Eduard Lysenko

Qualcomm (NASDAQ:QCOM) was based in 1985 by a bunch of tremendous sensible engineers led by Irwin Jacobs. They’d a imaginative and prescient for a future the place folks related and communicated by handheld units; Qualcomm sits on the coronary heart of the applied sciences of the telephones we use at the moment. The identify is brief for ‘high quality communications.’ The corporate has pioneered the cutting-edge chip expertise that permits telephones to attach with towers over radio frequency (RF). Their expertise has allowed 3G, and 4G and is at the moment supporting the 5G build-out.

As a consequence of their lengthy historical past, deep analysis experience, and technical functionality, Qualcomm is the perfect RF chip firm on the planet. Nonetheless, the cellphone increase is considerably prior to now; in 2000 just some folks had smartphones; at the moment everybody and their canine have one. The phone-based enterprise of Qualcomm will proceed to develop, if extra steadily. I consider it as a mature-stage firm paying a dividend, moderately than a development firm. Nonetheless, Qualcomm has its hopes set on the Web of Issues, IoT, which has the potential to energy a future increase in RF gross sales.

Radio Frequency Know-how

To allow the magic of connectingphones,s there are 4 obligatory elements to the entire infrastructure. First, there must be the RF chips. Second, there should be hand units. Third, there must be towers and satellites. Fourth, there must be a standard code that the telephones speak to one another on. Qualcomm has two essential enterprise segments that correspond to the primary and fourth of those elements, that are in all probability the higher-margin companies.

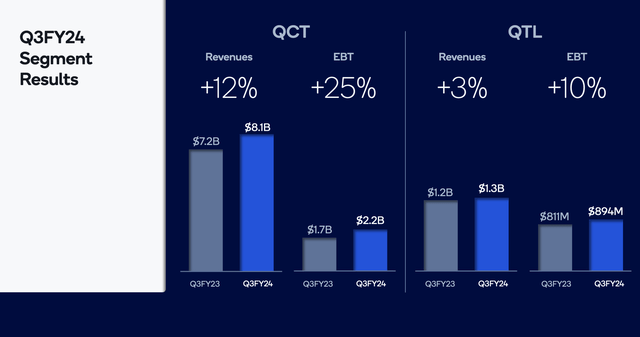

Qualcomm Q3 Phase Outcomes (Qualcomm Presentation)

Their first phase is QCT, which makes the RF chips that go into telephones, automobiles, and different locations. Like NVIDIA (NVDA), this can be a fabless chip enterprise. Qualcomm designs the RF chips and sends them to a chip fab. This enterprise is the most important enterprise, making up 86% of Q3 income. This enterprise has EBT margins of 27%.

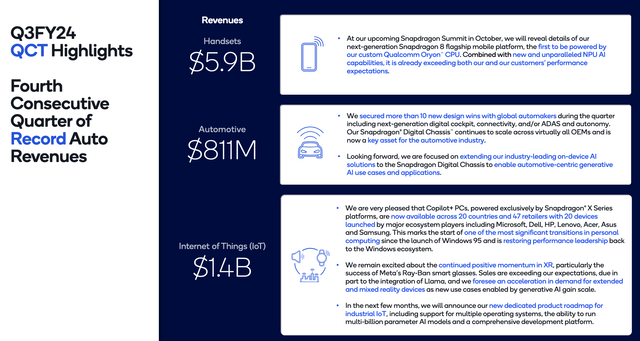

Qualcomm QCT Phase (Qualcomm Presentation)

It’s this phase that produces the System on a Chip model Snapdragon.

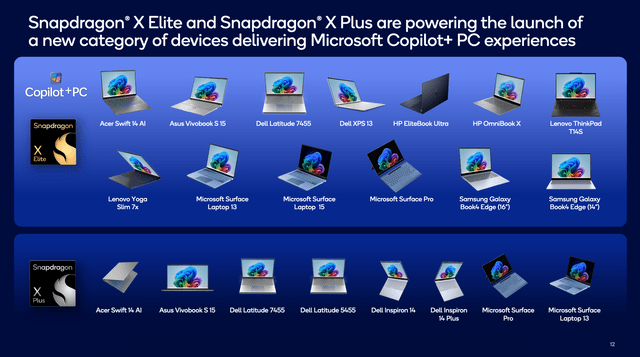

Snapdragon (Qualcomm Presentation)

The second enterprise phase is QTL, the place Qualcomm owns and licenses the IP that makes cellphone networks work. The corporate’s authentic expertise was known as CDMA, which is the tech that undergirded 3G; LTE was 4G, and 5G is known as NR (New Radio).

