bluebay2014

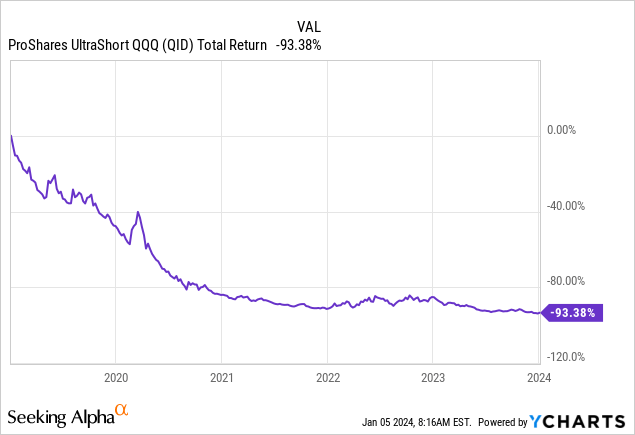

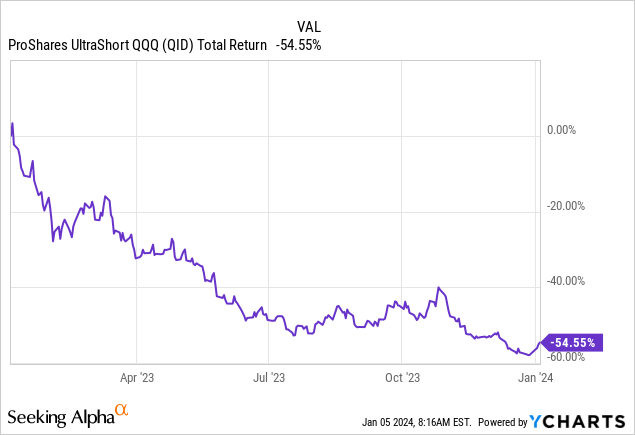

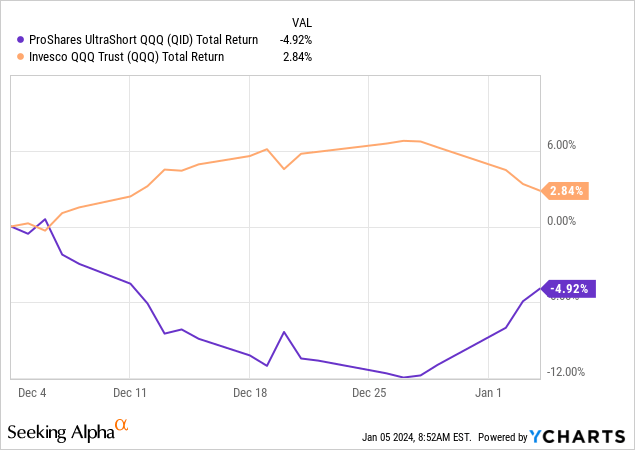

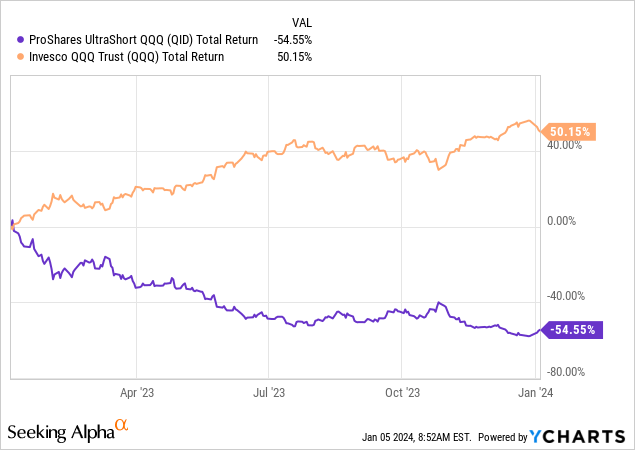

The ProShares UltraShort QQQ ETF (NYSEARCA:QID) has been a horrible investment over the last five years, the antithesis of owning Big Tech names through the Invesco QQQ ETF (QQQ). This product is the inverse design of holding the NASDAQ 100 stocks, basically shorting them with 2x leverage. How bad a ride for buy-and-hold investors has it been in QID? Try losing -93% of your initial investment for a total return over five years, and -54% over the latest 12 months!

