Sundry Photography

In this analysis of Rambus Inc. (NASDAQ:RMBS), we analyzed the company as it has finished 2022 with its strongest performance with the highest growth in the past 10 years. Thus, we analyzed the factors for its strong performance. First, we examined its revenue breakdown and identified its key growth segment which is Product Revenue and explained the products sold in the segment. Moreover, we analyzed its market share in the memory interface market and how it has changed as management attributed its strong segment growth to share gains.

Growth Driven by Memory Interface Products Segment

Revenue Breakdown | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | Average |

Product Revenue | 35.38 | 39.30 | 75.11 | 113.30 | 144.45 | 227.4 | |

Growth % | 11.1% | 91.1% | 50.8% | 27.5% | 57.4% | 47.6% | |

Royalty Revenue | 289.6 | 130.5 | 90.8 | 83.7 | 137.9 | 141.0 | |

Growth % | -54.9% | -30.4% | -7.8% | 64.7% | 2.2% | -5.2% | |

Other Revenue | 68.12 | 61.40 | 61.69 | 49.26 | 45.96 | 86.41 | |

Growth % | -9.9% | 0.5% | -20.2% | -6.7% | 88.0% | 10.4% | |

Total Revenue | 393.1 | 231.2 | 227.6 | 246.3 | 328.3 | 454.8 | |

Growth % | -41.2% | -1.6% | 8.2% | 33.3% | 38.5% | 7.5% |

Source: Rambus

Based on the company’s annual report, its Product revenue segment “consists primarily of memory interface chips” and it is also stated that it is “an increasingly growing part” of the company. Its customers include the largest memory companies including Micron (MU), Samsung (OTCPK:SSNLF) and SK hynix.

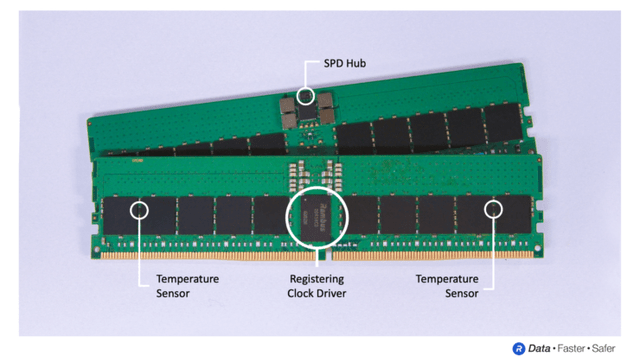

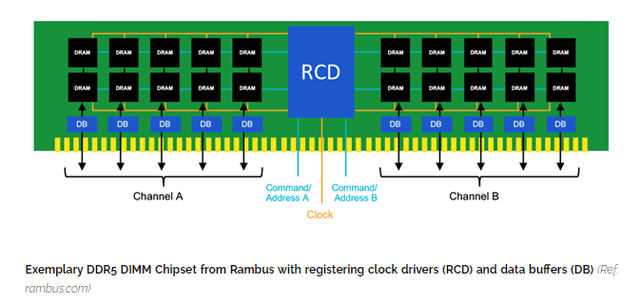

Rambus Lumenci

The diagram above by Rambus and Lumenci shows a Dual In-Line Memory Module (DIMM) which “is a module containing one or several Random Access Memory (‘RAM’) or Dynamic RAM (‘DRAM’) chips on a long, thin strip of printed circuit board with pins that connect it directly to the computer motherboard” according to Lumenci. Furthermore, the DIMM contains multiple memory chips which “are arranged in groups called ranks that can be accessed simultaneously by a memory controller” and contains either 8 or 16 DRAM chips depending on the configuration of the module.

Rambus’ products include the SPD Hub which is:

the center for control plane communication between DIMM components such as the registered clock driver (RCD), power management IC (‘PMIC’) and thermal sensors and system management devices such as the central processor or baseboard management controller (BMC) – Microcontroller Tips.

Furthermore, the company’s products include temperature sensors which allow:

accurate monitoring of the DIMM module temperature to better estimate the DRAM case temperature (T CASE) to prevent it from exceeding the maximum operating temperature – NXP.

Finally, it also has an RCD which is a significant component and “its main function is to first receive the instructions or commands from the CPU before sending them to the memory modules” according to ATP Electronics.