When an organization needs to construct a cellphone or a tower that makes use of any of those protocols, they should pay varied licensing charges to Qualcomm. The enterprise is 14% of Q3 revenues and has a 70% EBT margin.

Qualcomm continues to analysis future applied sciences, investing in its IP portfolio. In addition they made a serious acquisition of Nuvia in 2021, largely to spice up their IP pipeline.

Qualcomm has a 3rd phase, known as QSI, which is about investing in future applied sciences.

Qualcomm Progress

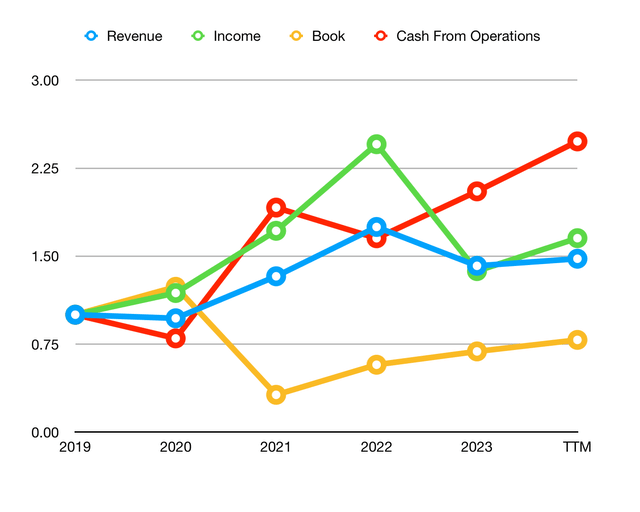

I like to take a look at the expansion of 4 gadgets to determine the long-term energy of Their enterprise: income, earnings, ebook worth, and money from operations.

Qualcomm Progress Numbers (Writer)

There are some things value mentioning right here. The income has had an 8.1% CAGR within the final 5 years. There was a cellphone increase round COVID that drew ahead a few of their income. Analysts estimate income will proceed to develop 7–10%, which is affordable given Qualcomm’s previous.

Qualcomm Income Estimates (Searching for Alpha)

The earnings has an identical form with a ten.5% CAGR over 5 years. Analysts estimate 19% development in 2024, then ~11% going ahead, which can also be cheap.

Qualcomm Earnings Estimates (Searching for Alpha)

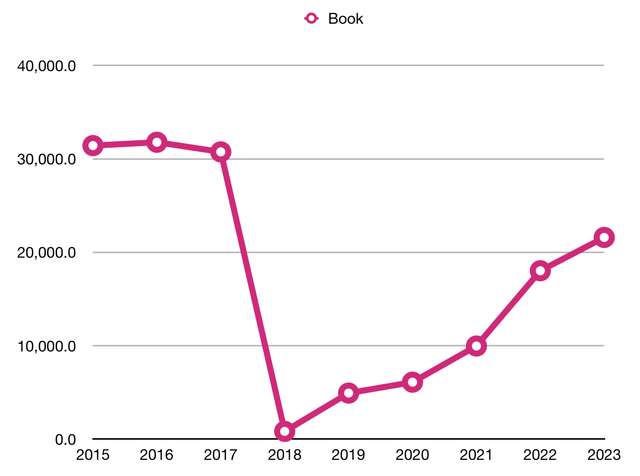

The ebook worth took a regarding dip, again in 2018. On this 12 months, they misplaced cash on a couple of issues, together with the failed NXP Semiconductor (NXP) acquisition, in addition to paying again $4 billion in debt. Because of this taking a look at metrics like ROI is a little bit bizarre Since, 2019 Qualcomm has grown BV at 34.5% CAGR, however this has been a restoration.

