Whereas 5,000 economists known as for the fast improvement of carbon taxation within the US and in Europe,1 the general public typically opposes this local weather coverage (Carattini et al 2018, Klenert and Hepburn 2018). In France, the federal government deserted its plan for an formidable carbon tax trajectory following the protests of the ‘yellow vests’.2

Why do residents typically oppose carbon taxation? Two frequent explanations are that residents refuse to bear the total prices of local weather change mitigation for lack of altruism, or that they disagree with the best way these prices are distributed. In a brand new paper (Douenne and Fabre 2022), we argue {that a} third mechanism might come into play — even when individuals are anticipated to learn from carbon taxation, pessimistic beliefs concerning the impact of the coverage might make them oppose it. It isn’t intuitive that individuals may gain advantage from carbon taxation. Truly, carbon taxation alone is mostly regressive as a result of poorer households spend on common a bigger share of their revenue on polluting items. But, since they spend much less on these items than richer households in absolute phrases, it’s ample to switch the proceeds of the tax as a uniform switch (a coverage referred to as a carbon tax and dividend) to design a progressive coverage and make a majority of individuals better-off (Pizer and Sexton 2019, Douenne 2020, Paoli and van der Ploeg 2021).

Pessimistic beliefs and public help for carbon taxation

We assess attitudes in the direction of a carbon tax and dividend in France through the yellow vests motion. We created a survey administered over 3,000 respondents consultant of the French inhabitants in February/March 2019. We offered to respondents a budget-neutral €50/tCO2 carbon tax and dividend coverage, with data on the impact on power costs (e.g. +€0.11 per litre of gasoline) and the switch that every family would obtain (€110/yr for every grownup). We discover that individuals largely reject this proposal — solely 10% of our survey respondents approve, whereas 70% don’t settle for the reform. This stage of rejection could be very excessive in comparison with what has been measured earlier than or after the yellow vests motion, the place about half of the inhabitants is discovered to just accept an unspecified enhance within the carbon tax (ADEME 2020). Thus, a primary perception from our survey is that public opinion could be very risky and strongly reacts to modern occasions.

Determine 1 CDF of goal (darkish blue) versus subjective (orange) web features from our tax and dividend

Word: Dashed blue strains symbolize distributions of goal features within the excessive case of completely inelastic expenditures. Vertical dotted orange strains present the bounds of intervals solutions of subjective features.

We then present that individuals maintain pessimistic beliefs concerning the coverage. Utilizing family price range survey information, we estimate that 70% of households would profit financially from the coverage (see the stable blue line in Determine 1). In our personal survey experiment, we ask respondents to estimate their anticipated achieve or loss from the reform (we proceed step-by-step, asking individually for the affect on their heating and transport expenditures). Solely 14% assume that their family would profit from the reform. This pessimism can’t be defined by an ignorance of value elasticities, as respondents appropriately estimate them in one other query, and the hole between perceived and precise web features would nonetheless be too giant if respondents assumed that their expenditures had been inelastic. Equally, respondents are pessimistic concerning the distributional and environmental results of the coverage. Solely 20% imagine that the coverage would profit poorer households and 17% assume that the coverage can be efficient in lowering polluting and combating local weather change.

We additionally discover that the extra individuals are against the coverage, the extra pessimistic they’re, and that the causality between beliefs and opposition runs each methods. On the one hand, when supplied with new details about the coverage, folks discard optimistic information however appropriately course of damaging ones. This phenomenon is stronger for individuals who initially oppose the coverage or who really feel near the yellow vests, which is according to the endogenous formation of beliefs by means of motivated reasoning. In different phrases, the much less folks just like the coverage, the much less possible they’re to assimilate optimistic details about it. Alternatively, our survey design allows us to point out that beliefs additionally causally decide help for the coverage. When satisfied that they might achieve financially, folks’s chance of accepting the coverage will increase by 50 proportion factors. Equally, the chance of supporting it’s 40 proportion factors greater when individuals are satisfied that the coverage would successfully cut back emissions.

