JHVEPhoto

Introduction

Recognized for its lineup of Snapdragon processors for cell units, Qualcomm (NASDAQ:QCOM) additionally gives a various array of automotive and Web of Issues (IoT) merchandise, and extra not too long ago, AI chips. Qualcomm’s semiconductor choices fall underneath its QCT section – which derives its income from supplying built-in circuits and system software program to corporations that require semiconductors, like Samsung and Dell.

R&D investments made by the QCT section permit Qualcomm to keep up its technological edge and always provide you with patented breakthrough know-how. Qualcomm’s QTL section then grants licenses and gives rights to make use of parts of the agency’s mental property portfolio to different corporations. Qualcomm’s patent portfolio primarily consists of applied sciences utilized in cell units, reminiscent of 5G, RF, graphics and Wi-Fi applied sciences.

Funding Overview

Due to Qualcomm’s know-how management within the fast-growing automotive and edge AI sectors, and constant positioning within the smartphone chipset enterprise, I firmly imagine that Qualcomm will proceed to develop their high and backside line of their product segments. Subsequently, I fee Qualcomm inventory a ‘Purchase’.

Smartphone Choices

Qualcomm instructions a big market share within the world smartphone chipsets market, accounting for round 20% of world shipments in 2023. With early investments in 5G know-how, Qualcomm has additionally secured a dominant place within the premium 5G chipset market with a 44% share.

The anticipated CAGR of the overall smartphone software processor (AP) market is just within the low single digits as a consequence of excessive smartphone saturation globally. Nevertheless, the migration to newer 5G mobile units and on-device generative AI adoption on premium smartphones could spur an upgrading cycle – one thing already seen in elevated demand for MediaTek’s 5G chips. 5G and Gen AI current themselves as tailwinds for Qualcomm’s income, given QCOM’s established place supplying 5G modems to premium smartphone producers; I might challenge Qualcomm’s smartphone chipset income to develop at excessive single digits.

Automotive Growth

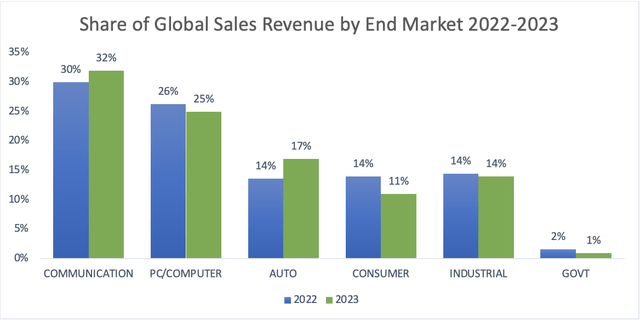

Qualcomm’s guess into the high-end automotive business seems to be paying off as nicely. Whereas the smartphone semiconductor market is nearing saturation, the booming automotive semiconductor is seeing excessive progress, experiencing the biggest progress in share of chip gross sales in 2023.

Breakdown of semiconductor market (semiconductor.org)

I imagine that latest traits within the automotive business will improve the contribution of the automotive section to Qualcomm’s total income, serving to QCOM obtain diversification into extra steady, faster-growing sectors.

Semiconductors now take up a considerable portion of the price of an automotive. Electronics account for almost 35% of a brand new automobile’s complete value and is prone to develop to 50% by the tip of this decade, pushed by traits like security, electrification and autonomous driving. Due to this, the worldwide automotive semiconductor market was valued at US$ 59 billion in 2023 with a gentle 7% ahead CAGR. The sector presents immense potential – India’s rising ADAS market and elevated adoption of autonomous driving know-how are all themes that might assist the automotive semiconductor obtain extra returns, and with that, Qualcomm’s revenues.

Qualcomm’s automotive enterprise has been doing higher than its opponents, with its automotive options being higher acquired and faster progress. Evaluating Qualcomm’s automotive portfolio to its opponents like Nvidia and Mobileye, Qualcomm’s serviceable addressable market and pipeline is considerably bigger ($45 billion in comparison with Nvidia’s $14 billion) as a consequence of its diversified merchandise, together with chips for digital cockpit units, infotainment, and connectivity. Whereas opponents solely provide particular options like ADAS and self-driving, Qualcomm’s diversified merchandise permit it to seize a better income share and extra importantly, to determine stronger business partnerships by working with automotive producers in horizontal integration with different digital techniques within the automotive.