Qualcomm E book Worth (Writer)

Qualcomm has grown its money from operations at a five-year CAGR of 9.2%, which is in keeping with its earnings development.

General, this can be a enterprise that ought to proceed to develop income at a charge of round 8-9% and earnings at a charge of round 10-11%.

Capital Allocation

Usually, I have a look at ROE and ROIC to judge a enterprise’s profitability, however their ebook worth has been whacky.

Qualcomm at the moment has $13 billion of debt, with its debt/earnings ratio at 1.5. I am at all times too joyful to see this quantity lower than three.

Qualcomm is at the moment paying an 85-cent quarterly dividend, which involves $3.40, or a 1.97% annual yield on the present share worth.

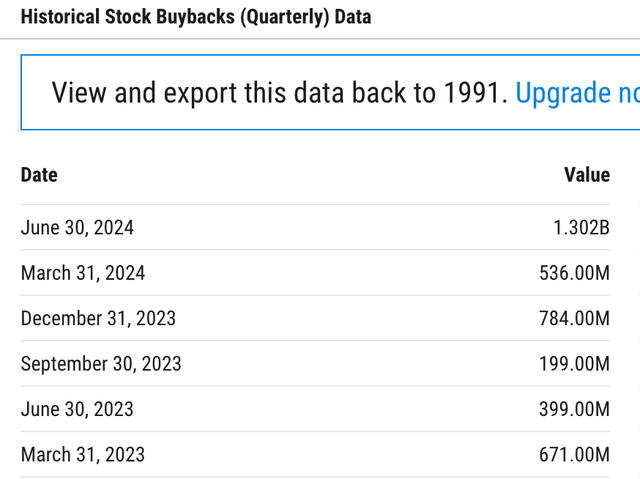

Qualcomm can also be shopping for again shares. They’ve bought $1.8 billion of shares, which is 0.95% of their present market cap.

Qualcomm Share Buybacks (YCharts)

General, it seems to be like the corporate is a good capital allocator.

The Bear Case

When evaluating the way forward for the enterprise, we’d like to consider potential issues. There are three causes to concern for the way forward for Qualcomm.

1. The Low Finish

There are numerous ranges of RF chip high quality. The latest iPhone has a extra refined RF chip than an affordable handset. The low finish of RF chips are simpler to make and are extra like a commodity. An organization like MediaTek can produce the low-end chips.

2. The Excessive Finish

At present, considered one of Qualcomm’s greatest clients is Apple. Nonetheless, Apple is paying giant charges and is searching for to design its personal RF chips. They haven’t been profitable and lately prolonged their contract from the tip of 2025 to the tip of 2027. That is excellent news, however Apple might get there and stop to be a buyer of Qualcomm.

Qualcomm is not going to exit of enterprise: they’re the perfect RF chip maker on the planet. They nonetheless have a moat, nevertheless it appears much less sturdy than it was ten years in the past.

3. IP Issues

Qualcomm is an organization beset by authorized assaults. It is likely to be that they maintain a monopoly on the IP for 4G and 5G. These patents symbolize a high-margin, low-cost enterprise that makes Qualcomm very worthwhile. Their clients will not be at all times joyful about this. Apple has tried twice to problem the Qualcomm monopoly within the courts. This problem has not succeeded. However there exists the potential of future challenges succeeding and killing the fats margins.

4. China Commerce Tensions

Lately, there was a ban on some IP tech between Huawei and Qualcomm. It seems to be like this ban is just not so extreme. If, nevertheless, this ban is an indicator of a political tradition that has extra future bans, it might actually harm Qualcomm’s backside line.

The Bull Case

Qualcomm will proceed to be an incredible tech firm that produces the RF chips that energy our connectedness. Nonetheless, the perfect days or development for his or her handset-based enterprise is behind us. Qualcomm is on the lookout for a special enterprise to energy its future: the Web-of-Issues (IoT).

IoT is just not a completely developed actuality but, however the fundamental thought is that our on a regular basis lives can be full of related units. The central instance of IoT is sensible automobiles, automobiles with sensors that may speak to one another. To realize this imaginative and prescient would require huge quantities of RF connectivity and big quantities of computing energy. If this imaginative and prescient is made a actuality, Qualcomm can be one of many key firms benefiting.

