Fahroni/iStock via Getty Images

RB Global (NYSE:RBA), formerly known as Ritchie Bros. Auctioneers, completed the merger with IAA in 2023 after a long battle between different stakeholders. As a combined entity, RB Global is targeting significant cost synergies and growth opportunities. In this text, I analyse the combined entity’s financials and estimate a fair value through a discounted cash flow model.

The Company & Stock

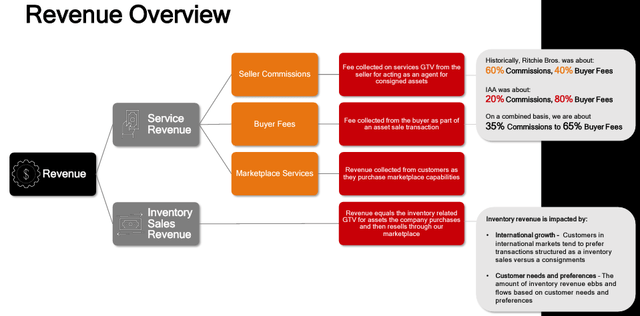

RB Global operates marketplaces for commercial vehicles such as excavators, dozers and commercial trucks, consumer vehicles, and other miscellaneous items such as oil & gas, agriculture, equipment and other products. RB Global makes its revenue through commissions and buyer fees. Of the two, commissions account for around 35% of revenues, and buyer fees for around 65%:

RB Global Q2 Investor Presentation

The company’s stock has appreciated at a CAGR of 12.6% in the past ten years. In addition, RB Global has paid out a growing dividend, with the current yield being 1.74%.

Ten-Year Stock Chart (Seeking Alpha)

Merger with IAA

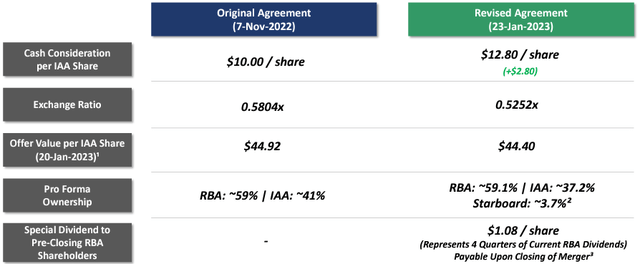

After a long-lasting battle for the merger with IAA, the acquisition of the digital vehicle marketplace was completed in March. The acquisition was made after a long fight; Luxor Capital Group, a fund manager that owns a significant amount of Ritchie Bros’ shares, was actively pursuing against the merger, claiming it as value-destroying for Ritchie Bros’ shareholders. Other shareholders, such as Eminence Capital, voted against the merger. To address the growing concern about the proposed merger, Ritchie Bros and IAA changed the terms of the agreement in January:

Final RBA Transaction Update Presentation (1/23)

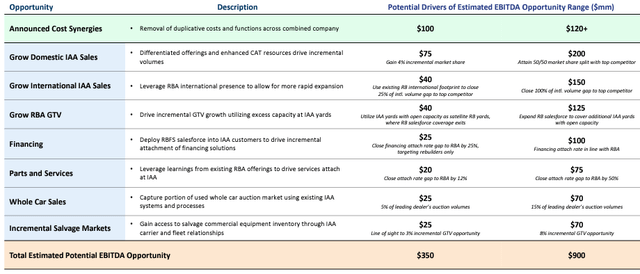

The edited valuation only slightly changed the valuation of IAA shares in the merger, but the acquisition was completed as enough resistance wasn’t formed. The final valuation of $44.40 per share corresponded to a P/E ratio of 20.4 with IAA’s 2022 figures. The rationale for the merger was a significant number of synergies and revenue opportunities as a combined entity. The companies targeted towards an EBITDA opportunity between $350 million and $900 million through removal of costs and multiple sales growth opportunities caused by merging operations:

Merger Synergies & Growth Opportunities (Final RBA Transaction Update Presentation (1/23))

Some of the targeted sales growth opportunities seem a bit far-fetched; for example, the company represents a $200 million opportunity with the expectation that the merged entity can attain a 50/50 market share with the top competitor, without giving synergistic catalysts that would attribute to such a market share capture. I believe that the merger will provide a good amount of synergies and sales opportunities, but the upper range limit of $900 million in EBITDA seems unattainable – I would conservatively estimate figures in the lower half of the range.

