AlexLMX/iStock via Getty Images

By Hyun Kang

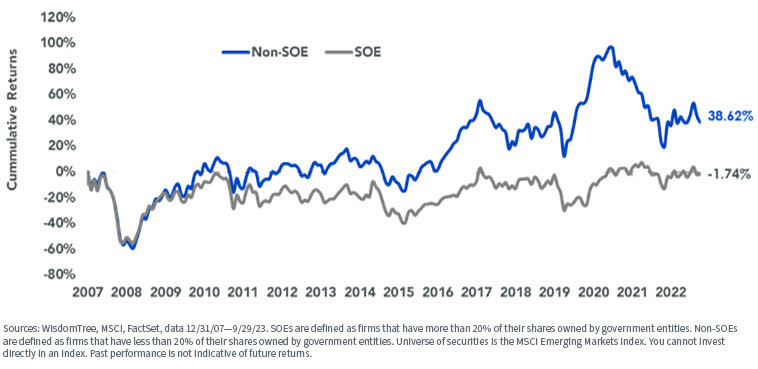

State-owned enterprises (SOEs) in emerging markets have historically underperformed compared to private companies. We hypothesize this differential exists due to state interests, which pressure SOEs into placing other objectives above shareholder value and profit maximization.

Cumulative Returns of SOEs vs. Non-SOEs in the MSCI Emerging Markets Index

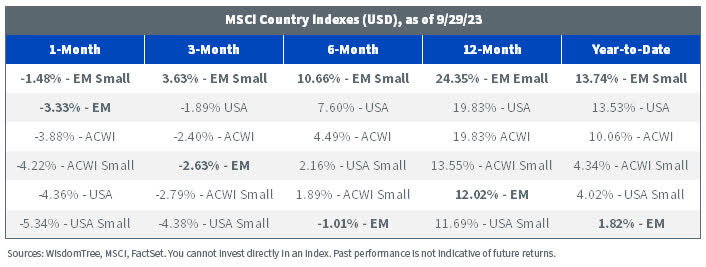

This has been a tough year for emerging markets amid high geopolitical tensions and increasing investor concerns regarding China. Large- and mid-cap emerging markets equities underperformed relative to their U.S. and global counterparts across multiple periods and lagged small-caps by over 11% year-to-date.

MSCI Index Performance by Region and Size

The

WisdomTree Emerging Markets ex-State-Owned Enterprises Index (EMXSOE) measures the performance of emerging markets companies that are not state-owned enterprises and is tracked by the WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE).

State-owned enterprises are defined as companies with government ownership of more than 20% of the outstanding shares. Since the end of its inception in August 2014, EMXSOE outperformed the MSCI Emerging Markets Index by over 14%.

WisdomTree Emerging Markets ex-State-Owned Enterprises Index vs. MSCI Emerging Markets Index

The

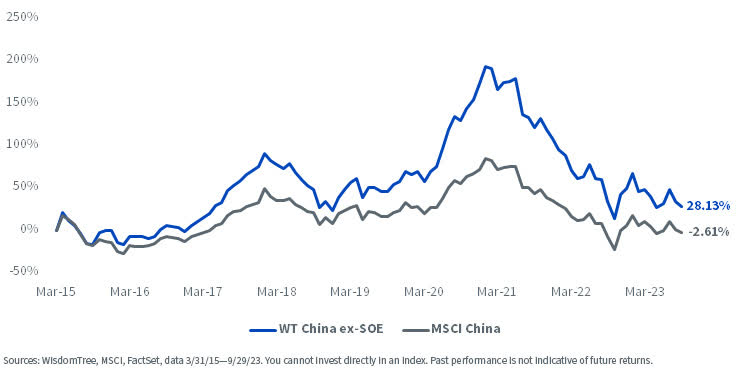

WisdomTree China ex-State-Owned Enterprises Index (CHXSOE) uses the same SOE criteria to measure the performance of Chinese non-SOEs and is tracked by the WisdomTree China ex-State-Owned Enterprises Fund (CXSE). Launched a year after its broad-EM counterpart in 2015, CHXSOE outperformed its benchmark, the MSCI China Index, by over 30% since its inception.

