Douglas Rissing/iStock by way of Getty Photos

Expensive companions,

The Fund had an distinctive efficiency final 12 months – helped in no small half by benign world markets.

Allow us to be conscious that the inventory market conduct just isn’t synchronous with the underlying firms monetary outcomes: the working progress of most of our portfolio got here in all probability shy of the rise of their share costs. Their Annual Outcomes are anticipated to be launched in March, when extra particulars can be supplied.

Whereas we’re definitely happy with 2024’s outcomes, such years come far and between. It could be some time till it’s repeated, so mood your expectations.

Annual | ACWI | SPY | |

2020 (Dec) | 3.7% | 3.4% | 3.3% |

2021 | 23.2% | 16.6% | 27.0% |

2022 | -17.1% | -19.8% | -19.5% |

2023 | 8.6% | 19.9% | 24.3% |

2024 | 35.8% | 15.5% | 23.3% |

Collected | 56.2% | 34.5% | 61.9% |

Annualized | 11.5% | 7.5% | 12.5% |

ACWI and SPY are ETFs that monitor the efficiency of the MSCI All-Nation World and the S&P 500 indexes, respectively. As a reminder, the ETFs proven within the desk above should not benchmarks. The Fund in the mean time has no place in any of their constituents. Its NAV (Web Asset Worth) is calculated in spite of everything charges and bills. |

All year long, many of the Fund’s property have been concentrated in our core positions: Tianjin Growth (OTCPK:TJSCF), First Pacific (OTCPK:FPAFY), Sanjiang Chemical substances (OTCPK:CNSJF), Halyk Financial institution and Compagnie de l’Odet (OTCPK:FCODF). There isn’t any level in discussing their latest monetary developments proper now; it makes way more sense to attend a few months so as to have up to date data. In any case, we may be assured that Sanjiang Chemical substances, First Pacific and Halyk Financial institution had from good to glorious years.

Due to this fact, equally to the First Letter of 2024, it is a pretty brief Letter. Its objective is to tell that:

- Final 12 months was good;

- Prospects stay nearly as good as ever;

- There’s nothing actually new to report when it comes to positions.

A short word on Compagnie de l’Odet

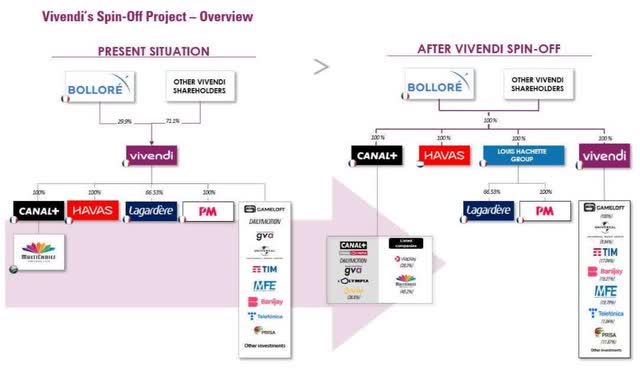

In the course of the Fund’s Annual Occasion in December, I discussed en passant that Vivendi (VVVNF, an organization managed by Bolloré SE (OTCPK:BOIVF), which in its flip is managed by Compagnie de l’Odet, certainly one of our positions) was within the means of splitting into 4 unbiased listed entities. It was efficiently accomplished by the top of 2024.

Now, along with an enormous pile of money (results of the sale of its logistics property), Bolloré has vital stakes in 5 listed firms:

- Common Music Group (OTCPK:UMGNF, which dwarfs the remaining ones);

- Canal+ (which in its flip controls Multichoice in South Africa);

- Havas (OTC:HAVSF);

- Louis Hachette Group (which in its flip controls Lagardère);

- the remaining Vivendi (whose important asset is a ten% stake in UMG, amongst a myriad of smaller participations).

Some market individuals anticipated a re-rating as a consequence of the cut up – Vivendi had for a very long time traded at a big low cost to the sum-of-its-parts – however at the very least till now, it didn’t occur. The truth is, the totality of the newly listed firms are buying and selling at a decrease stage than earlier than the spin-offs.

Up to now 5 years, Vincent Bolloré has 1) bought 30% of UMG to Tencent and Pershing Sq.; 2) IPOed UMG; 3) bought Bolloré Africa Logistics; 4) bought the remaining Bolloré Logistics property; 4) acquired management of Multichoice: 5) acquired management of Lagardère; 6) cut up Vivendi in 4 listed property. All multi billion euro offers.

It appears affordable to count on that the extraordinarily excessive liquidity of Bolloré Group – greater than € 6 billion in internet money – can be put into good use, both benefiting from mispriced property the Group already controls, or into new ventures.

We do know that buybacks on the Bolloré SE stage occur nearly each week. To be seen.

Finest regards,

Diego B. Milano

Authentic Submit

Editor’s Observe: The abstract bullets for this text have been chosen by Searching for Alpha editors.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.