Financials

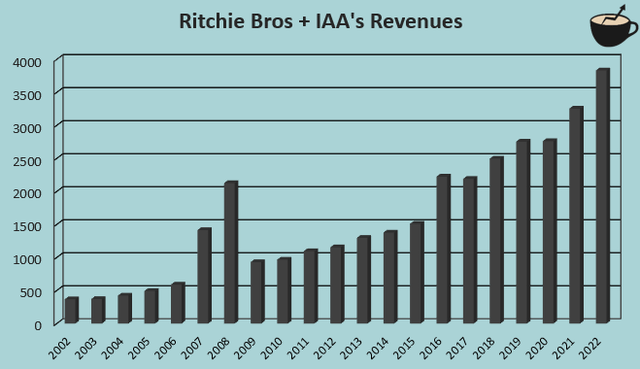

I analysed Ritchie Bros’ and IAA’s historical combined financials to get a grasp of the new combined entity’s capabilities. Historically, the combined entity has achieved a compounded annual growth rate of 12.4%:

Author’s Calculation Using TIKR Data

Both Ritchie Bros and IAA have historically pulled their weight in the growth. The prior has a CAGR of 13.7% from 2002 to 2022, with IAA’s growth being 11.6% in the same period. Although the companies have had some acquisitions in the period, a good part of the growth seems to be organic. As Ritchie Bros and IAA merge, the combined sales opportunities should fuel RB Global for further growth.

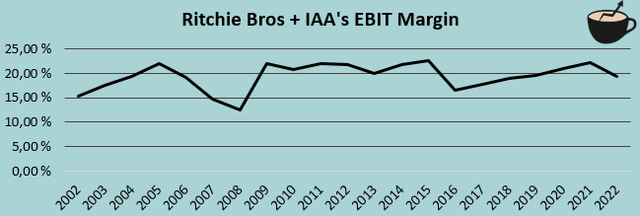

Ritchie Bros’ and IAA’s historical margin trajectories have been very different. Ritchie Bros’ EBIT margin has decreased from a figure of 30.6% in 2002 to 18.5% in 2022. On the other hand, IAA’s margin has mostly been on the rise. In 2002, IAA’s EBIT margin was 6.6% in 2002 and a significantly better 20.1% in 2022. Combined, the entity’s EBIT margin has stayed quite stable with an average figure of 19.4% from 2002 to 2022. In 2022, the companies precisely achieved the mentioned average EBIT margin of 19.4%:

Author’s Calculation Using TIKR Data

As Ritchie Bros’ and IAA’s operations merge, I believe that RB Global has an opportunity for margin leverage through cost synergies. After Q2, the company has actioned $36 million in annualized cost synergies with a significant amount yet to come, as told in RB Global’s Q2 investor presentation.

Valuation

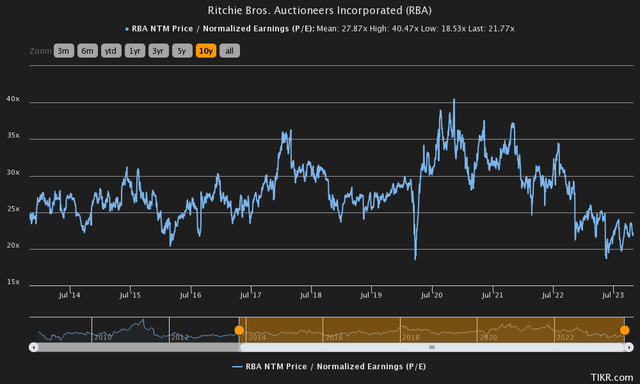

Currently RB Global trades at a forward P/E of 21.8, below the stock’s high ten-year average of 27.9:

Historical Forward P/E (TIKR)

As the merger with IAA has caused a significantly different financial profile for the merged entity, I believe a more thorough analysis of the valuation is necessary. In my usual manner, I constructed a discounted cash flow model. The DCF model uses financials of the two entities as a combination to illustrate the merger.

