DNY59/iStock via Getty Images

As we enter 2023, our macro outlook for fixed income markets revolves around three main drivers:

- Elevated inflation

- Restrictive monetary policy

- Rapidly slowing growth

In 2022, historically high inflation led global central banks to make a series of bold tightening moves. In 2023, we believe this may result in a significant slowing of global growth and, in the U.S., a likely recession by the middle of 2023.

U.S. outlook

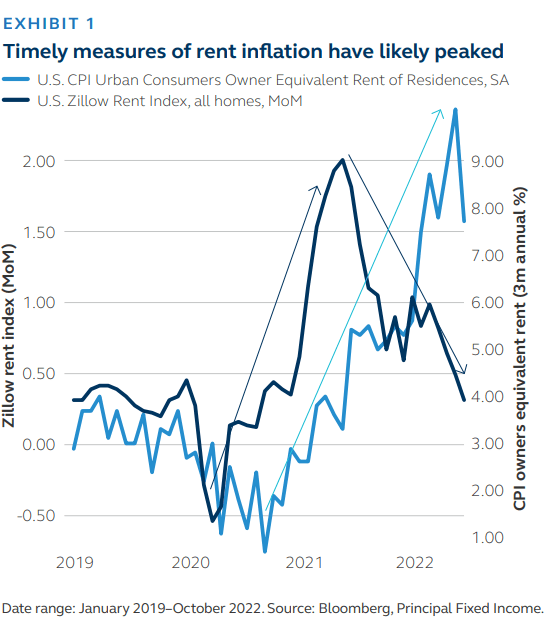

In the U.S., it’s our view that inflation may gradually move toward the Federal Reserve’s (Fed) 2% goal over the year. Core goods inflation has already made enormous progress over the course of 2022, driven by a softening in used auto, apparel, and furnishings prices.

Services have been stickier, due in large part to the long lags in shelter/owners’ equivalent rent. Further, timely measures of new lease signings suggest that it’s only a matter of time before rent/services inflation makes substantial progress towards the Fed’s goal.

In the meantime, the Fed continues to hike into a slowing economy, based on inflation metrics that lag the policy rate by as much as 18 months. Already, recession warnings are seen in many leading indicators, including:

• The yield curve

• Small-business optimism

• Housing

• CEO/CFO confidence

• Consumer sentiment

• Manufacturing new orders

At the end of 2022, risk appetite was buoyed by expectations of a December step-down in the pace of Fed hikes from 75 basis points (bps) to 50 bps per meeting.

However, once the euphoria of a slower pace of Fed hikes runs its course, the cold, hard realities – of restrictive policy, looming recession, and a Fed that can’t “come to the rescue” as quickly as the market has become accustomed to – should dampen risk appetite.

Global outlook

With a hamstrung Fed, the global outlook for 2023 is one of cautious optimism for fixed income. With the Fed unable to readily rescue the economy, global policymakers are factoring in a sharp drop in growth to tone down the pace of policy tightening.

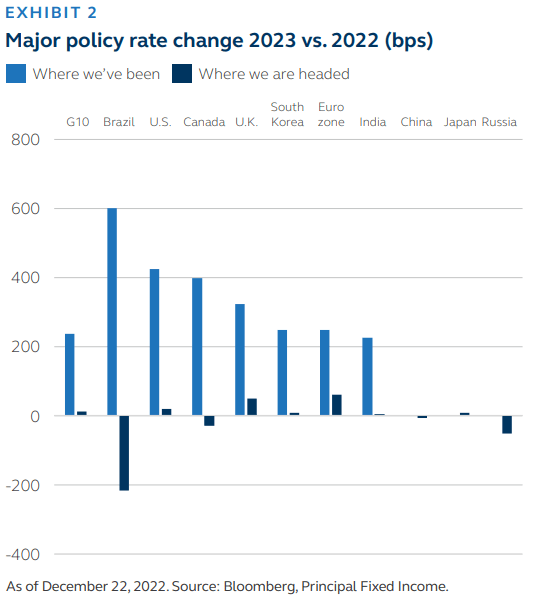

This is despite expectations of moderating, though still elevated, inflationary pressures. The average 230 bps of global rate hikes* seen in 2022 is expected to taper off to less than 20 bps—a trajectory that could be cushioned by the high yield levels in fixed income markets after this year’s correction. This provides a welcome respite/reset from 2022.

