coldsnowstorm

The demand for grocery-anchored shopping centers appears voracious. And Retail Opportunities Investments (NASDAQ:ROIC) is capitalizing on this demand. Current occupancy levels reflect this. The REIT can grow further through acquisitions. But transactional markets remain muted. With this in mind, shares appear fairly valued following a market-beating 20% gain since my prior update.

ROIC Q2 Results

Reported revenues and funds from operations (“FFO”) were in-line with expectations.

In the same-store population, the leased rate was up 60 basis points (“bps”) YOY to 98.3%. The occupancy gains paired with rental rate growth enabled a 3.9% increase in total cash-basis revenues. Revenue growth, however, was outflanked by 5.4% growth in total operating expenses. Still, same-store net operating income (“NOI”) grew 3.2%, with NOI margins in-line with last year.

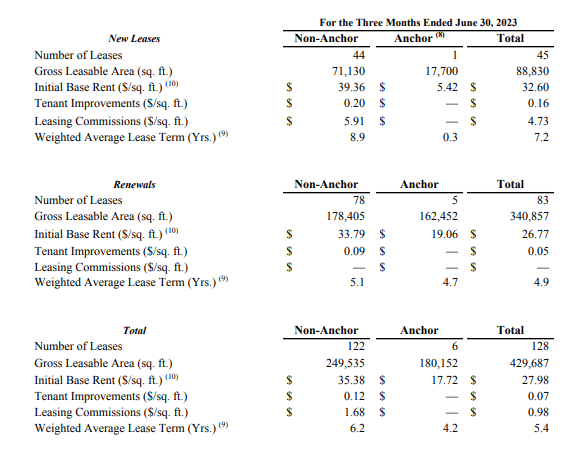

The same-store population was also reflective of the overall portfolio, which also was 98.3% leased at June 30. The occupancy gains followed leasing activity totaling 430K SF, most of which was attributable to renewal activity.

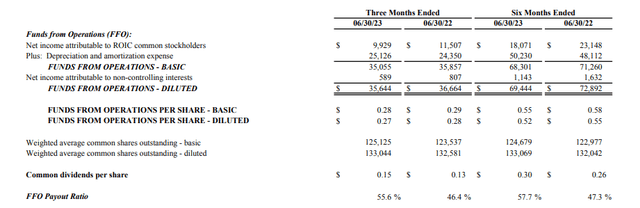

Overall FFO was $0.27/share, down a penny from the same period last year. Higher interest expense resulting from a slightly higher overall debt balance and weighted average interest rate was mostly to blame for the decline in FFO.

ROIC Q2FY23 Investor Supplement – Summary Of FFO

Key Takeaways From ROIC’s Q2 Results

Another Record Quarter

Though the total leasing volume of 430K SF was lower than the 559K SF completed in Q1, the activity marked a new second quarter record. For additional perspective on the extent of the volume completed, consider that there was 859K SF of space set to expire during all of 2023. But through the first half of the year, ROIC already completed nearly 1 MSF of leasing.

And while overall portfolio occupancy remained unchanged at 98.3%, it was noted that 48 of their shopping centers were 100% leased, which is a new company record.

The strong demand for space provided ROIC with significant pricing power. They achieved a 7% increase in cash basis rents with non-anchor renewals. And with regards to new leasing activity, they achieved an average increase of 13%, with one large anchor lease signed at an over 100% markup. In one instance, they also had one of their national supermarket anchors extend all their leases as opposed to just those expiring this year. The anchor is now locked in for at least another eight years.

ROIC Q2FY23 Investor Supplement – Summary Of Quarterly Leasing Activity

Evaluating Options On Upcoming Maturities

In Q1, ROIC made significant headway in reducing their variable rate exposure. At the beginning of the year, for example, floating rate debt represented approximately 30% of their total debt load. That was reduced to about 15% at the end of Q1. It still stood around there at June 30.

Looking ahead, ROIC does have one large maturity totaling +$250M due in December. On their earnings release, CFO, Michael Haines, noted that their intention is to refinance the bonds through a +$400M offering, which would be used to not only pay off the December bond but to also pay down the +$300M variable term loan.

The credit quality of their portfolio makes it likely they’ll be able to lock in the offering they’re seeking. But to be sure, they are also exploring other refinancing strategies, such as private placement, utilization of secure debt, or though equity.

Transactional Market Remains Muted

Dispositions are another option in addressing the upcoming maturities. In their Q1 discussion, CEO, Stuart Tanz, noted that they had one property under contract to sell for +$15M. This remains on track to close sometime in the next two months.

In addition to this sale, ROIC is intending on marketing two undeveloped land parcels in the San Francisco market. Combined with the pending property sale, ROIC expects total proceeds of between +$30M and +$40M.

The transaction market elsewhere, however, appears muted. For those deals completed in ROIC’s markets, pricing was in the high-five to low 6% cap range. But they were all leverage-free transactions. There’s been some signs of a market thaw, but most participants have taken a sideline approach.

The lack of activity is a detriment to ROIC, especially considering current portfolio metrics are nearly maxed out. Sure, the company can continue to push rents, but the returns are likely to be higher from acquisitions. Haines essentially acknowledged this on the earnings call when responding to an analyst’s question regarding capital usage.

Is ROIC Stock A Buy, Sell, Or Hold?

In my prior update on the stock, I set a target price of $14.50/share. This assumed a 6.5% cap rate. Shares have since surpassed this level and are now trading at around the cap rate used in my calculations.

I see this as fair, considering it was noted that deals in ROIC’s markets are occurring in the high-five to low 6% range. True, ROIC is not quite there yet. But at the same time, there hasn’t been enough activity in the transactional market to assert for certain that a low 6% cap is fair. Perhaps 6.5% is indeed a proper reflection of the value of their properties.

And outside of cap rates, to justify further appreciation in the stock, I believe ROIC would need to accomplish several action items. First, they would need to move the pending sale from Q1 to the finish line sometime before the end of Q3. Then, for the two undeveloped parcels they plan to market, investors should be provided with some sense of the interest level from potential buyers.

On the debt front, there needs to be more certainty regarding how ROIC intends on rolling the upcoming maturity. Options were outlined on the conference call. But given the rate environment, it’s important to assess how the new debt will affect future FFO.

Finally, the overall transactional markets need to become more fluent. At present, ROIC’s portfolio is nearly perfect. Without accretive acquisitions, the growth prospects in NOI would be limited and more exposed to any slowdown in rental rate growth.

With all these considerations in mind, existing shareholders may find it best to cheer the recent market-beating performance but to remain on hold otherwise. For all else, it may be best to simply wait for a better entry point.