Justin Sullivan

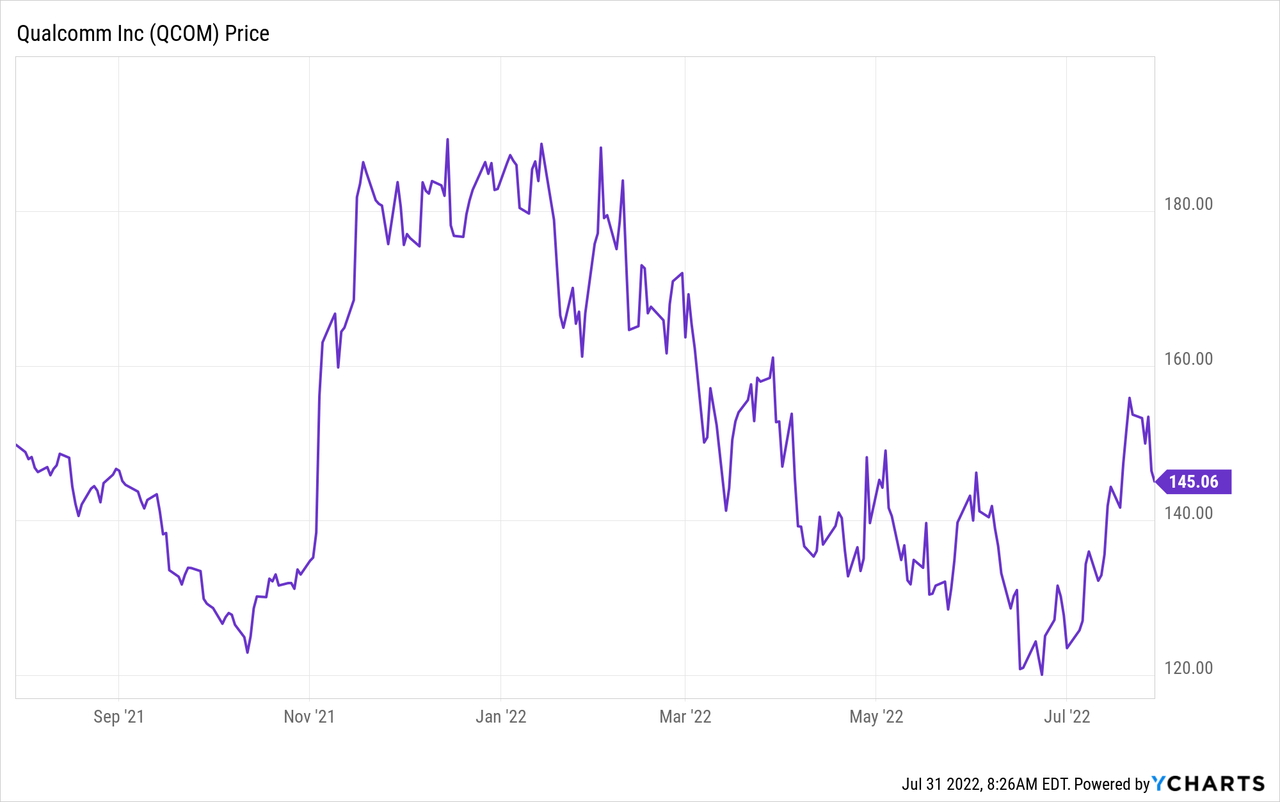

Qualcomm (NASDAQ:QCOM) is a number one expertise firm which designs modern semiconductor chips. The corporate’s flagship “Snapdragon” powers ~70% of the Samsung Galaxy sequence and its latest partnership has elevated the robustness of this settlement up till 2030. In my earlier publish on Qualcomm I introduced the corporate has a “$700 Billion Market Alternative” throughout Semiconductor Chips, IoT, AI, 5G and way more. The corporate just lately introduced stable earnings for Q322, however tepid steerage brought about the inventory value to slip by ~5%. Nevertheless, it’s nonetheless up ~17% over the previous month and jumped by 27% a pair weeks after my final publish (in the event you held by means of the dip). On this publish, I will breakdown the latest earnings, reveal the enterprise drivers and revisit the valuation, let’s dive in.

