Scott Olson/Getty Pictures Information

Funding Thesis

Whereas in a few of my earlier analysis I’ve taken a bullish stance on Coinbase (COIN) on account of their sturdy alternatives in custodying and buying and selling Bitcoin (BTC-USD), I imagine Robinhood Markets, Inc. (NASDAQ:HOOD) presents the very best crypto platform funding alternative on the market for US fairness buyers. Latest operational knowledge, plus their crypto alternate acquisition, positions Robinhood as a standout participant within the broader cryptocurrency market, making them a sexy funding for many who favor to not guess on particular person tokens.

As I discussed in my final report in Might (and now), Robinhood’s current operational efficiency has been sturdy. As an illustration, the corporate’s fairness buying and selling quantity surged by 23% month-over-month in Might, whereas their crypto buying and selling quantity, regardless of a 30% month-over-month decline, has greater than tripled year-over-year. This means a rising person base and elevated engagement with the platform’s buying and selling companies. This was additionally earlier than their most up-to-date acquisition.

In June 2024, Robinhood agreed to accumulate Bitstamp, a world cryptocurrency alternate, for roughly $200 million. Bitstamp at present has over 50 international energetic licenses and registrations, which can considerably develop Robinhood’s footprint within the cryptocurrency market.

Including to Bitstamp, Robinhood additionally acquired Pluto Capital. Pluto Capital is an AI-driven analysis platform, which goals to combine superior knowledge analytics and AI-powered capabilities throughout their choices. This can assist Robinhood ship extremely custom-made funding methods primarily based on buyer wants and monetary objectives, additional attracting customers to their platform (which I now assume is more and more turning into a one-stop store for buyers). The AI capabilities from Pluto Capital are anticipated to course of and interpret market knowledge extra effectively, enhancing Robinhood’s potential to supply well timed and related funding insights for all funding lessons.

Based mostly on the corporate’s sturdy operational knowledge mixed with their current acquisitions, I feel they’re nicely arrange for increasing inside the cryptocurrency market. I imagine the inventory continues to be a robust purchase.

Why I Am Doing Observe-Up Protection

Beforehand, in Might, I rated Robinhood a robust purchase. My main reasoning for this was the success of Robinhood Gold, their premium subscription service. Since this protection, the inventory has considerably outperformed the market, rising by 33.27% in comparison with the market’s 7.29% achieve.

Whereas this spectacular run-up may lead some to imagine that shares are overvalued, I imagine the inventory is simply getting began. Latest developments, notably Robinhood’s acquisitions of different corporations, are anticipated to trigger quicker progress than present road estimates recommend. This follow-up protection is supposed to dive deeper into their future progress prospects.

Crypto Deep Dive

As I discussed above, I feel Robinhood’s current acquisitions will probably be enormous for the corporate’s future. That’s to not say the brokerage is unfamiliar with crypto, nevertheless.

The brokerage agency has been supporting numerous currencies since all the best way again in 2018.