YCharts – QID, Total Returns, 5 Years YCharts – QID, Total Returns, 12 Months

The flip side of enormous leverage on the wrong side of the market may be approaching in 2024, however. If we do get a recession this year, and a deep one for contraction depth, QID could morph into one of the top performing holdings in the U.S. ETF universe. Why?

For starters, the main U.S. Big Tech names are incredibly overvalued vs. the entire market and whole economy. The Magnificent 7 stocks including Apple (AAPL), Microsoft (MSFT), Google (GOOG) (GOOGL), Amazon (AMZN), Meta/Facebook (META), NVIDIA (NVDA), and Telsa (TSLA) today account for $12 trillion in value out of the entire $47 trillion in equity market worth listed in New York (Wilshire 5000 index value). It’s an unheard of concentration of wealth, never before seen in American business history.

So, if a fateful recession, bear market, or even an all-out stock market crash are next for Wall Street in 2024, QID could overnight become one of the investment setups that performs best. Why do I say that?

Big Tech names will be “the” source of liquidity for people that have lost their jobs in a deep recession or banks/hedge funds looking to raise cash to offset expanding losses on their balance sheets and assets held in total. You could even see panic selling appear, where the hot-money and trend followers in Big Tech run for the exits at the same time. Don’t say it cannot happen, like overly confident investors did in 1929 or the year 2000. Busts and crashes are part of the investment process, pure and simple.

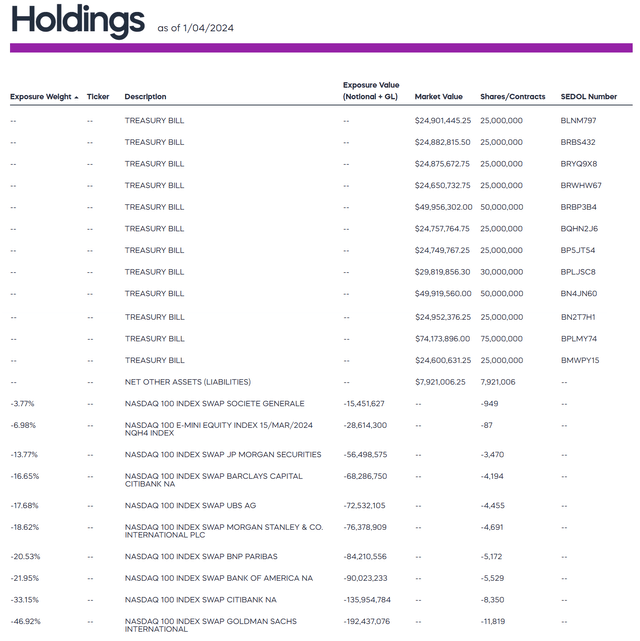

It also comes down to the trust design and its large cash holdings earning 5%+ in interest today. Roughly 93% of net assets were held as Treasury Bill securities on January 4th, 2024.

ProShares Website – QID, Holdings on January 4th, 2024

In past years, when interest yields on cash were low, the QID 0.95% annual management fee, and costs/premiums related to rolling over its swap agreements made keeping its 2x daily rebalance goal for performance vs. the NASDAQ 100 index next to impossible. In terms of time decay, 2x and 3x ETFs on the short side have been incredibly handicapped, especially during a huge bull market in pricing for the QQQ-bubble securities.

The extra cash yield and slighter premiums on swaps have already really pumped QID returns, believe it or not. The trailing ETF 12-month cash dividend payout of 5.3% has not stopped the short sale losses from ever-rising Big Tech gains, but returns over many months have been beating the 2x design during the 2023 period. And, if these variables remain the same, an oversized QQQ drop should translate into much better than 2x performance for QID on the upside soon.

