Niels Thygesen, Roel Beetsma, Massimo Bordignon, Xavier Debrun, Mateusz Szczurek, Martin Larch, Matthias Busse, Mateja Gabrijelcic, Laszlo Jankovics, Janis Malzubris 16 March 2022

The fourth EFB annual convention1 targeted on the linkages between public funds (each when it comes to sustainability and high quality) and the insurance policies aimed toward mitigating local weather change. Underneath the Paris settlement and European Inexperienced Deal, EU Member States set bold carbon discount targets to show the Union into the primary climate-neutral main financial system by 2050. This tectonic shift would require daring and troublesome selections by EU governments (Weder di Mauro 2021), with vital implications for financial progress and public funds.

Valdis Dombrovskis, Govt-Vice President of the European Fee, opened the controversy by asking how governments might obtain a growth-friendly composition of public funds, given the danger posed by local weather change for fiscal sustainability. In contrast to the affect of local weather dangers on monetary stability, their implications for fiscal sustainability are much less properly understood and would possibly thus be severely underestimated. To fill this hole, the EFB convention aimed toward clarifying the challenges posed by local weather change for the conduct of fiscal coverage, the sustainability of public funds, and, by implication, the way forward for the EU fiscal framework.

Understanding the local weather threat to authorities debt

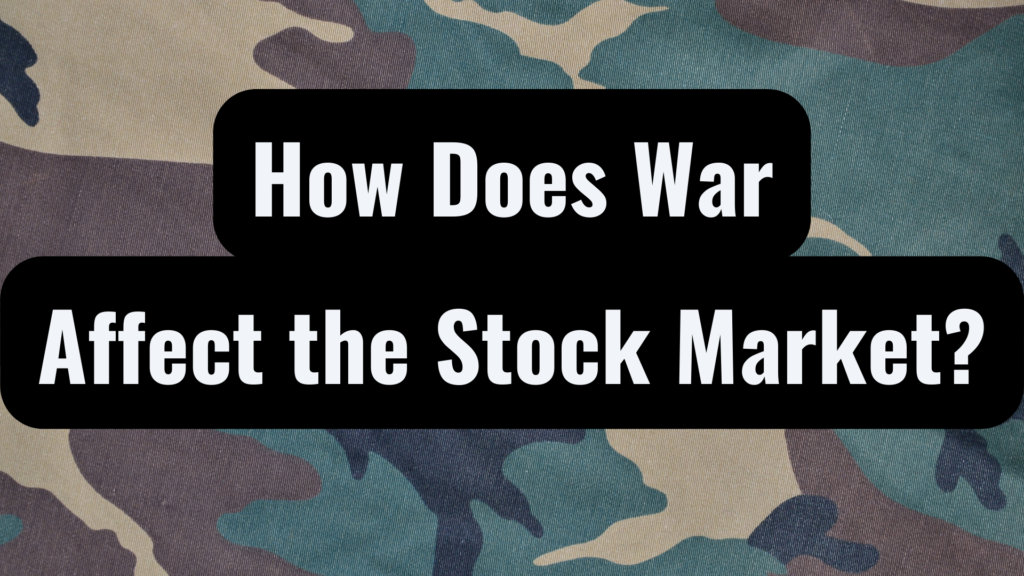

Within the transition to a decarbonised financial system, governments can deploy a variety of instruments to facilitate that transition. As Frans Timmermans, Govt-Vice President of the European Fee accountable for the inexperienced transition, said in his keynote speech, a mixture of carbon pricing emissions buying and selling techniques (ETS) and funding is required to succeed in carbon neutrality. Such adjustments will inevitably have vital macroeconomic, structural and budgetary implications. Though mitigation insurance policies carry sizable prices, Isabelle Mateos y Lagos (BlackRock) argued that these fall in need of the estimated injury beneath a business-as-usual state of affairs (25% of 2019 world GDP). Total, the web welfare affect of local weather insurance policies could be optimistic (Determine 1).

