Editor’s note: Seeking Alpha is proud to welcome Noah Cox as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

jetcityimage

Investment Thesis

Regional banks (and banks in general) have been slammed since the collapse of SVB in March. A big part of this has been investors’ concerns over large portfolios of HTM (held to maturity) securities, and commercial real estate loans. In this article, I’ll dive into how Raymond James’ (NYSE:RJF) management has been shrewd in its balance sheet management and how it will allow RJF to excel in any coming downturn. Finally, we’ll look at how excellent return on equity metrics warrant a continued appreciation of the stock, living up to its name as a compounder.

Introduction

Raymond James is a St. Petersburg’s Florida-based financial advisor, broker, asset manager and bank. It has over $1.296 Trillion in assets and assets under administration of $1.24 Trillion. RJF stock is down over 18% from its 52-week high but up 23% from its 52-week low based on the time of this writing.

In March, Raymond James (much like many other financial institutions) suffered a severe drop as a result of SVB’s failure. Much of the regional banking industry was written off as the quality of their loan books was scrutinized and the Held to Maturity part of their balance sheet was called into question.

I’m arguing that Raymond James has risen above the rest to deliver on management’s best in class balance sheet and franchise. Their asset-light wealth management division delivers SaaS like consistency of cash flow and high margin, sticky products to customers.

Paired with their banking division that has been shrewd with its loan issuance to commercial real estate and their low proportion of held to maturity deposits vs. uninsured deposits, this firm is set up to continue to be a long run compounder.

Looking At Management’s Comments

While SVB’s failure came as a surprise, management’s concerns about the quality of their loans and balance sheet conditions persisted since at least late 2022 (FY Q1 2023 for them).

In addition, we continue to monitor our exposure to office real estate where trends have changed following the COVID-19 pandemic. -Raymond James FY Q1 2023 10-Q.

In the FY 2023 Q2 10-Q (Mid-2023 filing), management noted continued concerns about commercial banking loans but took action. Their active observations of the commercial real estate market has allowed them to keep their exposure low, while allowing them to continue to generate high ROE (17.76%) for the firm as a whole.

In the recent 10-Q, management notes:

In response to changing trends, and industry-wide challenges following the COVID-19 pandemic, we have closely monitored each loan in our commercial real estate portfolio, particularly office real estate, utilizing LTV ratios and other metrics. We have also focused on reducing our corporate loan exposure in certain sectors with increasing credit concerns, and have sold approximately $450 million, before charge-offs and discounts or premiums, of corporate loans during the three months ended June 30, 2023.

This management team is shrewd. Recent developments with the Signature Bank’s liquidating loan portfolio show that there is little investor appetite for these types of loans. Marathon Asset Management has emerged as one of the few buyers (the FDIC has been trying to run this auction for months).

Management with discipline and shrewd risk-taking is key for long term viability, especially at a financial institution, where risk can be concave to the downside and knockout risks are high. This is part of what has allowed Raymond James to be a compounder over the long run.

As regional banks as a whole continue to suffer in this suddenly high interest rate environment and from losses in Commercial Real Estate, we remain bullish on Raymond James ability to use these opportunities to their advantage. The firm has continued to roll up wealth management divisions this year, buying billions in assets under management and using the opportunity to roll up wealth management customer deposits into their banking division.

Knowing you’re at a financial institution that will be there tomorrow and in the next ten years plays out best in markets like today. Raymond James is acquiring long run customers. Management is careful to protect this.

