Retail is on tempo to stay one of many strongest development sectors in industrial actual property within the upcoming 12 months, in response to PwC’s Rising Traits in Actual Property 2025 report. Regardless of an uptick in bankruptcies and legacy chainstore closures, retail leasing is anticipated to stay sturdy, pushed by evolving shopper preferences and the adaptability of areas to accommodate new and modern ideas.

Industrial Property Govt reached out to PwC Accomplice Andrew Alperstein to debate the prospects of the sector intimately. From the sustained demand for bodily retail house to the emergence of recent development tales throughout varied classes, this dialog focuses on the tendencies shaping the way forward for retail.

READ ALSO: ULI Particular Report: Convey on the Upcycle

How has the retail sector carried out over the previous few years?

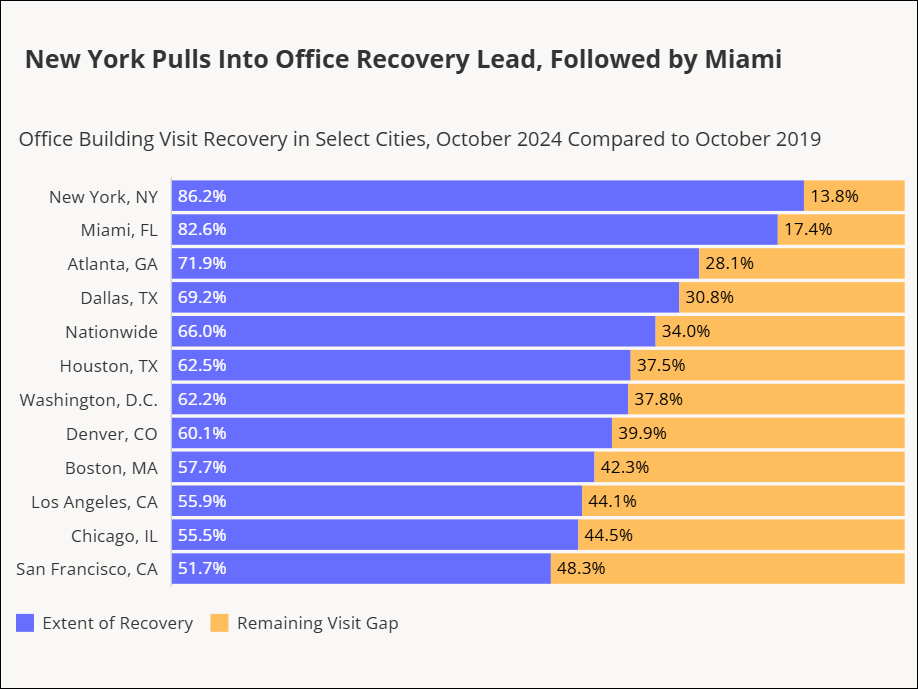

Alperstein: In accordance with our 2025 ETRE survey outcomes, contributors’ sentiment has continued to enhance since 2021. Retail nonetheless ranked fifth out of our six property sectors this 12 months, nevertheless it was solely barely behind inns and inside attain of each rental housing choices, single-family and flats. This enchancment in sentiment is sort of vital, reflecting the sector’s resilience and flexibility. It is going to be fascinating to see the survey outcomes for 2026, because the retail sector’s evolving tendencies and powerful fundamentals might doubtlessly increase its standing even additional.

What particular tendencies have been driving this resilience and flexibility within the sector?

Alperstein: Retail tendencies that stood out from our report interviews this 12 months revolved across the ongoing demand for bodily house, which has remained sturdy regardless of financial fluctuations, and the numerous redevelopment alternatives arising from the contraction in sure retail sectors, reminiscent of drug shops.

What particular components will proceed to drive development on this beforehand challenged sector?

Alperstein: There are a number of key components driving the sustained development within the retail sector inside industrial actual property. Firstly, we have now seen sturdy leasing exercise, notably in non-merchant classes. Regardless of an uptick in bankruptcies, demand stays excessive and new growth has been restricted, preserving emptiness charges at 20-year lows.

One other vital issue is the post-pandemic rebound. The demand for bodily retail house has surged since 2020, driving emptiness charges to their lowest in over a decade. This rebound was a lot stronger than many had anticipated.

So what precisely would you say makes retail investments notably engaging to buyers within the present market?

Alperstein: Funding stability performs an important position. Retail investments, particularly in open-air procuring facilities like grocery-anchored ones, have been much less unstable in comparison with different property sorts. This stability has attracted buyers on the lookout for dependable returns.

Moreover, the contraction within the drug retailer trade presents vital redevelopment alternatives. Many of those areas are being rapidly backfilled by increasing ideas, which assist preserve occupancy ranges.

Regardless of excessive shopper debt, retail gross sales have remained in optimistic territory since 2020. Continued shopper spending helps retail development, even in difficult financial situations.

What different tenant classes, past experiential ideas, are driving demand for retail areas?

Alperstein: New development tales are rising. Tenant regulars, off-price attire, grocery shops, health golf equipment, low cost shops and eating places proceed to actively lease house. The restaurant sector is rapidly increasing for quick meals and quick informal ideas. Nevertheless, new culinary ideas, experiential companies and medical spas are additionally driving demand for retail house. Experiential ideas, together with leisure venues, aggressive socializing and interactive artwork installations, are additionally seeing vital development. These new entrants are driving demand for retail house.

Moreover, medical spas and quasi-medical customers, reminiscent of pressing care and veterinary care services, have seen elevated demand. These sectors are increasing quickly and contributing to the general development within the retail actual property market.

Total, these components and areas of elevated demand spotlight the dynamic and resilient nature of the retail sector in industrial actual property.

What are your expectations for the sector’s efficiency within the upcoming 12 months?

Alperstein: Based mostly on the tendencies and information we have now noticed, I anticipate the retail sector to proceed its spectacular efficiency within the upcoming 12 months. The continuing demand for bodily retail house, notably in non-merchant classes, is more likely to stay sturdy. This demand is pushed by restricted new growth and excessive occupancy charges, which have saved emptiness ranges at historic lows. The post-pandemic rebound has proven that customers nonetheless worth in-person procuring experiences and this pattern is anticipated to persist.

Total, the retail sector is poised for continued development and adaptation, with sturdy fundamentals and modern developments main the way in which. We anticipate that these tendencies will maintain the sector’s optimistic trajectory into the subsequent 12 months, making it an thrilling time for retail actual property.