D3Damon/E+ via Getty Images

Overview of the thesis

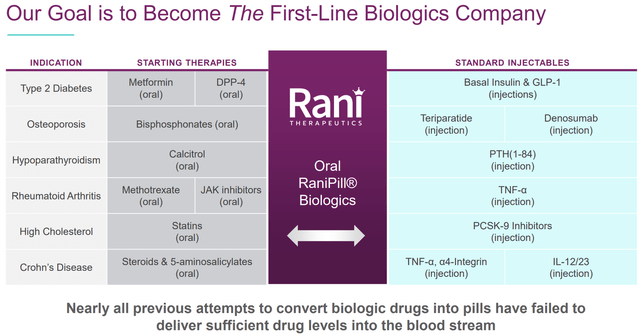

Rani Therapeutics (NASDAQ:RANI) is developing a robotic pill to allow oral delivery of otherwise injectable medications. RANI has provided sufficient proof-of-concept data, both in animal models and in early-phase human studies, demonstrating successful and safe delivery of drug payloads, achieving bioavailability similar to or better than subcutaneous injections. Importantly, the technology is payload agnostic, meaning enormous potential to penetrate the huge injectable drugs market. Celltrion partnership on adalimumab ($21.2B in Humira sales in 2022) and ustekinumab (Stelara sales of $6.4 billion in the United States and approximately $9.7 billion worldwide in 2022) further validates the technology and I wouldn’t be surprised if more partnership news are announced soon on other assets. However, being an early-stage biotech, investing in RANI at this stage is not without risk, including fierce competition in the field of oral drug delivery and need for lots of cash to support the pipeline.

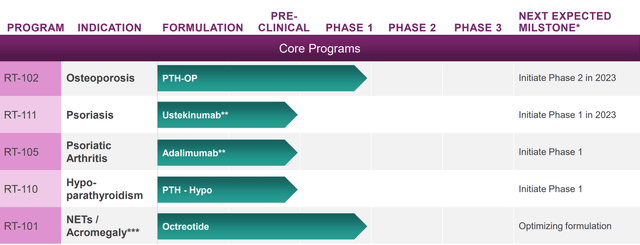

RANI’s current pipeline. Potential for expansion beyond this pipeline is enormous (Rani Therapeutics Corporate Presentation September 2023)

Overview of the potential

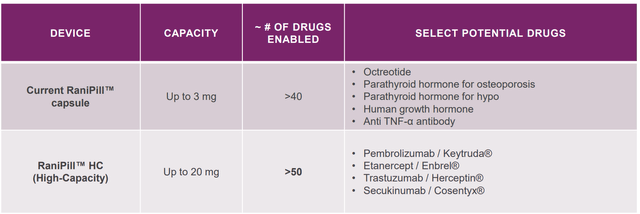

The global injectable drugs’ market size is currently about $500B and expected to reach $728B-$1251B by 2027-2032 according to various estimations (references 1, 2, 3). Obviously, many (if not most) patients would prefer a pill compared to intravenous (IV) /subcutaneous (SC) delivery. Therefore, it is not surprising that many biotechs have tried (some successfully already) to penetrate the injectable drugs markets with oral alternatives. Notably, the next generation high-capacity RaniPill allows delivery of larger biologics, supporting RANI’s ambitious goal to become “the first-line biologics company”.

Potential expansion to more biologics by the next-generation RaniPill (RaniPill HC Data Slides) Examples of indications to which RaniPill platform could be used. This is far from an exhaustive list of the possibilities (RANI presentation)

Overview of the technology

There are 2 methods to allow oral delivery of injectables; (1) chemical methods (used by other biotechs) that protect medications from degradation and/or improve absorption, and (2) oral mechanical device methods. The first approach usually results in suboptimal bioavailability, while the latter (used by RANI) is much more effective and versatile.