Financials

Actions speak louder than words. Raymond James’ balance sheet shows management’s actions reflect their cautious approach. This is reflected on two fronts:

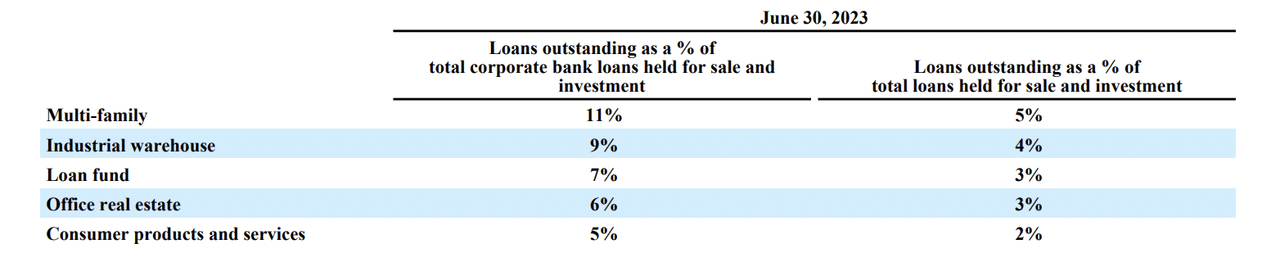

First, their low exposure to high volatility commercial real estate.

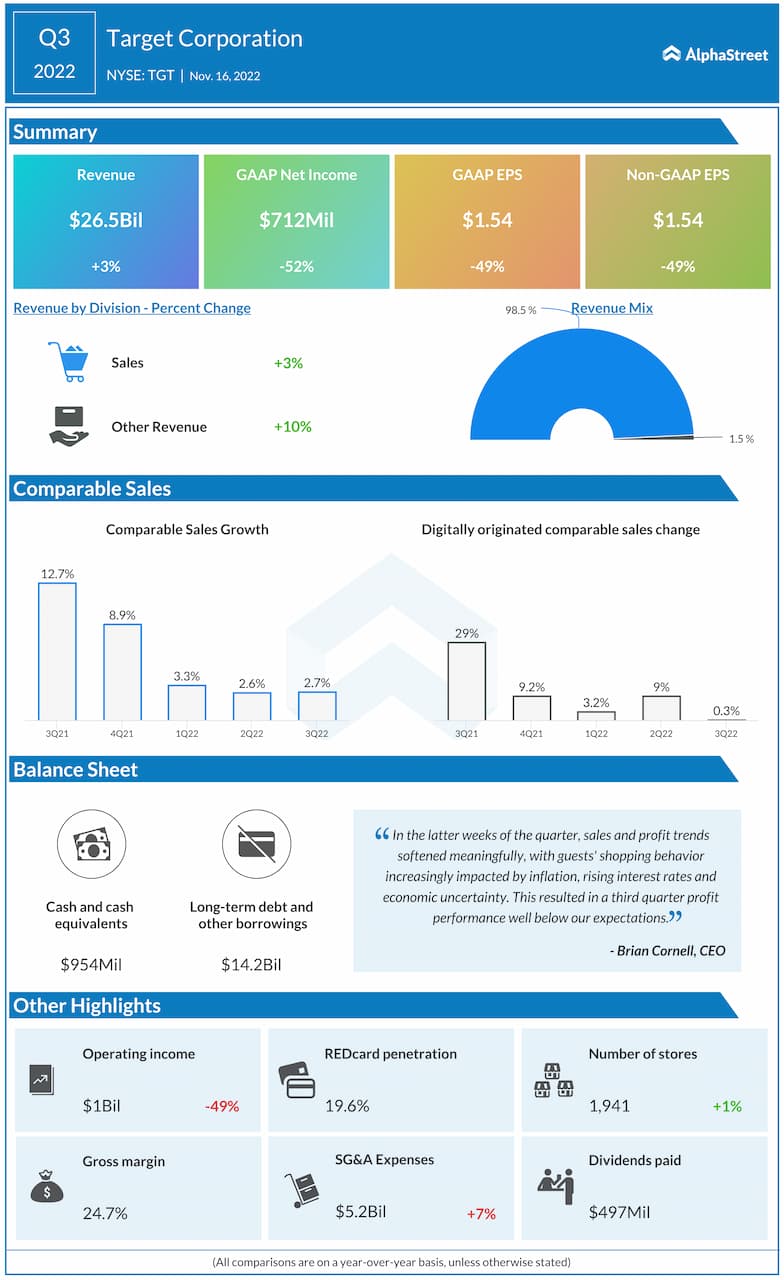

Raymond James Loan Portfolio Snapshot (Raymond James Q3 2023 10Q)