That said, risks remain. Central bank balance sheets have become bloated following a decade of on-and-off quantitative easing and need some release. The Bank of England already commenced asset sales in November and the European Central Bank pledged to taper in March of 2023.

The Bank of Japan eased its foot on the yield curve control gas pedal in the final major central bank policy action this year, a necessary precursor to a broader reduction of policy accommodation. The Fed will likely also look for opportunities in 2023 to shrink its balance sheet. Care will be taken to not disrupt markets, although the execution is going to be extremely challenging.

*Weighted by nominal GDP of the 10 largest economies within G20.

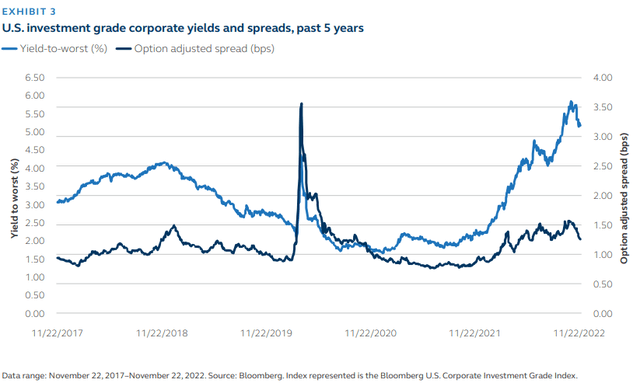

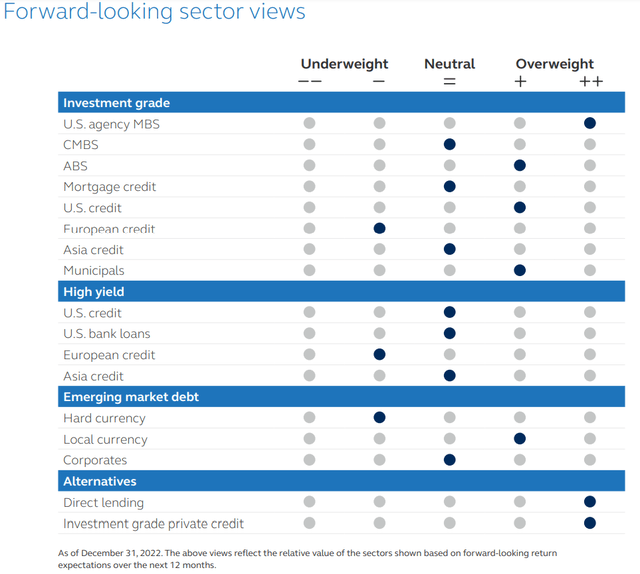

Investment grade credit

Often, heightened volatility presages attractive buying opportunities across fixed income markets. That’s the scenario we find ourselves in at the end of 2022 within investment grade credit. The combination of higher yields and wider spreads, along with stable credit metrics, provides an attractive backdrop for corporate bonds.

We all knew the journey to higher rates was going to be damaging from a total-return standpoint; however, we believe most of the wreckage is behind us, and the magnitude of that movement in U.S. Treasury yields makes the anticipated path ahead promising as yields settle into a more range-bound band. In investing, after all, it matters more what we expect a security or asset class to do tomorrow than what it did yesterday.

Given the historic and rapid rise in yields, we believe the Fed is closer to the end than the beginning of their hiking cycle. In other words, much of the response to Fed tightening has already been priced into the intermediate part of the U.S. Treasury curve, which forms the reference rate for the investment grade market.

Credit spreads drifted wider in 2022 and settled into a trading band that is, by historical averages, on the wider side. That has conferred a higher breakeven spread of nearly 20 bps for investment grade credit. With corporate fundamentals sound, more spread to cushion against further widening makes the argument for investment grade credit investment compelling. Plus, yields between 5 and 6% serve as enticing levels to draw in buyers.

Two points stand out about the nature and nuance of corporate bond supply and demand:

1. The majority of high-quality bonds trading at a discount to par means we have a number of bonds with compelling convexity profiles—which should stimulate demand. That’s the result of lower-coupon bonds enduring the path to higher rates and falling in price.

2. The flood of new debt recently issued stemmed from companies seeking to lock in low-cost funding. That prefunding deluge is largely done, so the backdrop from a supply standpoint appears supportive. In short, now represents a very favorable time for investing in high-grade corporate bonds.

High yield credit

If history repeats itself, the combination of slower economic growth and a likely recession doesn’t create an ideal backdrop for risk assets – —high yield included.