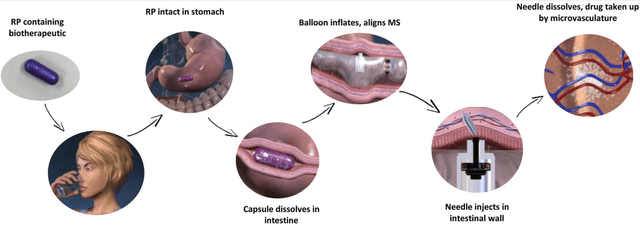

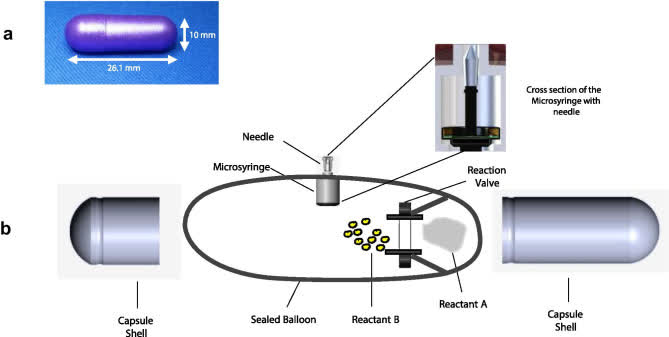

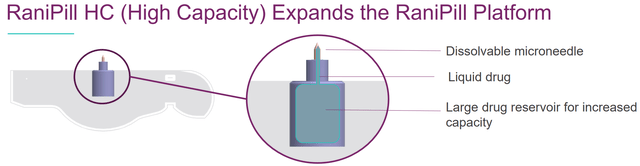

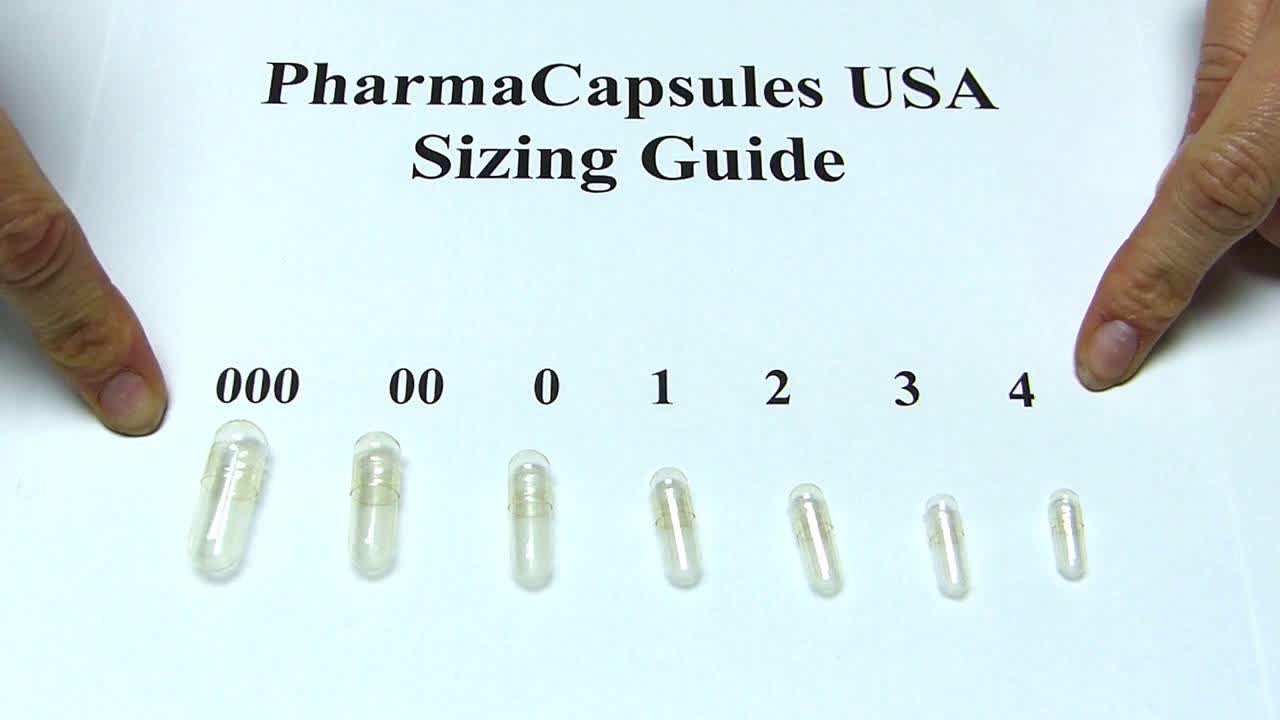

RaniPill is a robotic pill (RP) for drug delivery. The RP is a robotic auto-injector enclosed in a standard pharmaceutical “000”-sized capsule shell, enteric-coated to prevent its dissolution and deployment in the acidic environment of the stomach. A precise dose of the biotherapeutic (payload) is packaged inside a dissolvable needle loaded within a microsyringe, which itself is attached to a folded, self-inflating balloon. Once the RP reaches the small intestine, the pH change dissolves the enteric coating and the capsule shell, exposing the RP to intestinal fluid. This triggers a chemical reaction which leads to rapid inflation of the balloon, which aligns the microsyringe perpendicular to the long axis of the small intestine, and injects the dissolvable needle carrying the drug payload into the intestinal wall. As the intestine is insensate to sharp nociceptive stimuli, the injection in the intestinal wall is painless. The current RaniPill capsule, the RaniPill GO, is designed to deliver up to a 3 mg dose of drug with high bioavailability. RANI is also developing a high-capacity version known as the RaniPill HC, which is intended to enable delivery of drug payloads up to 20 mg with high bioavailability.