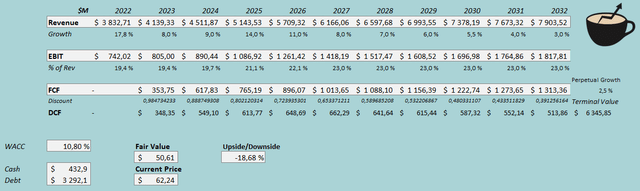

In the model, I estimate RB Global’s revenues to grow 8% organically on a pro-forma basis. The estimate seems to be mostly in line with the achieved Q2 figures. After 2023, I estimate that RB Global will slowly start executing on the sales opportunities brought on by the merger – for 2024, I estimate a growth of 9%, and in 2025, I estimate the growth to accelerate further with an estimated growth of 14%. After the year, I estimate that RB Global’s growth will come down in steps into a perpetual growth rate of 2.5%. In total, the estimated revenues represent a CAGR of 7.5% from 2022 to 2032.

For RB Global’s margins, I estimate a stable EBIT margin in the current year. After 2023, I estimate RB Global’s margins to start scaling slightly, though – the merger should achieve a good amount of synergies, as the company guides for synergies between $100 million and $120 million. As the operations scale in the DCF model, I estimate some further operating leverage as well. The mentioned factors contribute to an EBIT a margin of 23.0%, achieved in 2027. The mentioned margin represents a margin expansion of 3.6 percentage points from 2022. These estimates along with a WACC of 10.80% craft the following DCF model with a fair value estimate of $50.61, around 19% below the price of $62.24 at the time of writing:

DCF Model (Author’s Calculation)

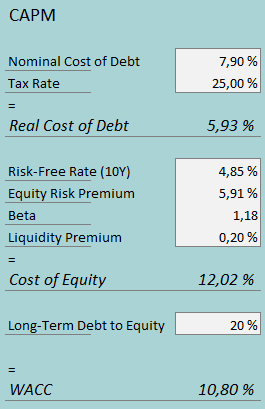

The used weighed average cost of capital of 10.80% is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

RB Global had interest expenses of $65 million in Q2. With the company’s current amount of interest-bearing debt, RB Global’s interest rate comes up to a figure of 7.90%. As Ritchie Bros and IAA merged, RB Global has taken on a significant amount of debt. I believe that the debt level is sustainable and doesn’t necessarily need deleveraging. For a long-term debt-to-equity ratio, I estimate a figure of 20%.

On the cost of equity side, I use the United States’ 10-year bond yield of 4.85% as the risk-free rate. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate for the US, made in July. For the beta, I use the average of Ritchie Bros and IAA – Yahoo Finance estimates RB Global’s, previously Ritchie Bros’, beta at 0.90, and Tikr estimates IAA’s beta at 1.46; I use the average of the two, 1.18, in the CAPM. Finally, I add a small liquidity premium of 0.2%, crafting a cost of equity of 12.02% and a WACC of 10.80%.

Takeaway

Summing up, the merger between Ritchie Bros and IAA should fuel the merged entity for growth and an expanding margin. Although the merger was done quite questionably as many shareholders in Ritchie Bros were against the transaction, I believe that the synergies could make up for the valuation. Still, the current stock price of RB Global seems too high at the moment – the price tag seems to price in synergies near the communicated upper range of $900 million in EBITDA, which I see as quite unlikely. My DCF model estimates the stock to be overvalued, but as the overvaluation isn’t too wide and falls within a fair margin of safety, I have a hold rating for the stock.