As we look into 2023, however, much has changed in the high yield market over recent years that, in our opinion, should lead to a better outcome for the asset class if the highly anticipated recession comes to fruition. Since the global financial crisis, the credit-quality profile of the high yield market improved progressively and is now at record highs.

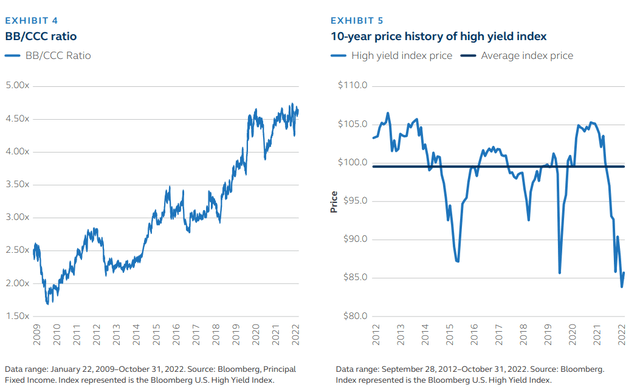

Since 2009, the BB to CCC ratio nearly tripled to over 4.5x today (see Exhibit 4). The changes in the index have been slow and steady, though, so its impact has been largely overlooked. In addition, leverage is near a low last seen in 2019, and interest coverage is at a record high. Let’s keep that in mind when comparing historic norms for traditional reference points (like spreads) to today’s high yield market.

The average spread of the U.S. high yield index from December 31, 2009, to November 30, 2022, was 468 bps. The average BB to CCC ratio was 2.8x. High yield spreads were volatile but gravitated toward that 10+ year average, despite the dramatic quality improvement of the Index discussed earlier.

We believe investors should consider this trend when weighing whether current spread levels offer an attractive entry-point for the asset class; combined with all-in yields near 9.0% to end the year, we think it is. For investors looking for global high yield, yields and spreads far exceed even these levels while facing similar macro headwinds.

Other positive factors ought to inform one’s view on high yield credit spreads. To name a few:

• Increasing levels of secured bonds

• Low default rates with minimal upcoming maturities

• Higher recoveries from defaults

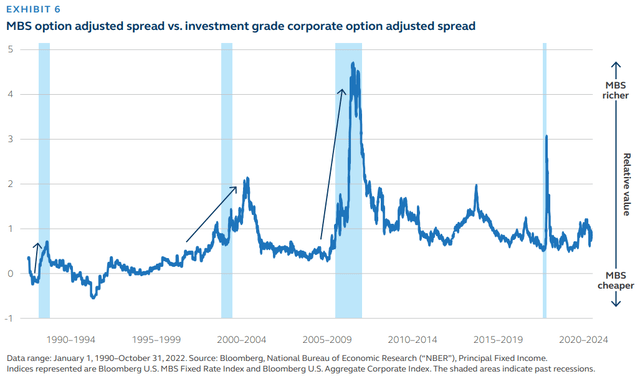

All the previously mentioned data points currently paint a picture of fundamental strength for the asset class, which warrants historically tighter spreads. Even though spreads aren’t significantly wider over the last decade, the dollar price of high yield bonds is definitely below the average (see 10-year price graph in Exhibit 5).

Bonds are often supposed to bring less volatility to a portfolio, but 2022 proved otherwise. The significant decline in bond prices seen over the year (to around $85 for U.S. high yield and $82 for global high yield) paves the way for an attractive entry point of not only a high-income asset but one with upside from capital appreciation. The result for this asset class is a level of higher-than normal returns that hasn’t existed for several years.

Securitized debt

We find short AAA consumer asset-backed securities and government-guaranteed mortgage-backed securities (MBS) attractive. In our view, both should offer attractive yields and tend to outperform into (and through) recessionary periods.

Asset-backed securities

We favor an overweight to AAA auto loan asset-backed securities (ABS), including subprime auto loan (although we would stick to the upper tiers of sponsors). Compared to corporates, structured products have generally underperformed in 2022.

Asset-backed securities have top credit ratings. And in many cases, they mature in just two or three years—providing cash-flow certainty for investors. Buying ABS amounts to a relatively short-term bet, and the price of the securities isn’t very sensitive to interest-rate changes. These factors make ABS attractive to investors during heightened market volatility.

The auto ABS subsector is mature and typically has less credit risk (or risk of default) than many other fixed income sectors. Since 2015, there were 2,867 upgrades in the auto ABS asset class and only 21 downgrades (less than 1%), according to S&P Global.

