Paul Bradbury/OJO Pictures by way of Getty Pictures

Most important Thesis & Background

The aim of this text is to judge the PIMCO Company & Revenue Alternative Fund (NYSE:PTY) as an funding choice at its present market worth. The fund’s goal is “to hunt excessive present earnings, with capital preservation and capital appreciation as a secondary goal”.

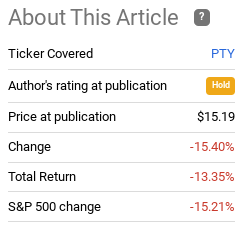

I cowl PTY about as soon as 1 / 4, with my most up-to-date evaluation about three and a half months in the past in March. At that time, I reiterated a stance that I’ve held for some time – that PTY must be approached cautiously. Trying again, this passive outlook remained applicable, with the fund dropping by over double-digits within the interim:

Fund Efficiency (In search of Alpha)

After all, the market as a complete has been beneath plenty of stress, so we have to take this into consideration. That is primarily why I do not assume it could have been advantageous to take a extra bearish stance. Sure, PTY did fall by fairly a bit. However the outcome really bests the broader fairness market and bond funds by and huge did not accomplish that nice both.

Due to this fact, I assumed it was time to take one other have a look at PTY to see if I can lastly shift this fund into my “purchase” column. Sadly, after evaluation, I stay cautious on this feature and can reaffirm a “maintain” ranking. The fund’s persistent premium to NAV offers me concern, though there are some constructive attributes that recommend a downgrade will not be applicable both. I’ll clarify these professionals and cons in additional element beneath.

PTY Hasn’t Been Working In 2022

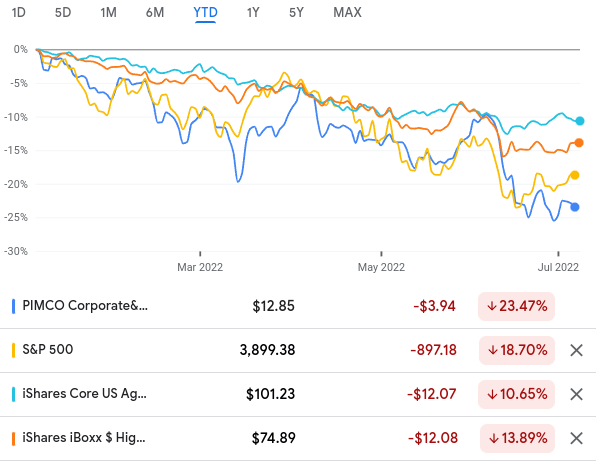

As we start the second half of 2022, I assumed it could make sense to look at the efficiency of this CEF for the primary half of the yr. Not surprisingly, the whole return has been very poor. Whereas the earnings stream is excessive sufficient to buffer a few of this downtrend, readers ought to acknowledge that PTY has carried out nearly on-par with the S&P 500, and has lagged the mixture bond index (as measured by the iShares Core U.S. Combination Bond ETF (AGG)) and the excessive yield company bond index (as measured by the iShares iBoxx $ Excessive Yield Company Bond ETF (HYG)):

YTD Efficiency (Google Finance)

My takeaway from that is there may be not a complete lot to be enthusiastic about. Most areas of the market have been in a correction or bear market, so it isn’t overly alarming that PTY is falling as effectively. However we see that it has not acted as a hedge in opposition to equities and has carried out worse than different fixed-income options. In a risk-off yr, PTY has been hit – onerous. That is essential as a result of we have now to think about the probability of a turnaround within the second half of the yr. If the macro-conditions keep the identical within the U.S. and across the globe, how sensible that PTY goes to immediately begin out-performing? Not too doubtless in my view.

This highlights the inherent threat of shopping for a leveraged CEF that’s lengthy riskier debt. That is true of PTY, and the plethora of different choices on this house, whether or not by PIMCO or different asset managers. When instances are good, these funds can flourish, however the reverse can also be true. And we’re in a kind of troublesome stretches proper now.

