Vitalij Sova

Thesis

With the future of the crypto industry seemingly in limbo, Riot Platforms (NASDAQ:RIOT) can go into the “too hard” pile. The company has difficulty being profitable with Bitcoin trading at these levels and is highly capital intensive. Riot Platforms is essentially a leveraged play on the price of Bitcoin, and if Bitcoin does return to previous highs it is likely that investors will be richly rewarded. That being said, for the time being we believe that investors can avoid Riot Platforms unless they are highly bullish on the future of Bitcoin.

Crypto Industry Woes

The recent wind-down of Silvergate has put the short-term future of the blockchain ecosystem in jeopardy. The bank was an important part of the ecosystem and its failure may dent the confidence around crypto. In addition to this, the collapse of SIVB will likely further reduce investment into web-3, blockchain, and cryptocurrency focused business ventures. The continued closure of the IPO window and difficult fundraising environment may cause current projects to run out of funds. All in all the current environment points towards lower confidence, lower investment, and lower prices.

Riot Platforms Business Challenges

Riot Platforms operates a highly capital intensive business model. As mining difficulty increases the company needs to purchase more advanced hardware to make mining more economical. If the price of Bitcoin has been languishing they tend to have difficulty financing these capital expenditures through their operations. This has led to the company diluting shareholders in the past, and will likely result in further dilution down the road if the price of Bitcoin remains where it is now.

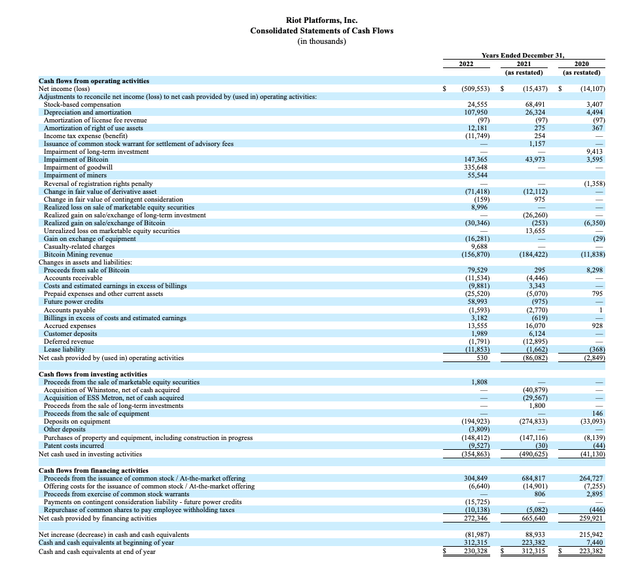

Statement of Cash Flows (Riot Platforms’ Q4 Earnings Report)

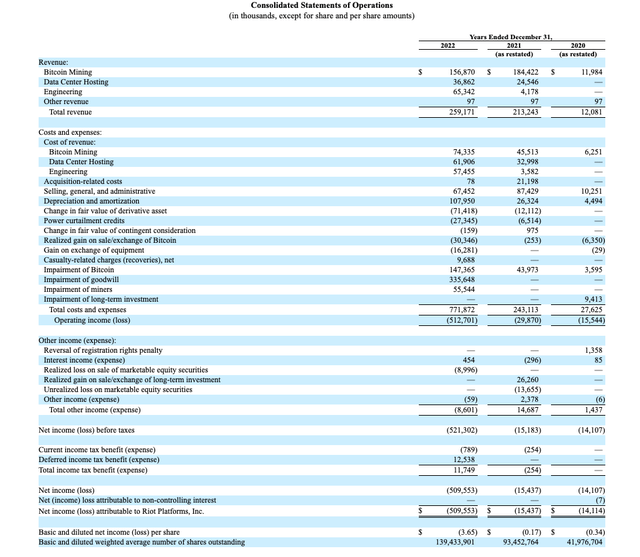

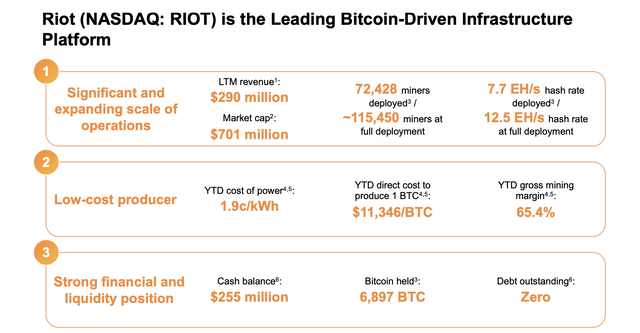

Riot has difficulty making money at these Bitcoin prices, even though their cost to mine Bitcoin is around $11,346 per BTC (according to their December 14 investor presentation).

