 11.76 | 13.73 | 18.08 | 9.72 |

Price to Book [TTM] | 1.55 | 1.36 | 1.13 | 0.99 |

Revenue Growth [YoY] | 9.45% | 14.60% | 5.74% | -5.75% |

EPS Diluted 3 Year [CAGR] | 9.97% | 14.34% | 12.60% | 4.37% |

Net Income Margin | 27.28% | 28.98% | 23.03% | 28.26% |

Return on Equity | 13.51% | 13.53% | 10.26% | 10.89% |

60M Beta | 0.79 | 0.87 | 1.16 | 0.93 |

Source: Seeking Alpha

Why Royal Bank of Canada is an Attractive Risk/Reward Choice and Aligns with the Investment Approach of The Dividend Income Accelerator Portfolio

- Royal Bank of Canada’s Dividend Yield [FWD] of 4.49% helps you to earn an important amount of extra income, which is one of the objectives of The Dividend Income Accelerator Portfolio.

- At the same time, it contributes to raise the Weighted Average Dividend Yield [TTM] of The Dividend Income Accelerator Portfolio.

- The bank’s 3 Year Dividend Growth Rate [CAGR] of 7.36% shows that it could contribute to raising dividend payments to a significant amount year over year, aligning with the approach of The Dividend Income Accelerator Portfolio.

- Royal Bank of Canada provides investors with an attractive mix between dividend income and dividend growth, matching with one of the main objectives of The Dividend Income Accelerator Portfolio.

- The Canadian bank’s 60M Beta Factor of 0.79 indicates that you can reduce the volatility of your portfolio by including it. This matches with the investment approach of The Dividend Income Accelerator Portfolio to provide a reduced risk level and to serve as a portfolio for all kinds of market conditions.

- I believe that the risk factors are relatively low and that the reward can be attractive for investors, implying that the bank is an appealing pick in terms of risk and reward, once again aligning with The Dividend Income Accelerator’s investment approach.

- I believe that Royal Bank of Canada can serve as a buy-and-hold investment from which you can benefit enormously when investing over the long term and from the steadily increasing dividend payments.

- Therefore, I believe that Royal Bank of Canada can help you to steadily increase your wealth, aligning with another objective of The Dividend Income Accelerator Portfolio.

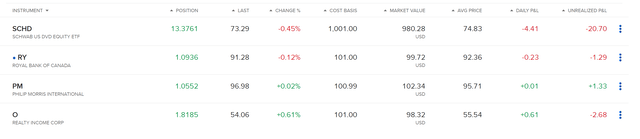

Investor Benefits of The Dividend Income Accelerator Portfolio after Investing $100 in Royal Bank of Canada

After the acquisition of shares to the amount of $100 in Royal Bank of Canada, the portfolio’s diversification has been increased.

Source: Interactive Brokers

At this moment in time, it can be highlighted that SCHD accounts for 76.92% of the overall investment portfolio.

The remaining positions (Realty Income, Philip Morris and Royal Bank of Canada) each account for 7.69% of the overall portfolio.

Through the acquisition of Royal Bank of Canada for The Dividend Income Accelerator Portfolio, the portfolio’s Weighted Average Dividend Yield [TTM] has been raised to 3.89%. Its Weighted Average Dividend Growth Rate [CAGR] over the past 5 years now stands at 11.76%.

These numbers reflect the portfolio’s attractive mix between dividend income and dividend growth from which investors can benefit enormously when investing over the long term.

It is also worth mentioning, that the risk level of The Dividend Income Accelerator Portfolio has been further decreased. This is the case, since Royal Bank of Canada has a 60M Beta Factor of 0.79, indicating that it has a lower risk level than the broader stock market (which has a Beta Factor of 1).

Therefore, it can be highlighted that The Dividend Income Accelerator Portfolio, which today consists of one ETF (SCHD) and three individual companies (Realty Income, Philip Morris and Royal Bank of Canada) provides investors with a Weighted Average Dividend Yield [TTM] of 3.89%, with a 5 Year Weighted Average Dividend Growth Rate [CAGR] of 11.76% and with a reduced risk level (all individual companies that have been added to the portfolio so far, have a 60M Beta Factor below 1).