If there’s a future for Qualcomm to exceed 10% earnings development, it will depend on IoT. My eagerness to spend money on Qualcomm will depend on my feeling in regards to the future potential of IoT. My feeling about that is this query goes into the hypothesis bucket. The IoT definitely will occur, however I am unsure how large it is going to be or how briskly it should occur. I do not really feel assured in an funding case that will depend on the best-case state of affairs for an IoT future. Subsequently, for my analysis mannequin, I’ll take 11% for future earnings.

Analysis

I take advantage of three analysis strategies, taught by Phil City and RuleOne Investing.

Margin of Security

The primary methodology is in regards to the incomes energy of a enterprise. A enterprise with a sturdy aggressive benefit will be capable to develop its earnings over time. You could have a way of what their earnings development charge has been and what it should seemingly be sooner or later, which requires understanding the enterprise. As soon as you possibly can estimate the earnings development charge, you possibly can develop the earnings ten years out.

Qualcomm at the moment has an EPS of $7.71. If we develop this for one 12 months by 19% after which for 9 years at a compounded charge of 11%, the long run EPS can be $23.47 in 2035. The share could be pretty valued then at $516.33, given a PE of twenty-two (double the expansion charge).

Discounting this by a charge of 15% at the moment offers a ‘truthful worth’ of $127.63. Phil City seeks a 50% margin of security, which supplies a purchase worth of $63.81.

Payback Time

The second methodology is known as Payback Time. This methodology seems to be on the free money circulate development over time. Mainly, you consider your self as proudly owning the enterprise. Should you owned it, how a lot FCF would you get per 12 months? You add up the rising FCF through the years. City argues that eight years is taken into account a ‘truthful’ period of time to get your funding returned. If an funding can ‘pay you again’ in eight years in FCF, then it is a good funding.

Qualcomm at the moment produces $11.35 FCF/share. If we develop this by 19% within the first 12 months after which by 11%, and add up this money, every share will produce $161.23 in eight years, which is the ‘purchase worth’ for PBT. The truthful worth on this view is $322.46.

Ten Cap

The third methodology is known as the Ten Cap. On this lens, we think about the enterprise is sort of a rental property that we personal. Every year there’s money coming off the property, which will not be rising, however is a reliable stream of earnings. Nonetheless, we have to pay for upkeep charges. That is like Warren Buffett’s idea of Proprietor Earnings. Phil City does an identical calculation to FCF, however he takes money from operations and subtracts solely the upkeep Capex, which is a proxy for depreciation, and provides again to the tax profit. That is the annual proprietor earnings. If a property pays 10% of its invested capital again a 12 months, it’s known as a ten cap. Something that may be a ten cap or larger is an effective funding.

(In billions) the working money circulate of Qualcomm is $13.6; the depreciation is $1.3; the tax profit is $3.1. These numbers yield proprietor earnings of $18.1 billion, or $16.41 per share. Should you held these shares for ten years, they might throw off $164.10, which might be a ‘whole lot.’ This analysis implies a good worth of $328.20.

Abstract of Analysis

Because the three strategies don’t have a look at the corporate in the identical approach, they don’t at all times agree. When two agree collectively, that is typically sufficient for a

The ten-cap methodology is usually probably the most conservative, however this says Qualcomm is a good deal. The shares are $172, which suggests an virtually 100% upside; so does the PBT methodology. This case is sensible as Qualcomm is a cash-generative enterprise. These two strategies collectively say the corporate is certainly on sale, down from $227.

The MOS signifies that the shares are barely overvalued, which makes me cautious. What offers me confidence in making a purchase score is that also they are paying a dividend and making share buy-backs.

Conclusion

Qualcomm is an excellent enterprise that can be a central a part of our technological future. There are some threats to their enterprise, however I believe these threats will not be dire threats.

For our analysis, we used a conservative development charge and located that Qualcomm appears to be on sale, even when there are some bear-case issues. If the IoT future is brighter then I believe there’s a whole lot of upside within the inventory. Nonetheless, I am pleased with a purchase score, even with the conservative future.