Qualcomm Stories Robust Q3 Earnings

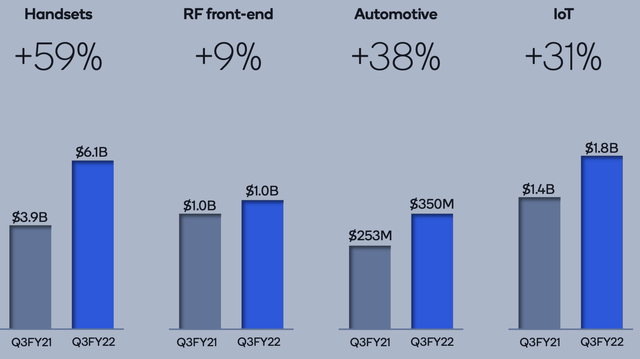

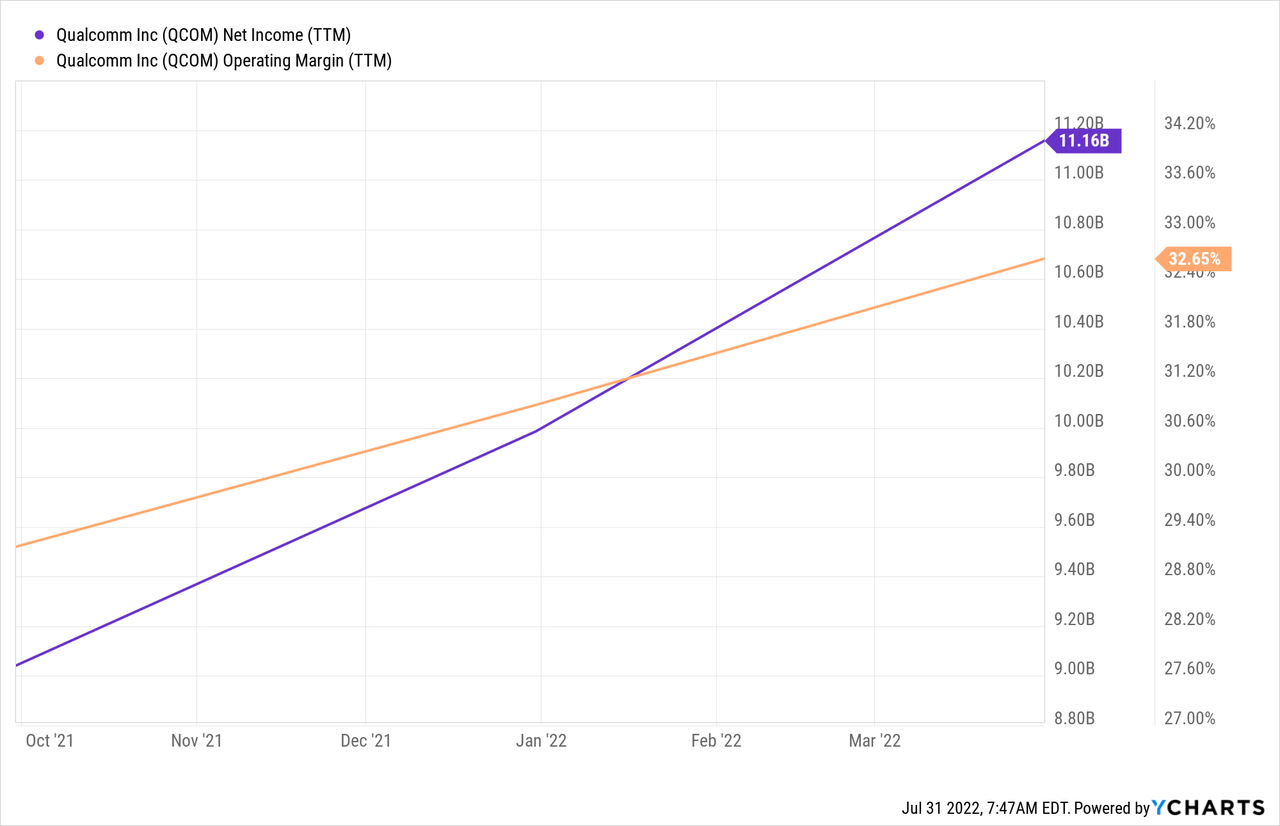

Qualcomm generated sturdy financials for Q322. Income popped to $10.9 billion, up a fast 37% 12 months over 12 months and beating analyst expectations by $74 million. The principle income driver of the corporate is its QCT section (Qualcomm CDMA Applied sciences). That is the biggest section and makes up roughly 86% of whole income. The section consists of semiconductor chip designs for Cellular Handsets such because the Samsung, RF entrance finish, automotive and IoT. Handset income generated blistering development of 59% 12 months over 12 months to $6.1 billion.

