Bloomberg/Bloomberg via Getty Images

Intro

We wrote about Repsol, S.A. (OTCQX:REPYY) in July’2021 when we reviewed the key metrics that make up the company’s dividend. Although we saw no adverse trends in Repsol’s dividend at the time, we stamped a ‘Hold’ rating on the stock due to how the company’s liabilities were outpacing its assets on the balance sheet. In saying this, forward-looking earnings expectations were bullish and to this point, Repsol has not disappointed. Net income in Q1 of 2021 came in at $766 million and has since grown to $1.44 billion in the company’s latest third quarter of 2023. Repsol’s strong Q3 bottom-line print was a 33% sequential improvement over Q2 with the integrated energy company being able to take advantage of higher oil and gas prices in the quarter.

The sizable jump in Repsol’s earnings in this period unsurprisingly has benefited shareholders over the past 30 months. Repsol stock has gained almost 32% where the total return exceeds 50% when one includes the company’s above-average dividend distributions. Suffice it to say, these returns are significant when compared to the S&P500 which has returned just north of 9% over the same timeframe.

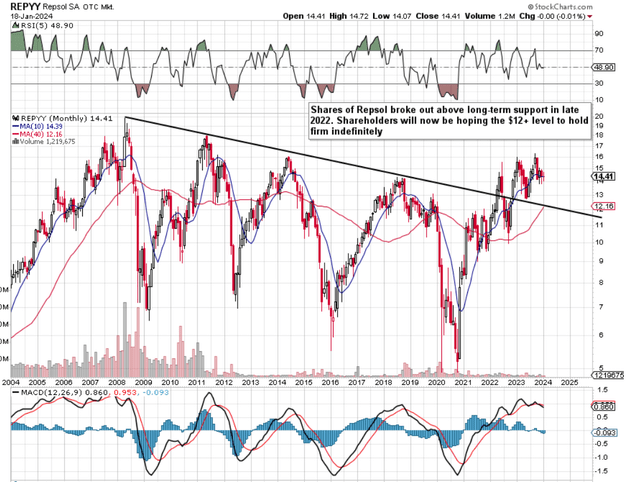

As we see from Repsol’s technical chart below, shares have been able to remain above the stock’s multi-year downtrend line although the MACD long-term technical indicator remains at an overbought level. The ideal scenario here for Repsol stockholders is that the depicted multi-year downcycle trendline (coincides with Repsol’s 40-month moving average of just over $12 a share) would now act as solid underside support if indeed a down-move or some consolidation lies ahead for the stock.

Upside breakouts on long-term charts are noteworthy as the technicals take into account all the known fundamentals (and more importantly forward-looking trends) in all of the four verticals.

Repsol Continues To Transform Itself

Repsol’s upstream operations continue to focus on projects that prioritize sustainability & profitability where volumes can be turned over at an accelerated rate. To this point, continued tensions in the Middle East should continue to act as a tailwind concerning higher commodity prices over the near term. Furthermore, volumes rose sequentially by 9% and came in even compared with the same period of 12 months prior as new production from the Eagle Ford and the Marcellus nullified what was lost from the Canadian assets sale. Suffice it to say, that the company continues to concentrate its upstream assets where low breakeven prices & predictable cash flows continue to rule the day.

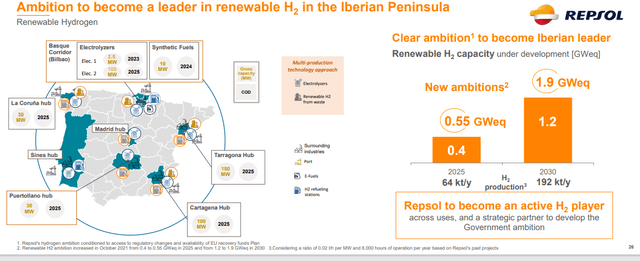

In the Industrial vertical, although near-term headwinds remain in the chemicals segment, the transformation of industrial sites in mainland Spain is encouraging from a forward-looking basis. As we see below, the likes of the biofuel initiative in Cartagena, the renewable hydrogen project in Bilbao as well as future biomethane initiatives in Galicia should aid Repsol’s quest to become the renewable hydrogen energy leader in Spain before long.

Repsol Renewable H2 Projects (Company Website)

The ‘customer’ vertical continues to go from strength to strength with the mobility segment driving EBITDA forward. Furthermore, the recent change to a more customer-specific setup seems to have been a big success with the Waylet app playing a key role in this transition. In ‘low carbon’ generation, Repsol’s large portfolio of late-stage projects is expected to improve profitability meaningfully over the forthcoming years.

As noted in previous commentary, lower prices in stocks such as Repsol many times can turn out to be a blessing as dividend compounding can take place at a much faster clip. Therefore, in essence, the key is that the share price does not decline sharply from its present level as a trend such as this tends to result in the majority of investors liquidating their holdings over time.

Therefore, let’s delve into the key trends that make up Repsol’s dividend as the underlying strength here will increase the possibilities of the stock maintaining its newly-formed long-term support level.