Talking of business partnerships, Qualcomm has additionally established sturdy business relationships to provide its merchandise an edge over opponents. As an illustration, it has partnered with SalesForce to ship a personalised consumer expertise by means of information analytics, and collaborates extensively with different suppliers within the automotive digital business to develop new merchandise, reminiscent of Bosch and Innoviz. Over time, this provides Qualcomm each a technological edge and improves its skill to deal with provide chain dangers, which is essential in coping with exogenous disruptions within the extremely susceptible semiconductor business. After all, Qualcomm already provides chips to luxurious automotive manufacturers like BMW and Mercedes, and it has even co-developed ADAS techniques with BMW in a strategic relationship.

Shifting shopper sentiment in direction of ADAS options additional underscores the attain that ADAS has achieved. This, mixed with the trickle-down impact – the place automotive know-how trickles down from the luxurious automobile section to the amount passenger automobile market – will considerably form the adoption of ADAS within the broader automotive market. Whereas ADAS integration in luxurious automobiles stands notably excessive at 53% as of 2023, penetration in mass-market automobiles stays comparatively modest, presently at 12%. The nascent market potential for ADAS options in mass-market vehicles represents a compelling progress alternative for Qualcomm.

Whereas there’s definitely the potential risk of recent entrants, semiconductor applied sciences should bear an extended qualification cycle as a consequence of laws and the wants of the business. This presents itself as an inherent barrier to entry for brand spanking new opponents, and the longer Qualcomm is within the automotive semiconductor market, the extra acquainted will probably be with the laws and the fixed adjustments.

The mixed impact of all these components offers Qualcomm a major edge over its opponents. Trying on the present market share for automotive chips, Qualcomm dominates the market with over 80% of the market share. I’m comfy with a long-term share of 60%, and mixed with a projected CAGR of the automotive chips market of 40%, Qualcomm’s automotive section will seemingly see comparable progress charges. The projection income is barely above Qualcomm’s forecasted >$4 billion in 2026, reaching >$5 billion in 2026, however I’m assured that Qualcomm’s established place on this excessive barrier-to-entry business justifies this optimism.

Development Prospects in AI

The burgeoning narrative round Qualcomm is about AI PCs. Qualcomm’s latest partnership with Microsoft to supply on-device AI chips (Snapdragon X) for Microsoft’s new Floor laptop computer lineup has vastly improved their progress prospects.

Qualcomm’s partnership with Microsoft (Qualcomm)

I anticipate income from the PC-related market with Qualcomm’s AI chips to solely hit Qualcomm’s revenue assertion in 2025, as expectations of gross sales of such “AI PCs” will solely begin to rise considerably over the following three years.

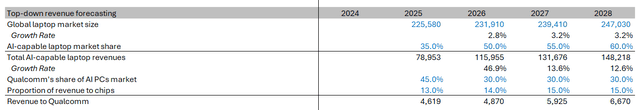

Utilizing a top-down income mannequin, I begin with world laptop computer revenues. To challenge the market share of AI-capable laptops, I reference ahead projections from business; HP estimates about 50% of shipments in 2027 to be AI-capable, whereas IDC forecasts AI PCs capturing almost 60% of the worldwide PC market share in 2027. Qualcomm is estimated to personal about 25% of the AI PC market by 2026 based mostly on projections from JPMorgan Chase, nonetheless, with the premium pricing on laptops with Qualcomm merchandise, Qualcomm could find yourself with the next market share when it comes to income. Assuming Qualcomm takes round 14% of the income of every laptop computer, I receive Qualcomm’s AI-related income.