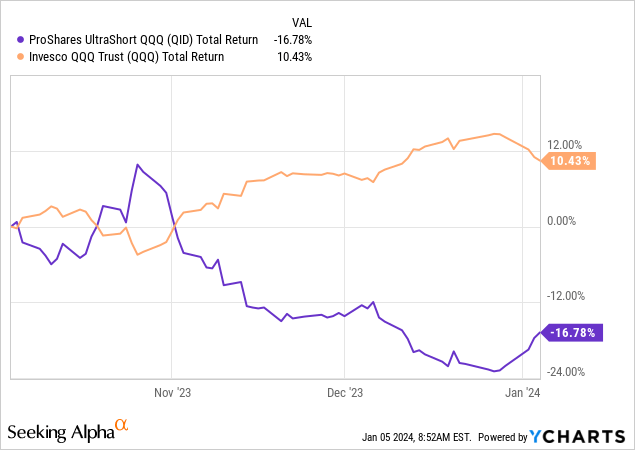

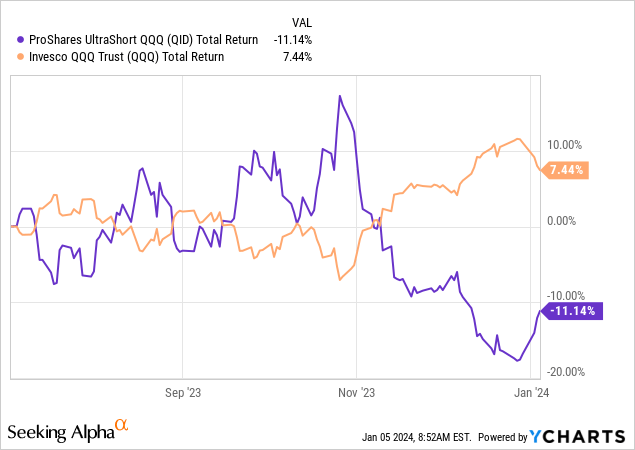

Below you can review the historical performance of QID vs. QQQ over the last year to get a better idea of what I am talking about. Remember, traditionally since inception, with the daily rebalance working against returns over time, alongside the extensive cost of creating the 2x leverage, QID used to fall in value at rates far greater than DOUBLE any QQQ advance.

YCharts – QID vs. QQQ, Total Returns, 1 Month YCharts – QID vs. QQQ, Total Returns, 3 Months YCharts – QID vs. QQQ, Total Returns, 6 Months YCharts – QID vs. QQQ, Total Returns, 12 Months

Recession and Bear Market Performance

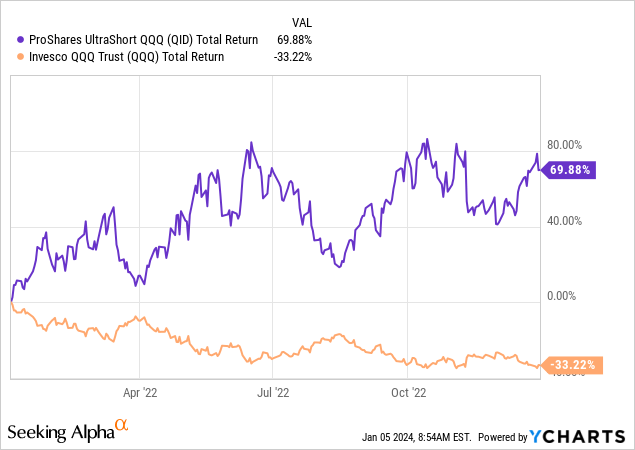

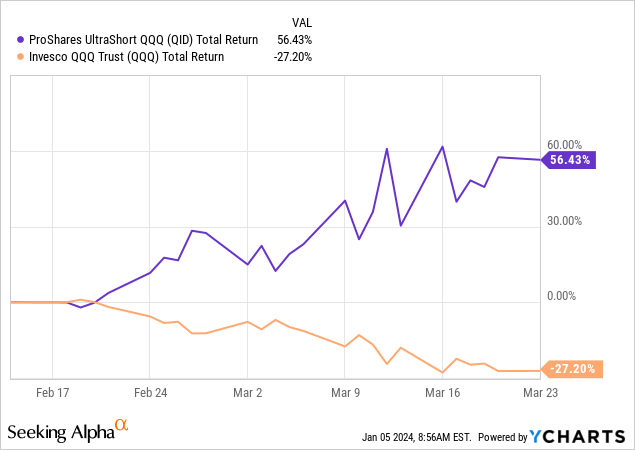

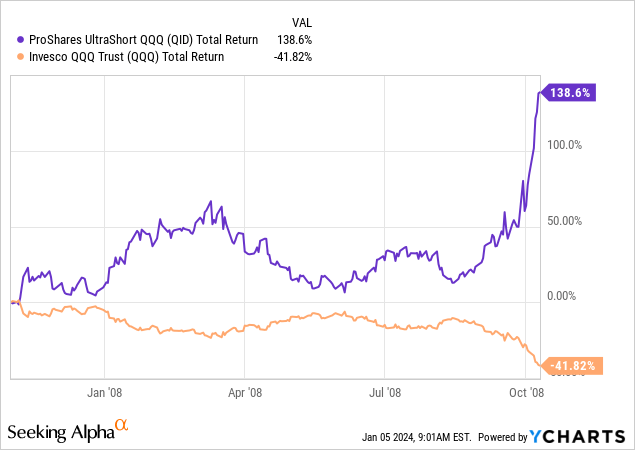

What’s possible on the upside for QID holders? We can look at total return gains during the 2007-08 Great Financial Crisis, 2020 COVID-19 pandemic panic, and calendar year 2022 bear market. Each generated percentage gains better than the 2x goal, simply because the daily rebalance feature works to compound your capital returns to the upside on prolonged trend downturns in QQQ (effectively).