The technology has major advantages; (1) High bioavailability, (2) Agnostic to payload (can accommodate therapeutic peptides, proteins, antibodies and nucleotides), (3) Minimal discomfort, (4) Clinical data, (5) Scalable design, (6) Strong patent position. Relevant data for points (1), (3) and (4) will be presented below in more detail.

RaniPill delivery method (PMCID: PMC8677648) RaniPill design (PMCID: PMC8677648) The higher-capacity 2nd generation RaniPill increases payload potential to up to 20mg (vs 3mg) and enables potential delivery of 90+ additional drug candidates (Rani Therapeutics Corporate Presentation September 2023)

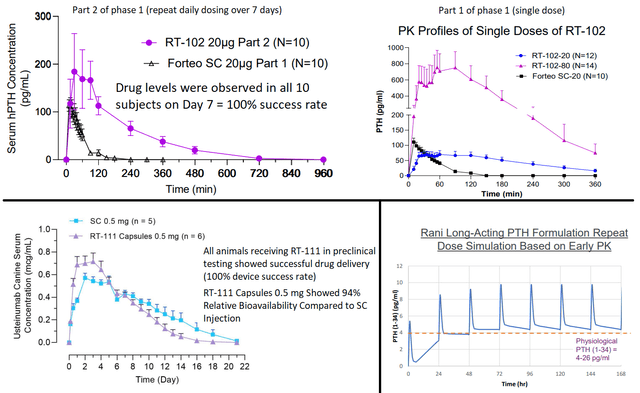

Proof-of-concept data for RaniPill GO

Clinical stage assets include RT-102 (oral teriparatide for osteoporosis, the most advanced candidate), RT-101 (oral octreotide for acromegaly/ NET tumors), RT-111 (oral ustekinumab, phase 1 just started) and RT-110 (phase 1 to start soon). In all programs successful delivery has been shown in pre-clinical studies. RT-101 and RT-102 are further supported by phase 1 data in humans. Notably, “RT-102 delivered PTH with 300% to 400% higher bioavailability for 20 micrograms and 80 micrograms of PTH respectively when compared to 20 micrograms of Forteo delivered via subcutaneous injection.”

Selected summary of proof-of-concept data for RaniPill GO. Upper 2 images; Results of phase 1 RT-102 study. Lower left figure; pre-clinical results of RT-111. Lower right figure; Simulated PK of daily RT-110 dosing based on pre-clinical data. (RANI presentations)

