Blue Harbinger Kraig Scarbinsky/DigitalVision through Getty Pictures

We simply had the very best week for shares since 2020, with all three main indexes up large (SPY) (QQQ) (DIA). However do not let that cloud your judgement as those self same indexes are all down considerably this yr and the market nonetheless faces important challenges (similar to inflation and geopolitical dangers). On this report we share knowledge on 100 big-yield investments (together with REITs, BDCs, CEFs and dividend development shares) after which conclude with a warning for traders about how they need to be taking part in present market situations.

The Week in Assessment:

For starters, here’s a video by Blue Harbinger’s Mark Hines on the week in overview, discussing elevated readability available in the market from China’s announcement that its tech crackdown will finish quickly and the US fed’s announcement that they count on to extend the goal federal funds charge six extra occasions this yr (following the 25 foundation level hike we noticed this week).

In a nutshell, the 2 takeaways from the video are that (1) the market hates uncertainty and (2) you should not ditch your long-term funding technique simply because the market had one good week. Keep disciplined, keep centered.

100 Massive-Yield Investments

If you’re like loads of traders, you’re sick and uninterested in dropping sleep at evening due to the extraordinarily risky market situations we have now been experiencing during the last 2 years. From the preliminary pandemic crash in early 2020, to the huge rebound (particularly for prime development shares), and now the market’s important decline this yr (particularly for risky excessive development shares) because the US fed offers with the devastating inflation numbers (Feb CPI elevated 7.9% year-over-year-the highest in over 40 years!) which might be mainly the results of the federal government’s panic-driven stimulus response to the pandemic (e.g. low charges, stimulus checks and large fed stability sheet growth, to call a couple of).

Many traders achieve consolation from investments that pay regular high-income funds (e.g. dividends) as a result of they like to maintain receiving that earnings even when the market is promoting off. Clearly, not all earnings funds are created equally, and so they every have their very own distinctive dangers, so we have now damaged the 100 into 4 distinct classes. Let’s begin with high-income Closed-Finish Funds (“CEFs”).

