bunnylady/E+ via Getty Images

iShares Residential and Multisector Real Estate ETF (NYSEARCA:REZ) is an interesting REIT fund. This is one of those funds I wouldn’t recommend for most investors because of its shift in focus, its sporadic distribution history, high expense rate and easy replicability.

Originally this fund was meant to include REITs that focus on residential markets such as operators of apartments, mobile home parks, condos, or single family homes but over time it evolved into more of an overall REIT fund, including companies from other sub-sectors of the REIT kingdom which made it less desirable since there are plenty of REIT funds as it is.

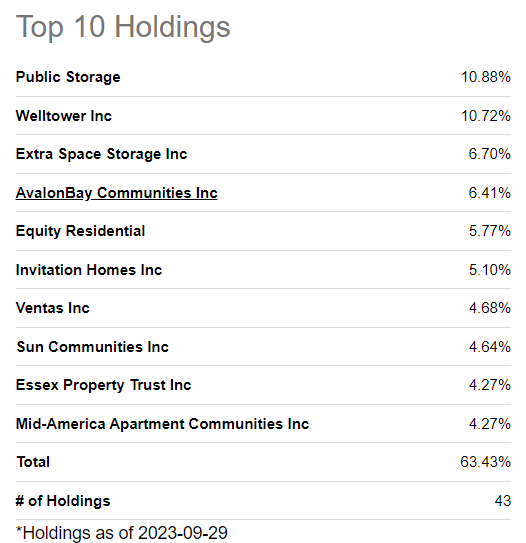

The fund is top-heavy with its top 10 holdings accounting for two thirds of its total value. The fund’s top holding is Public Storage (PSA) which accounts for almost 11% of its total weight and definitely isn’t a residential REIT. The fund’s second-biggest holding happens to be Welltower (WELL) which is more focused on healthcare infrastructure and the fund’s third-biggest holding is another storage company called Extra Space Storage (EXR). Interestingly enough, the fund’s biggest residential holding is AvalonBay Communities (AVB) which owns and operates close to 300 apartment communities, followed by Equity Residential (EQR) which manages a large number of apartments and condos.

Top 10 Holdings of REZ (Seeking Alpha)

Typically, I am a fan of residential REITs which allow people to take advantage of being a landholder without dealing with any of the work and drama that comes with it. The REIT company takes care of maintaining buildings, marketing, finding renters, collecting rent, fixing up properties while shareholders sit back and enjoy rent money coming their way while possibly enjoying their free time doing things they enjoy doing.

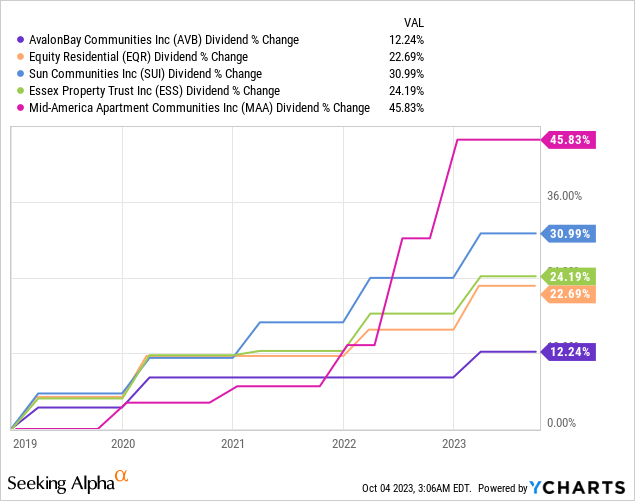

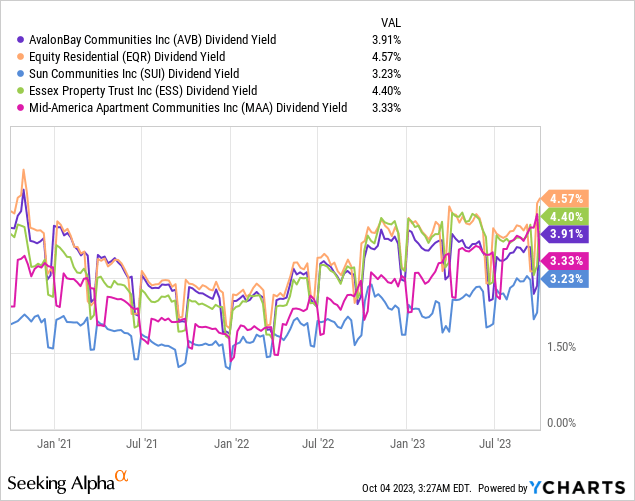

Residential REITs can also be a good hedge against inflation, since rents tend to rise at least at the same rate as inflation. In fact, rising rent prices tend to be one of the main drivers of inflation to begin with. Many residential REITs have a long history of hiking their dividends year after year. Below, you will see 5-year dividend growth rates for the top 5 residential REITs being held by this fund, and you’ll notice that they all hiked their dividends anywhere from 12% to 45% during this period. Mid-America Apartment Communities (MAA) seems to have accelerated their dividend growth in the last couple of years, possibly driven by rent hikes.

