The effect of the pandemic was huge on the real estate sector, how do you see the pickup in sales right now as is being reported and this across the major property hubs of the metros, the tier one, tier two cities how are they doing? Now that we have the potential tailwind of a pause in interest rate hikes by the RBI and possible kind of fillip to the real estate sector do you think these numbers can be sustained?

I am seeing a very good year to continue in 2023. The calendar year looks extremely exciting and the next nine months is probably going to see a 10 to 15% hike in total sales across the board. Housing finance companies, banks which are lending to retail home loans have increased their amount of lending by also about 12% to 15% on an average, this itself indicates that there is a buying. However, there has been a setback if I may point out that the growth in the case of the affordable segment for the first time in my lifetime I have seen a slower growth in the affordable segment as distinguished from the mid and the higher end segment.

So really the growth story if the interest rates fall down in the future I think the growth in the affordable segment will again pick up which means the overall sales of over 2023-2024 could be much higher if ultimately the interest rates actually start moving down may be in three months or six months’ time.

We hope that the system will change so 2023-2024 is going to see a boom year for real estate as concerned a 15% growth across the board. And housing finance companies are very interested to lend more to retail home loans because the NPAs in retail home loans have fallen to less than 1.5% across the board of all the companies which is the lowest NPA in any sector whatsoever of lending that takes place in the financing sector. So all in all looks like a positive boom year in the next 12 months.

So besides the interest rates what are the real factors at play this time around if you are going to see a boom year? What is really going to drive it, what are you seeing in the trends that are playing out because like you said in affordable we have not seen that much of a party really and for that interest rates need to come down whether or not that happens remains to be seen but at this point in time when you are watching the trends on sales what is really going to drive it if you are calling it a boom year?

I see the overall economy looking extremely positive except for one hesitancy that is the anticipated job losses in some of the sectors. So people in those areas where they think that the job losses could be there could hesitate to actually close transaction but on the other hand we have to see that the number of jobs which are now coming up are shooting back again. Even in the real estate sector the number of jobs which are taking place, the number of start-up operation of new projects being launched also seem to be increasing and in the next 30 to 60 days you will see all the top players which you have now mentioned are doing new launches this year.

One more factor which I have seen happening in the market place is a larger amount of consolidation in this field. So branded players are now taking a bigger proportion of the total market than earlier too. So people are more relying on branded players, people who are actually performing and delivering. Also, of course in the higher segment we have seen unprecedented sales which had never taken before. So I think after COVID people have started valuing their homes much more, having stayed at home for six, 12, 18 months.