Furthermore, the company also derives Royalty revenues from its patent licenses by providing “certain rights” to its patents. The company signs agreements with chipmakers granting them licenses to use its memory controllers in their chips. Its customers include:

- Memory Makers: Its customers include memory markers such as Kioxia, Micron, Nanya (OTCPK:NNYAF), Toshiba (OTCPK:TOSBF), Western Digital (WDC), Samsung and SK hynix. For example, Micron pays Rambus royalties for using its patents. Rambus’ memory interface products are used in the assembled DIMM for regulating temperature and ensuring connectivity between the DRAM chips with the CPU.

- GPUs Chipmakers: The company’s customers also include GPU chipmakers such as AMD (AMD) and Nvidia (NVDA). For example, the company previously gave Nvidia permission to “a patent license for certain memory controllers at a 1 percent royalty rate for SDR memory controllers”. Graphics cards consist of memory controllers which facilitate the data flow between the memory component and the GPU chip.

- Smartphone AP Chipmakers: Companies such as MediaTek and Qualcomm (QCOM) use Rambus’ patents in their mobile chipsets. We believe this also relates to memory controllers used in their mobile chipsets. According to Mobiles Explained, “a memory controller integrated into the processor plays an important role, as it provides a direct link to your phone’s memory”. Furthermore, “it ensures an instant connection to frequently used files and applications” which results in more efficient performance.

- Networking Chipmakers: The company’s customers also include Marvell (MRVL), Broadcom (AVGO) and Cisco (CSCO). According to Rambus, Marvell signed an agreement to use its “patented memory controller, SerDes and security technologies”. The memory controller facilitates the data flow between the ethernet chip and memory. Also, a “SerDes is a functional block that Serializes and Deserializes digital data used in high-speed chip-to-chip communication” according to Synopsys.

Based on the table, its revenue from Product Revenue has grown strongly and positively in all of the past 5 years. Its segment growth was much higher than its total growth except in 2021 when Royalty revenue growth surged in that period. Overall, its revenue growth was mainly driven by its Product revenue segment which includes its memory interface products.

We believe that product revenue will continue to increase in 2023 as compared to 2022, mainly from the sale of our memory interface chips. – Rambus Annual Report 2022

Overall, its Product Revenue segment which consists of memory interface products was its main driver of growth and management expects it to continue driving its growth going forward. We further examine whether the company’s memory interface could continue to drive its growth below.

Benefit From High Market Growth than Increasing Market Share

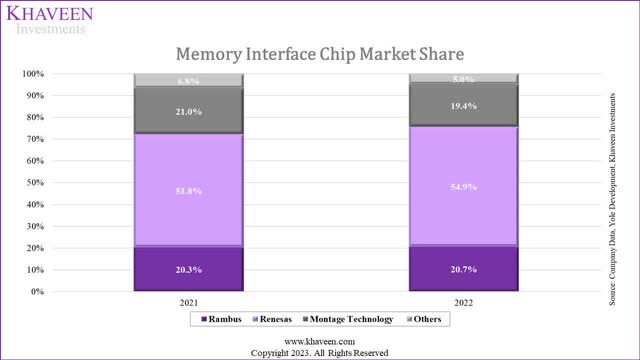

In the memory interface chip market, the company competes with Renesas and Montage Technology, which together with Rambus, accounted for 95% of the market share according to Yole Development. In the company’s 2022 annual report, management attributed the company’s strong performance “due to continued market share gains” of memory interface chips. Thus, we examine the company’s market share by deriving it based on the memory interface market by Yole Development.

Company Data, Yole Development, Khaveen Investments

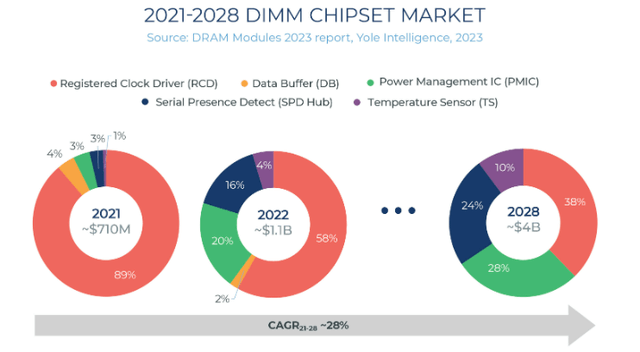

Based on Yole Development, the memory interface market was valued at $1.1 bln in 2022 and grew rapidly by 55%. Furthermore, the market is projected to grow at a CAGR of 28% according to Yole Development.

