franckreporter

By Antoine Bouvet, Padhraic Garvey, CFA, Benjamin Schroeder

Hawkish repricing into today’s CPI but the market still expects 2024 cuts

It’s an understatement to say that a more resilient US economy, and in particular its labour market, have caused some nervousness in global bond markets. This is the dominant mood among participants as we head into the first CPI print for the year. As usual, the focus will be on core inflation, and in particular on core services ex-housing as Fed Chair Jerome Powell and colleagues have stressed its importance for monetary policy.

The hawkish shift in market mood has resulted in 2Y Treasuries printing a new high for the year at 4.54% yesterday. The 45bp reversal in February (trough to peak) means front-end yields are now up in 2023. The same cannot be said of longer tenors, still standing below their 2023 starting levels. The resulting flattening of the US yield curve is probably the most striking example of the more hawkish mood in rates.. Another is forwards, which are now pricing a peak in the Fed Funds rate at 5.2% in July.

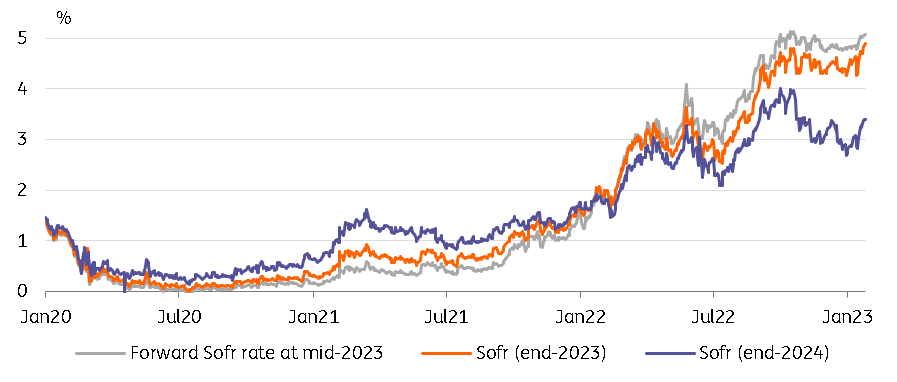

Sticking with forwards, the amount of Fed cuts priced for 2024 is nearly unchanged since January – roughly 150bp. Therein lies the rub – higher terminal rates this year, and generally speaking the better growth trajectory, have not translated into a material repricing of long-term policy rates. One reason is that other forward-looking indicators, for instance the New York Fed’s survey of consumer inflation and earning expectations, continue to point to a decline.

Higher US Swap Rates, But The Curve Is Still Pricing Cuts For 2024 (Refinitiv, ING)

Treasury yields: A rise before a fall, and Europe also has some reasons for inflation optimism

There is undeniably some upside to rates across maturities today on an upside inflation surprise, but the front end remains the most volatile point on the curve, so a change in the slope should be the clearer takeaway. We suspect complacent longs could still be shaken out by this report, and 4% in 10Y Treasuries cannot be excluded if hard activity data rebounds this week (retail sales and industrial production) also rebound, but this would be setting up for lower rates later this year.

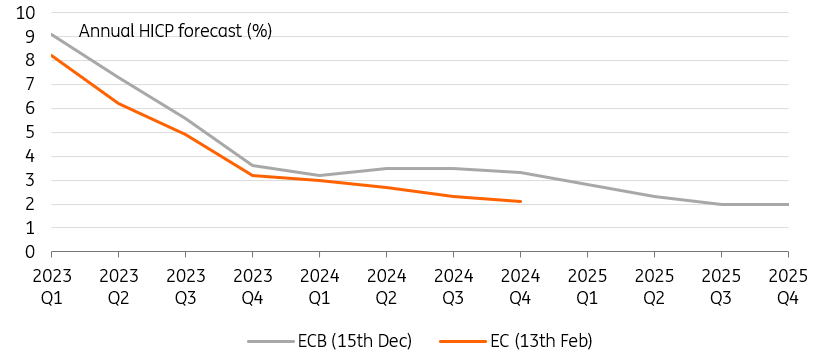

Of course, the hawkish repricing has not spared euro bond markets. Regular readers know that we find an even stronger case for the repricing higher in European rates, as the ECB is still behind the Fed in its fight against inflation. Some good news helped stem the hawkish repricing yesterday, however. A couple of ECB speakers stressed that the bank will turn to a more data-dependent setting after it delivers the 50bp it pre-announced for March. The European Commission’s own winter forecast updated yesterday also indicated some downside to the ECB’s own projections, which will also be revised in March.

European Commission Inflation Forecast Points To Downside Revisions In The ECB’s Projections (Refinitiv, ING)

Today’s events and market view

The main release of note out of Europe today is the second reading to the eurozone’s fourth-quarter GDP growth. The previous estimate was 0.1% quarter-on-quarter.

Bond supply consists in Italian (3Y/7Y/15Y) and UK (10Y) auctions. This will add to the European Union reopening two bonds with 6Y and 19Y of residual maturity.

Today’s US CPI report is easily the most important release this week, and maybe this month, although the sell-off that followed the January non-farm payrolls means there is fierce competition for this title. The median Bloomberg estimate for core is 0.4% month-on-month. An annual change in components weighting make this number more difficult to call than ususual. Note also that 2022 inflation prints were revised higher last week, adding to the market’s nervousness.

Other US-centric events today include small business optimism and a flurry of Fed speakers who will no doubt give their spin on the CPI print.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.