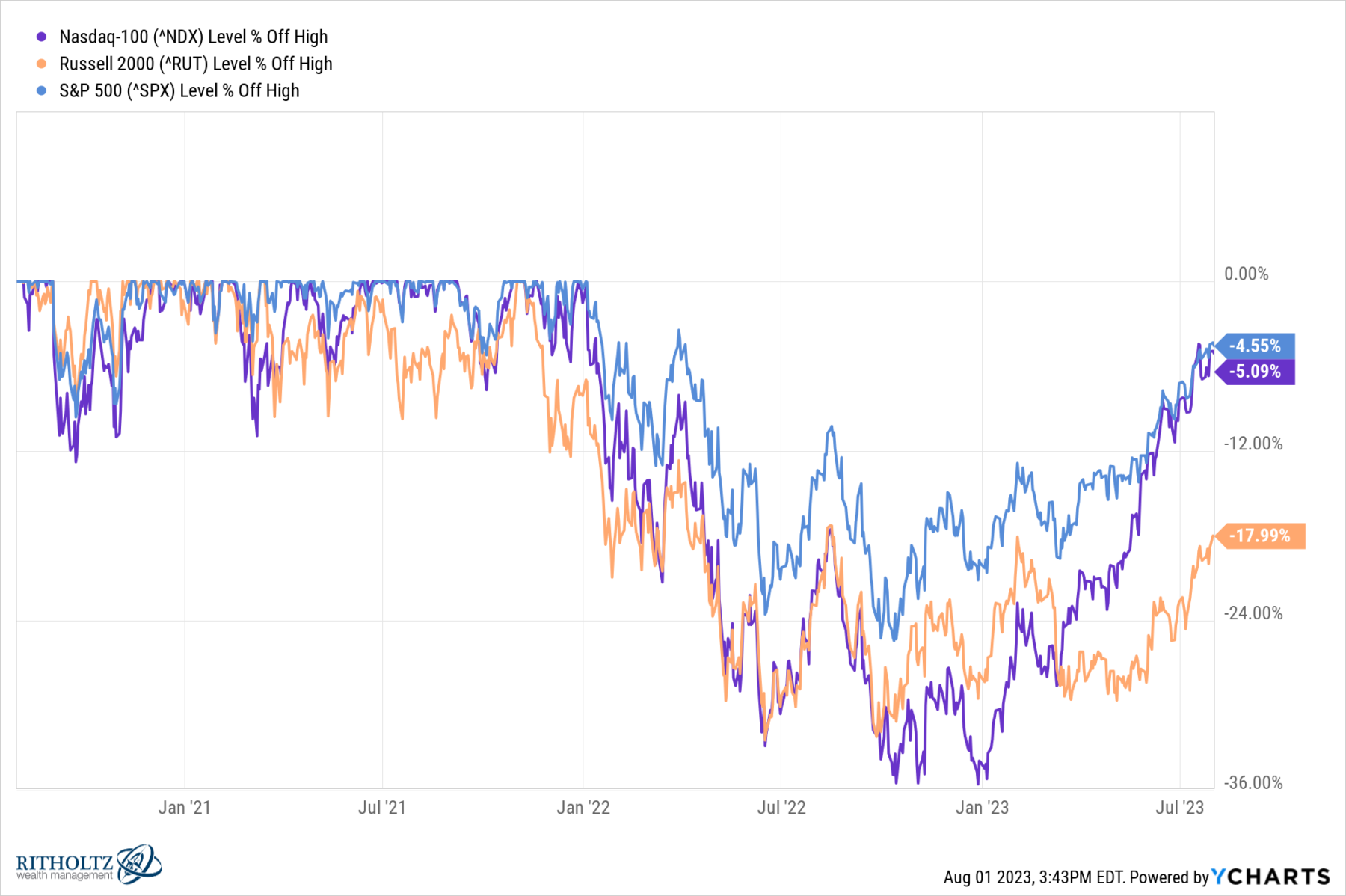

After a monstrous 68% recovery from the March 2020 pandemic low, and another nearly 30% gain in 2021, markets decided to have one of their all-too-regular spasms. Blame whatever you want – Too far, too fast? End of ZIRP? Too rapid rate increases? – but the giveback off the highs was substantial: S&P 500 was down ~23%, Russell 2000 was off 27%, and the Nasdaq 100 came down 32%.