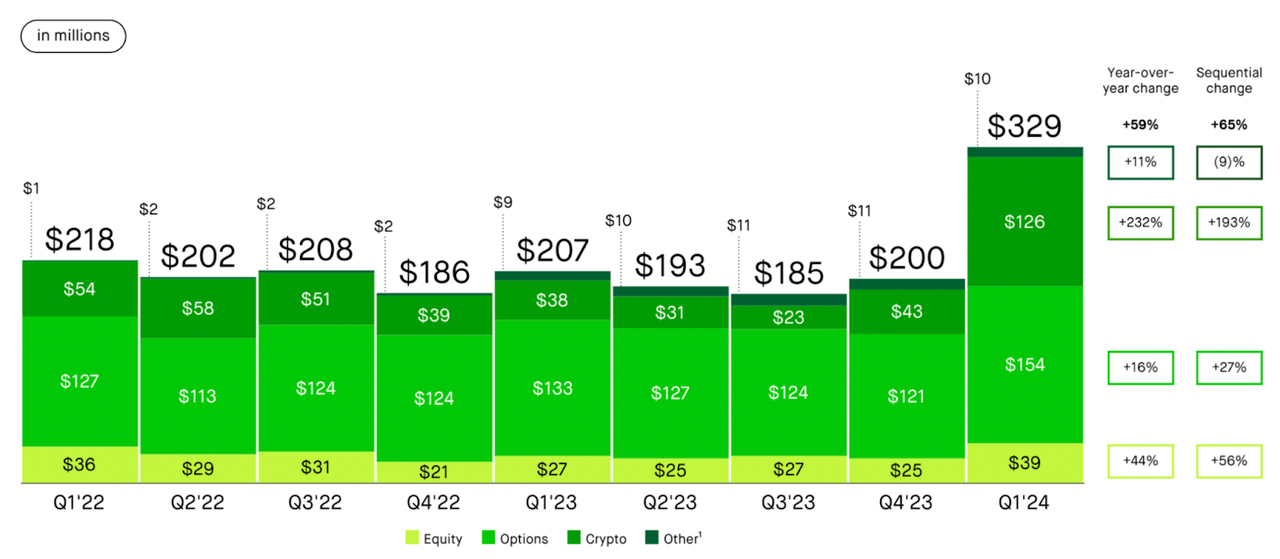

Since then, their crypto enterprise has ballooned, with crypto buying and selling revenues now reaching $126 million in Q1 alone (earnings presentation). That is now really the second-largest income presently, after possibility buying and selling ($154 million). And actually, that is greater than all of their crypto income in 2023 mixed. I imagine crypto goes to quickly be the most important income driver, pushed by the explosive progress in cryptocurrencies and their current acquisition.

Robinhood Efficiency By Division (Robinhood)

Since Q1, the corporate has invested additional with their Bitstamp acquisition, anticipated to be finalized within the first half of 2025 (at roughly $200 million).

With this, I feel the corporate is getting a foothold in one of the vital regulated monetary markets: Europe. The crypto alternate was based in 2011 in Luxembourg. As a result of alternate being based in Europe, they’ve undergone a lot increased regulation and compliance from European cryptocurrency legal guidelines. Because of this, the alternate now possesses 50 energetic licenses and registrations globally. This tight regulation implies that Robinhood is buying an alternate that can probably be a low stress crypto alternate to combine with. They’ve a comparatively clear slate in comparison with different exchanges.

Not solely will this acquisition be very clear on account of strict laws, however it is going to additionally enhance Robinhood person expertise. It permits customers to regulate all components of their liquid funds from the Robinhood app, corresponding to shares, bonds, money, and now a full crypto web site (greater than the handful of cryptocurrencies that Robinhood helps proper now).

This strategic transfer not solely enhances Robinhood’s presence within the U.S. nevertheless it additionally expands their place within the European and Asian markets, leveraging Bitstamp’s intensive person base and operational experience. By buying Bitstamp, Robinhood positive factors entry to a broader vary of tokens, providing greater than 85 tokens in comparison with the 15 at present obtainable to U.S. retail buyers and over 30 in Europe.

As said by the final supervisor of Robinhood Crypto, Johann Kerbrat:

The acquisition of Bitstamp is a serious step in rising our crypto enterprise. Bitstamp’s extremely trusted and lengthy standing international alternate has proven resilience by market cycles. By seamlessly coupling buyer expertise with security throughout geographies, the Bitstamp crew has established one of many strongest reputations throughout retail and institutional crypto buyers -Press Launch.

He then went on to state:

By means of this strategic mixture, we’re higher positioned to develop our footprint exterior of the US and welcome institutional clients to Robinhood.

The CEO of Bitstamp, JB Graftieaux, additionally spoke on this acquisition:

Because the world’s longest operating cryptocurrency alternate, Bitstamp is called one of many most-trusted and clear crypto platforms worldwide…bringing Bitstamp’s platform and experience into Robinhood’s ecosystem will give customers an enhanced buying and selling expertise with a unbroken dedication to compliance, safety, and customer-centricity.