Determine 1 Transition leads to internet financial achieve (estimated cumulative GDP affect of transition, 2020-40)

Notes: The bars present the general estimated affect of three components: prevented injury from local weather change on account of mitigating insurance policies (optimistic), inexperienced infrastructure spending (optimistic) and prices related to the transition (destructive). The black line reveals the estimated internet affect.

Supply: Isabelle Mateos y Lagos: BlackRock Funding Institute, Banque de France, Worldwide Vitality Company, OECD.

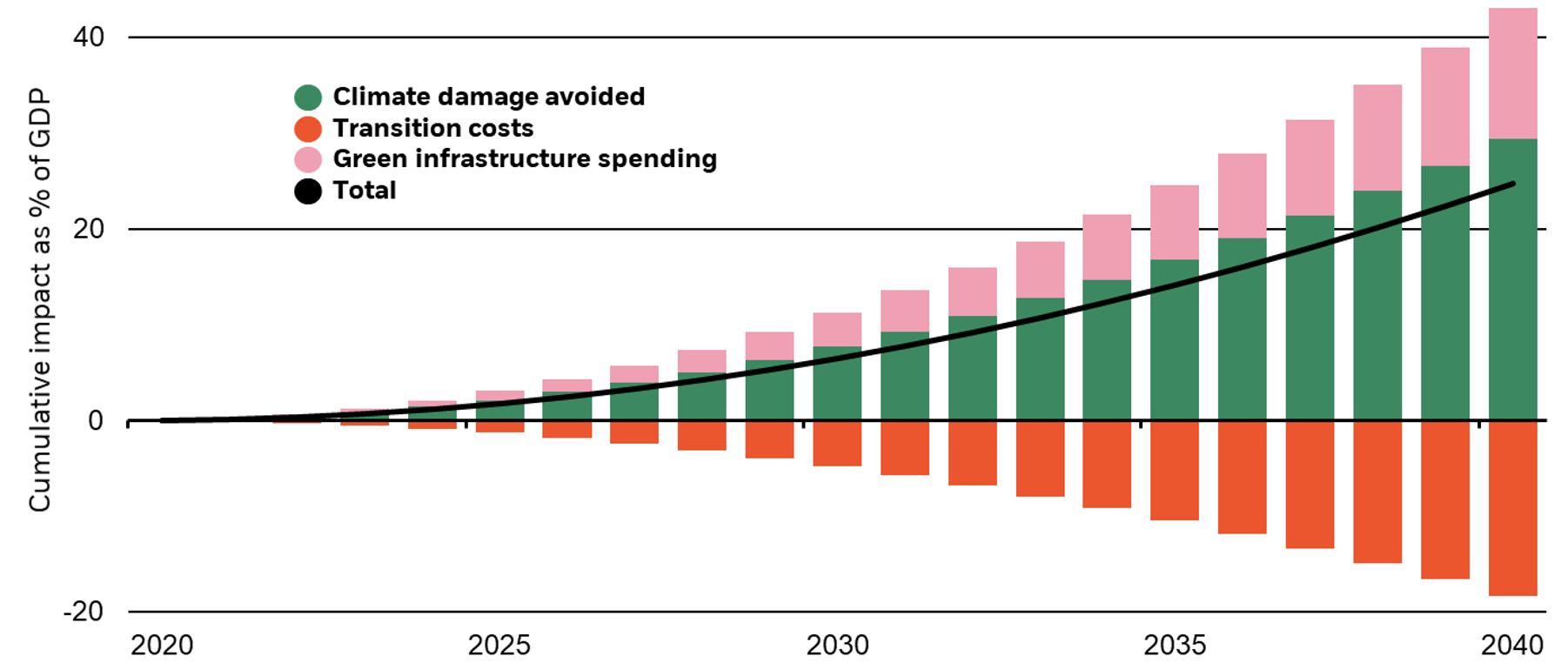

Inna Oliinyk (Community of EU Impartial Fiscal Establishments) particularly regarded into the general public finance penalties of an unmitigated world warming state of affairs, confirming that the budgetary footprint of inaction could be a lot worse than the prices of decarbonisation. For example, a case research of the UK means that over an 80-year horizon, public sector debt could be twice as excessive beneath inaction than beneath expensive mitigation insurance policies (Determine 2). Rick van der Ploeg (College of Oxford) additionally confirmed that delaying mitigation insurance policies merely inflated future spending on adaptation measures, in the end leading to larger revenue taxes.