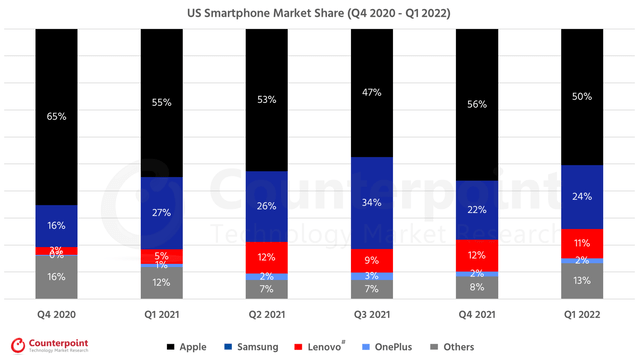

The corporate introduced a serious accomplice settlement with Samsung to increase its patent license settlement for 3G, 4G, 5G and even the upcoming 6G expertise, by means of to the top of 2030. This implies the corporate is anticipated to energy as much as ~70% of Samsung Galaxy units such because the S23 within the upcoming years with its Snapdragon platform. The settlement additionally consists of different “premium” Samsung merchandise similar to PC, tablets and even prolonged actuality units. The rationale that is vital is that in lots of Western markets such because the US and Europe, shoppers have a tendency to decide on primarily between and iPhone or a Samsung Galaxy. With the iPhone making up roughly a 50% market share and Samsung making up a 24% market share. Thus a guess on Qualcomm can be a guess on the success of future Samsung Galaxy fashions.

Smartphone Market share (Market Monitor Service )

Administration is forecasting Handset Revenues to develop at barely beneath 50% for the complete 12 months 2022, pushed by elevated processor content material per system and growth of their addressable market.

The partnership with Samsung is nice, however it’s also weak to the cyclicality of the handset market. Thus administration has made it a strategic precedence to develop its IoT (web of Issues) and Auto Segments in an effort to diversify income and develop their TAM. Their technique is working thus far, as IoT income was a report $1.8 billion, up a fast 31% 12 months over 12 months. This was pushed by Home windows of Snapdragon Compute platforms for on system AI. Additionally they introduced new Wi-Fi 7 platforms, which is the most recent technology of excessive pace Wi-Fi. As well as, to 2 new 5G prepared Robotics platforms with AI options.

Qualcomm Financials (created by creator Ben at Motivation 2 Make investments)

The Automotive section additionally generated report income of $350 million, up 38% 12 months over 12 months. This affords enormous potential for the corporate given they have already got a Design win pipeline of over $19 billion, which is big.

Qualcomm has main partnerships with 26 world automotive makers similar to BMW (OTCPK:BMWYY), GM (GM), Honda (HMC), Volvo (OTCPK:VOLVF), Renault (OTCPK:RNSDF) and even Ferrari (RACE). Its “digital chassis” platform permits these Automotive producers to show their automobiles right into a rolling excessive powered pc, equipping prospects with connectivity, AI and finally self driving options. QCOM just lately scored a partnership with main automaker Volkswagen (OTCPK:VWAGY) (which owns Audi, Porsche, Lamborghini, Seat) and its software program firm CARIAD to assist energy future self driving automobile options.

The prior acquisition of Arriver can be poised to assist enhance platform and its pc imaginative and prescient capabilities. Its RF entrance finish sub section additionally confirmed development of 9%, on subsequent technology Wi-Fi and Bluetooth RF front-end modules.

Qualcomm has additionally just lately introduced an “AI Stack Portfolio” which supplies builders the power to construct AI purposes on the Edge. The Synthetic Intelligence business is forecasted to be value a staggering $1.5 trillion by 2030, rising at a 38% CAGR.

AI Stack Qualcomm (Investor presentation Q323)

Different Enterprise segments embody Qualcomm Expertise Licensing which makes up ~13.9% of income. Income was $1.5 billion within the quarter which was solely up 2%, however that was according to the midpoint of the corporate’s steerage. Its Strategic Initiatives segments makes up a slither of income at 0.1%, and focuses on investing into new companies, services and products.

Total earnings per share had been $3.29 for Q322, which beat analyst expectations by $0.81 per share.

Qualcomm has a stable Steadiness sheet with $6.8 billion in money and brief time period investments. QCOM has $15.5 billion in whole debt, of which the bulk ($13.6 billion) is long run debt and thus manageable.

Tepid Steering

Shifting ahead, Qualcomm’s administration forecast adjusted earnings per share between $3 and $3.30 within the subsequent quarter, which might characterize a flat or a slight decline from the $3.29 EPS produced in the latest quarter. The corporate is anticipating whole income for Q422 to between $11 billion and $11.8 billion, which might characterize a slight improve from the latest quarter ($10.9B) however decrease than analyst expectations of $11.86 Billion.