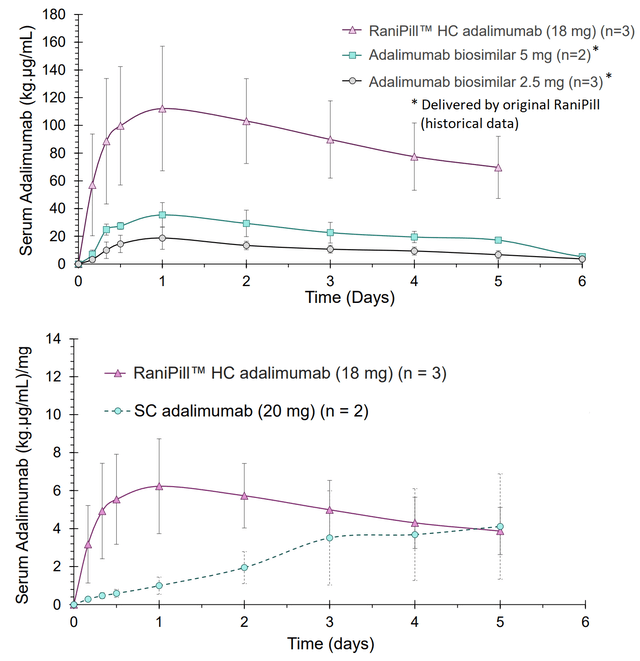

Proof-of-concept data for the next-generation RaniPill HC

With regards to RaniPill HC, proof-of-concept data demonstrate succesful adalimumab delivery in canines, much improved compared to delivery with 1st generation RaniPill GO (figure). Furthermore, compared to the subcutaneous route (current method of delivery in humans) RaniPill HC showed higher Cmax (maximum serum concentration) and shorter time to reach maximum concentrations. For the 1st generation RaniPill a daily dose would be necessary to match PK of SC adalimumab. Data for RaniPill HC in the canine model were available only up to day 5, but obviously the necessary frequency of administration would be much lower.

RaniPill HC vs RaniPill vs SC adalimumab (in canines) (RaniPill HC Data Slides (Dec 2022))

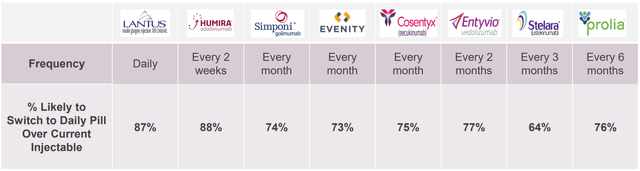

Shallowability and tolerability of RaniPill and patient preference compared to subcutaneous route

RaniPill capsule size is “000”, the largest for human consumption. Therefore, I am a bit concerned about the tolerability of shallowing RaniPill capsule and whether patients would prefer this to SC injections. Fortunately, RANI has conducted research to address these concerns. According to market research by RANI 87-88% of patients would prefer a daily pill compared to daily/biweekly SC delivery (the percentage drops to 64-76% for less frequent SC administrations, i.e. every 1-6 months). However, the results of this survey are theoretical and do not account for the pill size (i.e. patients who participated in the survey didn’t actually try RaniPill).

I am very satisfied that RANI has addressed the pill size concern as well. The shallowability and palatability of mock-RaniPill (same weight and size as RaniPill but filled with potato starch) was assessed in n=50 patients (age range 21-75) currently taking injections of various medications (details of the type and frequency of the subcutaneous injection are not reported). All patients successfully shallowed the pill and the majority (91%) stated they would prefer the pill to the subcutaneous injection.

As far as side effects are concerned, these appear to be uncommon. Specifically, based on two phase 1 studies including n=91 subjects, RaniPill related adverse events were reported by only 3 patients and were all mild and transient (n=2 mild transient abdominal pain, n=1 burping lasting for 2 days).

“Capsule Sizing Chart Gelatin Capsule Size Guide” by Healthy Life Supply (YouTube video) Patient preference survey (RANI presentation)

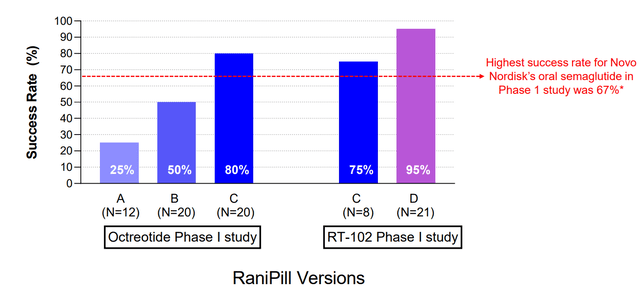

Drug delivery success rate by RANI platform

Unfortunately, the technology doesn’t always work as planned. Initial testing (aiming to fine tune the product) showed succesful delivery in 25-80% of doses. According to RANI ‘s latest company presentation this has improved to >90% based on available phase 1 studies (for comparison, approved oral semaglutide formulation results in measurable absorption in 67%). Although this percentage seems good enough it means that patients may miss 1 out of every 10 doses. For daily/frequent dosing this is unlikely to cause problems for most indications, but it can be a problem for some indications, which could limit expansion potential of the technology (e.g. I wouldn’t be comfortable with a patient missing 1 out of 10 insulin doses, if RANI were to develop a pill for oral delivery of insulin). Furthermore, missing a dose of a long-acting agent (=less frequent dosing, e.g. weekly/ biweekly) could have risks. Therefore, the potential for RANI to pursue development of long-acting RaniPills could be problematic. A plus is that device performance is not affected by presence of food.