Repsol Long-Term Technicals (Stockcharts.com)

Dividend Yield

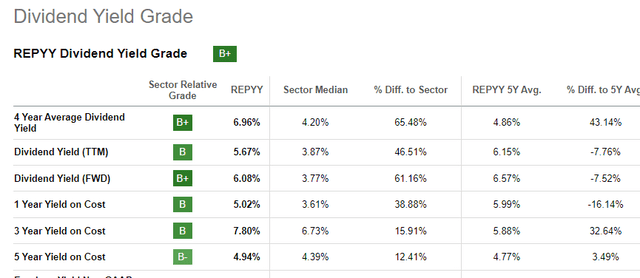

Repsol’s forward dividend yield presently comes in at 5.67% which is slightly below the stock’s 5-year average (6.15%) but well ahead of the sector average (3.87%) as we see below. Many investors use the dividend yield as a barometer of whether shares of the respective company are cheap or not. An elevated dividend yield in today’s climate is crucial to ensure the purchasing power of the investor is protected over time.

Repsol Dividend Yield Metrics (Seeking Alpha)

Dividend Growth

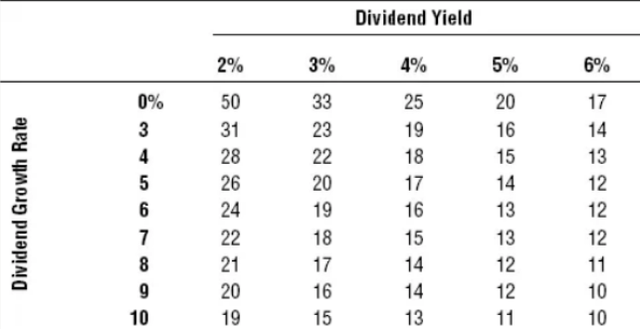

As we see below, near-term growth rates in Repsol have been better than what we have seen in the past. The combination of a high dividend yield & an elevated dividend growth rate results in a much faster payback period as we see below. The dividend remains well covered with the stock’s GAAP payout ratio coming in at an attractive 27%. The cash dividend payout ratio comes in slightly higher at 42%+ but looks to be only temporary due to outgoings concerning the Maxus litigation in Q3 as well as the Spanish windfall tax payments which are ‘expected’ to end next year. Therefore even if Repsol could average a 5% yield alongside a 5% average annual growth rate going forward, one’s initial investment would be recouped in full after 14 years. Income-orientated investors invest for income and the fastest way to earn income (over and above one’s initial outlay) is to invest in stocks that have an accelerated payback period. Repsol currently has these conditions as long as dividend growth can remain elevated going into 2025 & beyond.

| Time-Period | Growth-Rate | Yield-On-Cost |

| 12 Months | 11.1% | 6.32% |

| 3 Year | -29.2% | 2.02% |

| 5 Year | -15.5% | 2.45% |

| 10 Year | -6.7% | 2.84% |

Payback Period (Dividend) (The Little Book Of Big Dividends)

Balance-Sheet Trends

Shareholder equity increased to $28.3 billion at the end of Q3 which means the company’s trailing book multiple comes in at approximately 0.6. Rising equity means the company’s trailing debt-to-equity ratio now comes in at 0.42 as opposed to a 5-year average of 0.62. Furthermore, these positive balance sheet trends have led to a rising interest coverage ratio which has not surpassed 15. Moreover, with the current number of shares outstanding coming in at 1.23 billion, management continues to remain true to its word by returning a sizable portion of its cash flow to shareholders through both accelerated buybacks and above-average dividend payments.

Forward-Looking Earnings Expectations

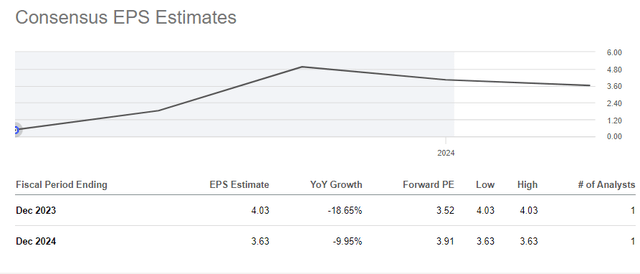

Despite the company’s sound profitability & low valuation, the consensus is expecting a bottom-line decline of approximately 19% this year followed by roughly 10% in fiscal 2024. Although Repsol’s near-term growth projections may not be ideal, growth estimates many times are overhyped in investments especially when the company in question is cheap, profitable & continues to generate healthy amounts of free cash flow. As noted above, (even with an 18% contraction in earnings this year), shareholder equity will grow in fiscal 2023 taking into account how share repurchases and an above-average dividend play into the investment case here.

Concerning Repsol’s valuation, rising equity has resulted in book value per share now topping $20. Therefore, given Repsol’s current share price ($14+), shares are trading significantly below book value (Trailing P/B of 0.7). Why is this noteworthy? Well despite the fact that the industry trades with a price-to-book ratio of 1.58, Repsol’s assets are primarily composed of liquid assets (inventory, receivables & cash) & its long-term assets. Intangible assets (which can distort balance sheets at times) only make up roughly 4% of Repsol’s assets which means there is strong validity to that current low book multiple.

Repsol Consensus EPS Estimates (Seeking Alpha)

Conclusion

To sum up, although Repsol’s earnings are expected to contract in fiscal 2023, the company has still ample profitability to keep on paying out an above-average dividend as well as buy back company stock. Due to how the company’s robust cash flows continue to make Repsol more valuable over time, we see limited downside in the stock at this point. We look forward to continued coverage.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.