temizyurek

Since I final wrote concerning the Australian iron ore miner Rio Tinto (NYSE:RIO) in March, its share worth is up by 4%. This isn’t a giant enhance by any stretch, after all. It’s even lesser than the ten% enhance seen within the S&P Metals & Mining Choose Business Index throughout this time.

It does, nevertheless, should be recognised that by mid-Might, the inventory had seen a a lot larger enhance of 20%, earlier than correcting considerably since on a run up in base metallic costs. As these costs noticed some correction, so did RIO.

Right here I take a better take a look at whether or not there is a case for extra sustainable worth rise for the inventory now, primarily based each by itself manufacturing and commodity costs.

Prospects for iron ore

Iron ore is the important thing commodity to contemplate for Rio Tinto, contemplating that it contributed nearly 84% of the corporate’s underlying EBITDA in 2023. If follows then, that a lot of the corporate’s fortunes are linked with these for the commodity, that are checked out in some element right here.

Manufacturing and projections

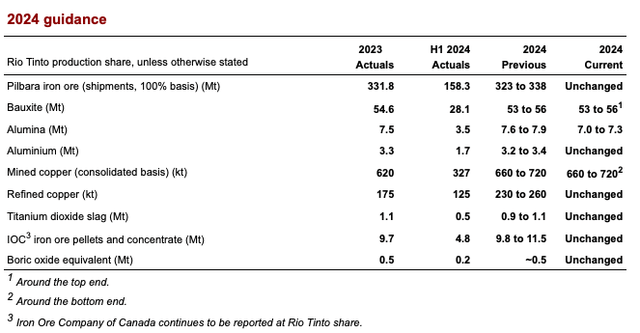

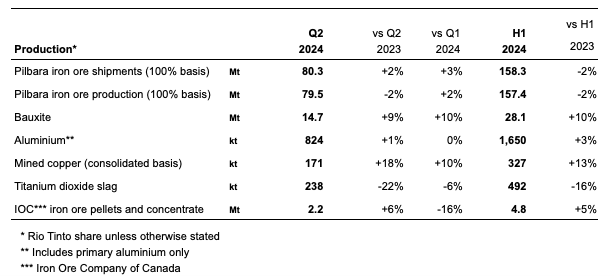

So far as manufacturing goes, the corporate’s essential Pilbara iron ore has seen no change in steering as much as H1 2024. On the midpoint of the vary (see Desk 1 under), there’s anticipated to be little change in manufacturing in 2024 from final yr as effectively. Nonetheless, after a slight decline of two% year-on-year (YoY) in H1 2024 (see Desk 2 under), it might effectively are available on the decrease finish of the vary.

Alternatively, a 5% YoY enhance in its iron ore pellets and focus manufacturing is a few comfort. It’s comparatively tiny in manufacturing phrases, although. Primarily, unchanged to barely decrease manufacturing for iron ore will be envisaged for 2024.

Desk 1 (Supply: Rio Tinto) Desk 2, Manufacturing, H1 2024 (Supply: Rio Tinto)

Iron ore worth

At some other time, unchanged manufacturing won’t have mattered as a lot however with an underwhelming outlook for iron ore costs, it does matter now. The commodity’s worth has already dissatisfied in 2024 to this point, with an over 20% worth decline and the value prospects don’t look encouraging both. At finest, it is anticipated to finish the yr flat. For particulars on iron ore costs please take a look at my latest article on BHP (BHP) right here.

Prospects for Aluminium and Copper

The prospects for aluminium and associated merchandise, which accounted for nearly 10% of the corporate’s underlying EBITDA in 2023, are higher. Each bauxite and aluminium manufacturing was up in H1 2024, and steering for them stays unchanged too. The one exception is alumina, which is now anticipated to see barely decrease manufacturing than final yr.

It’s additionally encouraging that aluminium’s worth on common in H1 2024 has been greater YoY (see chart under) as the bottom metallic noticed a brief worth spike in April following the US and UK banning Russian metallic imports.

Supply: Buying and selling Economics

Very similar to aluminium, copper worth too noticed greater worth on common in H1 2024 in comparison with H1 2023. Though the metallic contributed round a comparatively small 8% of the underlying EBITDA in 2023, along with aluminium, this provides when it comes to constructive traits for Rio Tinto. Additionally, copper manufacturing has been constructive, with a 13% YoY enhance in H1 2024 and steering has remained unchanged for it too. In sum, copper is a brilliant spot for the corporate up to now half yr.

Monetary outlook and market multiples

Broadly talking, nevertheless, aluminium and copper can do solely as a lot to prop up the corporate’s financials. With iron ore’s traits weak, the corporate’s H1 2024 numbers due later within the month are more likely to present weak spot.

The truth is, with iron ore costs anticipated to remain static at their 2023 ranges, at finest, the financials may keep sluggish for the rest of 2024 as effectively. That is additionally mirrored in analysts’ estimates on In search of Alpha, which count on income to say no by round 2% this yr and the EPS to remain flat.

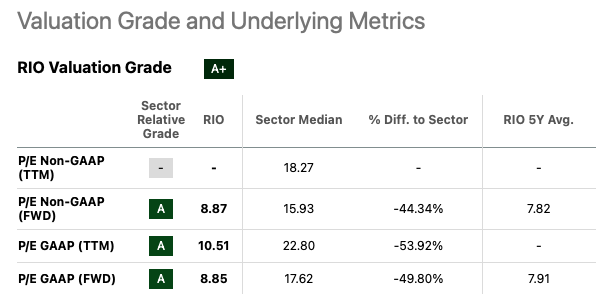

Even then, if the inventory’s market multiples had been low, there may nonetheless be a purchase case for it. That is not so, both. Its ahead price-to-earnings (P/E) ratios are greater than the five-year averages (see desk under). The truth is, even these look good in comparison with my estimates, which assume that the corporate’s internet margin stays fixed ultimately yr’s degree of 18.6%, and the income declines as indicated by the common of analysts’ estimates. This ends in a ahead non-GAAP P/E of 11.1x.

Supply: In search of Alpha

Primarily, it’s laborious to make a Purchase case for Rio Tinto from the value perspective. That mentioned, it’s price contemplating the dividend yield. The ahead dividend yield, particularly at 8% is spectacular.

Although, whether or not it makes up for the potential weak spot within the worth, stays to be seen. Prior to now three years, the overall returns on the inventory have been simply 5.7%, dragged down considerably by a 17.4% decline in worth. The commodity cycle is not simply in a weak place proper now, but it surely’s unlikely to see a big upturn anytime quickly as effectively.

That is largely because of China, the most important metals’ client, which hasn’t seen the hoped for pickup in demand. And the US economic system anticipated to proceed shedding momentum as effectively, it might be a while earlier than metallic costs begin shining once more.

What subsequent?

For long-term buyers on the lookout for dependable dividend revenue, Rio Tinto continues to be a very good inventory to purchase. Nonetheless, it’s laborious to make a Purchase case for it within the short-to-medium time period trying on the commodity worth outlook, its personal manufacturing steering and the market multiples.

I imagine proper now, there’s a danger to capital from shopping for the inventory. There might be quick time period upticks primarily based on information flows, as seen in April and Might, as base metallic costs noticed a rise. However its unlikely to be sustained. I’m reverting Rio Tinto to Maintain. This could change, if there are any sudden constructive developments on the macroeconomic entrance, however to this point that seems unlikely.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.