WisdomTree China ex-State-Owned Enterprises Index vs. MSCI China Index

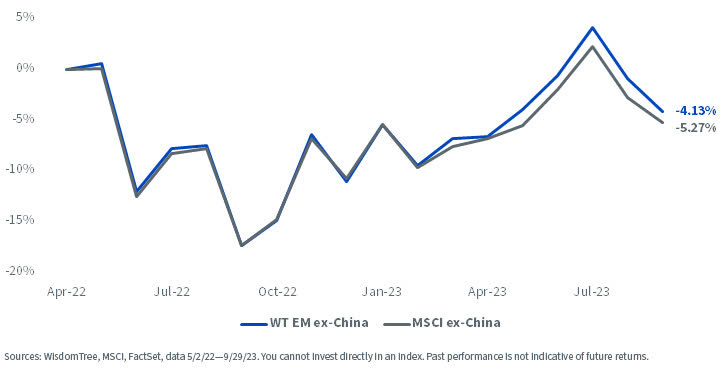

Similarly, the

WisdomTree Emerging Markets ex-China Index (WTEMXC) measures the performance of emerging markets non-SOEs excluding Chinese stocks and was launched in May 2022. Tracked by the WisdomTree Emerging Markets ex-China Fund (XC), the Index outperformed the MSCI ex-China Index by 1.14% since its inception.

WisdomTree Emerging Markets ex-China Index vs. MSCI Emerging Markets ex-China Index

While emerging markets equity returns are depressed this year, portfolios with reduced exposure to SOEs have been outperforming their more exposed counterparts over the long run.

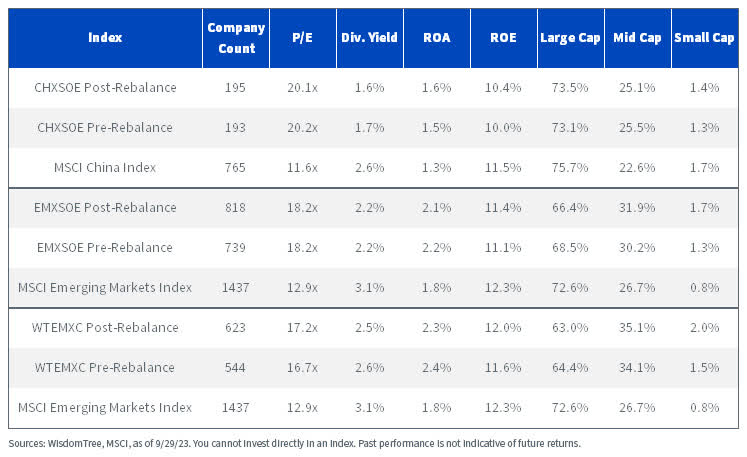

Ex-State-Owned Indexes Rebalance Highlights

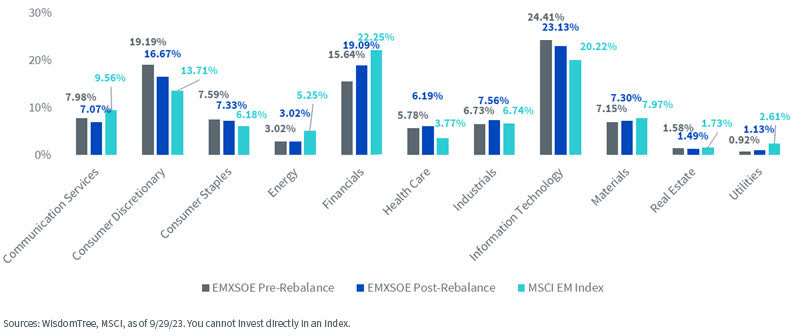

EMXSOE, CHXSOE and WTEMXC were rebalanced this October. Following the rebalance, EMXSOE’s country allocations were reset to match its starting universe and sector weights were constrained to within +/-3%

Relative to the MSCI Emerging Markets Index, EMXSOE maintained its over-weight allocations in the Consumer Discretionary, Consumer Staples and Information Technologies sectors, and under-weight allocations in Communications Services, Energy and Financials sectors.