Office real estate only makes up 6% of the total commercial bank loan portfolio. Furthermore, specific exposure to high volatility commercial real estate appears to be only $122 million in the last quarter. This is actually down from last year too (total standardized, risk-weighted balance sheet assets stood at $43.445 billion as of FY Q3 2023).

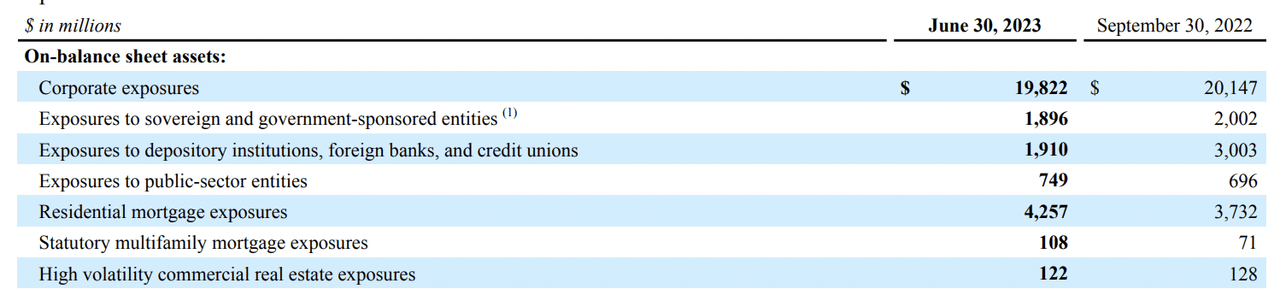

Raymond James Asset Exposure (Raymond James Q3 2023 10Q)

Second, Raymond James has something a little unconventional about their balance sheet: No Held-to-maturity assets.

We have classified all of our investments in debt securities as available-for-sale and have not classified any of our investments in debt securities as held-to-maturity. Accordingly, we account for our available-for-sale securities at fair value at each reporting date, with unrealized gains and losses, net of tax, included in AOCI. -Raymond James FY Q3 2023 10-Q.

In essence, RJFs assets (if sold to deal with deposit flight) would not result in a further impairment of the balance sheet beyond the unrealized losses they currently have.

While the drop in uninsured deposits would affect asset mixes, there doesn’t seem to be a scenario where there could be a run on the bank or a massive implosion of their balance sheet. Once again, this is characteristic of a compounder that knows how to minimize knockout risk.

