ijeab

“The power to differentiate between volatility and loss is the primary casualty of a bear market.” – Nick Murray, Writer of Easy Wealth, Inevitable Wealth

Portfolio Returns[1] | Q1 2022 | Q2 2022 | 2022 YTD | FY 2021 | FY2020 |

RCG Lengthy Solely | (-8.4%) | (-14.0%) | (-21.2%) | 2.5% | 40.3% |

RCG Lengthy Brief | (-8.2%) | (-1.9%) | (-10.0%) | (-14.3%) | 10.0% |

RCG Prime 10 | (-6.9%) | (-14.0%) | (-20.0%) | 18.6% | 16.4% |

Benchmark Returns | |||||

Russell 2500 Index | (-5.8%) | (-17.0%) | (-21.8%) | 18.2% | 20.0% |

Fairness Lengthy/Brief Index[2] | (-0.93%) | (-2.3%) | (-3.2%) | 10.7% | 9.4% |

S&P 500 (giant cap) | (-5.0%) | (-16.4%) | (-20.6%) | 28.7% | 18.4% |

Pricey Associate,

US Shares formally entered a bear market on June 13th when the S&P 500 closed 22% under its January 3rd excessive. We’ve been right here earlier than. Solely two years in the past, Covid-19 prompted a panic in fairness markets which led to a greater than 30% market decline. These losses had been (comparatively) shortly reversed as traders realized that each Congress and the Federal Reserve had been shortly performing of their favor. Simple financial coverage supported what we are able to now clearly see, in hindsight, was a speculative market bubble that continued for an additional two years.

We enter the summer season with the Fed taking sturdy motion to mood rampant inflation. On June fifteenth, the Fed stunned the market by elevating rates of interest by 75bps as an alternative of the anticipated 50bps. Markets are within the pink as traders think about the longer-term financial impacts of rising rates of interest. There is no such thing as a extra “purchase the dip”, and there’s no longer a certainty that the Fed will rescue fairness markets because it has in each different downturn because the 2008 World Monetary Disaster. Within the current previous, traders have remained assured that the Fed would both decrease rates of interest or pause plans to lift if shares declined an excessive amount of. There is no such thing as a such confidence now as Fed Chairman Powell is set to maintain elevating charges till inflation is tamed. That is the suitable technique. In our view, the Fed is “letting the air out of the tires” to maintain our economic system from skidding off the runway.

Many traders are nonetheless hopeful that the Fed can engineer a mushy touchdown. I don’t imagine that end result is probably going, nor do I imagine it to be the suitable focus. As famous by former U.S. Treasury Secretary Larry Summers, anytime we have now had unemployment under 4% (at the moment 3.6%) and inflation above 4% (at the moment 8.6%), a recession at all times follows inside 2 years. There may be an air of inevitability {that a} recession is pending. When inflation is important, so is the next downturn. For overheated markets, overcooling is finally required.

A slowdown within the economic system (and inventory market decline) is a part of the Fed’s plan as it’s a backdoor technique of lowering shopper’s incomes and spending through the “wealth impact”[3]. When funding portfolios are down 25%, shoppers start to rethink discretionary and luxurious purchases. What we’re starting to see now – falling share costs, asset costs, mortgage purposes, and housing demand are all useful to the Fed so long as markets don’t fall an excessive amount of and injury the actual economic system. Falling markets make individuals really feel poorer, encouraging them to save lots of extra and spend much less.

One other “constructive” signal that we’re on track is rising unemployment. The one situation by which inflation will drop from 8.6% to the focused 2% vary is that if unemployment is greater. When there are too many roles (extra job openings than individuals to fill them), shoppers really feel assured about job hopping and asking for extra money. Nobody is hoping for greater unemployment, a 2% rise in unemployment would imply job losses for 3 million Individuals. However it’s a sobering requirement for us to treatment our present ailment. As extra individuals turn into unemployed or there are fewer jobs out there (job market tightening), shoppers give attention to saving for a wet day. Once we all save (vs. spend) and refuse to pay costs That. Simply. Appear. To. Preserve. Rising. inflation eases and costs stabilize.

The Fed is taking the suitable steps, and we are literally coming into the recession on sturdy footing.

The one subject which, in my opinion, shouldn’t be coated sufficient is the idea of “deglobalization”. Deglobalization is the method by which nations around the globe start to rely on one another much less, and commerce and funding between associate nations begins to decline. A key measure of globalization — commerce’s share of world GDP — peaked in 2008 in the beginning of the Nice Recession.