Prime-down income mannequin (HP, IDC, JPM)

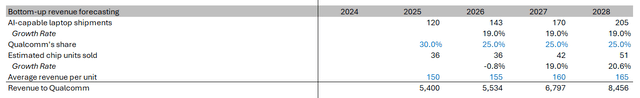

Utilizing a bottom-up income forecasting mannequin offers an identical conclusion. To forecast the amount of AI chips offered, I estimate the overall amount of AI-capable laptop computer shipments utilizing market analysis from Canalys, which places the amount of shipments at greater than 100 million in 2025, ultimately reaching 205 million in 2028. That is corroborated by IDC’s projection of 167 million shipments in 2027. Already by This autumn 2024, shipments of AI-capable PCs are anticipated to rise to round 20 million items, capturing over 25% of world PC shipments, which additional makes me comfy with projecting a excessive 120 million shipments beginning in 2025 alone. With an estimated per unit value of USD$150, I arrived at Qualcomm’s AI-related revenues.

Backside-up income mannequin (Canalys, IDC)

Taking the typical of the income from these two fashions offers Qualcomm’s income from its AI chip choices in laptops.

Income Forecasting

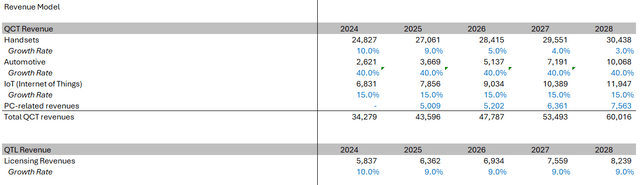

I forecasted Qualcomm’s future revenues by breaking down Qualcomm’s revenues by part.

Beginning with Qualcomm’s handset income, I mannequin the expansion charges at single digits CAGR because of the thesis described within the above sections, and equally for the automotive and AI PC section. For the IoT section, I anticipate Qualcomm’s income to develop in step with the broader market at 15% CAGR.

QTL is predicted to keep up its present income scale and margin profile for the QTL section. I anticipate QTL revenues to stay largely depending on the efficiency of the general smartphone market, as Qualcomm’s patent and IP portfolio continues to be largely oriented round smartphone know-how. Therefore I mannequin QTL revenues to largely observe income progress of the smartphone section.

Qualcomm’s income segments

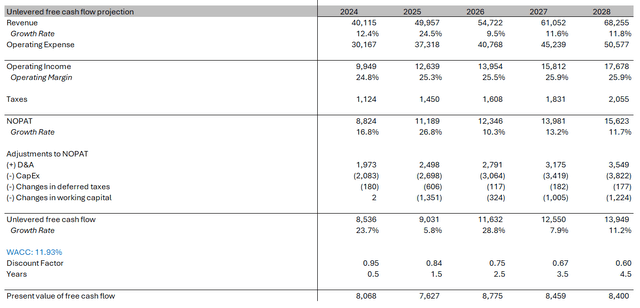

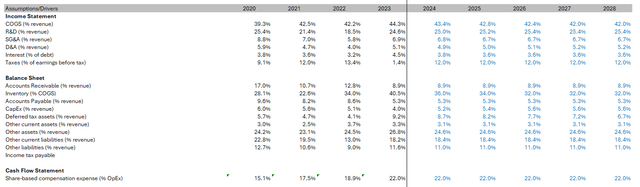

Historic working margins for Qualcomm have been round 26%. Contemplating that pent-up pandemic demand drove margins to a excessive of 35.6% in 2022 and the smartphone market downturn in 2023 which induced a low 20% margin, I might anticipate a gradual return to a 26% margin, assisted by administration’s cost-cutting efforts. Utilizing a WACC of 11.93% in keeping with GuruFocus, I low cost money flows.

Qualcomm’s discounted money flows

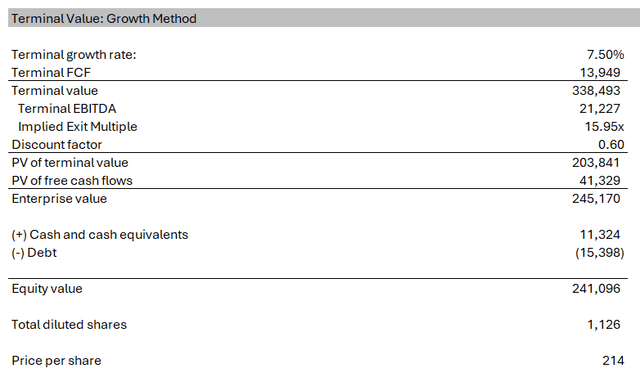

Qualcomm has a excessive long-term progress fee of seven.5%, contemplating the opportunity of long-term progress within the automotive market and additional 6G upgrading cycles. This places Qualcomm’s exit a number of in step with its 5Y common EV/EBITDA of 16.0x. Summing terminal worth and section 1 money flows to get the enterprise worth, I take away internet debt to acquire the fairness worth and an implied share worth of $214.