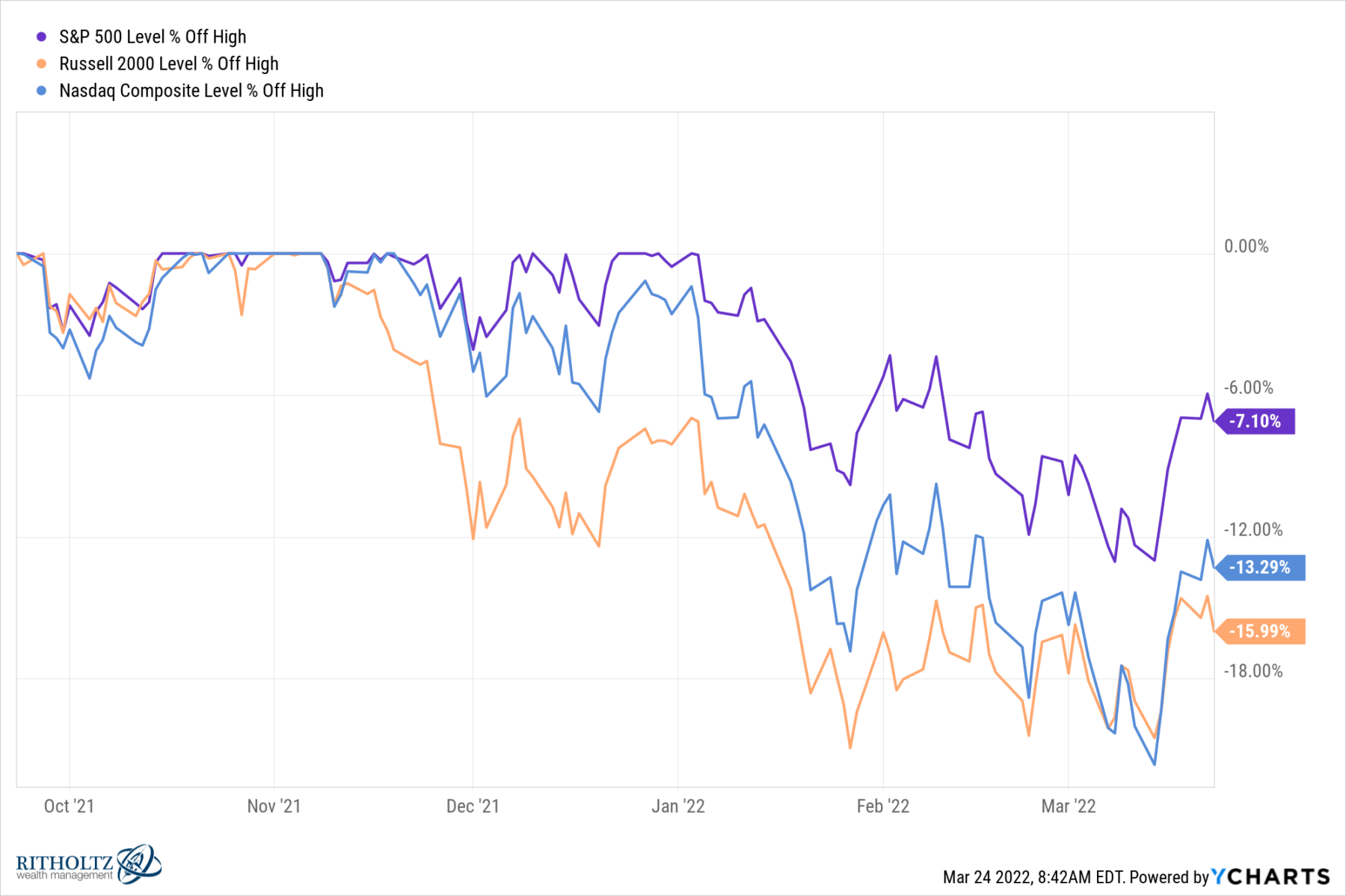

People find it worthwhile to invest a little more in a little bigger house in a better quality house, so they are willing to spend a little more. So while the number of transactions has gone up but the transaction in the mid and higher sector has gone up faster and hence to see the overall top number is much higher. As an asset class how is real estate really panning out because we are at a time when we are seeing a lot of volatility in the markets, we are seeing certain stoppages in SIP as well and part of the reason could be that the kind of returns that you get in the market could have plateaued. So when it comes to investments into real estate and like you said people are seeing value when putting in money into real estate and perhaps that is what is reflecting in sales. Also it has to kind of show in the kind of rentals that real estate can draw right whether it is residential or commercial, how is it looking on that front?

First the interest in the commercial real estate you are getting not only local players but international investors are going gung-ho on to it. So you are seeing much more investment come into the commercial real estate. However, the returns on the real estate rentals has gone up but not as muc.

The rentals are still averaged out, they have gone up by 5% to 10% but not more than that and except in certain locations where demand has suddenly gone up.

So for example in our project in Oragadam where we have the lower income levels of people already because of the industrial area, the rentals in terms of it may not have gone up much but the demand has gone up tremendously. So while the value of rentals still continue to be 3% to 4% at the most in residential. You are getting 6% to 7% plus in the case of commercial.

Hence, foreign investors are looking more at commercial than residential and that will continue to stay because I think they are more comfortable with the commercial side than the residential side. But I feel that rentals as far as our companies also concerned we do go in for some portion of the residential to be also given on rental which we never did before. So I do see that some of us would be taking up residential for rental also.

We mentioned the importance of branded players drawing that much more traction at this time as far as players within the real estate sector like yourself are concerned, how are margins looking and do you think you would be able to sustain these margins if you have to see sales getting pushed up because costs are always concerned and input costs we are seeing oil prices rise as well, is that going to have a bearing?

We do see a challenge in terms of costs. Inflation is certainly eating into the profits and that is a challenge definitely for all the companies. Those who are doing the booking in terms of it because delivery is two years forward so the cost increase is definitely have to be absorbed so margins could be hit. But at this point of time our margins are comfortable but future would be extremely difficult to predict as inflation rates could increase again we do not know for sure.