karelnoppe/iStock via Getty Images

The Industrial Select Sector (XLI) closed the week ending July 21, +0.87%. Rocket took the top gainer spot but trucking companies were not behind, landing three spots among the five. Meanwhile, Joby slumped on a downgrade and earnings began to show its impact on the stocks.

XLI was among the 7 out of the 11 S&P 500 sectors, which closed the week in green. The SPDR S&P 500 Trust ETF (SPY) rose +0.65%.

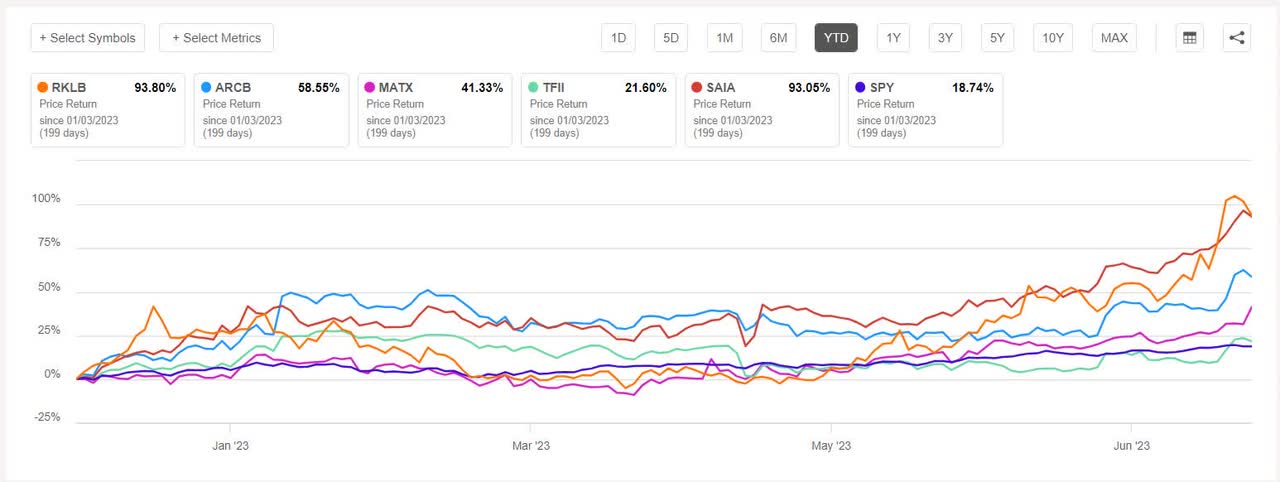

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +10% each this week. YTD, all these 5 stocks are in the green.

Rocket Lab USA (NASDAQ:RKLB) +18.67%. Rocket not only retained its spot among gainers from last week but this week, it topped it. The shares gained the most on Tuesday (+13.64%) after the company said it successfully launched seven satellites for NASA, Space Flight Laboratory and Spire Global from Launch Complex 1 in New Zealand. The stock had also gained on Monday (+9.02%).

YTD, the shares have soared +98.94%, the most among this week’s top five gainers. RKLB has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Hold. The stock has a factor grade of D- for Profitability and B- for Growth. The average Wall Street Analysts’ Rating differs with a Buy rating, wherein 4 out of 8 analysts see the stock as Strong Buy.

ArcBest (ARCB) +13,89%. The Fort Smith, Ariz.-based freight transportation provider was among the trucking companies’ stocks that rose this week after International Brotherhood of Teamsters said Yellow failed to make its required $50M in union contributions for the month of June. ArcBest’ stock shot up the most on Wednesday +9.28%.

Three weeks ago too the the trucking sector reacted to the news that Yellow Trucking Company could be heading for a bankruptcy. The SA Quant Rating on ARCB is Hold with score of A- for Momentum and C+ for Valuation. The rating is in contrast to the average Wall Street Analysts’ Rating of Buy, wherein 5 out of 11 analysts tag the stock as Strong Buy. YTD, the shares have jumped +55.77%.

The chart below shows YTD price-return performance of the top five gainers and SPY:

Matson (MATX) +12.21%. The shipping company announced its preliminary Q2 result on Thurday and forecast a Q2 EPS above estimates, which sent the shares surging on Friday (+7.55%).

MATX has a SA Quant Rating of Hold with factor grade of A for Profitability but F for Growth. The average Wall Street Analysts’ rating agrees with a Hold rating of its own, wherein 3 out of the 3 analysts view the stock as such. YTD, +41.29%.

TFI International (TFII) +11.30% and Saia (SAIA) +10.61%. The two trucking wrapped up the top five for the week, seeing a positive impact on their shares in part due to the news about Yellow.

The SA Quant Rating on TFII and SAIA, both, is Hold, while the average Wall Street Analysts’ Rating, on both, is Buy. YTD, TFI’s shares have risen +21.47%, while Saia’s stock has zoomed +92.06%.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -6% each. YTD, only 1 out of these 5 stocks is in the red.

Joby Aviation (NYSE:JOBY) -16.14%. The electric air-taxi maker landed the spot for the worst performer this week after being the top gainer three weeks ago. Shares slumped -15.81% on Wednesday after JPMorgan downgraded the eVTOL stock to an Underweight rating after having it slotted at Neutral.

The SA Quant Rating on JOBY Hold with a factor grade of A+ for Momentum but D- for Profitability. The average Wall Street Analysts’ Rating concurs with a Hold rating of its own, wherein 2 out of 7 analysts tag the stock as such. YTD, the shares have risen +146.57%, the most among this week’s worst five decliners.

Equifax (EFX) -10.22%. The data analytics company, which provides workforce solutions, saw its stock dip -8.89% on Thursday after Q2 results missed estimates. The SA Quant Rating on EFX is Hold with score of C for Growth but F for Valuation. The average Wall Street Analysts’ Rating has a more positive view with a Buy rating, wherein 7 out of 22 analysts tag the stock as Strong Buy. YTD, +9.26%.

The chart below shows YTD price-return performance of the worst five decliners and XLI:

ManpowerGroup (MAN) -7.33%. The Milwaukee, Wis.-based staffing company reported mixed Q2 results and provided an EPS outlook for Q3 which was below estimates.

The SA Quant Rating on MAN is Hold with factor grade of C+ for Profitability but F for Growth. The average Wall Street Analysts’ agrees with a Hold rating of its own, wherein 7 out of 15 analysts view the stock as such. YTD, the stock has declined -6.39%, and is the only stock among this week’s decliners which is in the red for this period.

Encore Wire (WIRE) -7.22%. Shares of the McKinney, Texas-based wires and cables maker dipped this week but YTD, the stock has climed +18.79%. The SA Quant Rating on WIRE is Hold, which is in stark contrast to the average Wall Street Analysts’ Rating of Strong Buy.

Herc Holdings (HRI) -6.68%. The equipment rental supplier’s shares fell -6.48% on Friday after the stock took on a double downgrade from Bank of America. YTD, +1.16%. The SA Quant Rating on HRI is Hold, while the average Wall Street Analysts’ rating is Buy.