Structures have improved considerably since the global financial crisis and performed resiliently during recent COVID-19 financial stress. While delinquency performance has recently weakened, consumers continue to value their auto loans, prioritizing auto payments “well above” credit cards and “just behind” mortgages (TransUnion study).

Auto ABS also benefits from a structure that rapidly pays down the bonds as credit support builds, improving the credit-risk profile as the security matures. Although higher unemployment and consumer debt increase the risk to the downside, ABS AAA auto structures are still robust and extremely difficult to break under recession scenarios.

U.S. agency MBS

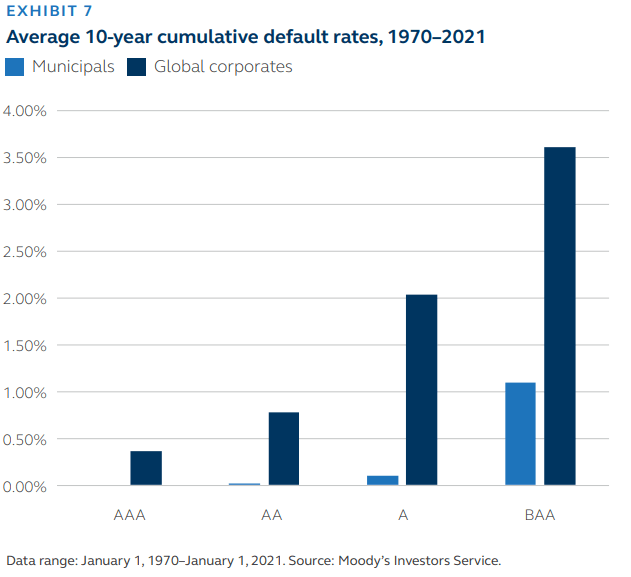

We also find agency MBS attractive. The asset class benefits from government guarantees of credit risk and little-to-no financing risk (even for a large rally in interest rates). Over the year, agency MBS spreads widened due to technical headwinds (limited bank sponsorship and Fed quantitative tightening) and are currently at attractive levels relative to investment grade credit.

As Exhibit 6 displays, MBS spreads have historically outperformed credit into a recession thanks to the government sponsorship of credit risk. Technicals have been on the mend, with slowing house price appreciation and housing activity reducing organic net supply.

At the same time, asset managers have begun the migration out of credit and risky assets and into MBS. Not surprisingly, MBS is poised to be the spread sector of favor as a recession nears.

Municipals

With additional rate increases and a recession on the horizon, taxable U.S. municipal bonds are particularly attractive investments when measured against other investment grade fixed income asset classes. This is particularly true for insurance companies, as well as liability investing and unconstrained portfolios.

With a market value of over $800 billion, taxable municipals generally have much longer maturities – as well as a higher concentration of securities rated AA and AAA – when compared to investment grade corporates. This concentration is especially beneficial for life insurers, as regulators introduced updated risk factors in early 2022 for fixed income, with return on capital steadily declining for lower-rated debt.

After consecutive years of outperforming corporates, 2022 was an underwhelming year for taxable municipal performance – both outright and relative. The primary culprit is the longer-duration characteristic of the asset class in a year during which interest rates rose steadily across the entire maturity spectrum.

The silver lining is that this underperformance sets up well for 2023. Using the JP Morgan JULI index as a guide, 30-year taxable municipal yields are the cheapest since 2013, while spreads measured against corporates are the widest since April 2020.