I discussed above the reliability of Bitstamp, and these quotes actually additional emphasize this together with how this acquisition will profit Robinhood’s enterprise immediately.

With this, Robinhood acquired Pluto Capital, the AI-driven analysis platform I discussed earlier than. What’s particular about this buyout is that Robinhood is permitting Pluto Capital CEO to work on their platform collectively put up acquisition. In an announcement, Pluto Capital CEO, Jacob Sansbury said:

Robinhood is the best vacation spot to construct merchandise that democratize entry to monetary companies like wealth administration and monetary planning by cutting-edge AI.

This buyout grants Robinhood entry to Pluto Capital know-how. By bringing on the manager crew in home and permitting Sansbury to proceed work on this venture, this can present them with entry to experience on the best way to greatest make the most of their know-how. AI growth is a expertise recreation. Robinhood will get this and is executing on a robust recreation plan.

This acquisition is aimed toward integrating superior knowledge analytics and AI-powered capabilities throughout Robinhood’s choices. Pluto Capital’s platform leverages state-of-the-art massive language fashions to course of and interpret market knowledge extra effectively, offering extremely custom-made funding methods primarily based on real-time private and international monetary knowledge.

I feel with these acquisitions, Robinhood won’t solely be capable to develop their market attain, but in addition enhance buyer expertise. AI + Crypto acquisitions are a robust mixture. This considerably enhances Robinhood because the place retail merchants will consolidate their funds at.

Valuation

Since I final coated Robinhood, the inventory has risen by roughly 33%, which is coincidentally the precise upside I known as for in my final piece. I additionally known as for shares to go up on account of my perception that this share worth improve would worth in an accurate worth/progress (PEG) ratio. Trying on the firm’s present ahead Non-GAAP PEG ratio of 5.68, 357.57% increased than the sector median, it’s clear the market has begun to cost within the potential upside of this inventory.