Determine 2 Three eventualities of public debt developments within the long-run

Supply: Workplace for funds accountability (2021).

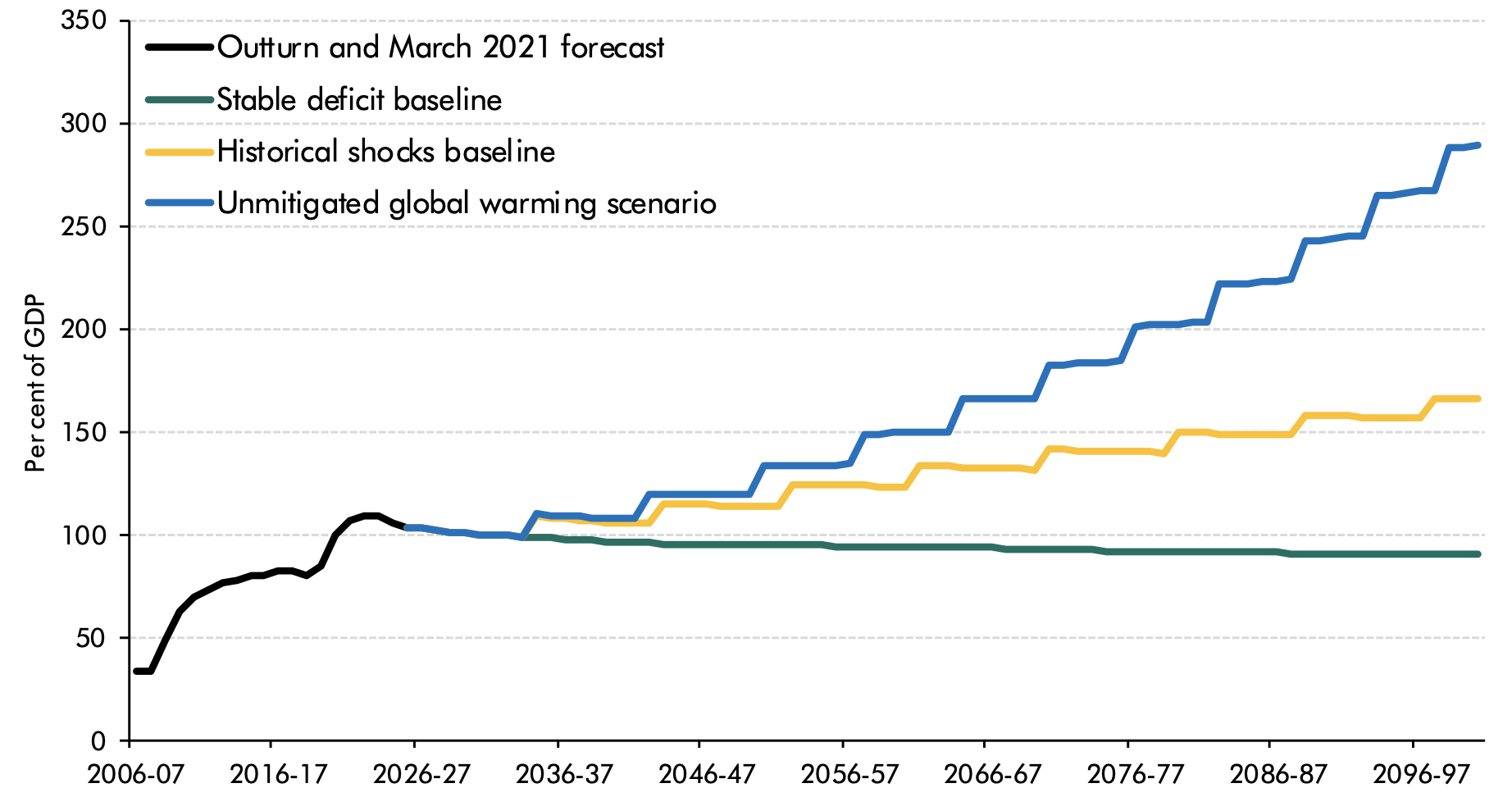

As inexperienced taxes intention at elevating the shadow value of carbon, they’ll each cut back emissions and create fiscal house to fund mitigation measures and different growth-friendly insurance policies (similar to distortionary tax cuts). That notion of double dividend is, nevertheless, misleading. Certainly, well-designed Pigouvian taxes are meant to destroy their very own tax base and within the longer run, revenues from inexperienced taxation are sure to vanish. The underside line is that the prices of mitigation measures can’t be offset by larger revenues, leading to larger public debt (Determine 3). A coordinated strategy on the EU stage would possibly assist design efficient and environment friendly mitigation insurance policies.

Determine 3 Web debt affect of reaching internet zero by 2050

Supply: Workplace for funds accountability (2021).

Fiscal challenges of implementing mitigation insurance policies

Mitigating local weather change and addressing its results are expensive propositions. Given the post-Covid legacy of traditionally excessive public money owed, the necessity to protect debt sustainability will drive governments to make onerous decisions. In line with the European Fee, Europe will want round €520 billion in further funding per yr over ten years to attain its local weather targets. Underneath the 2021-2027 Multiannual Monetary Framework (MFF) and NextGenerationEU (NGEU), the EU has secured round €86 billion per yr in public funding. Thus, even when scaling up public funding is a should, many of the required funding must be personal.

Probably the most vital contributions to local weather aims stems from know-how and innovation, Guntram Wolff (Bruegel) argued. Nevertheless, primarily based on previous expertise, he was sceptical that politicians confronted with the necessity to consolidate public funds could be keen to pay for added funding by reducing present expenditure. This argument echoed the work by Larch et al. (2022) exhibiting that within the wake of crises coverage makers typically don’t increase public funding.