For the previous 40+ years, globalization has been a powerful counterbalance to inflation. World commerce elevated competitors and added a whole bunch of hundreds of thousands of low-paid workers to the worldwide workforce. It elevated the effectivity of product improvement by market specialization – parts of the manufacturing course of for items may very well be outsourced to nations most specialised to ship in essentially the most cost-effective method. These items may then be delivered by a extremely environment friendly international provide chain. Interdependence saved a lid on costs for items. Interdependence introduced the world’s greatest minds collectively to handle urgent international issues comparable to power, illness, famine, and local weather change. In recent times, this conduct has modified. A geopolitical chilly conflict with each China and Russia created protectionist pressures (Tariffs and a Commerce Warfare) whereas the self-interested conduct throughout the Covid-19 pandemic made international leaders query the knowledge of counting on different nations for key items and companies. And naturally, the pandemic itself made cross border site visitors tougher. Nations are actually extra involved with closing their borders to immigrants lest they take the roles of extra deserving natives. And, because the conflict in Ukraine drags on, and multi-national corporations withdraw completely from Russia, leaders wonder if future conflicts will impression their means to reliably supply provides. Every of those obstacles have led to extra nationalistic conduct globally. When nations can’t (and don’t) depend on specialization from associate nations higher positioned for these capabilities, prices …and costs …rise.

The hope is that the globalization phenomenon has merely peaked and isn’t heading in the direction of a everlasting retreat. A wonderfully commingled world is an impossibility. However we’re significantly better off when can leverage the strengths and specialization of companions to extend our output at dwelling. The implications are that this silent issue may trigger inflation to linger regardless of the Fed’s greatest efforts.

Chosen portfolio dialogue

For the second quarter of 2022, the RCG Lengthy Solely technique declined 14% and the RCG Lengthy Brief technique declined 1.9% whereas their respective benchmarks the Russell 2500 Index and Fairness Lengthy Brief Index declined 17.0% and 12.3% respectively. Yr so far, our methods are roughly in keeping with their benchmarks with the Lengthy Brief technique trailing its index.

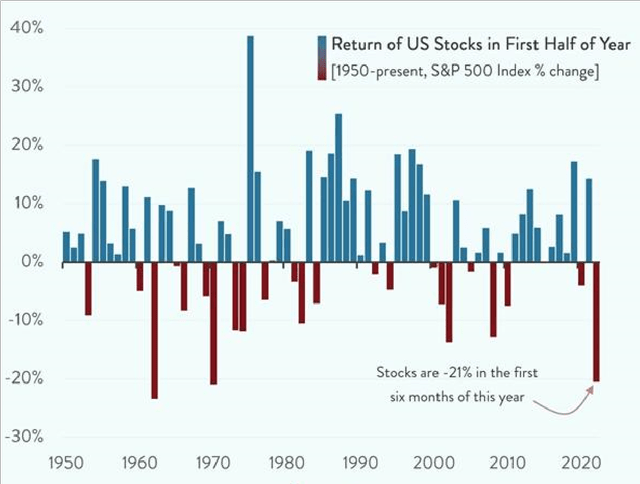

As I used to be getting ready this letter, I got here throughout the next chart which highlights the truth that, within the first six months of 2022, the US Inventory market had its worst begin to the yr in over 50 years:

Supply: Yahoo Finance, Chartr

I had two preliminary ideas. The primary was that the chart presents a little bit of cherry selecting. Market downturns don’t sometimes align completely with the beginning of calendar years as this one seemingly did. And second, I famous that in nearly yearly (~74% of the time) the place we had a dip within the first 6 months of the yr, the next yr started with a powerful rebound. And of the 23 occasions that shares have fallen within the first half of the yr, greater than half the time (52%), they’ve risen within the second half of the identical yr.

All of the above is simply numbers and patterns. And there are clearly no ensures. However I’m reminded that the market strikes in cycles. And what’s extra doubtless? – That this downward development continues for years, and the market by no means recovers? Or that in just a few years, we glance again on this era as an awesome shopping for alternative for great corporations on sale? I strongly imagine the latter.

Each cycle is totally different. However the S&P, on common (contemplating the 12 earlier bear markets since 1945), has fallen an extra 14% after coming into a bear market and brought 102 extra days to search out the underside. This timeline would take us into the autumn. However markets don’t sometimes backside close to “historic averages” and we’re in an uncommon setting with the economic system displaying extra energy than we might anticipate forward of a recession.

We regularly really feel losses extra intensely than we understand good points. These feelings can simply have an effect on our investing conduct. After seeing our technique ship roughly flat returns in 2021 after which decline 20% within the first half of this yr, the intestine response could also be to run for the exits, put all of your property in money, and lie within the fetal place till the queasiness subsides. Altering our technique is the worst resolution that we may make. The most effective resolution is to counter feelings and think about that lots of the great companies we maintain in our technique (that has delivered 240% internet returns since inception[4]) are actually on sale. We’re persevering with to speculate by the downturn in search of corporations with differentiated and worthwhile enterprise fashions poised to thrive regardless of present financial headwinds. We imagine that now is a superb time so as to add to fairness portfolios.