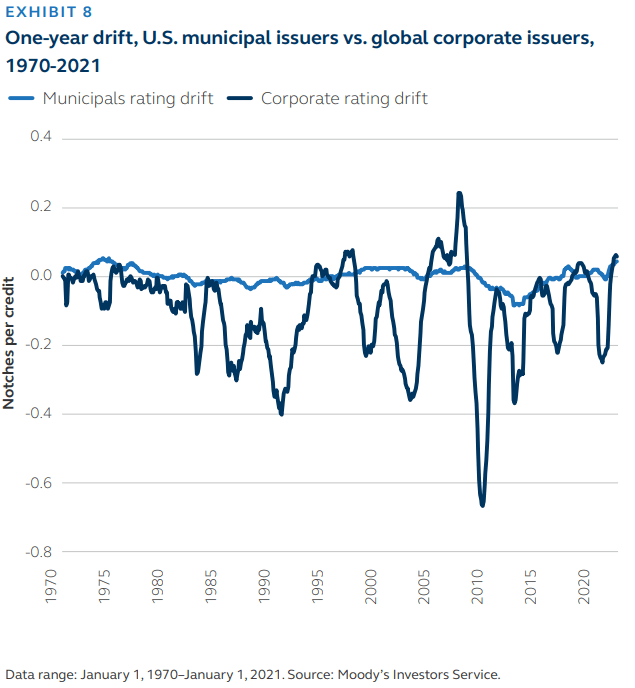

If the bond market is correct in forecasting a downturn – or worse – in 2023, stable municipal rating transitions and better historical default metrics add to the appeal of the asset class. This has been particularly evident around recessionary periods. The historical municipal average cumulative default rate from 1970-2021 is just 0.2% per Moody’s Analytics.

Emerging market debt

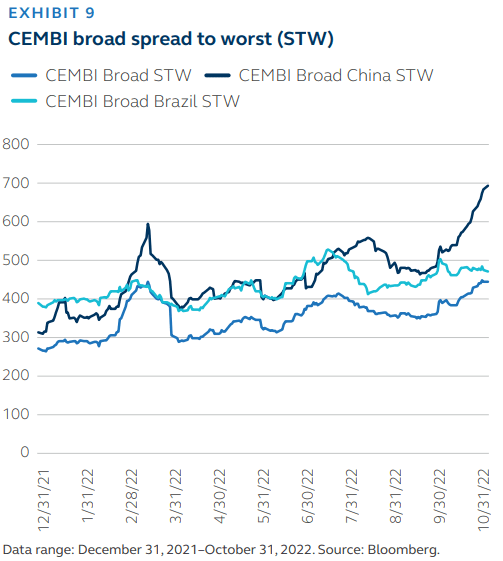

The global and U.S. cycles continue to be the major drivers for emerging-market (EM) bonds. While the sell-off in 2022 was led by rates moving higher, this period going into a late-cycle U.S. recession is likely to determine the path of credit spreads in 2023.

There was a significant divergence in the performance of investment grade versus high yield EM credits the past year, depending on the exposures to commodities and financial flows, reliance on USD funding, and resilience of the domestic economies.

As the largest emerging markets in Asia and Latin America respectively, China and Brazil remain a key focus. In China, the impact of the political transition into policymaking and the ongoing COVID-19 reopening are the major drivers of China’s macro and asset markets. In Brazil, the new Lula government coming into power will dominate market expectations of Brazilian assets.

China

The volatility around China’s political economy remains a key focus among EM and global investors. This is not only from the perspective of the impact of China’s assets but also related economic blocs (especially in Asia) and the macro implications affected by the nature of China’s growth slowdown.

China’s equity and bond markets went through a quarter of volatile trading punctuated by the focus on the 20th Party Congress meetings in October. The Party Congress meeting began initially with concerns over the lack of COVID-19 reopening and an emphasis on national security during the president’s speech. Concerns rose further on the market’s lack of understanding of the transition rules in the Chinese leadership.

But in quick succession, the Chinese authorities announced fresh support measures on China’s two major headwinds— COVID-19 and the property sector slump. In our view, the Chinese government’s actions, more than its words, will provide the best indicator of what any reopening may look like.

The current COVID-19 outbreak will prove to be a test of the resolve of a real reopening. The People’s Bank of China (PBOC) and China Banking and Insurance Regulatory Commission (CBIRC) 16-measure support for the property sector would be one of the most substantial plans for the sector we have seen in the past 18 months—keeping us cautiously optimistic on the asset class.

Brazil

In Brazil, Luiz Inácio Lula da Silva was elected President for a third time in an unexpectedly tight race against incumbent Jair Bolsonaro. Markets breathed a sigh of relief as President Bolsonaro, who had repeatedly intimated that he would not accept a loss, authorized the peaceful transition of power.

Now, the question for investors is, which Lula will they get? Brazilians and investors remember certain aspects of his first two terms (2003-2010) fondly, as the commodity boom propelled Brazil’s economy, and Lula’s policies reduced poverty.

On the other hand, Lula’s transition team already advocated the exemption of auxiliary social spending programs from the country’s main fiscal rule, which could destabilize Brazil’s already high debt burden. Compounding the problem, Lula has dismissed concerned investors as “not serious people” and has sought to reframe the conversation around “social responsibility rather than fiscal responsibility.”