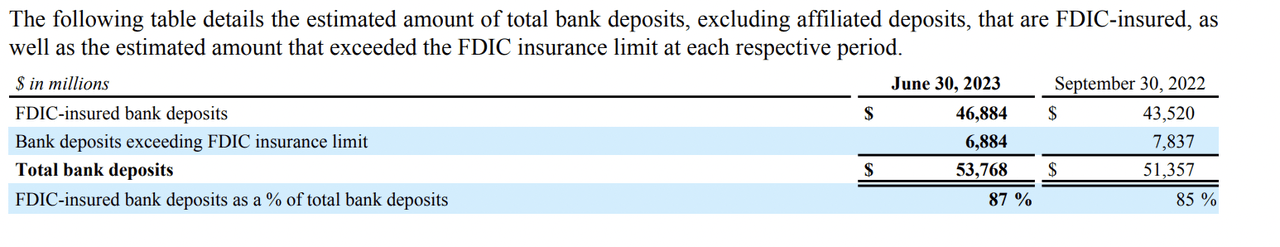

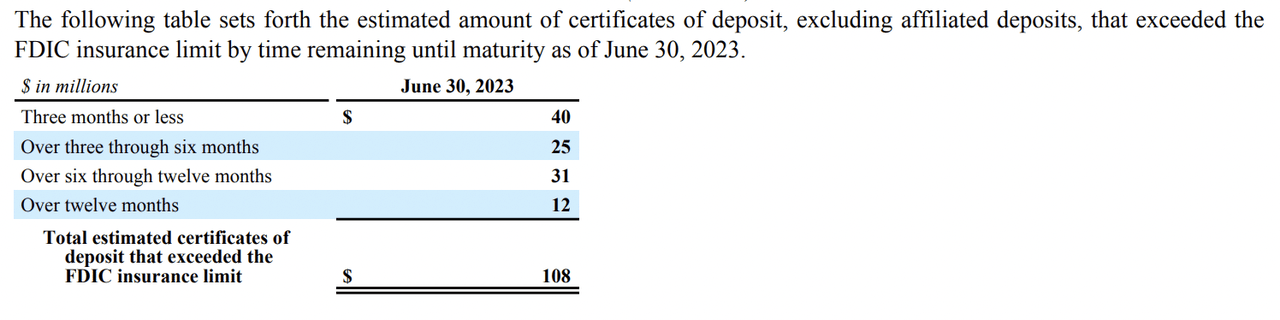

Total uninsured bank deposits RJF (Raymond James Q3 2023 10Q) Total uninsured CDs (Raymond James Q3 2023 10Q)

