Tippapatt

Roper Technologies (NASDAQ:ROP) is a serial acquirer and long-term owner of Vertical Market Software and Medical & Water products businesses. My interest in the company was first piqued after reading the chapter in the fantastic book Lessons from the Titans. Let’s see if the company looks attractive right now.

What makes Roper interesting?

Roper’s success can be summarized in the following quote from the book Lessons from the Titans:

Jellison’s (Ropers CEO at the time) vision itself was basic-focus on generating cash flow, invest that cash flow opportunistically, and employ capable leaders to run newly acquired assets.

Roper successfully employs many of the characteristics I like to see in serial acquisition businesses:

- A focus on Return on Investment

- A decentralized management style

- Buying and holding niche assets

- A focus on cash flows

Roper employs a custom metric to track return on investment, focusing better on real cash flows than accounting profits: Cash Return on Investment (CRI) is the basis of Roper’s compensation scheme. It is calculated as Cash Earnings (Net Income + D&A – Maintenance CapEx) divided by Gross Investment (Net Working Capital + Net PP&E + Accumulated Depreciation). This approach favors companies that can generate real cash flows with an asset-light business model.

Roper wants a high level of autonomy and accountability from its management teams and resource allocation at a business level. Local management teams are compensated based on organic growth, increasing margins and CRI and cash flow growth. There are no budgets, so if management thinks an investment makes sense on a CRI basis, they can go for it. I like this model of high trust in capable management teams to do the right thing.

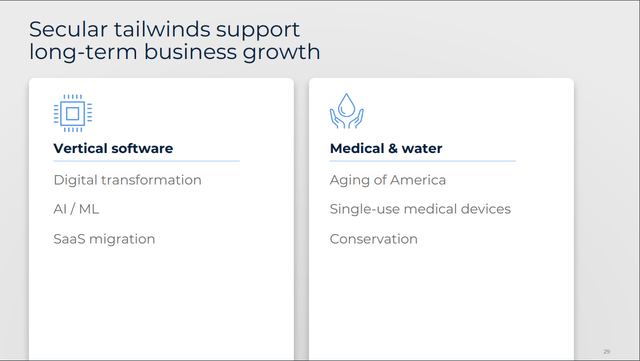

Roper also positioned itself well in sectors with long secular tailwinds to support the organic growth of the businesses, as the slide below illustrates.

Secular Tailwinds (Roper Investor Day)

Improving the business

In recent years, Roper has aggressively improved its portfolio by divesting inferior businesses and deploying more capital towards higher quality businesses. I love it when companies are brave enough to divest inferior business segments and shrink the company temporarily. I own two companies that are using this strategy:

- Danaher (DHR) divested all its industrial businesses and is now a life sciences and medical pure play.

- Carlisle Companies (CSL) divested all its non-core businesses and now is a building material pure play.

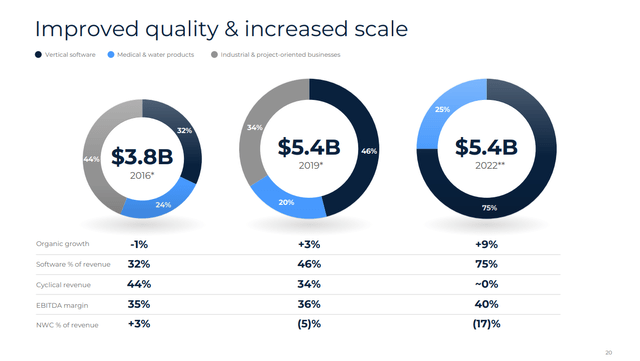

For Roper, this led to the exit of all Industrial and project-oriented businesses(44% of sales in 2016). Now, the portfolio only consists of Vertical Market Software (75%) and Medical & Water products (25%). This elevated organic growth and eliminated cyclical revenues. Roper now has 70% of its sales recurring ($2.9 billion) or reoccurring ($0.4 billion). Margins improved by 500 basis points and the cash conversion significantly enhanced. Due to the economics of recurring subscription businesses, where customers often pay the yearly fee in advance at the start of the year, Net working capital is negative. The Vertical Market Software industry is very lucrative, in my opinion and I own Constellation Software (OTCPK:CNSWF) [CSU:CA] in this space, a player focused on acquiring much smaller VMS businesses. I talk more about the advantages of VMS businesses in this recent CSU article.