Income Statement (Riot Platforms’ Q4 Earnings Report) Riot Platforms’ Investor Presentation

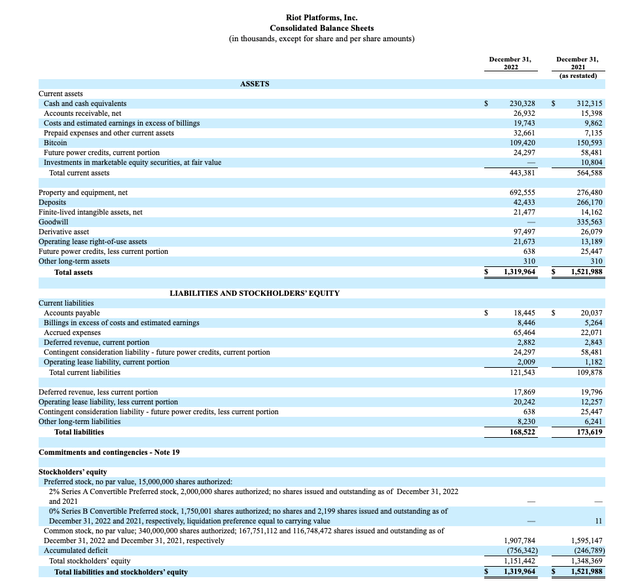

In the future it is possible for other cryptocurrencies like ETH to take the place of Bitcoin. This would be inconvenient for Riot as their operational focus and accumulated capital equipment is geared towards Bitcoin mining. The company also holds a significant amount of Bitcoin on their balance sheet.

Balance Sheet (Riot Platforms’ Q4 Earnings Report)

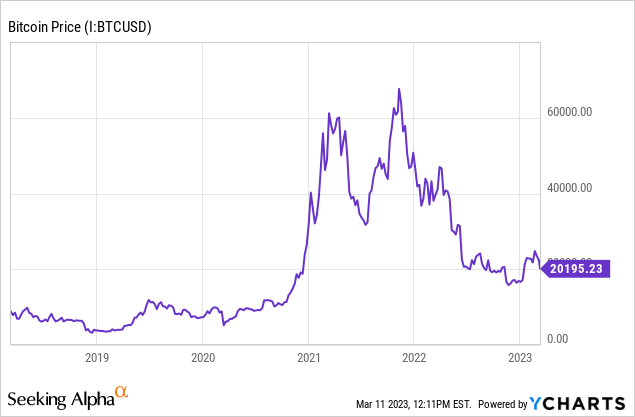

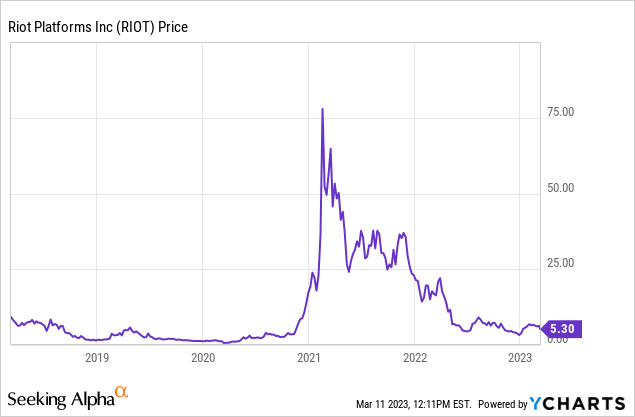

At the end of the day, if an investor wants to know where the price of Riot Platforms’ stock will go all they have to do is watch the price of Bitcoin. The company is a classic case of “live by the sword die by the sword” and as such their share price closely follows the trajectory of Bitcoin.

Price Action

The price of Riot Platform’s stock is highly correlated to the price of Bitcoin. As Bitcoin has sold off so too has Riot Platforms’ stock. Investors who are highly bullish on the future of Bitcoin may view this as a buying opportunity, and if Bitcoin returns to its previous highs investors will likely be richly rewarded.

A small move in the price of Bitcoin appears to cause a much larger move in Riot Platforms’ stock. Bitcoin investors seeking leveraged exposure may view an investment in Riot Platforms as a way to achieve this exposure without the use of derivatives.

While we are bullish on the future of blockchain and web-3, it isn’t clear that Bitcoin or any other specific coin prevalent today will be powering the most influential innovations.

Our focus is more on the underlying technology and ecosystem being developed, and as such we do not view Riot Platforms as an attractive candidate for investment because of their singular focus on Bitcoin mining and the capital intensity of their model.

Valuation

Traditional valuation metrics do not work here. In general, the higher the price of Bitcoin goes the more the assets on Riot’s balance sheet are worth. The longer prices remain stagnant, the less valuable their assets become. If prices remain stagnant or decrease the company may need to raise additional capital to fuel their capex requirements as mining difficulty continues to increase.

Risks

A risk to this bearish thesis is the potential for Bitcoin to once again capture the attention of the public. This could cause prices to resume their upward climb and drastically increase Riot’s profitability.

Another risk is that Riot continues to lower their Bitcoin mining costs. This additional operating leverage would improve their profitability and reduce their current operational difficulties.

We do not view the overall risk/reward as being favorable. If an investor is highly bullish on Bitcoin they can take a position here, but most investors would do well to remain on the sidelines.

Key Takeaway

The closure of Silvergate and collapse of SIVB do not bode well for development of the blockchain/web3 ecosystem. This means that Bitcoin prices will likely remain at these levels or decrease as confidence erodes. Riot Platforms is highly capital intensive and has difficulty being profitable with Bitcoin trading at these levels. Riot Platforms is essentially a leveraged play on the price of Bitcoin, and if Bitcoin does return to previous highs it is likely that investors will be richly rewarded. That being said, for the time being we believe that investors can avoid Riot Platforms unless they are highly bullish on the future of Bitcoin.