Bartlomiej Wroblewski/iStock via Getty Images

Investment Thesis

Rigetti Computing, Inc. (NASDAQ:RGTI) stock is on fire after yesterday’s Q2 earnings release. Revenue growth demonstrates strong momentum, and the company delivered solid improvement in cost control, which enabled the company to push the gross margin above 80% and decrease operating losses.

While Rigetti’s financial performance is improving notably, the company is still burning cash, and the management expects that it will face the need to raise additional capital in late 2024. Given the harsh environment and tight credit conditions, this can be a difficult task. The company operates in a rapidly evolving quantum computing industry, but there is a vast level of uncertainty regarding the company’s ability to achieve profitability in the foreseeable future. Moreover, the valuation does not look attractive. All in all, I do not recommend buying and assign the stock a “Hold” rating.

Company Information

Rigetti Computing is a vertically integrated company involved in quantum chip design, manufacturing, and cloud services. RGTI owns and operates Fab-1, a wafer fabrication facility located in Fremont, California.

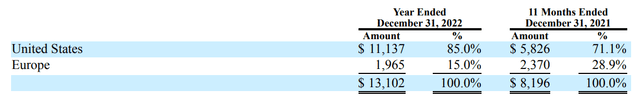

The company’s fiscal year ends on December 31 as a sole reportable and operating segment. According to the latest 10-K report, 85% of the total sales were generated in the U.S. in FY 2022.

RGTI’s latest 10-K report

Rigetti Computing Financials

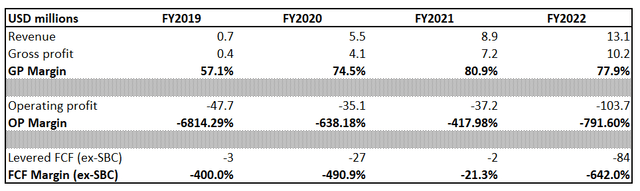

RGTI went public in March 2022. Therefore, the history of earnings is relatively short. But we can see the impressive revenue growth trend, though comps are easy to beat. The company is far from generating operating profits, with substantial losses. So is the free cash flow [FCF] margin, whether stock-based compensation [SBC] is included or not.

Author’s calculations

The company’s balance sheet is robust, with a substantial net cash position. Financial leverage ratios are moderate, and liquidity metrics are in excellent shape. RGTI had $105 million in cash as of the latest reporting date. To add context, the company, on average, burns about $20 million of cash each quarter. The outstanding cash balance will be enough to finance about four more quarters at the current cash burn rate. The company will likely need to raise additional capital in late 2024.

The latest quarterly earnings were announced on August 10, and it was a huge positive catalyst for the stock, which soared more than 40% after the earnings release. RGTI topped consensus estimates on revenue and GAAP EPS. The top line demonstrated strong growth momentum with a 55% YoY increase. The gross margin followed the top line and expanded from 59% to 82%, primarily due to the significant variability in the pricing of development contracts. Another positive sign is that the total operating expenses decreased YoY from $27 million to $19 million. This was due to decreased SBC, lower employee wages and benefits costs, and the savings generated by a 28% staff layoff in February 2023. Another bullish sign is that the CEO reiterated RGTI’s year-end technology milestones during the earnings call.

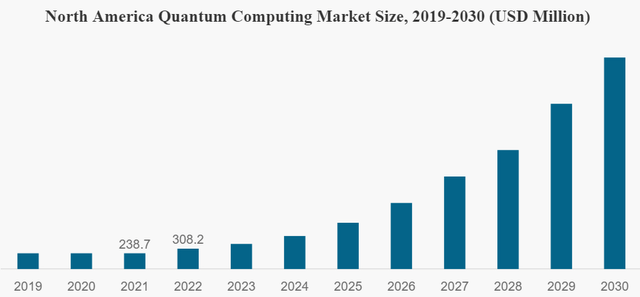

Overall, the company operates in a market that is highly likely to be the hottest topic alongside AI in the next decade. The quantum computing market is projected to compound at a staggering 32% rate up to 2030. The industry is young, and being one of the industry pioneers puts Rigetti in a pole position. On the other hand, I cannot say that being a pioneer means the company has a wide “moat” and will definitely absorb secular tailwinds. It looks like a fifty-fifty game because many companies with much larger scales are investing heavily in the research and development of quantum computers.

fortunebusinessinsigts.com

RGTI Stock Valuation

RGTI stock is on fire this year with a 232% year-to-date rally, significantly outperforming the broad market and iShares Semiconductor ETF (SOXX). Seeking Alpha Quant assigns the stock an average “C+” valuation grade, though significant parts of multiples are inapplicable due to negative profitability metrics.

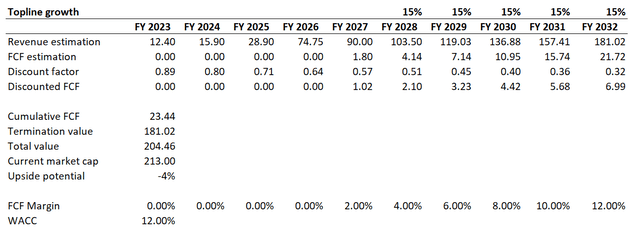

As a growth company, the best way to conduct valuation analysis here is the discounted cash flow [DCF] approach. I use a 12% WACC due to the high level of uncertainty and the company’s substantial losses over the past years. I have revenue consensus estimates available up to FY 2027, projecting more than sevenfold top-line growth. For the years beyond, I expect revenue growth to be moderate at 15%. For the FCF margin, I expect it to turn positive in FY 2027 and to expand by two percentage points yearly.

Author’s calculations

The current market capitalization is slightly above my fair value estimation, with no upside potential. I do not add the company’s net cash position to the fair value calculation because this cash is highly likely to be burned within the next four quarters. That said, I think the stock is fairly valued at the current level.

Risks To Consider

Rigetti Computing, Inc. is in the early stages of its life cycle, meaning there is a high level of uncertainty about whether the company will be able to remain in business over the long term. Rigetti is burning cash rapidly, and this means there is a substantial risk of bankruptcy in the foreseeable future if the company fails to raise additional capital. The company will need substantial financial resources to scale up production volumes, since Rigetti’s business model assumes operating and owning a fabrication facility.

Aggressive revenue growth expectations are priced in. If the company fails to meet them, investors will be disappointed, and a massive sell-off is highly likely to occur. The timing of reaching positive FCF also would significantly affect the market’s opinion about the stock.

Working in the semiconductor industry means fierce competition with giants like Intel (INTC), Nvidia (NVDA), and Advanced Micro Devices (AMD). While RGTI’s technology does not directly overlap with these companies, there is no guarantee that they will never decide to expand their reach and one day become a direct competitor to RGTI. Companies with established brands and vast financial resources are highly likely to outperform small companies like RGTI.

Bottom Line

To conclude, Rigetti Computing, Inc. stock does not look like a “Buy” to me. Overall, the quantum computing industry looks promising, with a massive growth potential. But Rigetti is in its early stages of development, and there is a very short history of operations, which makes future projections highly uncertain. The company is still burning cash, and the business model assumes substantial resources to be invested in R&D and CAPEX. Last but not least, the valuation does not look attractive.