Strong showings by the opposition in October’s congressional elections will dent his ambitions. Brazil has been among the standout performers in EM, driven by strong domestic growth and commodity exports. The central bank’s rate hikes helped power the Brazilian Real in 2022 to the strongest performance among major currencies.

With growth forecast to fall sharply next year and debt to GDP of ~80%, investors will look for any deviation from fiscal orthodoxy. Investor sentiment towards Latin America has already been chilled by the spate of leftist victories (see Chile, Colombia). It remains to be seen how Lula will balance his campaign promises with economic and political reality

Private credit

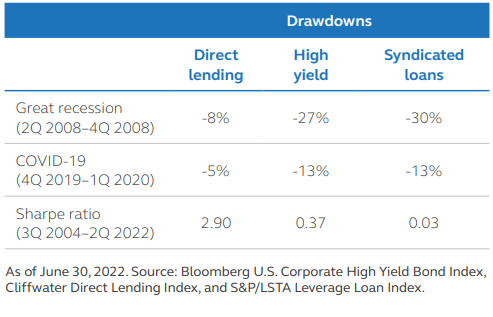

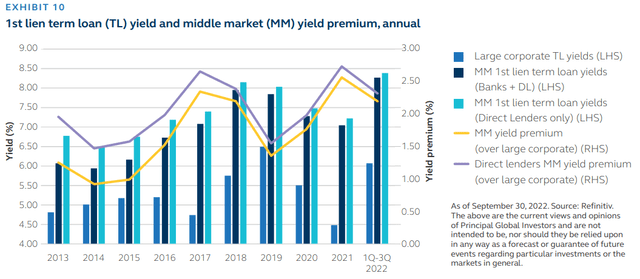

The current market presents attractive opportunities for investors as market volatility and economic uncertainty contribute to tighter credit conditions, which in turn contribute to a favorable lending environment.

Though recessionary fears, persistently high inflation, rising interest rates, and public market volatility may cause investors to pause when considering a new or incremental allocation to middle-market direct lending, we believe the loans originated during the current and upcoming period will prove to deliver value.

Borrowers being financed in the private middle market continue to be heavily focused in resilient, generally non-cyclical industries. Deal terms have clearly shifted to favor lenders.

With the current economic and market outlook, lenders continue to be very selective, while private equity (PE) sponsors are also focused on pursuing financing for companies they expect to realize attractive financial performance through more challenging economic conditions.

We expect deal flow to moderate in the coming quarters, with a decline in leveraged buyouts (LBOs) and a shift to a greater proportion of add-on acquisitions for existing business platforms. Access to capital and the cost of debt capital will be a driver of some of this moderation, along with sellers and buyers resetting clearing valuation multiples for new transactions.

Add-on acquisitions for existing platforms can be very attractive during more challenging economic conditions. Enterprise valuations of the add-on acquisition typically decline more relative to the acquiring platform. In addition, the acquisitions deliver additional business diversification. Ultimately, prudently growing a business during an economic downturn can be attractive for both the PE sponsor/owner and lenders.

We expect loan yields to remain at very attractive levels in the coming year, with risk premium spreads remaining elevated along with a high base rate (secured overnight financing rate, or SOFR). This higher income, along with improved call protection and greater original issue discount (OID), is expected to drive greater returns.

However, with higher rates and associated cost of debt capital for borrowers, debt service should be a key focus. So, in addition to the quality of a borrower’s business, leverage levels and credit structure will be very important. The lower leverage and better credit structure (with meaningful financial covenants) associated with lower and core middlemarket companies should provide investors with meaningful benefits.

This is especially the case compared to upper middle-market deals, which are often much more levered and thus have higher interest burdens to meet in a rising-rate environment. The private middle market, having less cyclical industry exposure and generally lower leverage than the public market, should offer the opportunity for attractive absolute and relative performance – as has been the case during many prior economic cycles and periods of market volatility.

Conclusion

Some of the pain of 2022 will likely continue into 2023. It will likely take additional rate hikes, for instance, before the Fed is satisfied that inflation is abating. Globally, many central banks will continue looking for opportunities to shrink their balance sheets. And a recession by mid-year seems highly likely. There are reasons to be hopeful, however.

Inflation pressures are moderating globally, and recession fears are already priced into most markets. These factors – combined with lower prices, higher yields, and wider spreads in many fixed income categories – should provide ample opportunities for fixed income investors in 2023 and beyond.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.