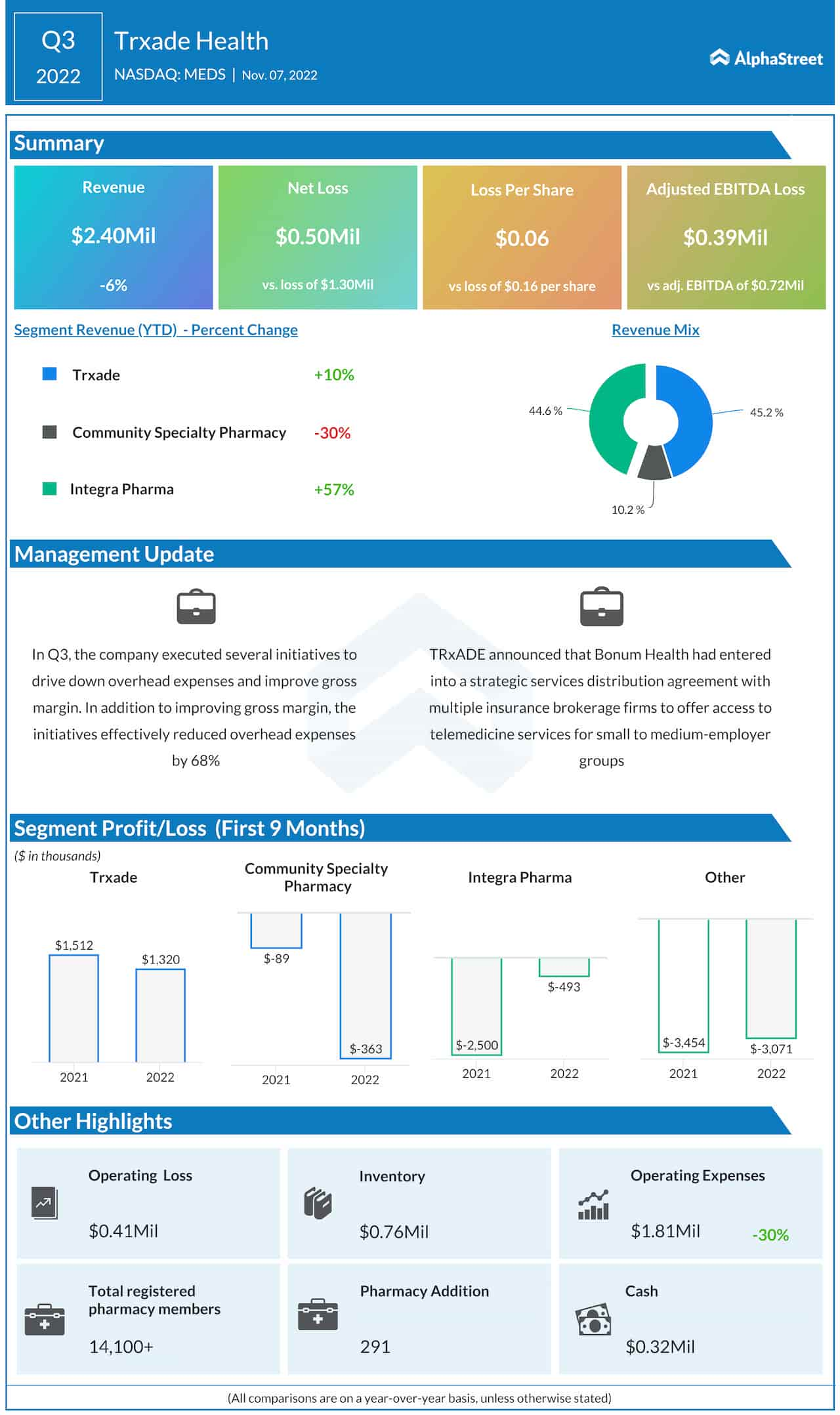

25 Excessive-Yield CEFs

CEFs are sometimes an earnings investor favourite as a result of they’ll pay excessive ranges of earnings (usually month-to-month), present some ranges of instantaneous diversification (as a result of their underlying holdings usually embody many alternative particular person investments) and since they’ll often commerce at engaging costs relative to the underlying worth of their holdings (i.e. reductions and premiums versus internet asset worth or “NAV”).

Here’s a desk we shared with members of our Looking for Alpha market service, Massive-Dividends PLUS, earlier this week. One factor we famous was the engaging costs on a couple of PIMCO Bond CEFs (similar to (PDI) (PAXS)), which have mainly elevated in value sharply since then because the market has rallied following elevated readability from the fed.

Blue Harbinger

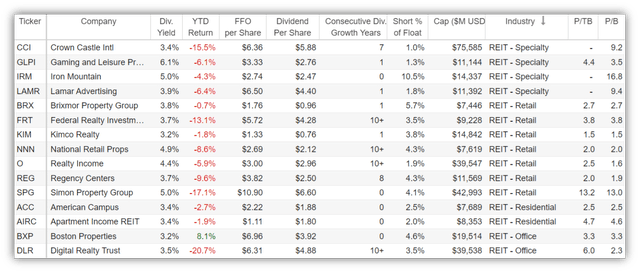

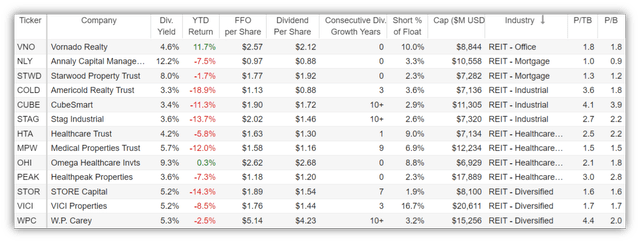

25 Massive-Yield REITs

REITs are one other earnings investor favourite as a result of they can also provide large dividends (that can assist you sleep effectively at evening), plus they typically personal bodily belongings (actual property) which might do effectively in an inflationary surroundings. Listed below are 25 big-dividend REITs, sorted by trade.

Inventory Rover (knowledge as of 3-18-22) Inventory Rover (knowledge as of 3-18-22)

Noteworthy from the above desk are Realty Earnings (O), Digital Realty (DLR), Stag Industrial (STAG) and W.P. Carey (WPC) as a result of all of them provide engaging dividend yields which were elevated for a minimum of 10 years straight and they’re all buying and selling at decrease costs this yr. We have written in additional element about them lately for members.