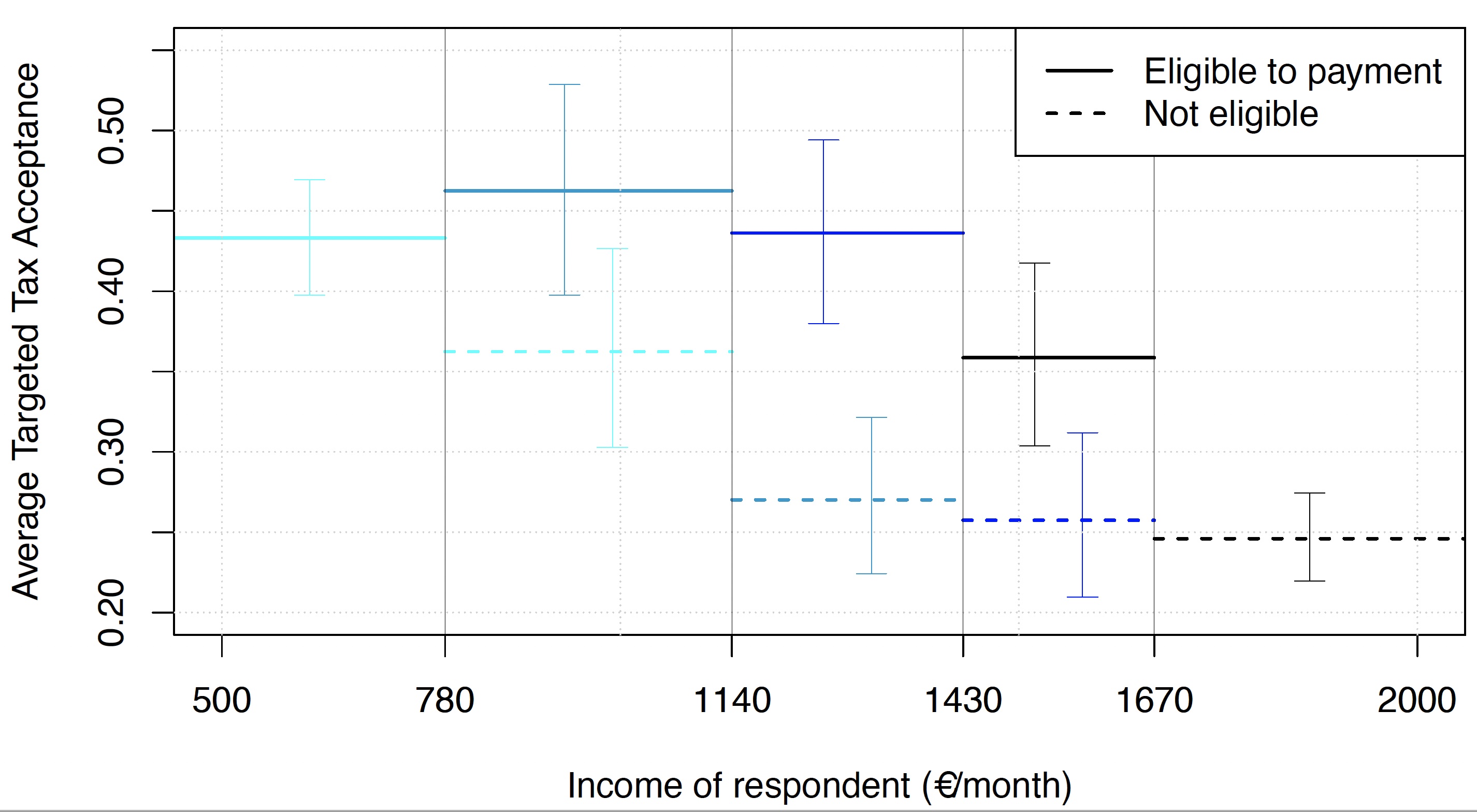

To acquire causal results, beliefs about environmental effectiveness are instrumented by randomly offering (or not) data that there’s a scientific consensus on the effectiveness of carbon taxation. Beliefs about one’s personal features are instrumented with two impartial designs that each result in very comparable outcomes. Our most popular design makes use of variants of the principle coverage the place the dividend is focused on the backside 20%, 30%, 40%, or 50% of the revenue distribution. Every respondent is randomly assigned a variant the place he’s both eligible for the dividend or not. For instance, a respondent within the thirty fifth. percentile of the revenue distribution has an equal likelihood of being assigned the reform focused to the underside 40% (the place he’s eligible) or 30% (not eligible). This random task creates an exogenous variation within the perception to win or lose from the tax and focused dividend. Beneath the credible assumption that, conditional on revenue and controlling for the variant, eligibility impacts acceptance solely by means of the assumption of 1’s personal achieve, our fuzzy regression discontinuity design appropriately identifies the causal impact of the assumption that one loses on the acceptance of the reform. Determine 2 reveals that acceptance of a given variant is certainly greater for these eligible to the dividend, i.e. on the left of the revenue eligibility thresholds.