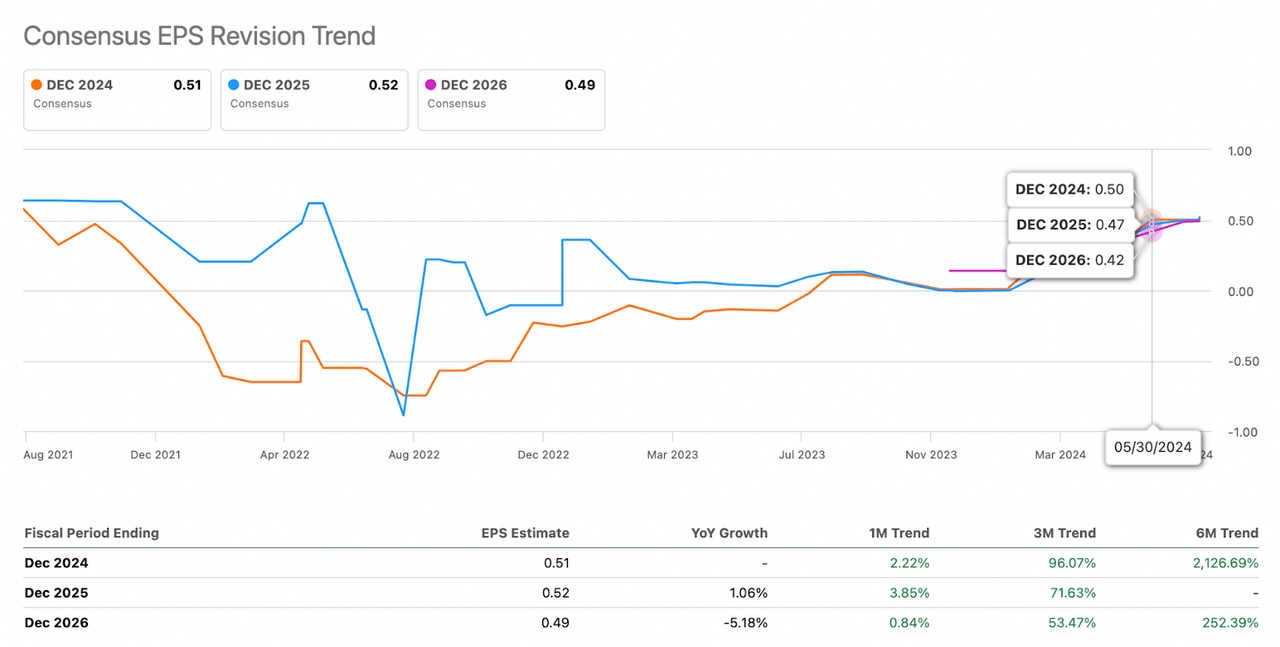

Nevertheless, I feel you will need to word Robinhood’s present ahead Non-GAAP P/E earnings ratio, which at present stands at 27.85, is barely 143.90% increased than the sector median. I feel this premium ratio is probably going increased than it really will probably be sooner or later, given the place EPS estimates at present stand.

Robinhood’s EPS revisions, I feel they’re far too low. For instance, the corporate’s EPS is anticipated to succeed in $0.51/share by December, and $0.52/share by December 2025. The 1-month revision for December 2025’s prediction is barely a rise of three.85%, regardless of the acquisition of Bitstamp being introduced in early June. That is huge to assist herald new shopper belongings ultimately. I’m stunned we’re not beginning to see this within the 2025 numbers.

In line with analyst knowledge offered by In search of Alpha, it is obvious the market is anticipating the corporate’s EPS to flat line.

Robinhood Ahead EPS Revisions (In search of Alpha)

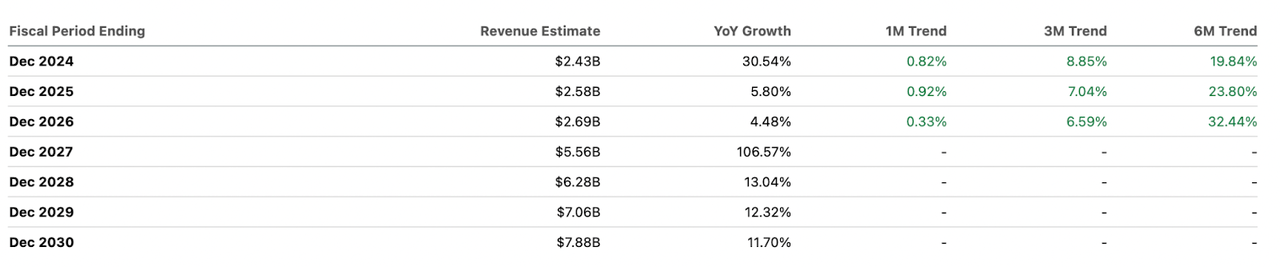

I feel that is drastically inaccurate, and their EPS are arrange for big progress. The insecurity interprets to Robinhood’s income, as seen within the chart under.

Robinhood Ahead Income Revisions (In search of Alpha)

The market has solely elevated the income estimates for December 2025 by 0.92% within the final month, regardless of sturdy efficiency and the acquisition. I once more, imagine this can be a extreme undervaluation.