Valuation

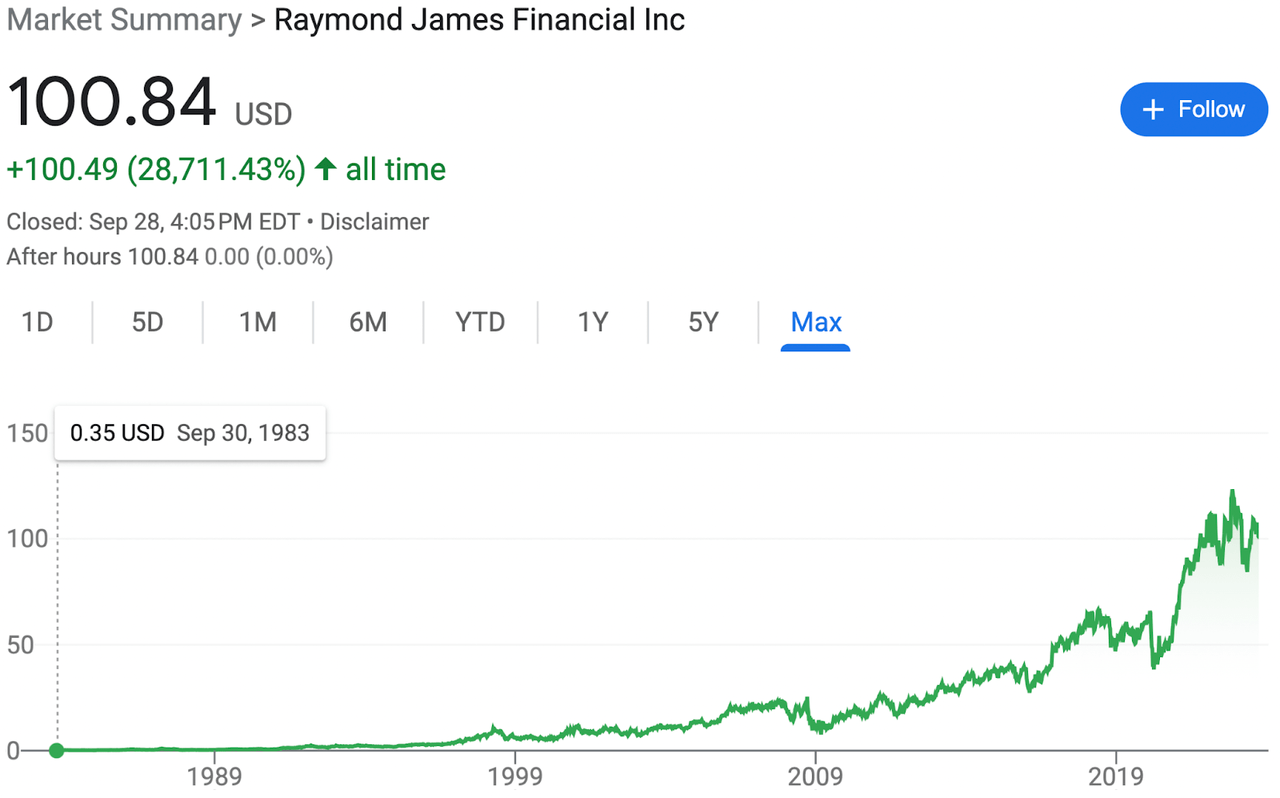

Raymond James has been a compounder for 40+ years. Its total return (not including dividends) is 28,711%. This has beaten the S&P 500 by over 10x (2,500% return over the same time -also without dividends).

Raymond James Stock Chart 9/28/2023 (Google Finance)

This is astonishing. What’s more astonishing is that this compounder actually trades at a lower multiple than its larger rival, Charles Schwab (SCHW). As of this writing, Schwab trades at 16x trailing 12 months earnings even though revenue and profits have declined, and their banking franchise faces large unrealized Charles Schwab’s growing paper losses raise questions for investors, making it vulnerable to more interest rate increases and deposit flight.

Raymond James’ earnings are growing, and it trades at 12.7x earnings. This is a 25% discount to Schwab’s multiple. Raymond James trades at ~10.5x forward earnings estimates, Schwab trades at ~13x forward earnings estimates. Here’s a table to better compare Raymond James to some of its competitors:

| Stock | Raymond James | Charles Schwab | Morgan Stanley (MS) |

| Stock Price | 100.84 | 54.55 | 82.19 |

| Current EPS Multiple | 12.7 | 15.84 | 14.48 |

| Forward Multiple | 10.3 | 13.17 | 11.25 |

Finally, RJF’s ROE sits at 17.76% as I mentioned before. This is similar to Schwab’s ROE of 17.43% but doesn’t come with the balance sheet risk. It also appears convex to rising interest rates, as ROE has accelerated in the last few years and is above most of the 2010s.

ROE is one of Buffett’s favorite financial metrics. In fact, RJF has sported a higher and more stable ROE (on average) for most of the last decade than Berkshire Hathaway (BRK.A).

Risks

While no investment is perfect, Raymond James is exposed to interest rate sensitivity. This is what largely drove net income down in 2020 and the first half of 2021 and is a big part of their earnings. Most of their net income is based on the short end of the yield curve, given most of its loans are variable interest (based on SOFR/LIBOR) and client deposits are invested in short duration treasuries in money market accounts at Raymond James. However, given the increasing funding needs of the US government and a mantra on Wall Street of “higher for longer” Raymond James is likely facing higher neutral interest rates going forward, than the last decade or so since 2008. This will be good for net interest margins (assuming loan default rates don’t tick up significantly).

Finally, while asset prices have decreased since the end of 2021, the firm has done a great job continuing to grow client assets by bringing in new accounts and new practices. These assets would likely go back up in a lower interest rate environment in the long run, meaning while the firm would lose net interest income, it could make up much of this with higher asset under management fees.

Catalysts

Like many compounders, there will always be a reason not to buy. There’s the old adage, “time in the market beats timing the market.” I believe this will be the case here. I believe it is a standard long-term buy and hold.

The Bottom Line

Raymond James offers a best in class balance sheet, brand and valuation. It trades below the multiple of a less financially stable peer (Charles Schwab) and yet offers an almost identical return on equity. Less risk for the same reward and a track record of performing. I like it.

Disclosure: I am/we are long.