Improved sales mix (ROP Investor Day)

Q3 Earnings

Roper reported earnings last week and delivered another beat and raise. The company has beaten EPS for the previous eight quarters and revenue for 7/8 quarters (the miss was under 1%). Revenues grew 16%, with 6% organic and 10% acquired growth. Recurring software revenue outgrew total organic growth slightly (high-single-digits) and Free Cash Flow grew by 77% in the quarter. Debt increased in the quarter by over $900 million spent on acquisitions of Syntellis and Replicon, drawn from the $3.5 billion revolving credit Roper has and pushed net debt to EBITDA to 2.7 times, from 2.2 times last quarter. Roper increased its guidance across the board slightly:

- Total revenue 12% -> 13%

- Organic growth 6%-7% -> 7%

- Adjusted diluted EPS $16.10-$16.30 -> $16.36-$16.50

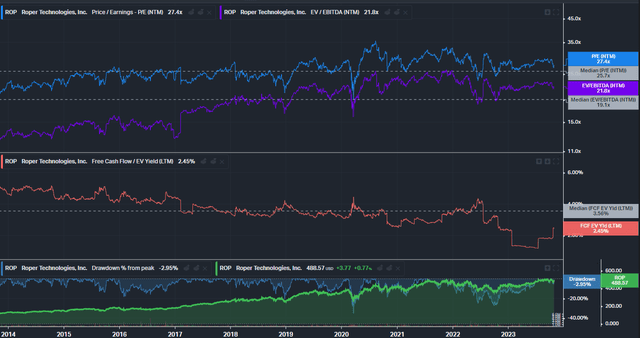

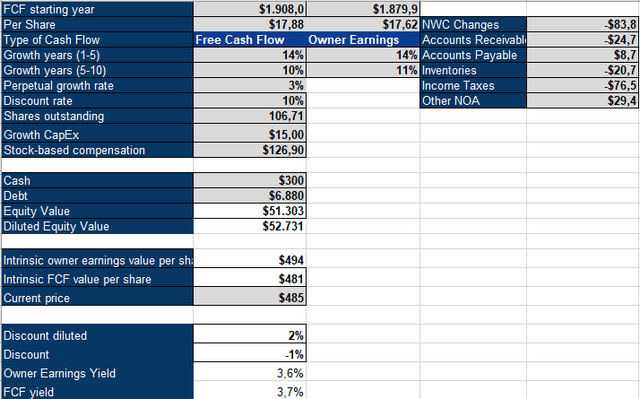

Roper is not a steal

To value Roper, I’m using an inverse DCF model. I used the adjusted Free Cash Flow Roper presents in its investor relations material. The only adjustment made was a $435 million tax payment related to divestitures, a non-recurring cash outflow. As a capital-light business, there isn’t much capex required and hence little growth capex that we need to add back. The market expects around 14% growth in the next five years, followed by 11% growth for five years. Over the last 15 years, Roper compounded revenue at 8%, EBITDA at 11% and FCF at 12%, so the market expects an acceleration in growth. There are reasons to believe that sustainable mid-teen Free cash flow growth can happen, as Roper guides in its Long-term compounding growth algorithm (mid-single-digit organic revenue + M&A + increasing margins). Roper looks fairly priced here but does not offer a margin of safety.

ROP Inverse DCF Model (Authors Model)

Risks

While Roper has a pretty stable business with a very high (70%) portion of recurring revenues and no real cyclical risk, there are still risks in the business. One of them is the leverage Roper employs. Roper states that they have over $4 billion in capacity for capital deployment right now between cashflows and the ability to draw more on the revolver. Taking out the full revolver would push net debt to around $9 billion or 3.75 times EBITDA. I’m not too fond of leverage above two times. Roper can delever due to its predictable cash flows, but this would impair their ability to deploy more capital on M&A. Roper trades above its historical valuation multiples, so an increased debt and therefore lowered expected future growth could revert the valuation closer to the mean.

Over the long term, I do not see many substantial risks for Roper. The business is diversified, in good markets and with good management. As long as they don’t overdo themselves with leverage, they should be a fine long-term investment. That being said, I’d wait for a cheaper entry price.

ROP valuation multiples (Koyfin)