As if environment friendly prioritisation weren’t onerous sufficient, Rick van der Ploeg (College of Oxford) argued that it was fraught with political frictions. Expertise factors to 5 key obstacles to the environment friendly greening of our economies: (i) carbon taxes are a lot decrease than fossil gasoline subsidies, (ii) carbon taxes harm the poor disproportionately, (iii) free using behaviours are ubiquitous on the worldwide stage, (iv) the burden of paying for mitigation is erratically distributed over generations, and (v) electoral concerns are inclined to bias selections in favour of straightforward options, similar to a desire for subsidies in comparison with taxation. Van der Ploeg argued in favour of higher consideration paid to distributive concerns. Specifically, he favours channelling tax revenues to poorer residents, organising transfers from wealthy to poor international locations and from future generations to present ones (via debt). Relatedly, Xavier Debrun (EFB) argued that the inexperienced agenda magnified the deficit bias that usually outcomes from political frictions. Particularly, governments favor a package deal of mitigation insurance policies tilted in the direction of subsidies (over taxation) and public funding (over focused regulatory and tax measures encouraging personal funding). In an surroundings the place rates of interest are anticipated to remain beneath progress charges for the lengthy haul, the inexperienced agenda gives a handy pretext for completely larger deficits: debt is free, returns look excessive.

Higher assessing the consequences of local weather change on public funds is important

Guaranteeing that every one stakeholders within the funds course of perceive the affect of local weather change on public funds is a primary step in addressing political biases. Sadly, most international locations lack a complete evaluation of the affect of local weather transition on fiscal sustainability. In line with Inna Oliinyk, solely about one-third of nationwide governments have carried out such a complete evaluation. Absent estimates of future liabilities on account of local weather change, authorities don’t have any incentive to behave now, argued Helene Rey (London Enterprise Faculty). She proposed enriching customary debt-sustainability evaluation with such estimates.

