Michael Edwards

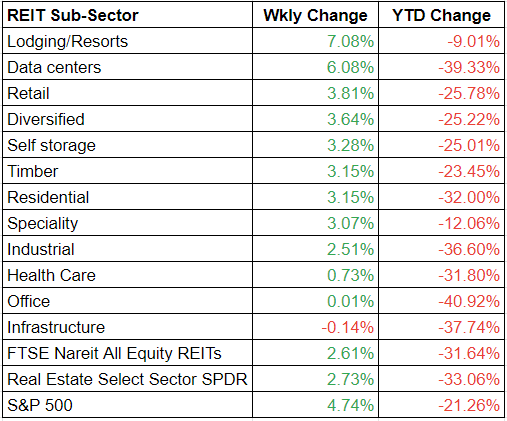

REITs largely finished in green this week on the optimism surrounding the Q3 results.

Crown Castle (CCI) had a strong Q3, while Prologis’ (PLD) Q3 earnings topped consensus. SL Green Realty (SLG) reported a beat, and Rexford Industrial Realty (REXR), First Industrial Realty Trust (FR) and Brandywine Realty Trust (BDN) also reported solid Q3 results.

The sector’s balance sheets are the strongest they’ve ever been, according to Seeking Alpha author Riyado Sofian.

Debt Ratio is at only 35%, lease lengths are much longer and interest coverage ratio is at all-time highs, the author said.

With optimism around REITs’ results and a recovery in the travel industry, Hotel REITs gained the most in value this week, i.e. 7.08%. This is more than the broader S&P 500 index, which finished 4.74% higher compared to the previous week.

The sector’s fundamentals remain solid, but macro concerns are dominating, according to a Baird report.

For Q3, “we are not expecting anywhere near the magnitude of beats that occurred during 1Q22 or 2Q22 earnings,” the report noted, having also said that the agency continues to see value in the group at current levels.

The second major gainer for the week was the data center sub-sector, having finished 6.08% higher than the previous week.

Data center REITs have the advantage of being able to mostly pass through rising power costs to customers via higher rents, according to Jefferies analyst Jonathon Peterson, who believes this sub-sector is among the best suited for a stagflation environment.

Infrastructure was the biggest laggard, the only sub-sector to continue declining in value on a weekly basis.