industryview/iStock via Getty Images

Regal Rexnord (NYSE:RRX) on Monday reported Q2 earnings that beat estimates as the maker of motors, factory equipment and industrial powertrain systems began a post-merger integration.

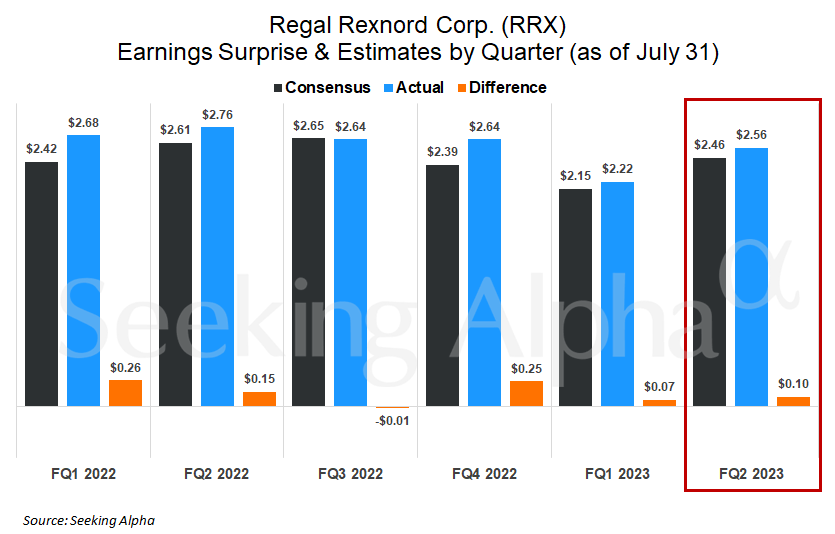

Net income was $33.2 million, or $0.48 a share, compared with $143.2 million, or $2.12 a share, a year earlier. Adjusted EPS of $2.56 beat the consensus estimate of $2.46.

Sales rose 31% to $1.77 billion, matching the consensus estimate.

Regal Rexnord (RRX) narrowed its guidance of full-year adjusted EPS to $10.20 to $10.60 from the prior range of $10.20 to $11.10 estimated in May.

At that time, management had raised its estimate from a range of $10.05 to $10.85 to include the addition of Altra Industrial Motion, whose $5 billion acquisition was completed in March.

“As I look ahead to the remainder of 2023, I am enthusiastic about the tremendous value creation opportunities before us,” Louis Pinkham, CEO of Regal Rexnord (RRX), said in a statement. “While some of our end markets are experiencing lingering destocking headwinds and demand uncertainty, our teams continue to manage the performance of the business in a disciplined manner.”