chonticha wat

By David Brady

Treasury Inflation-Protected Securities, or TIPS, are the inverse of actual yields. When TIPS rise, actual yields fall, and vice-versa. Gold has an inverse correlation to actual yields, such that when actual yields rise, Gold falls, and vice-versa. Because of this TIPS and Gold are extremely correlated. When TIPS rise, so does Gold, and so they fall collectively too. I imagine TIPS, represented right here by the “TIP” ETF, are about to shoot greater and Gold will observe go well with. Actual yields will dump.

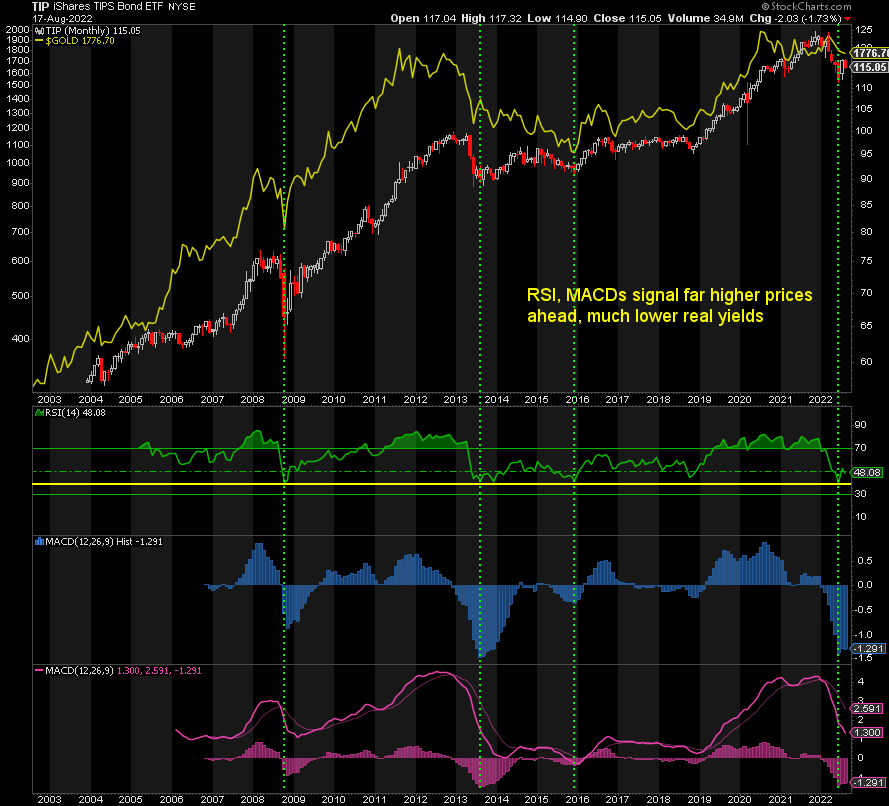

TIP Month-to-month

The RSI and the MACD are at excessive lows now which might be in step with the start of prior rallies in TIPS, i.e., far decrease actual yields, which usually interprets into far greater costs for Gold.