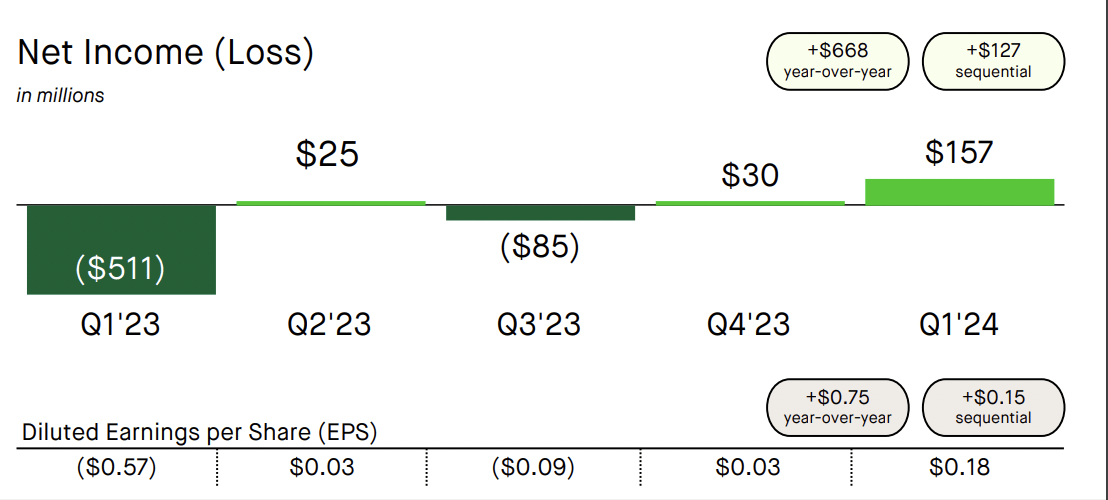

Remember the fact that in Q1 alone, they ran at a GAAP EPS of $0.18/share. If they simply preserve Q1 efficiency ranges for the remainder of 2024 (I count on efficiency to extend all year long) then we’re taking a look at a GAAP EPS in 2024 of a minimum of $0.72/share (considerably increased than the EPS estimates for the following 2 fiscal years). Crypto is a key a part of this. The Bitstamp acquisition is core to Robinhood’s crypto technique.

Robinhood EPS Progress (Robinhood)

With this, I imagine Robinhood’s ahead Non-GAAP P/E premium of 143.90% must be a lot nearer to their ahead income progress premium of 360.28%. If their P/E ratio elevated to a 200% premium to the sector median, this could signify a brand new worth of 32.46. With this improve, this could signify roughly a 16.6% upside potential in shares from at the moment’s costs.

Dangers

Whereas I imagine this can be a strong funding, it nonetheless comes with dangers. The largest concern I’ve is the downturn in crypto quantity. Lately, whereas Robinhood’s fairness buying and selling quantity surged by 23% month-over-month, their crypto buying and selling quantity slid by 30% over the identical interval.

The crypto market is extremely unstable, which is probably going the reason for this downturn, regardless of the general constructive efficiency from the corporate. If this development continues, it’s more likely to have an effect on Robinhood’s income and progress even with this bolt-on acquisition.

On this level, possibility income additionally faces volatility dangers. Possibility buying and selling for retail buyers tends to do greatest in bull markets. Since we’re in a single proper now, possibility quantity is sweet (up 16% YoY in Q1). If the market slumps once more, nevertheless, count on this income to additionally stagnate or decline.

Nevertheless, even with the considerations concerning a slowing crypto market or choices income that may very well be fickle, I imagine cryptocurrency is just not going anyplace. This might offset any lower in possibility buying and selling income over the long term given the expansion. Their buying and selling quantity has seen unimaginable progress yr over yr. Add in the truth that they may probably seize market share from different exchanges (not as a lot from Coinbase however from different main exchanges) and I feel that is nonetheless a robust setup.

Backside Line

Robinhood’s acquisitions of Bitstamp and Pluto Capital will permit the corporate to develop their crypto choices and improve their platform’s capabilities. I imagine this places Robinhood in a strong place to capitalize on the rising cryptocurrency market and seize extra pockets share for retail merchants. Regardless of the current run-up within the inventory, as proven within the valuation part, shares nonetheless seem to have extra upside.

The volatility in crypto buying and selling volumes and potential integration challenges current dangers, however the total progress trajectory and market alternatives make this (in my view) a danger price taking. I feel these acquisitions are just the start for Robinhood. I nonetheless imagine shares are a robust purchase.