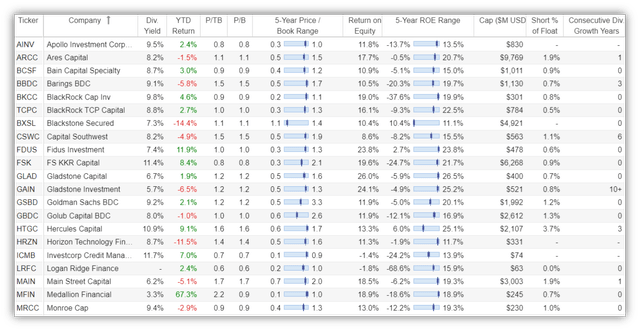

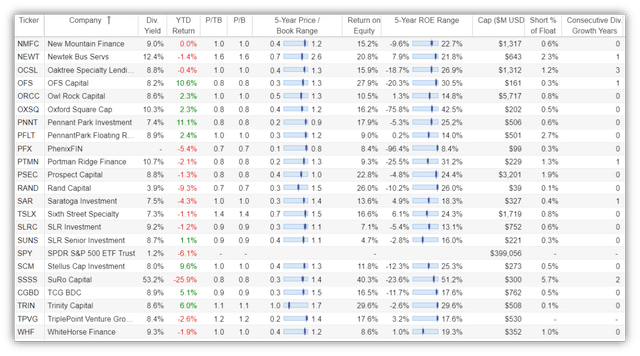

Massive-Dividend BDCs

BDCs are enterprise growth corporations, and so they mainly present financing (principally loans) to center market companies which might be usually too small (or somewhat bit too dangerous) for large banks (particularly contemplating the extra stringent financial institution lending guidelines that got here into place following the monetary disaster of 2008-2009 when many conventional large banks had been deemed “too large to fail”).

Inventory Rover (knowledge as of 3-18-22) Inventory Rover (knowledge as of 3-18-22)

One fascinating factor about financials typically (particularly those who present capital although lending) is that their total enterprise relies largely on internet curiosity margins, and people internet curiosity margins usually enhance (resulting in extra profitability) when rates of interest go up. Clearly, there are various several types of BDCs (and lots of several types of loans with considerably completely different danger profiles), however ceteris paribus, BDCs might be helped by the fed’s new trajectory of six extra anticipated rate of interest hikes this yr (as a result of it may in the end assist to enhance BDC internet curiosity margins). Moreover, BDCs maintain among the increased yielding belongings that large banks want they may (however they can’t due to the brand new extra stringent stability sheet guidelines following the ’08-’09 monetary disaster).

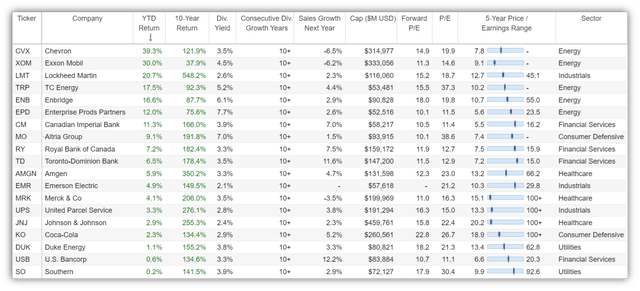

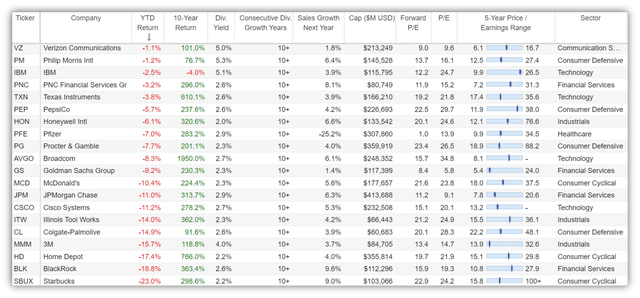

25 Dividend-Progress Shares

Generally there actually is not any want for traders to chase after the shares that provide the most important potential returns as a result of they typically include much more danger and volatility (one thing loads of traders are simply sick of and haven’t got the endurance to tolerate, relying on their stage in life). On the contrary, blue-chip dividend-growth shares are sometimes well-established, wholesome enterprise that may be worthwhile in good occasions and in unhealthy (thereby lowering among the volatility and danger that so many traders hate), plus a lot of them pay wholesome rising dividends, similar to these listed within the following desk.

Inventory Rover (knowledge as of three/18/22) Inventory Rover (knowledge as of three/18/22)

Blue-chip dividend development shares are definitely not proof against volatility (you may see a lot of them are literally down this yr within the desk above), nonetheless they typically decline much less that many different shares, and shopping for them when they’re truly down a bit could be profitable from a contrarian standpoint, particularly contemplating their wholesome dividends simply continue to grow through the years and thereby serving to to compound your longer-term wealth. Many readers seemingly have their very own favorites from the above record.

Conclusion

The key inventory market indexes simply had their finest week since 2020, however that does not imply we’re out of the woods. For perspective, the “dot com” bubble that peaked in March of 2000 took over two years to burst and it fell over 76% from peak to trough (technically it has since made up all these losses since then plus lots more-that’s the ability of long-term compound development). Sadly, many traders incorrectly tried to name a backside in that bubble each time it fell 10% or so, and so they ended up being mistaken (and dropping cash) for over two years straight. On the finish of the day, nobody is aware of the place the market goes within the short-term, however disciplined, goal-focused, long-term investing tends to be a extremely profitable technique, and proudly owning issues that provide large wholesome yields could make it that a lot simpler so that you can sleep effectively at evening.