Our greatest detractors for the quarter

We had quite a few detractors throughout the quarter because the market left few locations to cover. The vast majority of the positions in our portfolios had been down 10% or extra, and so I gained’t focus on all of them. One notable exception was The Commerce Desk (TTD) which declined 40.0%. On the finish of 2021, TTD had grown to one of many largest positions in our portfolio. Nevertheless, as we entered 2022, I lowered our place to one of many smallest within the portfolio resulting from valuation issues. However we have now many causes to stay invested on this great firm. The Commerce Desk is the main Demand Facet Platform (DSP) for digital programmatic promoting. Their clients are the advertisers and businesses in search of to handle complicated advertising and marketing campaigns which TTD permits by real-time auctions, AI, and analytical instruments inserting consumer’s advertisements in the perfect context on the lowest value. Advertisers love programmatic advertisements as a result of they know precisely who they’re reaching and might maximize the effectiveness of their advertising and marketing finances. Publishers love programmatic promoting as a result of they will promote the precise areas they should fill. Over the previous two years, the promoting area has shifted:

- With the arrival of streaming platforms (Netflix, Hulu, and many others.), and the modifications that each Apple (AAPL) and Google (GOOG, GOOGL) have carried out to their advert monitoring fashions, advertisers have scrambled to search out methods to successfully attain their goal clients.

- And as advert spending continues to shift away from social medial platforms (Fb/Meta, Snap, and many others.), entrepreneurs are in search of more practical and focused channels outdoors of walled gardens.

TTD is properly positioned for this shift. In partnership with the promoting group, TTD has constructed a novel and efficient resolution to counteract these modifications within the type of UID 2.0. The market has discounted the whole advert tech sector resulting from issues that advertisers will considerably scale back their promoting finances throughout a recession. We imagine {that a} recession is pending, if not already right here. However even when we do have a deeper recession, advertisers will scale back their advertising and marketing budgets however not eradicate them. Advertising will nonetheless be important to pursue shopper spend. Advertising groups will need to associate with the platform offering the perfect resolution. That’s TTD and their Solimar platform which gives entrepreneurs with a wealthy measurement market. The advert tech sector might be a “winner take most” race and TTD will proceed to thrive regardless of challenges amongst their peer group. As Netflix (NFLX) begins their journey in the direction of providing an advert supported subscription tier, they haven’t any alternative however to incorporate The Commerce Desk of their resolution course of as a result of they’ve the perfect options. At their annual assembly in Could, TTD administration reaffirmed Q2 steerage and CEO Jeff Inexperienced reiterated that they anticipate to proceed development in extra of their market’s projected development fee (8% to 16%) whereas sustaining a 90%+ retention fee for his or her present clients.

Our greatest contributors for the quarter

The portfolio positions that elevated throughout the quarter doubtless did so due to the sectors by which they’re categorized versus any firm particular information. American Tower (AMT up 2.9%) is among the largest international REITs. The corporate owns and operates multi-tenant cell towers globally. Our lengthy tenured funding is predicated on their impenetrable enterprise mannequin and the lengthy tail of the present 5G funding cycle that can prolong over the following decade. Carriers are within the early phases of upgrading their cell websites with new gear to supply contiguous 5G protection globally. Moreover, since 5G know-how requires elevated cell website density, mobile carriers might want to make investments extensively to make sure sturdy efficiency throughout their networks. Kinsale Capital (KNSL up 0.7%) is a pure-play insurer within the extra and surplus insurance coverage market. KNSL focuses on hard-to assess enterprise dangers, and they’re the perfect of their business as evidenced by their market main mixed ratio. They’re the uncommon insurer that has achieved sturdy premium development whereas sustaining margins.

Enterprise Updates

In the course of the quarter, our prolonged workforce has been working onerous advertising and marketing the agency to lift property and safe new institutional purchasers. We just lately obtained some nice publicity because the Instructor’s Retirement System of Texas requested us to current on the Texas Alternate options Convention the place I competed within the pitch competitors. I gained the Choose’s Alternative and Viewers Alternative awards primarily based on my suggestion for Nexstar Media Group (NXST). This supplied nice visibility for the agency. We now have held our place in NXST since 2016, and our unique thesis is out there on our web site.

We’re nonetheless increasing our workforce. In the course of the quarter, we interviewed quite a few excellent candidates. We’re shut to creating affords, and we’ll present updates in our subsequent letter.

Lastly, we might be internet hosting our first (digital) Restricted Associate assembly on the finish of July. All LPs will obtain an invite underneath separate cowl. In case you are curious about turning into an LP within the administration firm, please contact us instantly.

We perceive that our purchasers have positioned their belief in us to guard and handle their helpful property. And particularly, in periods comparable to this, we all know that we have now an important job to do and we don’t take that evenly.

Khadir Richie

Principal, Richie Capital Group

“It’s a privilege to handle cash for others.”

[1] All portfolio and index returns talked about are offered internet of bills and most administration charges paid by any account inside the composite. All efficiency is estimated pending year-end efficiency audit. Accomplished audit numbers out there upon request.

[2] BarclayHedge Fairness L/S Index

[3] The Wealth Impact Definition

[4] Portfolio returns replicate efficiency of the RCG Lengthy-Solely Technique from inception by December 2021. Annualized internet returns of +14.6%. Comparable return of 218% and comparable IRR of 13.7% for our benchmark the Russell 2500. Efficiency has been independently verified by a 3rd half GIPS efficiency supplier. Returns are offered internet of bills and most administration charges paid by any account inside the composite.

Authentic Publish

Editor’s Be aware: The abstract bullets for this text had been chosen by Searching for Alpha editors.