In precept, complete assessments may gain advantage from impartial enter or at the very least vetting from impartial our bodies similar to nationwide impartial fiscal establishments (IFIs). Nevertheless, the EU Community of IFIs and the OECD famous that not all IFIs have the mandate to observe inexperienced budgeting and most have inadequate experience and assets to take action. Furthermore, IFIs additionally lack details about governments’ plans, measures and dealing assumptions. In line with the EFB (2021), whereas nationwide IFIs at the moment are integral a part of the EU fiscal framework, they continue to be too heterogeneous to constantly affect the conduct of fiscal coverage via recommendation.

Though fashions assessing the affect of local weather change on fiscal sustainability stay of their infancy, they’re key to offer believable estimates of climate-related fiscal dangers. Stavros Zenios (College of Cyprus) confirmed the right way to hyperlink a full-fledged evaluation mannequin to plain debt sustainability evaluation. By incorporating a number of channels via which local weather dangers have an effect on public finance, Zenios reveals that they’ll have a big impact on debt dynamics. Therefore, it might be essential for governments to develop a holistic view of fiscal planning.

The way forward for the EU fiscal framework

What does this all indicate for the financial governance evaluate, relaunched on 19 October 2021?1 The present framework being blind to local weather change concerns, a pure query is whether or not these needs to be added to the record of well-known weaknesses that the reform ought to search to handle (e.g. European Fiscal Board 2019, 2021).

For international locations to design optimum inexperienced insurance policies, clear steerage on the design and implementation of fiscal guidelines needs to be in place. In his opening speech, Commissioner Dombrovskis said that the Fee doesn’t envisage adjustments to the three% and 60% of GDP reference values of the Treaty. As an alternative, the pace of decreasing debt needs to be gradual and progress pleasant creating house for funding scaling up.

To be efficient, the EU fiscal framework should not be perceived as curbing the fascinating fiscal response to present challenges. Specifically, it ought to encourage local weather change mitigation insurance policies with out endangering fiscal sustainability. In his closing speech, Commissioner Gentiloni identified two methods of together with local weather change within the EU fiscal framework: via a inexperienced golden rule, or a typical EU facility. Xavier Debrun (EFB) warned that incorporating inexperienced contingencies into guidelines would make them much more difficult, much less clear, and simpler to avoid. Apart from, the Inexperienced Deal being a European undertaking aimed toward addressing a world drawback, inexperienced funding is a pure candidate to turn into a European public good funded by a brief EU fiscal facility.

The EFB proposed earlier to enhance the EU funds by devoted nationwide envelopes for offering EU widespread items, similar to inexperienced public funding and transnational infrastructure initiatives. Such a facility might usefully safeguard towards potential cuts in nationwide public investments, and be more practical than an advanced and weak inexperienced golden rule (European Fiscal Board 2021).

References

Community of EU IFIs (2021), “Assessing the fiscal coverage affect of local weather transition”, February.

European Fiscal Board (2019), “Evaluation of EU fiscal guidelines with a give attention to the six and two-pack laws”, Brussels.

European Fiscal Board (2021), Annual Report 2021, Brussels.

Larch, M, P Claeys and W van der Wielen (2022), “Scarring results of main financial downturn: the function of fiscal coverage and authorities funding”.

Workplace for funds accountability (2021), Fiscal Threat Report, July.

Thygesen, N, R Beetsma, M Bordignon, X Debrun, M Szczurek, M Larch, M Busse, M Gabrijelcic, E Orseau and S Santacroce (2020), “Reforming the EU fiscal framework: Now’s the time”, VoxEU.org, 26 October.

Weder di Mauro, B (2021), Combatting Local weather Change: a CEPR Assortment, CEPR Press.

Endnotes

1 https://ec.europa.eu/data/business-economy-euro/economic-and-fiscal-policy-coordination/european-fiscal-board-efb/public-finances-and-climate-change-post-pandemic-era_en

2 https://ec.europa.eu/fee/presscorner/element/en/ip_21_5321