EMXSOE Sector Changes

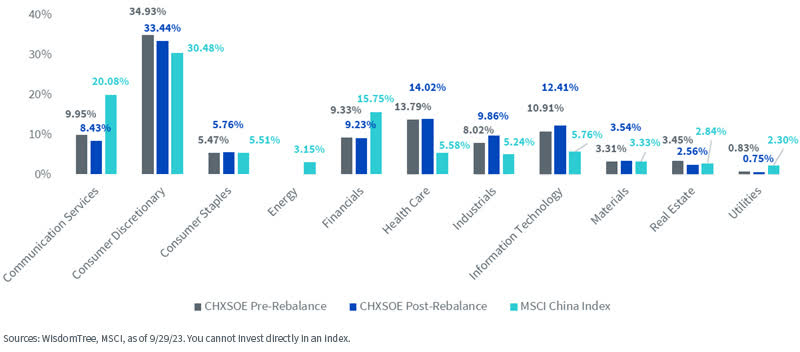

CHXSOE remained under-weight in the Communications Services and Financials sectors and over-weight in Consumer Discretionary, Health Care, Industrials and Information Technology sectors relative to the MSCI China Index.

CHXSOE Sector Changes

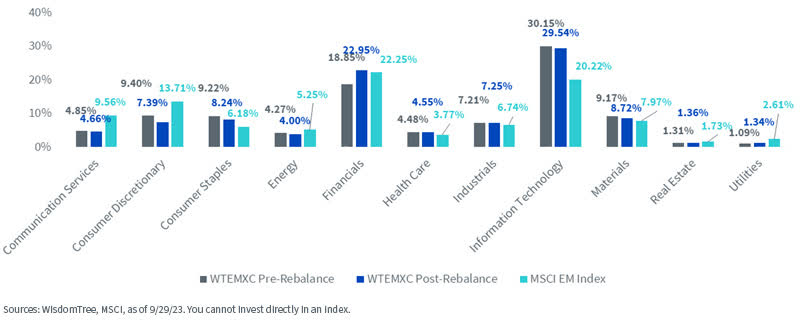

Relative to the MSCI Emerging Markets Index, WTEMXC remained under-weight in the Communication Services and Consumer Discretionary sectors, while over-weight in the Consumer Staples, Information Technology and Materials sectors. The Index increased its exposure to Financials, and is now over-weight in the sector relative to the MSCI EM Index.

WTEMXC Sector Changes

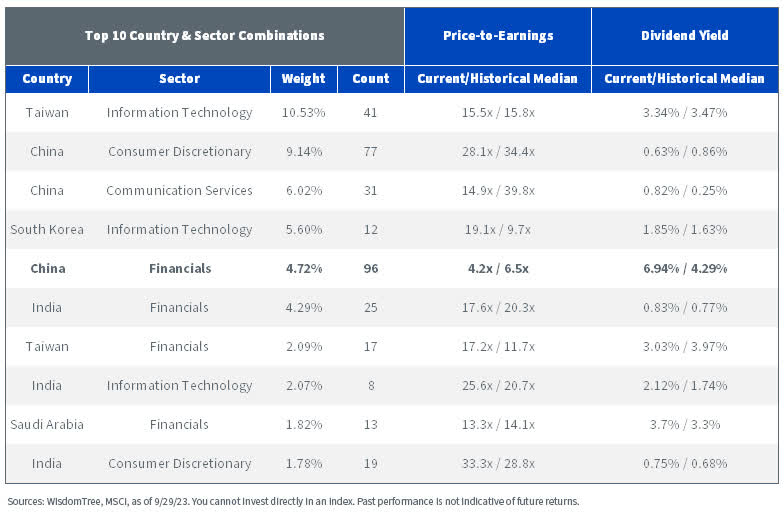

According to a recent report from the International Monetary Fund, Chinese government deficits are projected to increase due to heavy local government borrowing. The local Chinese governments are struggling to service their debts, roughly 80% of which is held by Chinese banks, as land sales have dropped considerably in the past few years.1 EMXSOE, CHXSOE and WTEMXC are all under-weight in Chinese Financials, which are among the cheapest of equities currently, compared to the MSCI Emerging Markets Index, and thus are less exposed to a potential Chinese financial crisis.

MSCI Emerging Markets Index Country-Sector Combinations

Rebalance Fundamentals Changes

1 Greg Ip, “A Financial Crisis in China Is No Longer Unthinkable,” The Wall Street Journal, 10/19/23.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Hyun Kang joined WisdomTree in July 2022 as a Research Analyst. As a part of the Index team, he assists with the creation and maintenance of the firm’s indexes and supports the group’s research initiatives across various strategies. Hyun graduated from Carnegie Mellon University, with a B.S. in Business Administration and an additional major in Statistics and Machine Learning.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.