What a difference a year makes: Indices are within spitting distance of all-time highs. Seven full months into the new year, thirteen months after the June lows, and nine months after the October bottom, we have come all the way back to where we began.

In light of this round trip, it is a good time to think about what happened, and what we might take from it.

The Crowd: Did the crowd’s YOLO enthusiasm infect you on the way up? Were you a late FOMO buyer in 2021? Did the palpable panic in June/October 2022 lead to ill-advised sell(s)?

The wisdom of the crowd is why the efficient markets work most of the time, but it really helps to be aware when the crowd turns into an unthinking mob of hooligans.

Framing & Context Matters: Major indices had an enormous run in the prior decade. It is useful to put drawdowns of 20 or 30% into proper context when they follow gains of 100% (SPX) and 200% (NDX).

Markets go up and down; it is easier to ride out a drawdown when you realize the giveback is but a small percentage of the prior gains.

Forecasting Folly: Did you get sucked into the endless predictions of doom and gloom? Were you convinced by the people who saw the Recession coming? Never forget that forecasts are marketing.

Recall what John Kenneth Galbraith observed: “The only function of economic forecasting is to make astrology look respectable.”

Tech Concentration: Yes, a handful of giant tech stocks are driving market gains. But these are not the profitless ideas of the dot-com era, companies like Apple, Microsoft, Google, Amazon, etc., are fast-growing, highly profitable key players in the modern economy.

Take Apple as an example: Nearly $400 billion in revenue, $95 billion in profits, 5-year revenue growth at 11.5%, and 5-year profit growth of over 20%.

I keep wondering why technology is only 29% of the S&P500…

Expensive Markets: There is this fantasy that markets should always revert back to fair value. In reality, that is a point on the spectrum from cheap to dear markets wave hello and goodbye to as they blow past in either direction.

Overvalued markets can stay overvalued for much of a bull market cycle.

Private Credit: An unnamed person from the hedge fund industry pointed out that around the June 2022 lows, there were big redemptions from allocators who shifted capital away from hedge funds. The reason? They were piling into private credit.

That was a crowded trade, and it has underperformed versus equities since. But we won’t know how big a losing trade it might be until early 2024, when we see the updated valuations. Some folks who are more familiar with the numbers than I have suggested it will not be pretty.

Yield Curve Inversion: Cam Harvey, the creator of this recession indicator, points out that it is 8 for 8 in terms of recession forecasts. That is a good track record but also a very tiny sample set. And it never has operated in an era where rates were at or near zero for more than a decade.

Some people have argued that instead of predicting recessions, an inverted yield curve actually predicts the FOMC’s response to falling inflation, which can be – but isn’t always – associated with economic contractions.

There are no holy grails and no indicators that are perfectly reliable.

Narratives & Holding Periods: Traders have very short holding periods, and are concerned with catalysts that drive prices short-term. Investors hold asset classes, to benefit from long-term value creation and compounding.

Damage occurs when narratives of traders are used to justify the actions of investors, and vice versa.

Understand your investment horizon, be it minutes or decades. Never use someone else’s narrative to justify your investment behavior.

Howard Marks is fond of saying “Experience is what you get when you don’t get what you want.” If you have not gotten what you wanted from markets since the lows of 2022, then perhaps you can find a silver lining in gaining experience…

Previously:

Wrong Side of the Trade (April 15, 2022)

One-Sided Markets (September 29, 2021)

Forecasting is Marketing . . . (January 24, 2015)