Improving delivery success rate with later versions of RaniPill (Rani Therapeutics RT-102 Phase 1 Part 2 Repeat Dose Data Slides)

Next steps

Following succesful completion of phase 1 studies, RANI is progressing RT-102 (oral teriparatide for osteoporosis) to the phase 2 stage in H2 2023. The phase 2 will be a small (n= 25 Forteo SC arm vs n=25 RT-102 20μg arm) and short (primary outcome= changes in bone growth biomarkers at 8 weeks) study. RANI also plans to start a phase 1 study with RT-110 containing PTH for hyperparathyroidism.

With regards to the injectable biologics market, RANI just announced initiation of a phase 1 study of RT-111 (ustekinumab). The study is conducted in co-operation with Celltrion. According to the agreement; ustekinumab biosimilar (CT-P43) used in RT-111 is manufactured and supplied by Celltrion, RANI is granted an exclusive license to use CT-P43 in the development and commercialization of RT-111, and Celltrion is granted a right of first negotiation to acquire worldwide rights to RT-111 following a Phase 1 clinical trial that meets its primary endpoint(s). Results are expected in Q1 2024. Further validating the platform’s potential RANI’s partnership with Celltrion was expended to include adalimumab (RT-105) under a similar agreement, representing the first partnership for the next-generation high-capacity RaniPill HC. RANI is planning initiation of a phase 1 study for RT-105, which like prior phase 1 studies should have results within a few months following initiation. I wouldn’t be surprised if more deals with other pharmas are announced in the meantime, or following positive phase 1 results, given the potential of RaniPill HC.

Finally, RANI is working on its preclinical pipeline aiming to expand its oral delivery platform to more molecules. E.g. RANI has already presented preclinical results showing bioavailability comparable to SC route for GLP-1, oligonucleotides (an important emerging market) and FSH, but as already discussed there are numerous more possibilities.

Competition

Considering the market size it is not surprising that several other companies are pursuing penetration of the injectables market by oral alternatives, mostly by chemical methods which are however limited both in terms of achievable bioavailability, as well as in terms of the molecules that can be delivered (method not suitable for larger biologics).

However, at least 2 companies (mentioned in RANI’s 10-K) are developing device-based oral drug delivery;

- Novo Nordisk; Novo Nordisk is developing oral delivery in co-operation with MIT. So far 2 technologies have been licensed from MIT, “LUMI” and “SOMA”. LUMI is not mentioned in either the 2022 Annual report or 2023 Q1-Q2 reports of Novo Nordisk. Therefore, only SOMA appears to still be in active clinical development. However, based on available published data the capacity of SOMA is much lower compared to RaniPill HC, thus limiting its potential to smaller molecules. Notably, SOMA is described in NOVO’s latest annual report as a “device for the oral delivery of peptides and proteins” (i.e. no mention to larger biologics). The only candidate in clinical development appears to be DV3395 for type 1/2 diabetes. According to the Q1 SEC filling “in February 2023, Novo Nordisk completed a phase 1 trial with the DV3395 oral device concept. The trial investigated safety and gastrointestinal transit of the DV3395 device, without active pharmaceutical ingredient. Novo Nordisk is now evaluating further progression of DV3395”. No results have been published/announced to my knowledge and the candidate is not even mentioned in the latest quarterly report. LUMI technology is not mentioned in either the 2022 Annual report or 2023 Q1-Q2 reports.

- Biograil; Biograil is developing BIONDD. An advantage of Biograil is the smaller pill size, currently at “00” with Biograil claiming being close to an even smaller pill size of”0″. The company also appears to have big pharma support. Nevertheless, progress appears to be slow and the asset is still in the pre-clinical stage, with no ongoing trials at least according to ClinicalTrials.gov.

Beyond the above 2 companies there are at least a few more companies/technologies I could find (review article) e.g. Biora therapeutics (still in the preclinical stage, with much lower cash balance) and Baywind bioventures (preclinical stage, no recent news since 2018 in the company’s website).