After The Drop, PTY Ought to Be A Discount, Proper? Nope

So PTY has been having a tricky time in 2022. This a lot is thought. However what’s extra essential at this juncture is the way it will fare for the rest of the yr. That’s what traders who’re contemplating shopping for now are most involved with. On the floor, a drop of over 13% since late March ought to pique some curiosity. In spite of everything, with such a pointy drop, PTY might be wanting engaging from a valuation perspective. At the least that’s what one would assume.

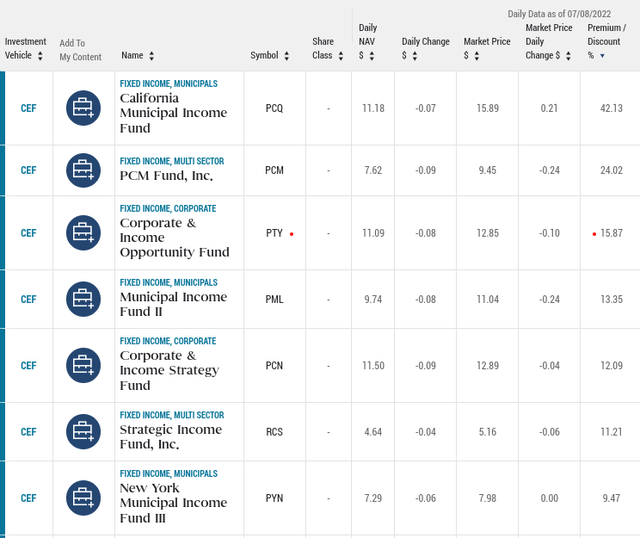

Sadly, that’s really not the case. Again in March, PTY was buying and selling at a valuation that appeared a lot too expensive for me. Its premium was close to 14%, a key purpose why I advocated warning. Regardless of the drop in share worth, this valuation story stays largely intact at this time. PTY stays some of the costly PIMCO CEFs obtainable, and its premium has really widened by 2%, to only beneath 16% at time of writing:

PIMCO CEF Metrics (PIMCO)

The pure query to ask right here is how can this be occurring? The rationale is not fairly. Whereas the share worth has dropped off, the fund’s underlying worth (or NAV) has fallen extra aggressively. That is the other of what traders need to see:

| NAV as of three/31/22 | NAV as of seven/8/22 | Change in NAV |

| $15.35/share | $12.85 | (16%) |

Supply: PIMCO

There’s not a lot constructive we will take away from this. The fund’s underlying securities are shedding worth swiftly, and that has stored PTY’s premium from shrinking. Due to this fact, fairly than being a price alternative after the sell-off, PTY is much more costly than earlier than. That alone prevents me from upgrading my ranking to “purchase” in the intervening time.

So, The place’s The Good Information?

To this point, I’ve talked about just a few destructive attributes for this fund. However as I began earlier there are some positives to think about. One in all them specifically is the present yield, which is available in simply over 11%. This can be a very tempting earnings stream even when the Fed is elevating rates of interest. With the benchmark charge seeking to settle round 3% within the near-term, an 11% distribution charge is nothing to sneeze at and can most likely pique investor curiosity within the second half of the yr.

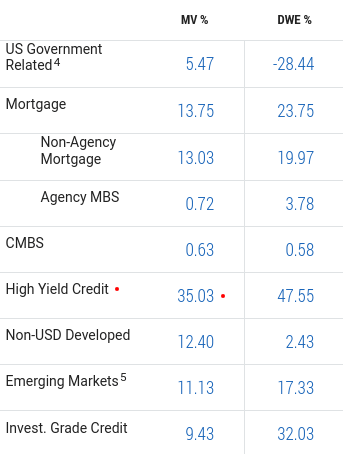

One of many causes PTY’s yield has gotten so engaging is as a result of the excessive yield company market has offered off. That is at all times an essential consideration when evaluating PTY as a result of excessive yield credit score makes up over 1/3 of whole fund property, as proven beneath:

PTY’s Holdings (PIMCO)

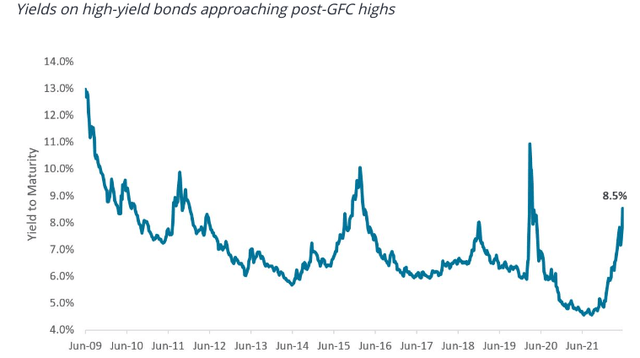

This may be good or dangerous, relying on one’s personal threat tolerance and outlook. Given PTY’s use of leverage and chubby allocation to excessive yield credit score, readers ought to strategy this fund cautiously even in regular instances. However for many who can tolerate extra threat, there may be undoubtedly benefit to giving it some consideration proper now. It’s because yield spreads have gotten extraordinarily vast. In actual fact, the present unfold is at one of many highest factors it has been prior to now decade:

Junk Bond Yields (On Common) (Janus Henderson)

What this tells us is that traders have fled the excessive yield sector. This makes some intuitive sense given all the issues dealing with the globe proper now. With recession chance rising, traders are involved about being paid again on their loans and debt securities. However the contrarian would see this as a chance. Everyone seems to be promoting – so why not purchase? The yield is engaging, and delinquencies and defaults haven’t but turn into materials. Whereas they may within the near-term, the earnings stream appears to recommend that taking over that threat is well worth the payout. In the end, that’s up for every particular person investor to determine, however there is no such thing as a denying this earnings degree is traditionally fairly excessive.

Revenue Metrics Are Very Strong

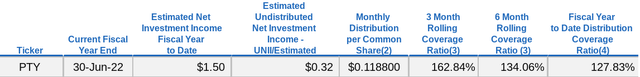

Increasing on the earnings dialogue, followers of PTY can be put comfortable considerably after they contemplate the newest earnings metrics revealed by PIMCO. PTY did disappoint not too way back when it lower its distribution by round 8% again in September final yr. However since then, it has stored its new distribution charge constant. Additional, that story is unlikely to alter within the short-term as a result of the fund’s UNII figures are very robust:

UNII Metrics (PIMCO)

As you possibly can see, the fund’s protection ratios are effectively over 100%, suggesting the fund is comfortably incomes what it must with a view to pay its present distribution. Additional, it has virtually three full months of earnings in reserves for a wet day. This implies the earnings is secure – making the 11% yield fairly compelling. There’s the opportunity of a year-end particular distribution for this fund given the massive UNII steadiness, so holding this CEF in a tax-deferred account would most likely make sense because of this.

International Headwinds To Preserve In Thoughts

My subsequent subject is one other level of concern I’ve for this fund specifically. As my readers know, my portfolio is particularly U.S. primarily based. Nonetheless, I do department out into international equities as a relative hedge, however this sometimes includes developed markets. I’ve solely a small quantity of publicity to rising markets, and no “debt” funds particularly in that area. PTY is on no account over-exposed to international markets, however its 11% weighting in direction of rising markets is certainly one thing to think about earlier than diving in.

