shaunl

The following segment was excerpted from this fund letter.

We originally wrote about and included our analysis on Reitmans in our January 2023 and April 2023 newsletters. Recently the stock sold off after their reported quarter because of difficult year-over-year comparisons. This is a flawed way of approaching the results. The quarter was actually in line with our model and expectations. The main point to take notice of is that there were $20m of compensation costs expensed in 2023 that was based on performance in 2022.

By simply comparing year-over-year results, you’re not comparing apples to apples. We would suggest following the cash. Operating cashflow in the quarter was $37m and total cash increased $27m. The market cap is only $127m with $100m of cash on the balance sheet.

Considering the recessionary storm clouds, another assumption is that a clothing retailer is a risky investment. Reitmans is a value brand, and they have had resilient revenue because of the value they offer. In 2008-2009, during the worst recession in recent history, sales remained consistent, and profits were stable. If you were to apply how much they made per store in the 2009 recession to their store count now, the stock is trading on 3x earnings. Now they are even more streamlined, have a high percentage on online sales, and a rock-solid balance sheet.

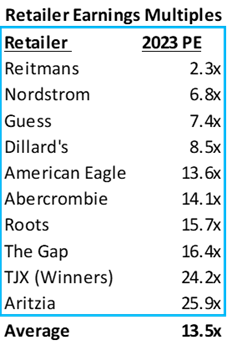

We have updated our valuation tables and added the recent Chico’s women’s clothing takeout by Sycamore Partners that was announced in September. Private equity firm Sycamore Partners is paying $938m, which equates to 11x PE multiple. Reitmans has higher gross profit, operating margins, net margins, plus a better balance sheet.

Retailer Multiples

Reitmans Valuation Potential

Valuation Method | 2023 PE Multiple Value per Share |

Average competitor multiple | 13.5x $13.84 |

Closest Canadian Competitor | 15.7x $16.09 |

Chico’s takeout multiple | 11.1x $11.38 |

Average Reitmans multiple 2002-2013 | 15.0x $15.38 |

Average | $14.17 |

From current prices, this suggests +500% upside and doesn’t take into account the large cash hoard, the completely owned office building and distribution center. The delta between where the stock trades and its intrinsic value is so large that it begs the question if something else is holding it back? To that end, we have sent a letter to the board because we believe the business is being run well operationally (day-to-day) but not at the board level (this letter can be found as an appendix).

Their approach to the capital markets and treatment of minority shareholders is poor and outdated. We believe by consolidating into a single class share structure, thus eliminating the no coattail clause issue, plus uplisting to the TSX and becoming more shareholder friendly will undoubtably help close the gap.

We continue to buy both classes of shares.

Reitmans is one of the most straight forward examples of the value that is available in this environment. We expect to be active in many more scenarios like this where companies should be taking advantage of the environment we are in and maybe need a little push to do so.