Massimo Giachetti

Author’s note: This article was released to CEF/ETF Income Laboratory members on September 24th.

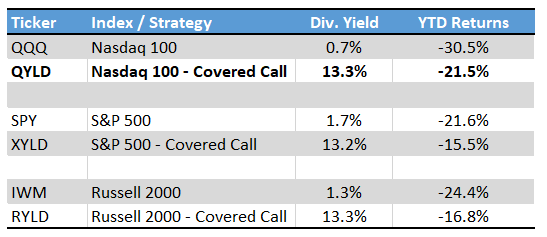

The Global X NASDAQ 100 Covered Call ETF (NASDAQ:QYLD) is a Nasdaq 100 covered call ETF.

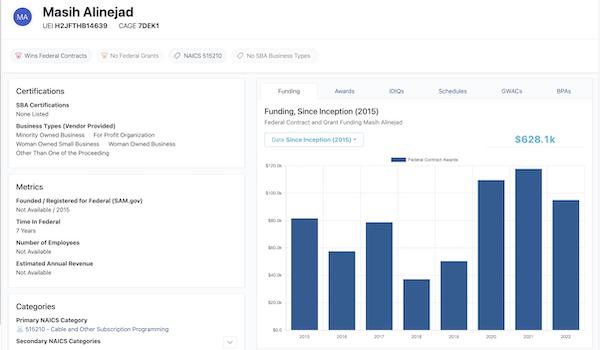

Covered call funds are extremely popular investments in retirement circles, and with good reason. Covered call funds offer investors strong, fully-covered dividend yields, albeit low potential capital gains. QYLD itself yields 13.3%, an incredibly strong yield, although in-line with its covered call peers.

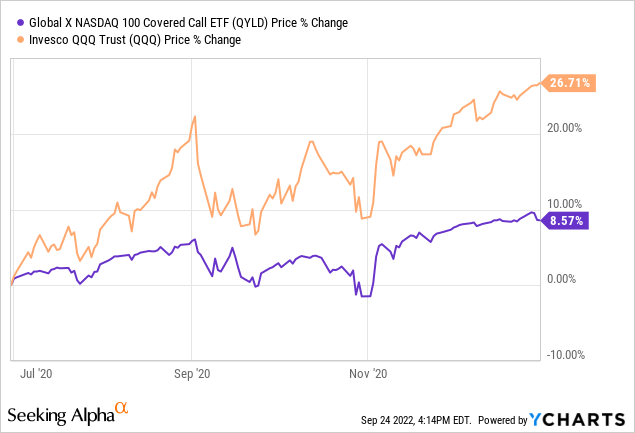

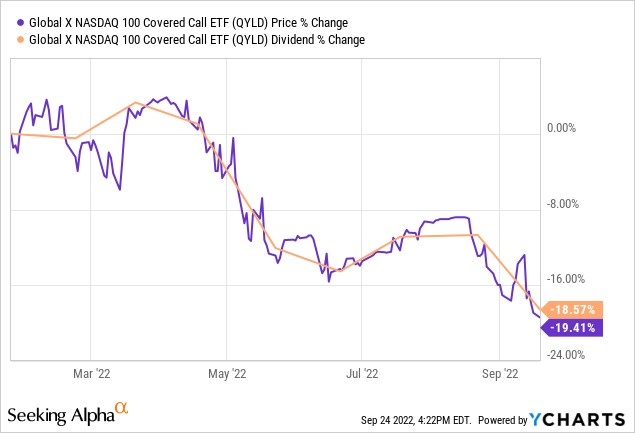

QYLD’s strong dividends have been particularly impactful this year, as equities tumble and capital gains are non-existent. Said dividends have allowed QYLD to outperform relative to the Nasdaq 100, and by quite a large margin. Other covered call funds have outperformed their respective indexes as well.

Seeking Alpha – Chart by Author

Although QYLD and its peers have many benefits, mostly their strong dividend yields, they have many drawbacks as well. Chief among these is their low potential capital gains: covered call funds see very lackluster share price appreciation during bull markets and recoveries, the latter of which likely prove decisive in the coming years.

Equities have seen very large drawdowns YTD, but equities will almost certainly recover sometime in the future. When that happens, most equity funds will see significant capital gains. QYLD, on the other hand, should see very little in capital gains, lagging behind most equity indexes. QYLD’s dividends should stagnate as well, as these are somewhat dependent on capital levels, which are stagnant. In simple terms, no capital gains mean no capital growth, and no capital growth means no income growth.