Based on the above, RANI technology appears to be far more advanced in clinical development and appears to be progressing faster compared to other companies developing device-based oral delivery methods. However, despite disadvantages (mainly poor bioavailability) of chemical methods, competition appears to be successful in some indications. Examples of approved products include Rybelsus (oral semaglutide) and Mycapssa (oral octreotide), both utilizing permeation enhancers. Notably, the latter is competing with RANI’s RT-101 pipeline, with further much stronger competition by CRNX’s paltusotine that recently announced a positive phase 3 trial. Furthermore, RANI’s most advanced candidate (RT-102), faces competition by Entera bio (developing a teriparatide oral formulation currently in the phase 3 stage).

To improved competitiveness RANI is working on a sustained release formulation for RT-110 and RT-101 candidates. This would indeed be a major commercial advantage if successful, allowing both oral delivery, as well as less frequent dosing vs competition. However, missed doses (due to failure of delivery, even if infrequent) could be a problem for sustained released formulations.

Financials

Cash, cash equivalents and marketable securities as of June 30, 2023, totaled $74.6M. Total operating expenses were $18.3M (R&D $11.1M, G&A $7.2M). At current burn rate RANI has cash for about 4 quarters (up to Q2 2024). Furthermore, considering planed initiation of a phase 2 and three phase 1 studies operating expenses are likely to increase. Therefore, RANI will very soon need cash. Hopefully, potential dilution impact will be minimized by further progress in the pipeline and/or more partnerships.

Major risks ahead

Despite the promises of the technology there are major risks for RANI;

- Variable success in delivery of the payload (i.e. some doses may fail to work as planned, which is equivalent to missing a dose). The so far reported 90% success rate is good enough for most but not all indications which could limit RaniPill’s potential target markets. Nevertheless, at this rate of successful delivery I don’t expect major problems for RANI’s pipeline.

- The choice of first indications to target was unfortunate given success of competition, as discussed above. Personally, I would prefer RANI to focus its resources on penetrating injectable biologics markets. Despite competition RANI appears to be taking all the right steps and has progressed several molecules to the clinic.

- Novo Nordisk has successfully challenged four European patents, although RANI has appealed the decisions. According to RANI; “our current patent portfolio provides us with meaningful protection of the RaniPill technology in Europe even apart from the four European patents which are the subject of the current opposition proceedings. However, if any of the current oppositions results in a revocation or reduction in our patent protection, it could encourage Novo Nordisk As or other parties to seek to invalidate or reduce additional patents in Europe or other jurisdictions”.

- Pill size. As discussed above RANI research indicates that this doesn’t appear to be a problem. However, I would like to see more data with longer term use.

- RANI needs partners to advance its pipeline, but may fail to do so in time. Nevertheless, as stated by RANI’s founder and CEO “as we generate more data, I think there is a potential that pharma companies will be less inclined to enable us to compete against them as opposed to working with us”. Therefore, given results so far I expect RANI being able to form more partnerships soon.

- RANI stock price has been in a steady downward trend and has a “strong sell” quant rating. Therefore, there might be a better (or at least safer) entry point to start buying the stock.

Conclusion

The upside potential for RANI if successful is enormous as it can disrupt several multi-billion dollar markets (even 1% penetration of these markets would equate to >$5B revenue). Notably, RaniPill (both the 1st generation and the 2nd generation higher-capacity pill) has been proven to be an effective and well-tolerated oral delivery method for various molecules (including larger biologics, like monoclonal antibodies) in both pre-clinical and early-phase clinical studies, thus significantly de-risking the platform. However, considering fierce competition, challenged patents in Europe, large pill size, inconsistent payload delivery, very early stage in clinical development (many years ahead of potential commercialization), cash balance and operating expenses there are major risks ahead. In my opinion, most promise comes from next-generation high-capacity pills that allows delivery of larger biologics, a huge target market. The stock has been beaten down recently and starting building position might be worth it, as long as potential investors understand the risks and have a long-term perspective. Personally, despite above risks, I tend to be optimistic. I see RANI as a speculative long-term investment with asymmetric risk-reward and I am willing to hold for several years.

Your feedback is appreciated

Please comment below if you have any feedback (negative or positive), if you spot any mistakes or if you believe I missed something important in the article.