Determine 2 Acceptance of a tax and focused dividend in perform of revenue (therefore eligibility to the dividend) and of the variant’s goal (one color per variant)

Word: For instance, acceptance fee is 43% for these eligible to the dividend within the reform focused to the underside 20%, whereas it falls at 36% for many who will not be eligible.

The earlier outcomes can clarify how widespread opposition can progressively construct round carbon tax proposals. If opinions form beliefs, that in flip decide opinions, folks’s pessimism attributable to earlier (unfair) reforms might make them oppose new (truthful) insurance policies.

An agenda for formidable local weather insurance policies

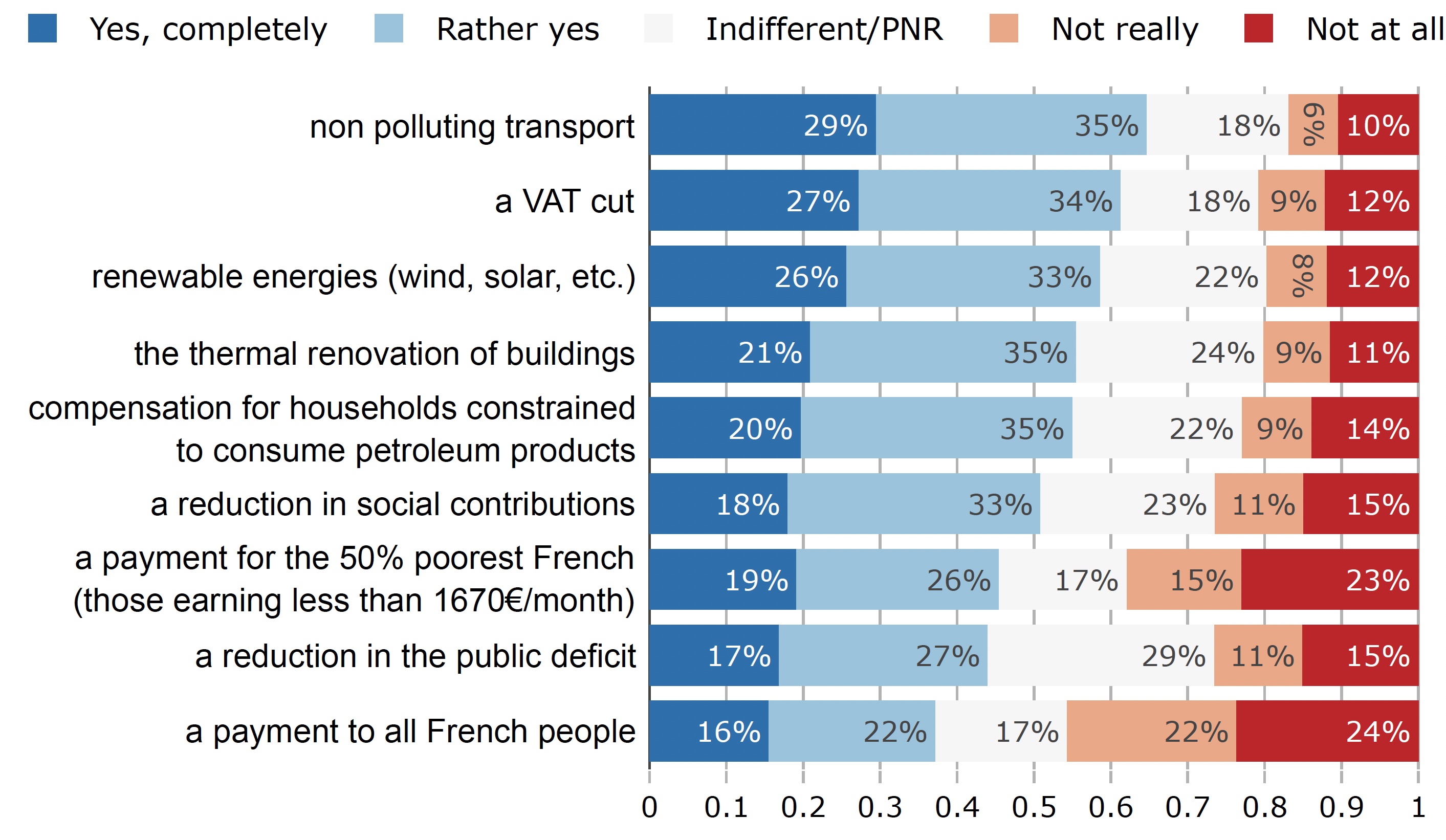

Whereas many French folks reject a carbon tax with dividend, the overwhelming majority is worried about local weather change and helps different insurance policies, as we present in a companion paper utilizing the identical survey information (Douenne and Fabre 2020). The primary insights from this paper is that individuals favour measures that convey co-benefits (like lowered air air pollution), want norms or subsidies to taxes, and strongly help public investments. A pure clarification for these preferences is that individuals favour insurance policies whose prices are the least salient, though they could be much less cost-effective (Levinson 2018). Nonetheless, by offering alternate options to fossil fuels, these insurance policies may additionally tackle vital obstacles to altering habits. Certainly, we discover {that a} essential impediment to altering habits is the dearth of alternate options to fossil fuels like public transportation. In keeping with the literature (e.g. Bergquist et al. 2020), we discover that the progressivity of the coverage bundle can be key for acceptance.

Determine 3 “Would you approve of a rise of the carbon tax if the revenues had been used to…?”

These observations counsel the next path in the direction of a profitable decarbonisation in France and Europe. Before everything, an data marketing campaign may very well be launched to enhance understanding about local weather insurance policies – which we discover to be positively related to the help for measures – and present that the European Inexperienced Deal addresses folks’s equity considerations. Second, the federal government might develop alternate options to fossil fuels by means of numerous insurance policies: investments, subsidies, and laws in favour of public transport, cleaner autos and thermal insulation, and so forth (see Pisu et al. 2022 for an evaluation of assorted insurance policies). Final however not least, the extension of carbon pricing proposed by the European Fee ought to quickly complement these insurance policies, as folks get satisfied by the progressivity of a carbon value with dividend and by the EU’s dedication to a good decarbonisation.