QYLD will almost certainly underperform once equity markets recover, a significant negative for the fund and its shareholders, and an important fact for investors to consider. In my opinion, QYLD’s investors should strongly consider reinvesting a portion of their dividends in other funds, to ensure capital gains and dividend growth once markets recover, and to take advantage of cheapening valuations and rising interest rates. QYLD provides investors with strong dividend yields, and I think investors should take advantage of that fact.

I’ll be taking a closer look at how QYLD works in this article, but focusing on the implications of reduced capital gains moving forward.

QYLD – Overview

Covered call funds invest in equities, and sell covered calls on their holdings. Doing so trades away most potential capital gains for increased income, while downside potential remains unchanged.

QYLD itself invests in all Nasdaq-100 components, and sells covered calls on the entirety of its holdings. For simplicity’s sake, I’ll be assuming that QYLD invests in the Invesco QQQ ETF (QQQ), a Nasdaq-100 ETF. There are no functional differences between said assumption and QYLD’s actual strategy and holdings.

QYLD invests in QQQ, at a current share price of $275.

QYLD then sells covered calls on the entirety of its shares to a counterparty.

Selling a covered call gives QYLD’s counterparty the right, but not the obligation, to buy QQQ at a predetermined date, for a predetermined price. In QYLD’s case, the date is one month in the future, and the price is always slightly higher than the current share price, let’s say $280.

What happens next depends on QQQ share price movements.

If QQQ’s share price surges, let’s say to $400, the counterparty would buy QQQ from QYLD at the predetermined price of $280, sell it on the market for $400, and profit from the spread. QYLD would have bought at $275, and sold at $280. Capital gains would have been very low, even as QQQ surged. Capital gains were, effectively, given away to the counterparty. In graph form, profits for QYLD would be as follows.

Investopedia – Chart by Author

If QQQ’s share price decreases, let’s say to $200, the counterparty would refrain from exercising the option. Said counterparty would not decide to buy QQQ at the predetermined price of $280 if the market is offering shares at $200. QYLD would retain ownership of its QQQ shares, bought at $275, with a current market price of $200. Capital losses are equal to those of QQQ.

In exchange for the above, QYLD receives a flat premium from the counterparty. The premium compensates QYLD for the loss of (almost all) potential capital gains. Premiums vary widely, but are currently equal to 43% annualized, a staggering amount, but significantly higher than average, due to heightened volatility and high option prices.

In short, selling covered calls means trading away most potential capital gains for increased income, while downside potential remains unchanged.

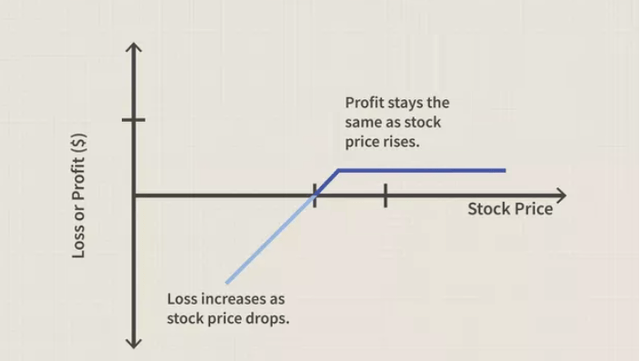

Covered Call Funds – Performance During Bear Markets

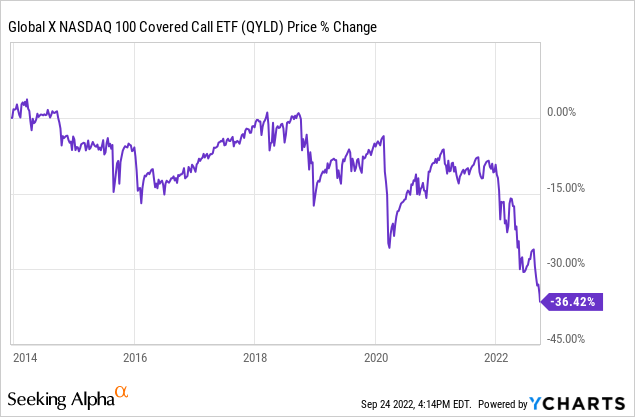

Covered call funds invest in stocks, and so should see lower share prices when stocks are down. Losses should roughly equal the losses of their reference index. QYLD should see similar losses to QQQ when stocks are down, as has been the case YTD. Other indexes included for reference.

Seeking Alpha – Chart by author

As covered call funds have limited upside potential, recoveries are difficult, and tend to be quite shallow. As an example, QYLD saw capital gains of 8.6% in 2H2020, during which QQQ surged by 26.7%. Gains were significantly lower, as expected.

Let’s explain the above, using QYLD as an example.