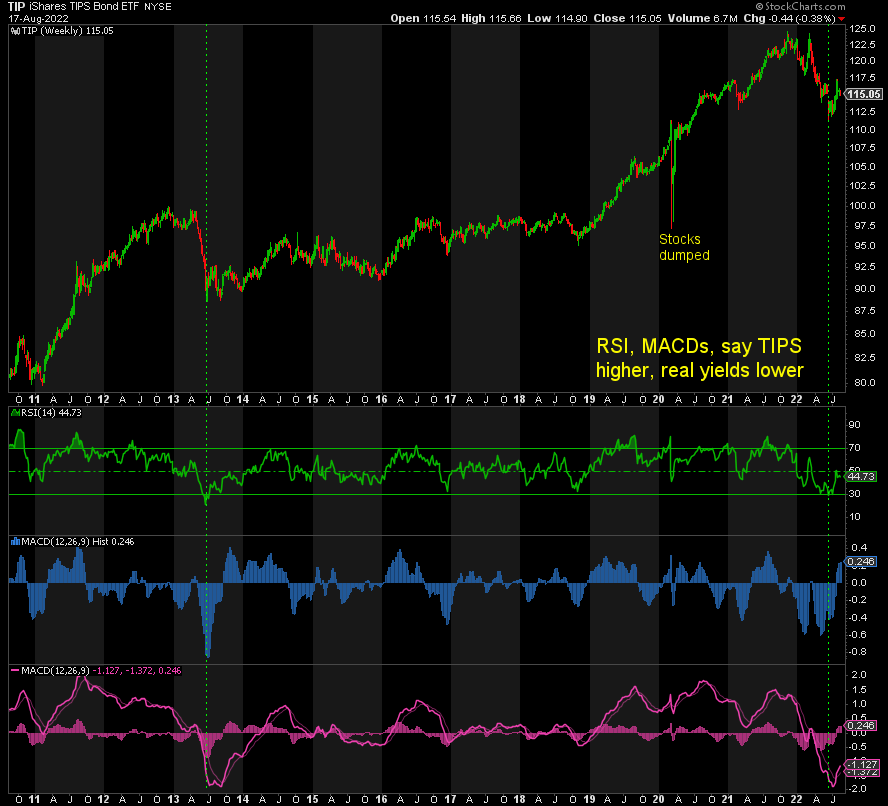

TIP Weekly

The weekly chart reveals that each the RSI and the MACDs are coming off excessive lows not seen since 2013, when TIPS final bottomed out. This too suggests a giant rally is coming in TIPS and a pointy drop in actual yields.

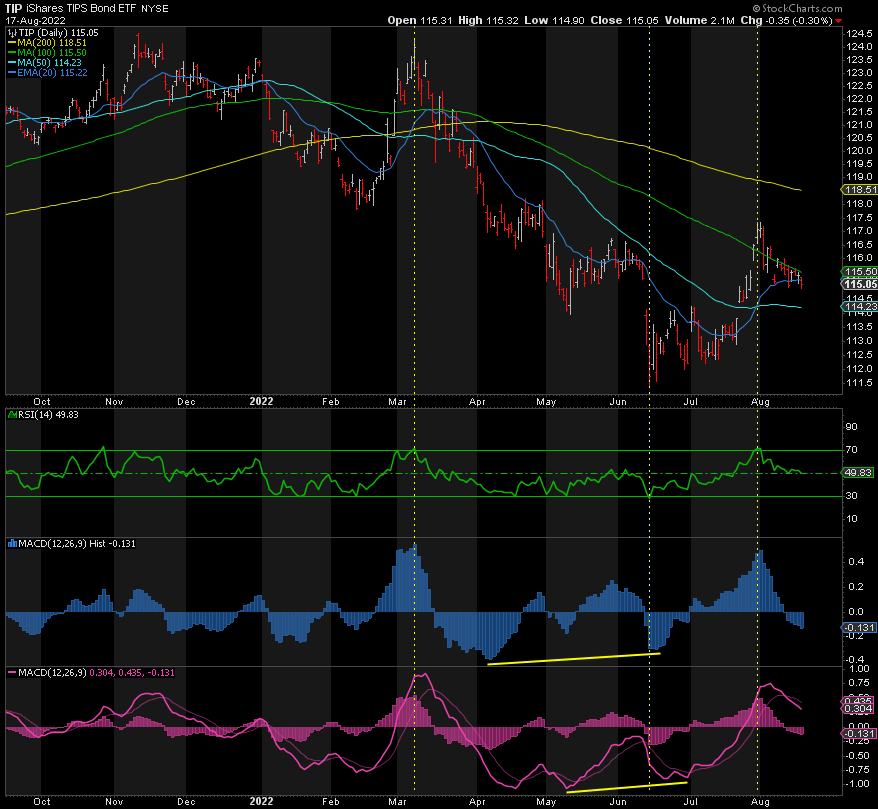

TIP Each day

TIP bottomed out on June 14, 2022, following a giant drop from its peak simply over three months earlier in March. This was the height in actual yields at 0.89%. It additionally simply occurred to be the height within the 10-Yr Treasury at 3.48%. Based mostly on the weekly and month-to-month charts, I imagine this to be the underside in TIPS and the height in each nominal and actual yields.

TIPS have been extraordinarily oversold on the RSI and positively divergent on each MACDs as of June 14, and the rally that ensued was wave 1 or A, IMHO. Now, we’re in wave 2. Whereas we do not know the place the underside is but, primarily based on the weekly and month-to-month charts, as soon as we backside out, TIPS will take off in wave C or 3. Based mostly on such prior episodes, I’m assured that Gold will shoot greater from that time, Silver and the miners much more so. Based mostly on all of those charts, I imagine it’s inevitable – and shortly!

What may trigger yields to plummet? A major drop in yields that’s sooner than the drop in inflation expectations; a spike in inflation that far outpaces the rise in yields; or yields are capped by one other spherical of QE by the Fed. Regardless of the driver, actual yields are going quite a bit decrease quickly, and meaning greater costs for valuable metals and miners – probably new report highs.

Unique Publish

Editor’s Be aware: The abstract bullets for this text have been chosen by In search of Alpha editors.