Risk Factors

Due to Royal Bank of Canada’s significant competitive advantages and its strong financial health (underlined by its Aa1 credit rating by Moody’s and its Net Income Margin of 27.28%), I believe that the risk factors that come attached to an investment in the Canadian bank are relatively low, particularly when compared to its peer group.

This theory is also underlined by Royal Bank of Canada’s 60M Beta Factor of 0.79, which is below the one of competitors such as The Toronto-Dominion Bank (60M Beta Factor of 0.87), Bank of Montreal (1.16), or The Bank of Nova Scotia (0.93).

The fact that the Canadian bank is ranked 135th in the ranking of the most valuable brands in the world serves as an additional indicator that the risk level is relatively low, since it’s strong brand helps to establish an economic moat over existing or potentially new competitors.

However, there are different risk factors that come attached to an investment in Royal Bank of Canada, such as Market Risk Factors and Credit Risk Factors, which investors should have in mind before taking the decision to invest in the Canadian bank.

Market Risk

For example, market risks can arise from movements in exchange rates, commodity prices or interest rates, which can have significant impacts on the bank’s financial performance. Nevertheless, I believe that these kinds of risks would particularly have an effect on the bank’s short-term financial performance. Therefore, I suggest that investors see an investment in Royal Bank of Canada as a long-term investment, benefiting from the bank’s steadily increasing dividend payments.

Credit Risk

Credit risk is the obligor’s potential inability to fulfill contractual obligations on a timely basis. Royal Bank of Canada uses different risk measurement methodologies in order to mitigate credit risks. Nevertheless, investors of Royal Bank of Canada need to be aware of the fact that potential defaults can have significant negative effects on the bank’s financial performance (particularly in the short term).

In order to mitigate the risk level for investors, I would like to repeat that I suggest investing over the long term, benefiting from steadily increasing dividend payments and from the reduced risk level.

The fact that I believe Royal Bank of Canada’s risk level is lower when compared to its competitors aligns with the investment approach of The Dividend Income Accelerator Portfolio, reiterating that the portfolio aims to provide you with a reduced risk level, helping you to increase the probability of reaching attractive investment results over the long term.

Conclusion

I believe that Royal Bank of Canada is an appealing pick for The Dividend Income Accelerator Portfolio. The company combines dividend income and dividend growth, offers investors a reduced risk level, and is attractive in terms of risk and reward.

All of these characteristics indicate that Royal Bank of Canada strongly aligns with the investment approach of The Dividend Income Accelerator portfolio.

Due to the inclusion of Royal Bank of Canada, we have managed to further increase the portfolio’s Weighted Average Dividend Yield [TTM] to 3.89%. In addition to that, the portfolio provides investors with a Weighted Average Dividend Growth Rate [CAGR] of 11.76% over the past 5 years.

One of the reasons for which I have selected Royal Bank of Canada over its Canadian competitors is the fact that it comes attached to a reduced risk level.

Royal Bank of Canada’s 60M Beta Factor of 0.79 indicates that we can reduce portfolio volatility by its inclusion, thus contributing to decreasing the risk level and preparing our portfolio for different market conditions. In comparison to Royal Bank of Canada, The Toronto-Dominion Bank (60M Beta Factor of 0.87), Bank of Montreal (1.16), and The Bank of Nova Scotia (0.93) come attached to a slightly higher risk level.

Due to its attractive Weighted Average Dividend Yield [TTM] of 3.89% in combination with its 5 Year Weighted Average Dividend Growth Rate [CAGR] of 11.76%, The Dividend Income Accelerator Portfolio can already help you to generate a significant amount of extra income via dividend payments. It can further help you to raise this amount on an annual basis while providing you with a reduced risk level. At the same time, the portfolio aspires to reach an attractive Total Return.

Author’s Note: Thank you for reading! I would appreciate hearing your opinion on my selection of Royal Bank of Canada as the fourth acquisition for The Dividend Income Accelerator Portfolio. I also appreciate any thoughts about The Dividend Income Accelerator Portfolio or any suggestion of companies that would fit into the portfolio’s investment approach!