Qualcomm’s per share worth

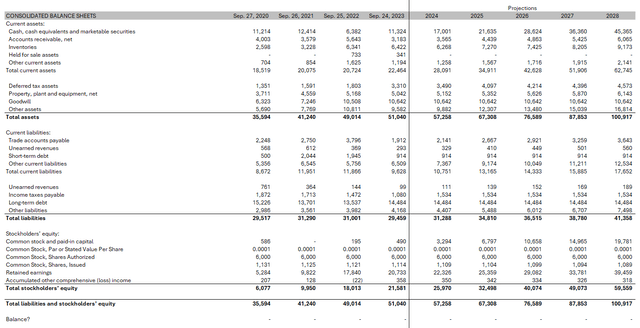

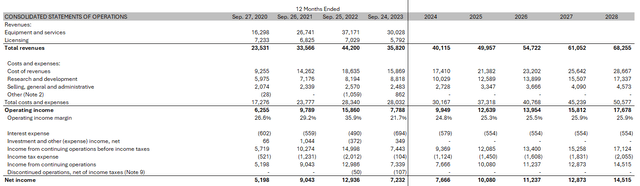

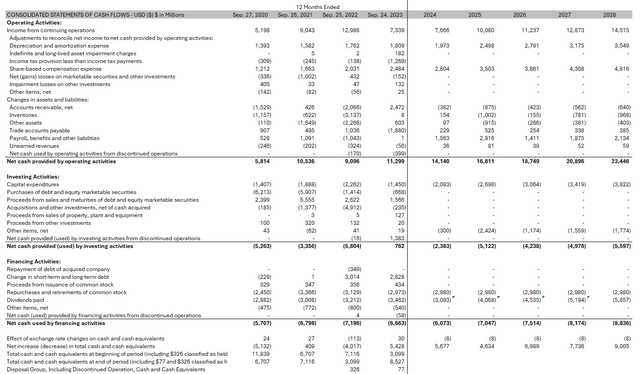

I’ve additionally included forecasts of Qualcomm’s 3 monetary statements beneath.

Qualcomm’s steadiness sheet Qualcomm’s revenue assertion Qualcomm’s assertion of money flows Assumptions/Drivers

Dangers

Arm is suing Qualcomm over the precise to make sure chips with its know-how after Qualcomm acquired CPU firm Nuvia in 2021, and with it, Nuvia’s Arm license. Whereas it’s seemingly that the 2 corporations will attain a settlement earlier than the trial, there’s nonetheless an actual threat {that a} protracted authorized battle would dispute the entry of those AI laptops into the market. I might preserve a watch out for any potential developments that will both reaffirm the authorized viability of those merchandise or affect the sleek gross sales of Microsoft’s AI laptops.

Remaining Phrases

Opposite to the opinion that Qualcomm’s enterprise is a low-moat enterprise, I really feel that there are appreciable limitations to entry within the enterprise that Qualcomm operates in. It takes a chronic quantity of funding and appreciable know-how accumulation to determine a place within the extremely aggressive market – Huawei’s wrestle to make a dent available in the market share is an illustration of this, regardless of assist from the Chinese language authorities in its HiSilicon chips unit, and the struggles of semiconductor corporations within the automotive area reveals the business know-how required to do nicely in automotive electronics.

I give QCOM a BUY ranking with a TP of USD214 per share, pegged at ~10x P/BV, barely decrease than its 5-year median of 15.84. With the restoration within the smartphone market and Qualcomm’s sturdy pipeline of AI-related choices and automotive integration, I’m assured of their prospects. I imagine that Qualcomm will proceed to achieve share in these rising markets and is fairly valued relative to the potential for considerably larger earnings.