References

ADEME (2020), “Représentations sociales du changement climatique: 21ème imprecise”.

Bergquist P, M Mildenberg, and L C Stokes (2020), “Combining local weather, financial, and social coverage builds public help for local weather motion within the US”, Environmental Analysis Letters 15(5)

Carattini S, M Carvalho, and S Fankhauser (2018), “Overcoming public resistance to carbon taxes”, Wiley Interdisciplinary Critiques: Local weather Change 9(5).

Douenne T (2020), “The vertical and horizontal distributional results of power taxes : A case research of a French coverage”, The Vitality Journal 41(3).

Douenne T and A Fabre (2020), “French attitudes on local weather change, carbon taxation and different local weather insurance policies”, Ecological Economics 169(C).

Douenne T and A Fabre (2022), “Yellow vests, pessimistic beliefs, and carbon tax aversion”, American Financial Journal: Financial Coverage 14(1).

Klenert D and C Hepburn (2018), “Making carbon pricing work for residents”, VoxEU.org, 31 July.

Levinson A (2018), “A carbon tax can be much less regressive than power effectivity requirements”, VoxEU.org, 5 July.

Paoli, M C and R van der Ploeg (2021), “Recycling income to enhance political feasibility of carbon pricing within the UK”, VoxEU.org, 4 October.

Pisu M, F M D’Arcangelo, I Levin, and A Johansson (2022), “A framework to decarbonise the financial system”, VoxEU.org, 14 February.

Pizer, W and S Sexton (2019), “The distributional impacts of power taxes”, Overview of Environmental Economics and Coverage 13(1).

Endnotes

1 In 2019, the Local weather Management Council printed a column signed by 3,354 American economists within the Wall Avenue Journal to help carbon taxation. The same assertion from the European Affiliation of Environmental and Useful resource Economists was signed by 1,772 economists.

2 Initially launched in 2014 at a stage of seven€/tCO2, the French carbon tax had grown to 44.6€/tCO2 in 2018 and was purported to additional enhance to achieve 86.2€/tCO2 by 2022. This plan was deserted in November 2018, following the large-scale protests of the Yellow Vests—on the time largely supported by the general public opinion—in a context of excessive gas costs.