The corporate’s CFO (Akash Palkhiwala) cited weak point in mid tier Android handsets as the principle trigger, as client demand falters.

A constructive tailwind which many analysts have ignored is the CHIPS Act, which was just lately handed by the Home of Representatives. This consists of $52 billion in subsidies for home semiconductor chip manufacturing, tax credit of $24 billion and likewise $200 billion to spice up scientific analysis into semiconductors over the subsequent decade. That is pushed by the political want for the US to compete higher with China and be much less weak to produce chain points.

QCOM Inventory – Superior Valuation

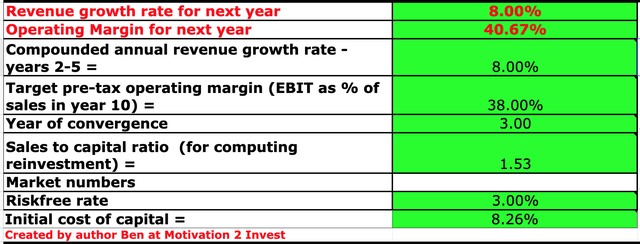

As a way to worth Qualcomm, I’ve plugged the most recent financials in my discounted money circulate mannequin. I’ve been very conservative with development forecasts estimating simply 8% development per 12 months for the subsequent 5 years.

Qualcomm inventory valuation 1 (created by creator Ben at Motivation 2 Make investments)

I’ve additionally predicted its working margins to really dip barely due ~38%, resulting from rising enter prices and inflation.

Qualcomm inventory valuation (created by creator Ben at Motivation 2 Make investments)

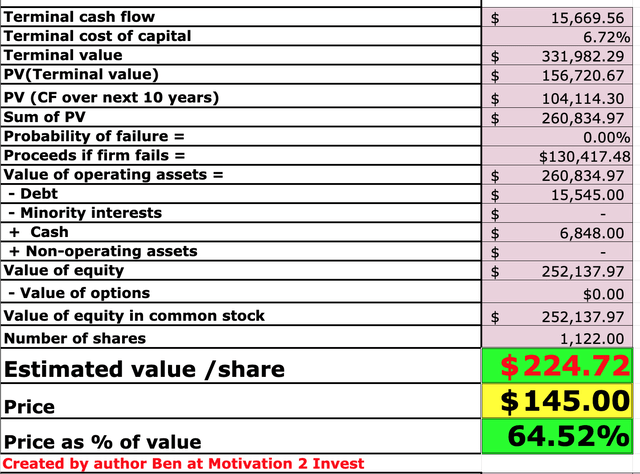

Given these elements I get a good worth of $224 per share, the share value is ~$145 on the time of writing and is thus ~35% undervalued.

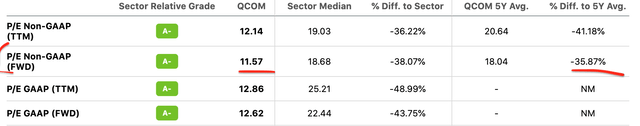

As an additional datapoint, Qualcomm is buying and selling at a PE Ratio (FWD) = 11.57, which is ~36% cheaper than its 5 12 months common.

Qualcomm PE Ratio (In search of Alpha)

Dangers

Handset Income Focus

Qualcomm makes roughly 55% of its income from Handset Semiconductors and a big portion of that comes director from powering the Samsung Galaxy sequence. Though, the corporate has just lately prolonged their partnership until 2030, which provides income stability it’s nonetheless closely concentrated. The excellent news is administration has made it a strategic precedence to develop into different markets and have just lately hit report IoT and Automotive income.

Recession

Within the phrases of Warren Buffett “Inflation Swindles virtually all people”. The excessive inflation and rising rate of interest surroundings is squeezing each companies and shoppers with greater enter prices. Many analysts are forecasting a recession and thus Qualcomm could expertise volatility. Administration has already lowered steerage for the upcoming quarter.

Ultimate Ideas

Qualcomm is a improbable firm which affords best-in-class semiconductor expertise, which powers the Samsung Galaxy Smartphones. Administration has aggressively expanded its whole addressable market and has grown its smaller segments sturdy. The inventory is undervalued intrinsically and relative to historic multiples, thus this appears to be like like an excellent alternative for the long run. Nevertheless, because of the aforementioned dangers do anticipate brief time period volatility.