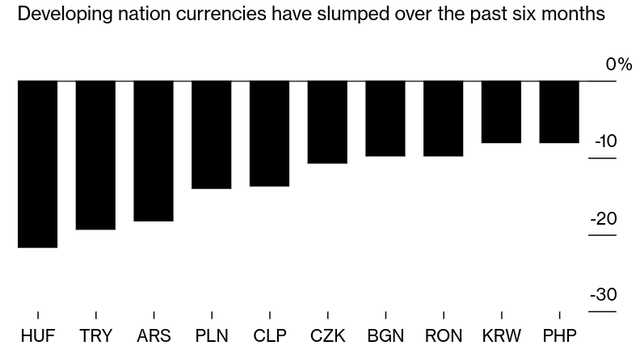

That is attribute is just like excessive yield in that it is vitally individually dependent. What I imply is, this threat and publicity could also be proper for some and never for others. There isn’t a proper or flawed right here, merely threat tolerance and desire. For me, as a contrarian, there may be some benefit to purchasing into EM debt in the intervening time. However with the rise within the greenback, geo-political dangers in Europe and brewing dangers in Asia, in addition to the potential for a recession, I do not see plenty of upside for EM debt in the intervening time. Importantly, neither does the market as a complete, as traders have been pounding EM currencies lately:

EM Foreign money Efficiency (Bloomberg)

This definitely suggests a contrarian play to go in opposition to the market and financial institution on a turnaround. If that occurs, PTY’s publicity to EM debt will assist the underlying NAV. However I do not see plenty of catalysts on the horizon near-term to markedly enhance the prospects for EM nations. This can be a nook of the market I need little or no publicity, so I don’t view PTY’s inclusion of it as a constructive for now.

It is Not Like Equities Are Low-cost

My final level simply touches on options to PTY. Personally, there are a selection of different PIMCO CEFs which have related holdings, related yields, and a less expensive valuation. For me, it is sensible to personal these over PTY. However given the correlation between equities and excessive yield / EM debt, evaluating the relative valuations of those property additionally is sensible. In spite of everything, we do not put money into a vacuum. So if one is worried about PTY’s valuation and desires to stay that cash into equities, they might really not get fairly the discount they needed.

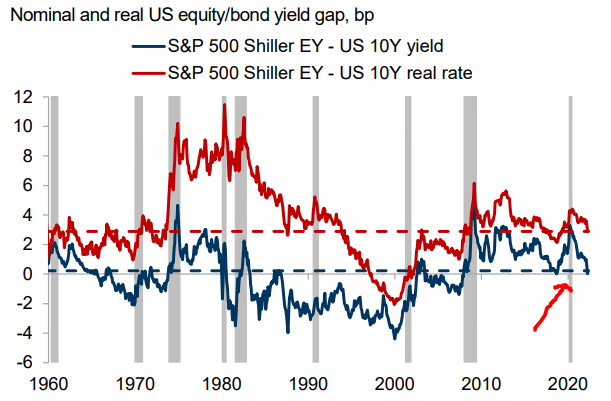

What I imply is, equities (or no less than as measured by the S&P 500) aren’t low-cost both. So after I recommend PTY is pricey, that does not imply all the pieces else is affordable. In actual fact, with inflation rising, recession issues, and bond yields pushing larger, the attractiveness of equities to bonds has really been falling over the previous few quarters:

Fairness valuations have re-rated vs bonds (Goldman Sachs)

What I get at right here is that equities have dangers of their very own to think about. There’s an argument to be made for transferring into fixed-income, floating charge debt, commodities, actual property, or any variety of options. As such, PTY definitely may have a spot in a single’s portfolio, particularly on the expense of equities. Holding excessive yield credit score will virtually definitely repay if the U.S. avoids a recession, and that may beef up debt in international markets – developed and rising – as effectively. However one has to determine if PTY is absolutely the easiest way to play that development. If you will get the identical kind of publicity with out paying a 16% premium, it makes one marvel why they would not pursue an alternate choice that’s cheaper.

Backside Line

PTY has had robust years prior to now, so it has remained on my radar for some time. But, newer reminiscence will not be type for this one. I carry on reviewing it within the hopes that the worth proposition will shift in my favor, however that has but to happen. That is why that is the “standard tune and dance” for me at the moment. PTY has some constructive attributes, however the worth to purchase into them simply appears too lofty. After I couple this with the actual fact that is debt with above-average threat and the U.S. is dealing with growing odds of a recession, I’ll proceed to move. In consequence, PTY stays a “maintain” for me, and I recommend readers strategy any new positions within the fund cautiously going ahead.