Based on Rambus’ revenue of $227.4 mln in 2022, we calculated its market share at 20.7% in 2022. In addition, we derived its 2021 market share of 20.3% based on its 2021 Product segment revenue. In addition, we estimated Renesas’ market share based on its investor presentation’s 2023 target of JPY100 bln ($1 bln) and Industrial, Infrastructure and IoT growth rate (64%). Renesas had the highest share of 54.9%, which increased from 51.8% in the prior year. Furthermore, we estimated Montage Technology’s share at 19.4% as the remainder of Renesas and Rambus from a combined 95% based on Yole Development. The company’s share decreased from 21% based on its 2022 revenue growth rate of 43.3%.

Overall, we believe Rambus’ slight share increase of only 0.4% to 20.7% in 2022 indicates that its market share did not increase substantially and was rather flattish in 2022. Thus, we attribute its strong performance to the strong market growth rather than mainly due to share gains.

Content Growth Supported by DDR Technology Advancements

Yole Development

Based on the chart above from Yole Development, the memory interface market is projected to reach $4 bln from $1.1 bln in 2022. Over the past year, the share of PMIC, SPD Hub and Temperature Sensor has increased compared to 2021. Furthermore, the share of these products is expected to continue increasing through 2028 according to Yole Development. This is attributed to new DDR generations. For example, according to Rambus, “the DDR5 server DIMM chipset replaces the DDR4 SPD IC with an SPD Hub IC and adds two temperature sensor (TS) ICs. The SPD Hub has an integrated TS, which in conjunction with the two discrete TS ICs, provides three points of thermal telemetry from the RDIMM”. Thus, we believe that the content growth in DDR5 memory could benefit Rambus as it has TS and SPD chips from the previous point.

The number of DIMM chips per module has increased with the most recent DDR generations. The on-module chipset includes RCD, DB, PMIC, SPD Hub, and temperature-sensor chips for the most advanced modules. – Yole Development

Rambus

According to Rambus, one of the key focus areas for the company is “Next-Gen Memory Architectures and Performance”. Based on its Q1 2023 earnings briefing, management highlighted that the company was “making good progress on the follow-on generations of DDR5” with its “Gen 2 RCD in qualification across the ecosystem” and Gen 3 sampling to customers. Furthermore, the company “recently announced GDDR6 interface, achieving a best-in-class data rate of 24 gigabit per second”.

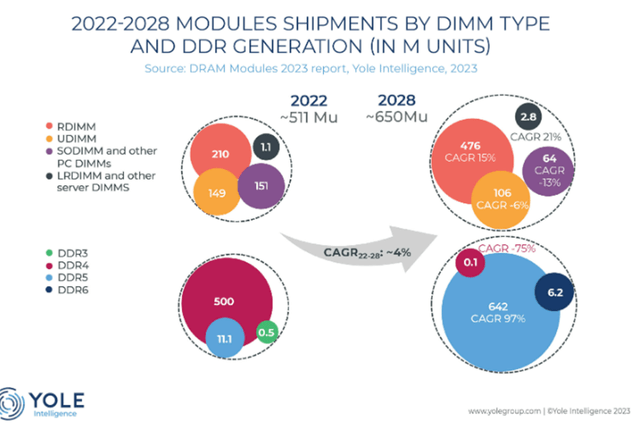

Yole Development

The diagram above shows Yole Development’s breakdown of the memory modules market by DIMM and DRR types in 2022. Different DDR types represent different standards of DIMM. Based on Utmel, “each generation of DDR update is accompanied by a doubling of the number of memory prefetch bits (2bit-4bit-8bit), which brings a doubling of memory bandwidth”. Yole Development projected DDR5 shipments to grow at a 62% CAGR to 642 mln by 2028 while DDR6 is projected to reach 6.2 mln. Additionally, Yole Development projected the DDR5 DIMM chipset to be valued at $4 bln by 2028 and “is expected to overtake DDR4 by 2024 in terms of market share”.