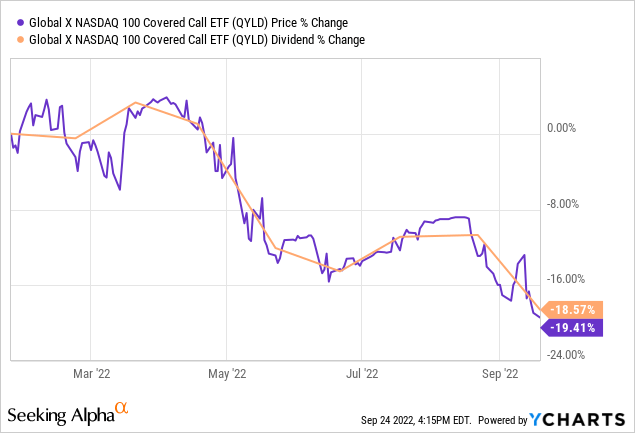

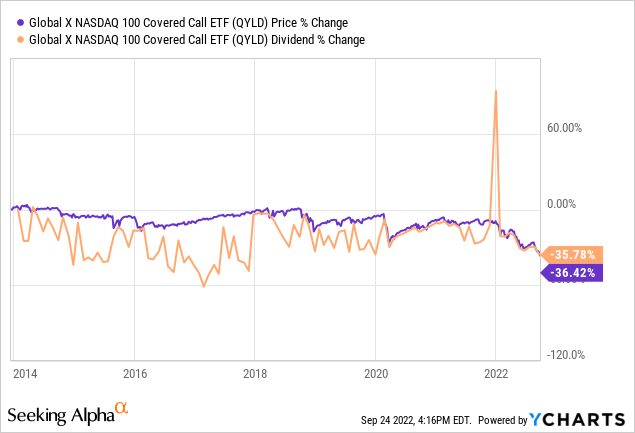

QYLD buys QQQ, and sells covered calls on its holdings. Option premiums are distributed to shareholders, although distributions are capped at around 1.0% per month. Option premiums are strongly dependent on asset values: QYLD generates higher premiums from selling options on an expensive asset versus selling options on a cheap asset. So, higher QQQ prices means higher option premiums for QYLD, and hence higher distributions for QYLD’s investors. The opposite is true as well, with lower QQQ prices ultimately resulting in lower dividends for QYLD’s investors. This has been the case for QYLD YTD, as expected.

As covered call fund dividends are somewhat dependent on asset values / share prices, and as said funds should see long-term capital losses, dividends should also trend downwards long-term.

Covered call funds tend to see declining share prices and dividends in the long-term, two very significant negatives for shareholders. Yields are incredibly strong too, QYLD yields a whopping 13.3%, but these are very significant, negative issues, that investors should be aware of.

There are several ways to limit the negative impact from the above.

Investors can re-invest some of their dividends, thereby ensuring consistent capital levels and dividends received throughout the years. By my estimates, reinvesting around 5.0% of QYLD’s dividends would ensure consistent long-term capital levels, but these are very rough figures, and strongly dependent on future market movements. Re-investing a portion of these dividends in other high-yielding funds would work as well, and would take advantage of declining asset prices. QYLD provides investors with a very hefty dividend yield, and I think opportunistically deploying said dividends during periods of market weakness to be a fantastic idea.

Investors can also choose to invest in more diversified covered call funds. Diversification reduces the possibility of significant losses and underperformance. The Global X S&P 500 Covered Call ETF (XYLD) has less tech exposure than QYLD, so outperforms during tech routs, as has been the case YTD. Diversification also reduces the possibility of significant capital gains: tech significantly outperformed in 2020, so tech-focused funds outperformed there too. Covered call funds have limited upside potential, so this is less of a negative for these funds. QYLD experienced few gains when tech soared in prior years, but has experienced the full brunt of capital losses once tech valuations normalized, a dreadful combination, and one investors might prefer to avoid.

Something that doesn’t work, but which has come up in conversations with readers and subscribers, is to opportunistically invest / re-invest dividends in these funds during market downturns. In most cases, investing during downturns means locking-in above-average yields, a significant benefit for income investors. Covered call funds see lower dividends as share prices decrease, so investors see no benefit from investing in these funds when share prices are lower than average. QYLD’s dividends declined as share prices tumbled, so investing at lower share prices would not have meant higher dividend yields.

Conclusion

QYLD offers investors a strong, fully-covered, double-digit dividend yield. The fund also sees significantly reduced capital gains during bull markets and recoveries, a negative for the fund and its shareholders. Reduced capital gains put pressure on fund asset values and dividends. As such, investors should consider re-investing a portion of their dividends in QYLD or other funds, so as to ensure sustainable long-term capital and dividends.