2022 Bear Market

YCharts – QID vs. QQQ, Total Returns, January 1st to December 30th, 2022

2020 Pandemic Selloff

YCharts – QID vs. QQQ, Total Returns, February 14th to March 23rd, 2020

2007-08 Great Recession

YCharts – QID vs. QQQ, Total Returns, November 1st, 2007 to October 10th, 2008

Final Thoughts

With today’s more advantageous setup for futures/swap contract premiums and unusually high cash yields, any major bear downturn in Big Tech of greater than -20% for price change should push QID higher by at least +40% for a total return (my estimate), particularly if the move happens suddenly over less than six months in duration.

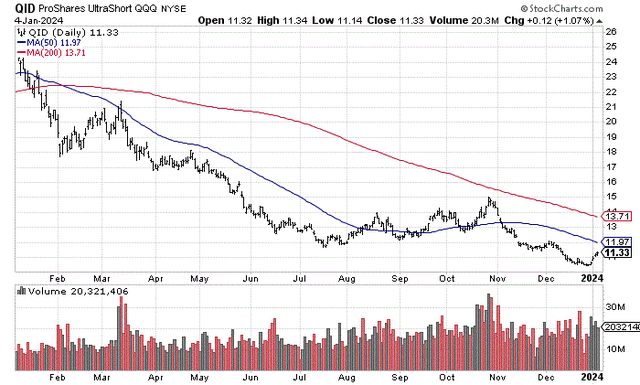

When you look at the past year of trading in ProShares UltraShort QQQ, it’s hard to draw any bullish conclusions or infer a bright future for this security. Nevertheless, for speculators and hedgers worried about a recession and rich Big Tech valuations, QID could surprise most everyone in 2024 on the upside.

StockCharts.com – QID, 12 Months of Daily Price & Volume Changes

For sure this ETF is a GAMBLE, truly a speculation on rotten events unfolding for the world in 2024. Theoretical “risk” holding QID is sky-high if you do own it, but reward potential may play out in a bear market soon.

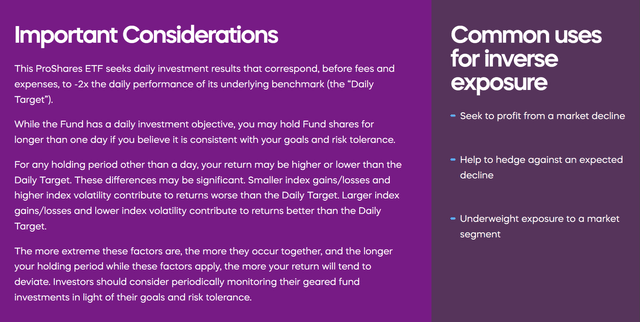

Below is a disclaimer on the unique considerations and risks of owning a leveraged inverse ETF like QID, taken from the ProShares website here.

ProShares Website – QID Disclaimers

In many respects QID is in a similar boat to my bullish takes on the ProShares Short S&P 500 ETF (SH) here, and ProShares Short QQQ ETF (PSQ) here. The two less-risky 1x products also appear to be well situated based on Mr. Market’s insistence on paying a higher cash yield of 5%+ to be short the U.S. stock market vs. the insanely low dividend yields under 1.5% to be long a regular index fund. From my research, QID, SH, and PSQ offer the least-expensive downside leverage today (measured against potential rewards) vs. direct shorting or index put options for the average brokerage account.

If you do own the leveraged 2x QID ETF, please keep your exposure to a minimum. There is a decent chance large losses will appear again, given the general equity market continues running higher. I will not hold more than 1% or 2% of my total portfolio assets in QID. I rate QID a Buy in limited quantities.

As I have mentioned in my writings since the summertime, Big Tech names are overvalued and over-owned presently. If we do experience a recession this year, I suspect an extended drawdown in pricing for 2023’s leading securities will take place. How you prepare for and play such a move is up to you.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.