While we expect Rambus to capitalize on the market growth opportunities from DDR5, both Renesas and Montage Technologies also have competing DDR5 technologies and thus we believe it is not an advantage for Rambus. Notwithstanding, we believe Rambus stands the chance to continue benefitting from the strong memory interface chipset market growth outlook.

Risk: Short-Term Market Headwinds

Despite the positive market outlook, in Q1 2022, the company’s total revenue grew by 14.8% YoY which represents a slowdown compared to its solid 2022 growth (38.5%). In its Q1 2023 earnings briefing, management does “expect a stronger second half as inventories return to more normal levels and demand for DDR5 continues to ramp”. Despite this statement, management provided weak guidance of $114 mln at midpoint which represents an annualized growth rate of 0.26% for total revenues. Analyst revenue growth consensus for Rambus is only 4.5% in 2023 but increases to 15% in the following year. Also, management cited that “DDR4 inventories remain high at some end customers”. Previously, the company stated in its Q4 2022 briefing that the company has “improved visibility of supply” but was seeing “elevated inventory levels at some end customers” and that this is the reason for “softness in the first half”.

DRAM Market vs Rambus | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

DRAM Market ($ bln) | 71.71 | 99.66 | 62.48 | 67.04 | 94.92 | 80.10 |

Growth % | 39.0% | -37.3% | 7.3% | 41.6% | -15.6% | |

Rambus Memory Interface Revenues ($ mln) | 35.379 | 39.304 | 75.108 | 113.298 | 144.452 | 227.4 |

Growth % | 11.1% | 91.1% | 50.8% | 27.5% | 57.4% |

Source: Company Data, TrendForce, Khaveen Investments

Based on the table, we compared the DRAM market and Rambus’ memory interface chip revenue. As seen, the company had strong growth in 2022 despite the market weakness in DRAM. Its revenue growth had also been strong in 2019 despite the decline in the DRAM market in that year. Therefore, the company’s revenue growth does not appear to follow the DRAM market.

Rambus Revenue Forecast ($ mln) | 2020 | 2021 | 2022 | 2023F | 2024F | 2025F | 2026F | 2027F |

Total Revenue | 246.3 | 328.3 | 454.8 | 479.9 | 515.7 | 554.2 | 595.5 | 639.9 |

Growth % | 8.2% | 33.3% | 38.5% | 5.5% | 7.5% | 7.5% | 7.5% | 7.5% |

Source: Company Data, TrendForce, Khaveen Investments

To conclude, the company’s growth slowed down in Q1 2023 and management provided weak guidance which we believe highlights the challenging market conditions remaining significant headwinds in the short term. Thus, we conservatively forecasted the company’s revenues through 2027 in the table above. For 2023, we based our forecast on its actual Q1 results and Q2 guidance while for H2, we projected it based on its past 5-year growth rate of 7.5%, thus resulting in a growth rate of 5.5% in 2023 which is lower than 2022. Beyond 2023, we forecast it based on its past 5-year average of 7.5%.

Verdict

Rambus experienced significant growth primarily driven by its Product Revenue segment, which includes memory interface products. The company expects this segment to continue fueling its growth in the future. However, upon closer examination, Rambus’ market share only saw a slight increase of 0.4% to 20.7% in 2022, suggesting that its market share remained relatively stable rather than experiencing substantial growth. Therefore, we attribute Rambus’ strong performance more to the overall market growth rather than significant gains in market share. While we expect Rambus to benefit from the opportunities presented by the DDR5 market growth, competitors such as Renesas and Montage Technologies also offer competing DDR5 technologies. Additionally, the company’s management had provided weak guidance for 2023 despite being optimistic about a stronger H2.

Nonetheless, we believe Rambus has the potential to continue benefiting from the positive market outlook for memory interface chipsets beyond 2023. However, we believe the short-term headwinds the company faces could impact its outlook in 2023 and we conservatively forecasted its growth at only 5.5% factoring in management guidance which is a significant decline from its 2022 performance (38.5% growth). Based on analysts’ consensus price target of $65.50, we rate the company as a Hold with an upside of only 8.6% given the weak outlook this year compared to 2022 and its stock price had already increased by 180% in the past year.