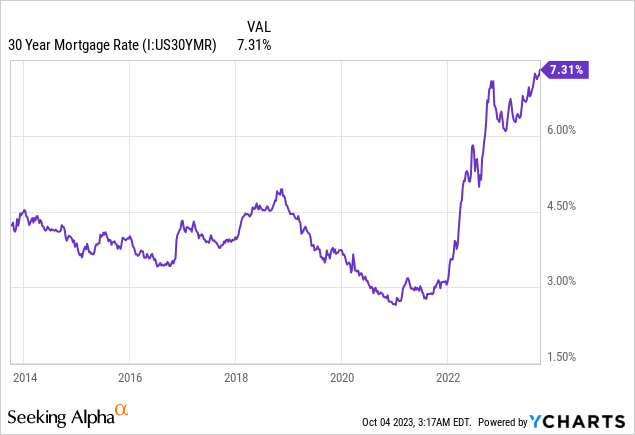

With mortgage rates at 10-year high levels, many renters are having trouble buying their first home. As a matter of fact, the current high rate environment is hitting them from two sides. First, mortgages are becoming increasingly more unaffordable for them. If you are looking to buy a house worth $400k, each 1% increase in mortgage rates can increase your monthly payment by $400-500 a month, depending on other factors. This means many renters will be stuck renting and residential companies will have a “captive audience” for a while. This is not the only way high rates hit new home buyers, either. High mortgage rates also cause a shortage of inventory because people are less likely to sell their homes when they have already locked in 3-4% rates a few years ago, and selling their home means losing that mortgage rate. This creates a shortage of houses to buy, which adds more pressure to renters who were perhaps planning to buy their first home and keeps them renting for much longer periods of time.

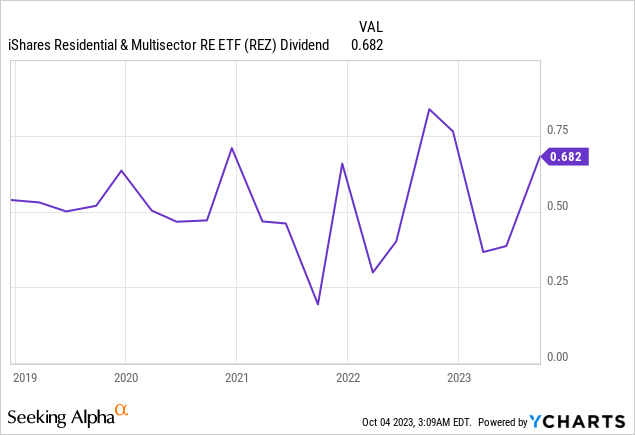

Having said that I like residential REITs, I am not a big fan of this fund’s shift of focus away from residential REITs to all REITs. Another thing I am not a fan about this fund is its sporadic dividend distribution history. Even though many of the fund’s holdings have a history of hiking dividends year after year, the fund itself isn’t following a predictable pattern where distributions grow 20-30% one year and drop 20-30% in the next year. Distributions seem to be all over the place with this fund. When investors put their money into REITs (especially residential REITs) they do it for the purpose of being able to collect rent and possibly use it as a hedge against inflation, which means distributions would need to be more predictable and rising steadily year after year.

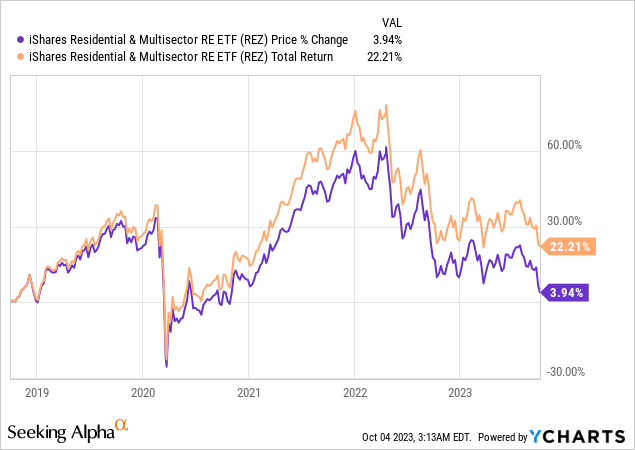

The fund’s past performance leaves a lot to be desired. In the last 5 years, the fund’s share price is up only 4% while its total return (including reinvestment of dividends) is up 22%. Of course, this includes a 2-year period starting January 2022 where the entire REIT industry has been in a bear market (which is still continuing today if not intensifying). By December 2021, the fund was actually looking at a total return of almost 70%, so its performance wasn’t always this bad. Perhaps it can recover and outperform again if REITs enter another bull market some day.

There is one more thing I am not a fan of when it comes to REZ. The fund has an expense ratio of 0.48%. This is pretty large considering that the fund’s current distribution yield is 3.25% which means the fund’s expense ratio is about 15% of its total yield. Since the fund has only 41 stocks and top 10 stocks account for two thirds of its total weight, investors could easily replicate much of this fund and save themselves 0.48%. This would boost their possible yield from 3.25% to 3.73% which can add up over the years.

You don’t even have to buy all 41 stocks to beat this fund. I would actually buy a basket of those 5 residential stocks I mentioned above. This way you’d get an average dividend yield of 3.9% plus 5-year dividend growth rates ranging from 12% to 45% with an average 5-year dividend growth rate being 27%. You would also save on expense ratio, so you’d most likely come out ahead.

Investors should avoid paying high expense ratios for funds that they can most likely easily replicate or beat. This includes equity funds with a handful of holdings. I wouldn’t mind paying a higher expense ratio if the fund is doing something unique such as using leverage in an advantageous way or utilizing options to generate extra income, but this fund isn’t really doing anything special in my opinion. If you don’t want to deal with individual stocks, you can also buy a much cheaper REIT fund such as Vanguard’s VNQ (VNQ) which has similar holdings to this one but comes with an expense ratio of 0.12% and a dividend yield of over 4%.